July 15, 2015

As they say at the Post, don’t let the data bother you, or so it would seem with yet another article bemoaning the lack of consumption. The proximate cause was a Commerce Department report showing weaker retail sales in June after a big jump in May. The piece explained to readers:

“The figures suggest that Americans are still reluctant to spend freely, possibly restrained by memories of the Great Recession.

“‘Household caution still appears to be holding back a more rapid pace of spending growth,’ Michael Feroli, an economist at JPMorgan Chase, said in a note to clients.”

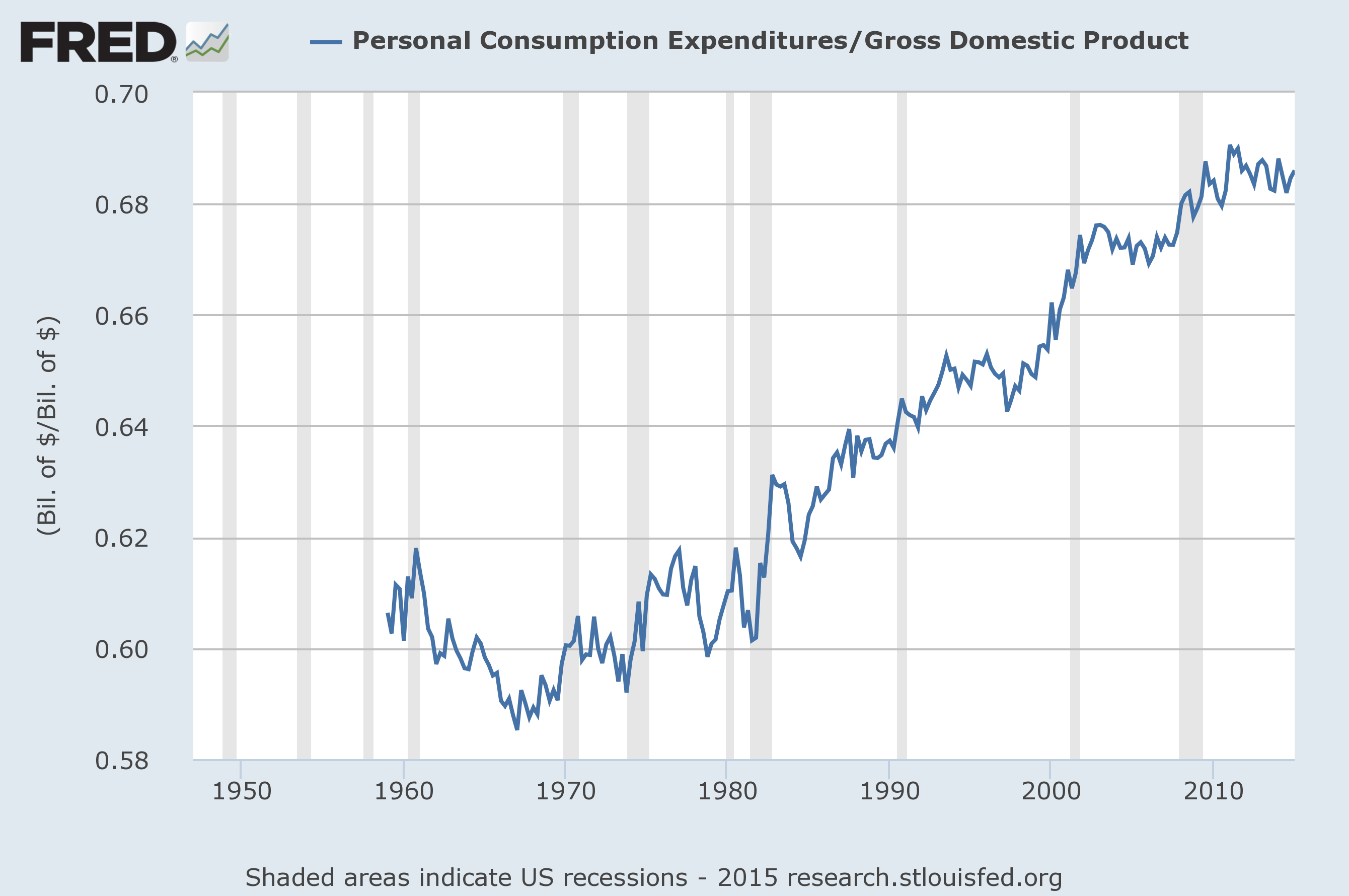

Here’s the slightly longer term picture.

For the record, there is no economist who wants to argue that the consumption share of GDP should continue to rise. The logical implication of such an argument is that investment, government spending, and net exports would continue to decline as a share of GDP. So we should look at levels, not changes here. And the level is actually higher than it was before consumers were scarred by memories of the Great Recession.

Btw, the folks who think that people need to save more for retirement, which include me, think that consumption is too high relative to income, not too low. That is definitional. Savings are the income that is not consumed.

Comments