September 29, 2014

In a post for the Roosevelt Institute’s Econobytes Janine Duffy of the Center for Economic and Policy Research shines a spotlight on the work of Harvard Business School’s Gareth Olds that demonstrates health insurance’s impact on self-employment.

A new paper by Gareth Olds finds that the availability of publicly funded insurance may have boosted entrepreneurship by allowing parents to start their own businesses while maintaining health insurance coverage for their children.

- The Children’s Health Insurance Program (CHIP) provides health insurance to children in families with incomes too high for Medicaid but below a higher cutoff that varies by state.

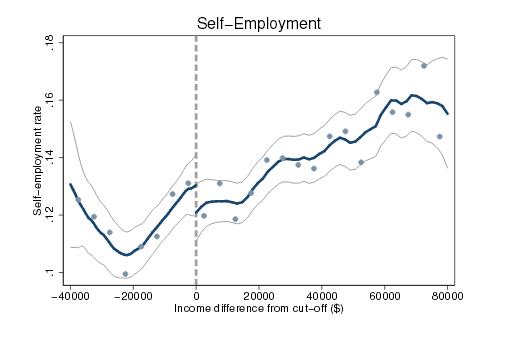

- The graph below displays the rate of self-employment among families near this income cutoff.

- If access to CHIP had no effect on self-employment, then we would expect no break in the relationship between self-employment and income near this cutoff.

- As the figure shows, there is a sharp break, with self-employment about eight percentage points higher just below the cutoff.

- Overall, comparing Census data before and after passage of the program in 1997, Olds found a 23 percent increase in the rate of self-employment and a 31 percent increase in the rate of ownership of incorporated businesses among CHIP recipients.

Improving the social safety net, in this case through more widely available and accessible health insurance, may actually spur entrepreneurship.

- Concretely, the availability of publicly provisioned health insurance seems to mean that parents don’t have to rely on a particular employer for health insurance and can instead become self-employed or start their own small business.

- The United States has among the lowest levels of self-employment and small business employment in the OECD and the existence of universal health insurance in every other OECD country might explain why the U.S. is such an outlier.

- The implementation of the ACA may trigger a wave of entrepreneurship and small business formation.