Article Artículo

Returns on Public Pensions: What Rates Should We Assume?It seems that Andrew Biggs, at the American Enterprise Institute, is taking issue with my argument on the rate of return that public pensions should assume on the portion of their assets held in stock. (The rate of return on the asset is the same issue as the rate of discount applied to future liabilities. I use rates of return just because it makes the discussion easier to follow.)

To start, we should be clear on what exactly is at issue. Andrew and I are not debating the expected rate of return on stocks. Both of us agree that the pension funds are at least close to the mark in their assumptions on stock returns. Rather, Andrew feels that their return assumption does not correctly account for the risk associated with stock returns. He notes that the higher return on stocks comes in exchange for higher risk. Since the pension obligation is an absolute commitment, he argues that pensions should assume a risk-free rate of return on their assets.

My contention is that because a state or local government is essentially an infinitely lived entity, it need not be as concerned about the variance in returns as individuals. Therefore state pension plans can make their projections based on the expected value of their stock holdings.

CEPR / March 06, 2011

Article Artículo

Economic Policy Still Failing U.S. WorkersEileen Appelbaum / March 05, 2011

Article Artículo

The Post Complains About Congress Soliciting Bernanke's OpinionDean Baker / March 05, 2011

Article Artículo

Unemployment Rate Drops Again for Third Consecutive MonthDean Baker / March 04, 2011

Article Artículo

Employment-to-Population Ratio for Men and Women, Age 20+, 2000-2011CEPR / March 04, 2011

Article Artículo

Unemployment Edges Lower as Job Growth ReturnsDean Baker / March 04, 2011

Article Artículo

Economists on Stock Returns: It Depends on the Weather or Maybe PoliticsDean Baker / March 04, 2011

Article Artículo

Spending Cuts Won't Help 25 Million Hurting for JobsDean Baker / March 03, 2011

Article Artículo

Bottom is Falling Out for Private-Sector WorkersJohn Schmitt / March 03, 2011

Article Artículo

Is the Obama Administration Still Clueless on Housing Bubble?Dean Baker / March 03, 2011

Article Artículo

Has Haiti’s Food Aid Been Shelved?CEPR / March 02, 2011

Article Artículo

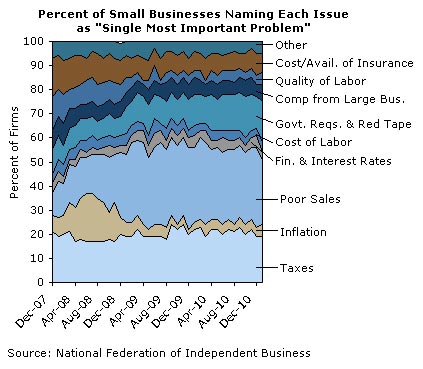

Structural Unemployment: The Data Just Doesn't Match UpStructural unemployment – unemployment stemming from a mismatch of workers' skills and job requirements – has been cited in mainstream media as the main cause of current, high unemployment. Data from the National Federation of Independent Business (NFIB), however, suggest that structural unemployment is not what is ailing the economy. The graph below draws on data from the NFIB's monthly survey from December 2007 (the official start of the recession) to January 2011. Each month, the NFIB asks its sample of small businesses to state the single most important problem facing their business today. Since the recession began, respondents overwhelmingly have cited "poor sales," suggesting that today's unemployment is primarily due to a lack of demand. "Quality of labor," the factor most consistent with structural unemployment, barely made the list.

In fact, as the recession deepened, "poor sales" became increasingly important, while "quality of labor" was cited less and less often. Furthermore, through an analysis of the NFIB data, we looked at the indicators that had the largest increase since and decrease since 2007, and they ended up being "poor sales" and "quality of labor" respectively. These findings suggest that the current, high unemployment is indeed cyclical and not structural.

CEPR and / March 02, 2011

Article Artículo

Are Republicans Really Worried That The Economy Is Creating Too Many Jobs?Dean Baker / March 02, 2011

Article Artículo

The Washington Post Tell Readers That Obama Doesn't Have Fiscal Credibility (Yes, In Its News Sections)Dean Baker / March 02, 2011

Article Artículo

They are Just Trade Agreements, not "Free-Trade" AgreementsDean Baker / March 01, 2011

Article Artículo

Uninformed Appraisals Should Lead to Inaccurate Appraisals, Not Low AppraisalsDean Baker / March 01, 2011