April 07, 2017

April 7, 2017 (Jobs Byte)

By Dean Baker

Wages grew at just a 2.4 percent annual rate comparing the average over the last three months compared with the prior three months.

The unemployment rate fell to 4.5 percent in March, its lowest level since May of 2007. The employment-to-population ratio (EPOP) also edged up to 60.1 percent, a new high for the recovery, but still more than 3.0 percentage points below its pre-recession level.

However, the good news in the household survey was accompanied by weak job growth in the establishment survey. The economy added just 98,000 jobs in March. Job growth was also revised downward by 38,000 for the prior two months, bringing the three-month average to 178,000. There also has been some shortening of the average workweek. The index of aggregate weekly hours is essentially unchanged from its January level.

The strongest areas of job growth were restaurants (21,700), building support services (16,800), and health care (13,500). Mining also added 11,000 jobs, as did manufacturing. Retail was a big job loser in the month, shedding 29,700 jobs. This sector is likely to continue to show weakness as several major chains have announced plans to close a large number of stores. Government employment rose by 9,000 in March after falling by 2,000 in February.

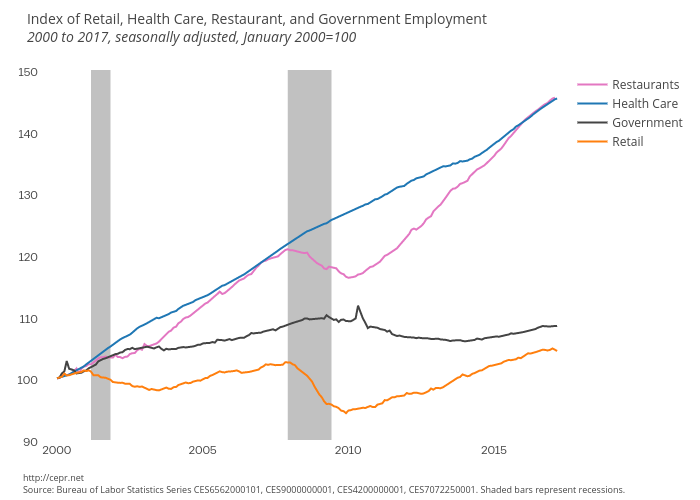

The March job growth follows a pattern than we have seen throughout most of this century. The health care and restaurant sectors have been the big job gainers since 2000, with employment in both sectors up by more than 45 percent since the 2000. By contrast, job growth in both retail and government has been sluggish. Retail employment is up by less than 7.0 percent since 2000 and government jobs are up by less than 9.0 percent. Government employment is just about even with its pre-recession level, while retail employment is slightly higher.

Wage growth appears to be slowing slightly. While the year-over-year increase in the average hourly wage was 2.7 percent, wages have grown at just 2.4 percent comparing the average of the last three months to the prior three months. This should give pause to those concerned about the labor market being too strong. The fall in the length of the workweek, coupled with modest wage growth, indicates there is much room for further strengthening.

Most of the news in the household survey was positive. The biggest drop in unemployment by demographic groups was a 0.5 percentage point drop to 5.1 percent for Hispanics. The EPOP for Hispanics also rose by 0.6 percentage points to 63.3 percent, a new high for the recovery.

The number of people involuntarily working part-time fell by 151,000 down to 5,553,000. This is 567,000 below its year-ago level, although still far above pre-recession levels. The number of people working part-time voluntarily fell by 50,000 in March, but is still 293,000 above its year-ago level. As noted previously, the Affordable Care Act appears to have had a large effect in increasing the number of people voluntarily working part-time, particularly among young parents and pre-Medicare age workers, as it allows people to get insurance outside of employment.

The duration measures of unemployment were changed little with the average and median duration of unemployment spells both increasing slightly, while the share of long-term unemployed fell to 23.3 percent, a new low for the recovery. The share of unemployment due to people voluntarily quitting their jobs rose slightly to 11.1 percent. This is still well below pre-recession peaks, which were over 12.0 percent and far below the peak of more than 15.0 percent reached in 2000.

On the whole, this should be viewed as a healthy report, but one that hardly suggests excessive labor market strength. The weak job growth in March is likely an anomaly. Unusually good winter weather in the Midwest and Northeast likely boosted job growth in January and February, which meant that March did not see the bounce it would ordinarily receive. Nonetheless the weakness in hours and the mild slowing in wage growth are not signs of a strong labor market. There seems little basis for concern about inflationary pressures at this point.