April 01, 2016

April 1, 2016 (Jobs Byte)

By Dean Baker

Self-employment has risen substantially since the ACA took effect.

The economy added 215,000 jobs in March, with the unemployment rate rounding up to 5.0 percent from February’s 4.9 percent. However, the modest increase in unemployment was largely good news, since it was the result of another 396,000 people entering the labor force.

There has been a large increase in the labor force over the last six months, especially among prime-age workers. Since September, the labor force participation rate for prime-age workers has increased by 0.8 percentage points. This seems to support the view that the people who left the labor market during the downturn will come back if they see jobs available. However, even with this recent rise, the employment-to-population ratio for prime-age workers is still down by more than two full percentage points from its pre-recession peak.

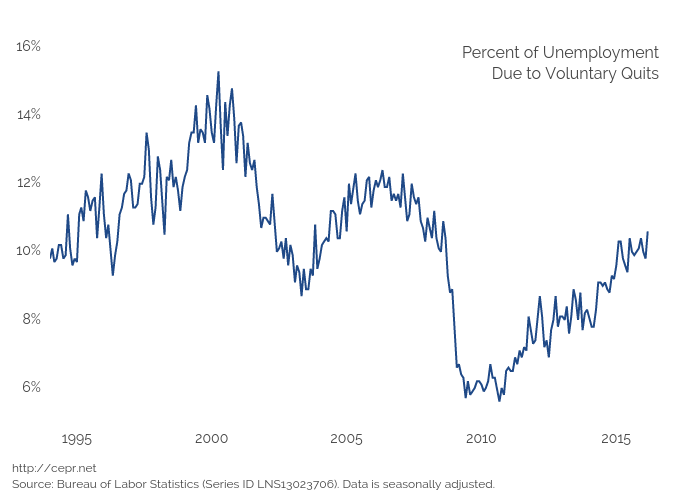

Another positive item in the household survey was a large jump in the percentage of unemployment due to voluntary quits. This sign of confidence in the labor market rose to 10.5 percent, the highest level in the recovery to date, although it’s still more than a percentage point below the pre-recession peaks and almost five percentage points below the peak reached in 2000.

Other items in the household survey were mixed. The number of people involuntarily working part-time rose by 135,000, reversing several months of declines. However, involuntary part-time work is still down by 550,000 from year-ago levels. The number of people voluntarily working part-time fell in March, but it is still 654,000 above its year-ago level.

One of the desired outcomes from the ACA was that it would free people from dependence on their employer for health care insurance, allowing them to work part-time or start a business if they so choose and get insurance through the exchanges. There has been a substantial rise in self-employment since the exchanges began operating in 2014. In the first quarter of 2016, incorporated self-employment was up by more than 400,000 (7.8 percent) from the same quarter of 2013. Unincorporated self-employment was also up by almost 360,000 (3.9 percent).

While the employment growth in the establishment survey was in line with expectations, average weekly hours remained at 34.4, down from 34.6 in January. This indicates that February’s drop in hours was not just a result of bad weather. As a result, the index of aggregate hours worked is down by 0.2 percent from the January level. This could be a sign of slower job growth in future months.

The employment growth in March was largely in retail (47,700 jobs), construction (37,000), health care (36,800), and restaurants (24,800). Retail has added more than 180,000 jobs over the last three months. This is an extraordinary pace that is unlikely to continue. Construction growth also has been unusually rapid the last six months, rising at 37,000 per month. Health care employment growth sped up sharply in 2015 to almost 40,000 a month, from less than 25,000 a month in 2014. That pace appears to be continuing into 2016.

The losers in recent months have been mining and manufacturing. The mining sector lost another 12,400 jobs in March and is down 184,500 jobs from its 2014 peak. Coal mining lost another 1,100 jobs and is down 33,100 (36.9 percent) from its 2012 peak. Manufacturing lost 29,000 jobs in March.

Two areas that could suggest some future weakness are trucking, where employment is down by 3,300 since January, and the temp sector. The latter had a small increase in March, but is still down by more than 52,000 from December.

The average hourly wage rose modestly in March after a reported decline in February. There is zero evidence of any acceleration in wage growth. The average for the last three months increased at an annualized rate of 2.3 percent compared with the average of the prior three months. This is virtually identical to the increase over the last year.

On the whole this is a positive report, both because the economy continues to create jobs at a healthy pace and even more importantly because it indicates that people are returning to the labor market. The continuing weakness in wage growth is discouraging, but also should signal to the Fed that there is little reason to raise interest rates.