July 20, 2017

Most economists would probably agree that a tax reform that cleaned up loopholes could provide a boost to growth. Most would probably also agree that the 1986 tax reform was more good than bad in this respect. (Lowering the top individual tax rate to 28 percent would fall in the “bad” category for many of us.) But it is unlikely that many would endorse the claim in James B. Stewart’s column that after the tax reform:

“The economy (and the stock market) soared.”

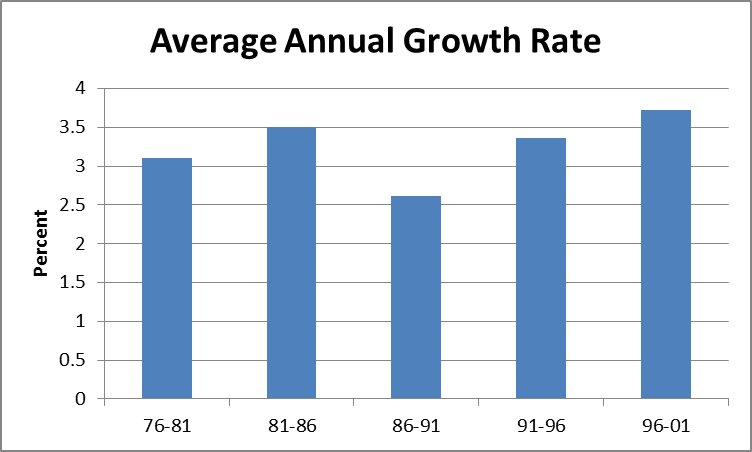

This one is clearly wrong. Growth in the five years following the passage of the tax cut was considerably worse than in the ten years preceding it or the next ten years as shown below.

Source: Bureau of Economic Analysis.

Growth in the five years following the tax reform averaged just 2.6 percent. That compares to 3.5 percent in the five years preceding the reform and 3.4 percent in the subsequent five years. It accelerated to 3.7 percent in the next five year period. I suppose some folks may want to claim the late 1990s boom was due to the 1986 tax reform, but the price of that sort of delayed effect means that the Johnson-Nixon administrations deserve credit for the 1980s growth and the current weak growth should be laid at the doorstep of George W. Bush.

There are of course complicating factors and the tax reform could have been a boost to growth that was offset by other factors, but the simple claim that we cut taxes and the economy boomed is clearly not true.

Comments