March 07, 2013

With news of President Obama’s efforts to make some Republican BFFs, there are reports that he’s trying to make a deal by yet again offering to cut Social Security and other benefits, while at the same time raising income taxes on almost everyone.

This would be done by changing an official measure of inflation to a new index, called the Chained CPI. As CEPR has shown, this change would lead to a painful cut in Social Security benefits and a stealth tax hike, by slowing down annual increases in Social Security and other benefits – including those for veterans, the disabled, and low-income children and their families – as well as income tax brackets. (That would lead to incomes jumping to higher brackets faster, or in other words, tax increases.)

In fact, as Howard Gleckman at the Tax Policy Center recently noted, the Congressional Budget Office has estimated that moving to the Chained CPI “would raise taxes as much as it would cut spending.”

Meanwhile, Thomas Edsall wrote in the New York Times that this is essentially a “War on Entitlements.” He argues that the “debate… is taking place in a vacuum, without adequate consideration of fundamental facts,” and the “very nature of the basic security Americans are entitled to is at stake.”

His column serves to provide fundamental facts as well as insightful analysis of the politics. It’s well worth a read. For example, he points out that

Cutting benefits is frequently discussed in the halls of Congress, in research institutes and by analysts and columnists. The idea of subjecting earned income over $113,000 to the Social Security payroll tax… is largely missing from the policy conversation.

and then explains why he thinks this is so

most important in terms of the policy debate, while both means-testing and eliminating the $113,700 cap on earnings subject to the payroll tax hurt the affluent, the latter would inflict twice as much pain.

Citing CEPR research, he also notes that

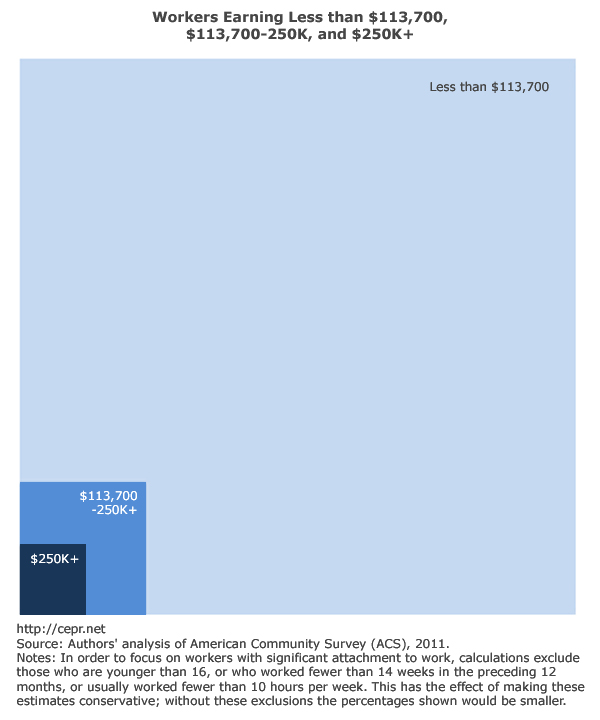

Simply by eliminating the payroll tax earnings cap — and thus ending this regressive exemption for the top 5.2 percent of earners — would, according to the Congressional Budget Office, solve the financial crisis facing the Social Security system.

And today bills were introduced to get this into the conversation in Congress. Senator Bernie Sanders introduced legislation, co-sponsored by Senate Majority Leader Harry Reid, to apply the Social Security payroll tax to income over $250,000. Representative Peter DeFazio introduced a companion bill in the House. CEPR has found that this proposal would affect only the wealthiest 1.3% of Americans.

Here are some of their statements.

Sanders said. “The most effective way to strengthen Social Security for the future is to eliminate the cap on the payroll tax on income above $250,000 so millionaires and billionaires pay the same share as everyone else.”

Reid said, “His legislation should make people think twice before assuming that the only way to strengthen Social Security is to take away benefits that seniors have earned, or raise taxes on the middle class.”

DeFazio added, “Despite the hype, Social Security is not now, and never was, the cause of our deficit. Those spreading these false claims are the same people who have for years been working with Wall Street to privatize the program. We shouldn’t cut benefits or try to balance the budget on the backs of seniors who have earned these benefits. We can just close a tax loophole that allows millionaires and billionaires to pay a lower percentage of their income into Social Security than everyone else.”

So, to summarize. The Chained CPI would cut Social Security and other benefits and increase taxes on almost everyone. Raising the Social Security payroll tax cap would help preserve benefits while asking the richest Americans to pay the same rate as all the rest of us. Seems like a no-brainer. But then we’re in Washington, DC, where no-brainers often are ignored.