May 11, 2015

Last month, CEPR’s David Rosnick wrote a blog post critiquing a study by the American Enterprise Institute on workers’ retirement incomes. David talked about how middle-income households are increasingly financially unprepared for retirement.

This may be having an effect on the job market. When my colleague Kevin Cashman and I were putting together an age-adjusted employment-to-population (EPOP) ratio to track recovery in the labor market, we split employment amongst six different age groups: Americans aged 16 to 24, 25 to 34, 35 to 44, 45 to 54, 55 to 64, and 65 and over. We found that while employment rates had fallen significantly during the recession for Americans under 65, employment had actually gone up for those 65 and over. One possible explanation for this rise is that insufficient pensions and savings are forcing many Americans to work longer than they would otherwise prefer.

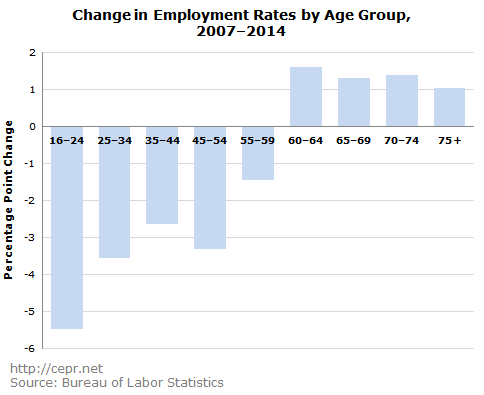

This explanation is supported by a more careful parsing of the data. The Bureau of Labor Statistics (BLS) calculates employment-to-population (EPOP) ratios for Americans of various age groups; I’ve pulled their data on Americans aged 16 to 24, 25 to 34, 35 to 44, 45 to 54, 55 to 59, 60 to 64, 65 to 69, 70 to 74, and 75 and over. Here is how rates of employment changed between 2007 and 2014 for the nine groups:

Even in the midst of a weak labor market, employment rates increased for retirement-age Americans. And the percentage-point increases in the graph above are especially striking once one considers just how low employment rates often are for retirement-age Americans.

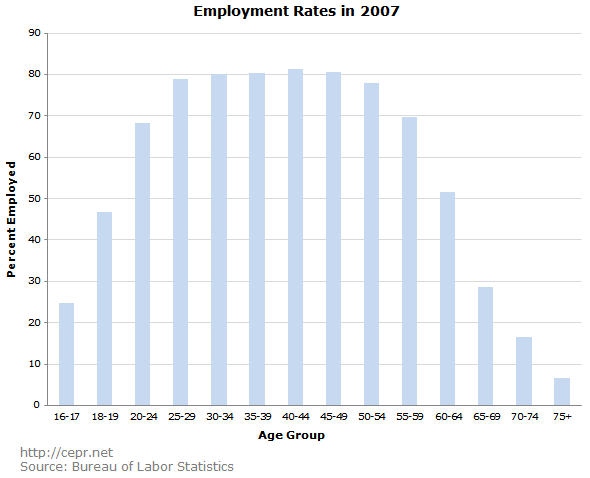

Moreover, while there is no one specific “retirement age,” changes in employment rates seem to show a break right around the ages we typically associate with retirement. Using the BLS’ most specific breakdowns by age, Americans were employed at the following rates in 2007:

In 2007, employment was highest amongst Americans aged 40 to 44, with 81.4 percent of people in this age group being employed. The two biggest drops in employment across age groups occur when people shift from the 60 to 64 age group to the 65 to 69 age group and when people shift from the 55 to 59 age group to the 60 to 64 age group. Employment rates decline 23.0 and 18.0 percentage points, respectively, when people move from the former age groups to the latter ones. This means that the increases in employment rates among these older workers are quite large relative to the share of these age groups who had previously been working.

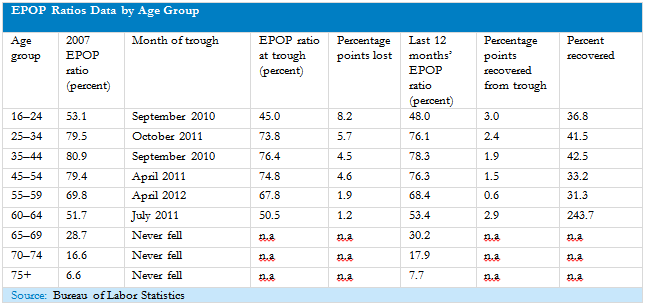

It is important to keep in mind that the increase in employment amongst retirement-age Americans has occurred in the context of an exceptionally weak labor market. Employment fell for all age groups 59 or younger during the recession; these groups have since recovered 31 to 43 percent of their lost employment. By contrast, employment is more than fully recovered for Americans aged 60 to 64, and employment never fell at all for even older Americans:

If employment had risen amongst retirement-age Americans at a time when employment was also rising for younger Americans, we most likely would have attributed the rise in retirement-age employment to increased demand in the labor market. But that simply isn’t the case. Employment rates increased for retirement-age Americans even as employment was falling for everyone else.

This indicates that Americans are increasingly likely to be working in what formerly had been their retirement years. While we can’t say for certain why this is occurring, it is certainly plausible that it is a result of the decline in household wealth for older Americans.

A more benign explanation is the improving educational profile of retirement-age Americans. The baby boomers in general have higher levels of educational attainment than the generations that preceded them; with more baby boomers moving into retirement age, we can expect the educational profile of retirement-age Americans to improve, which should in turn result in higher rates of employment. This possibly explains a sizable portion of the increase in employment among workers aged 60 to 69. Yet faced with the prospect of little retirement income other than Social Security, many older workers are likely forced to put off retirement and continue working long past their ideal retirement age.

If this is true, it means that we should be expanding rather than cutting Social Security. This would improve the well-being of older Americans who could retire at the point they expected. It may also help younger workers who could apply to the vacancies created by older workers’ retirements. If older Americans are working longer into their retirement years because they’re unprepared for retirement, everyone may gain from an expansion of Social Security.