July 14, 2015

In her WaPo column Catherine Rampell points to the sharp decline in labor force participation rates for prime age workers (ages 25-54) in recent years and looks to the remedies proposed by Jeb Bush and Hillary Clinton. Remarkably neither Rampell nor the candidates discuss the role of the Federal Reserve Board.

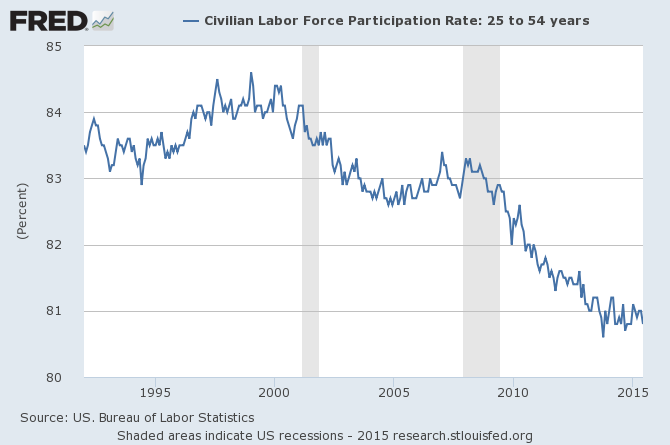

There is not much about the drop in labor force participation that is very surprising. It goes along with a weak labor market. When people can’t find a job after enough months or years of looking, they stop trying. Here’s what the picture looks like over the last two decades.

While the story would be somewhat different for men and women, we see that the labor force participation rate (LFPR) rose from the mid-1990s to the late 1990s during the strong labor market of those years. It fell with the 2001 recession and the weak recovery that followed. (We continued to lose jobs until late 2003 and didn’t get back the jobs lost in the downturn until early 2005.) After the labor market started to recover, the LFPR started to rise again, but then fell sharply with the downturn following the collapse of the housing bubble.

It’s great for politicians to round up their favorite usual suspects in trying to explain why so many prime age workers no longer feel like working, but to those not on the campaign payrolls, it seems pretty obvious. We don’t have enough demand in the economy and therefore we don’t have jobs.

This is where the Fed comes in. If the economy were to continue to create 200,000 plus jobs a month, then we can be pretty confident that the LFPR will rise again as it did in the late 1990s. However if the Fed is determined not to allow the unemployment rate to fall below some floor like 5.2 percent, then it will prevent the economy from creating large numbers of jobs. In this case, the LFPR will not rise much regardless of whether we follow the prescriptions of Bush or Clinton, since people will not look for jobs that are not there indefinitely.

It is worth noting in this respect that in the 1990s, the vast majority of economists, including Janet Yellen who was then a member of Fed’s Board of Governors, did not want the Fed to allow the unemployment rate to fall much below 6.0 percent. It was only because then Chair Alan Greenspan was not an orthodox economist that were able to see that the unemployment rate could in fact fall much lower without triggering inflation. (The unemployment rate averaged 4.0 percent in 2000.)

It should seem obvious that Fed’s policy will play a major role in determining the LFPR going forward. It is bizarre that it does not seem to be getting into the debate.

Comments