March 14, 2016

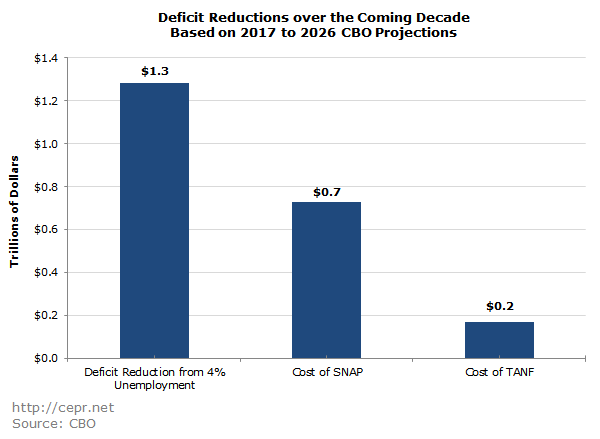

The graph above shows the impact on the deficit of sustaining a 4.0 percent unemployment rate over the next decade, alongside projected spending on TANF, and SNAP. A 4.0 percent unemployment rate is 0.9 percentage points below the 4.9 percent average rate of unemployment projected by the Congressional Budget Office over the next decade.

The economy sustained a 4.0 percent unemployment rate as a year-round average in 2000, with the rate falling as low as 3.8 percent over the course of the year. Contrary to the predictions of most economists, there was no notable uptick in the rate of inflation despite this low unemployment rate. While we cannot know for certain the lowest unemployment rate the economy could sustain without leading to inflation, most economists had badly overstated this rate in the 1990s. There is reason to believe, most notably due to the aging of the labor force (older workers have lower unemployment rates), that the economy might be able to sustain a lower unemployment rate today than it did two decades ago.

In addition to allowing more people to have jobs, a lower unemployment rate would have a large impact in reducing the deficit. Even without any fiscal stimulus, the unemployment rate could drop significantly if the Federal Reserve held off on future interest rate hikes.[1] In this scenario, because more people would be working, tax revenue would be higher and spending on programs for poor or unemployed Americans would be lower. As shown by the figure above [2], if the unemployment rate were to stay at 4.0 percent from 2017 to 2026 – rather than the 4.9 percent average projected by CBO — the cumulative 10-year deficit would fall by $1.3 trillion, not counting savings on interest payments. By contrast, CBO’s projected outlays over the next decade for TANF and SNAP are $170 billion and $728 billion, respectively. This is a useful comparison, since these two programs have often been targeted as areas of waste that can be reduced in order to lower the deficit. As the graph above shows, maintaining a lower rate of unemployment would have far more impact on the deficit than any plausible cuts in SNAP or TANF.

[1] CBO predicts that the Federal Reserve will raise interest rates significantly during the coming years: “After holding the target range for the federal funds interest rate (the Federal Reserve’s primary policy rate) at zero to 0.25 percent since late 2008, the Federal Reserve raised the range to 0.25 percent to 0.50 percent at its December 2015 meeting. In CBO’s forecast, the federal funds rate rises to 1.2 percent in the fourth quarter of 2016 and 2.2 percent in the fourth quarter of 2017, and it settles at 3.5 percent in the second quarter of 2019.” (2016 Budget and Economic Outlook, p. 39)

[2] Unemployment’s impact on the budget is based on CBO data on automatic stabilizers. Between 2000 and 2015, the unemployment rate was on average 1.3 percentage points higher than the CBO’s estimated long-term rate of unemployment. During this time, revenues were estimated to average 0.6 percent of potential GDP lower than they would’ve been at the long-term unemployment rate; spending on automatic stabilizers was estimated to average 0.2 percent of potential GDP higher than it would’ve been at the long-term unemployment rate. This implies that every percentage-point decrease in the unemployment rate boosts revenues and decreases spending by 0.5 and 0.1 percent of potential GDP, respectively.