October 25, 2011

October 25, 2011 (Housing Market Monitor)

By Dean Baker

The first time buyers tax credit has left many new homeowners underwater.

The Case-Shiller 20-City index was virtually unchanged in August, rising by just 0.2 percent from its July level. Prices rose in 10 of the cities and declined in the other 10. Most of the changes in either direction were modest. The largest gain was a 1.6 percent gain in Washington, D.C., followed by 1.4 percent gains in both Chicago and Detroit. The largest price decline was a 2.4 percent drop in Atlanta followed by a 0.4 percent drop in Los Angeles.

Most of the cities showing strong price growth over the last few months have been in the Midwest. Prices in Cleveland rose at a 10.4 percent annual rate between May and August. Prices in Chicago and Minneapolis rose at a 29.1 percent and 29.3 percent rate, respectively, and prices in Detroit rose at a 55.9 percent rate over this period.

Most of this story seems to be a bounce back from overselling earlier in the year. Prices in Cleveland are down by 4.8 percent from their year-ago level, while prices in Chicago and Minneapolis are down by 5.8 percent and 8.5 percent, respectively. Prices in Detroit are up 2.7 percent from their year-ago level, but are still down by 26.4 percent from their 2000 level, so there is no issue here of a returning bubble.

The other cities showing large recent gains include Washington, D.C., which has seen a 17.4 percent rate of increase over the last three months; Boston with a 13.0 percent rate; Dallas with a 10.5 percent rate; and New York with a 10.2 percent rate. Only in D.C. are prices higher than their year-ago level — and even in this case by just 0.3 percent. This is more likely a story of stabilizing prices rather than any sustained upturn.

It is interesting to note how much of the movement continues to be focused on the bottom end of the market, which in most cities is again doing worse than more highly priced homes. This is most clear in Atlanta where prices in bottom-tier homes fell by 9.3 percent and stand 38.9 percent below their year-ago-level. However, prices for bottom-tier homes also fell by 1.5 percent in San Francisco, 1.1 percent in Las Vegas, and 0.8 percent in New York.

Most of the story with bottom-tier homes over the last two and half years can be explained by the first-time buyers tax credit. Predictably, the credit had the largest effect on the bottom tier of the market both because this is where first-time buyers are concentrated and also because the credit would be a large share of the house price.

In Phoenix, prices of bottom-tier homes rose by 27.7 percent from the pre-tax credit level to the tax credit peak in 2010. In Minneapolis, the increase was 30.6 percent. Prices in these two cities have since fallen by 18.2 percent and 26.4 percent, respectively. This means that anyone who took advantage of the credit to buy a bottom-tier house in the summer of 2010 is almost certainly underwater and has lost considerably more equity in their home than they received from the credit.

The effect of the credit in these cases was to allow some homeowners to get out before the bubble had fully deflated and to allow many more to refinance while they still had equity in their homes. In both cases, this often meant transferring a mortgage with questionable prospects from private lenders to the federal government, since almost all new mortgages are covered by Fannie and Freddie or the FHA. This is a rather dubious goal for housing policy.

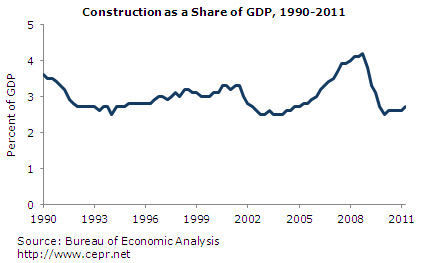

While it is unlikely that prices will go into another free fall, the near-record vacancy rates will continue to put downward pressure on house prices for at least the next couple of years, making unlikely that house prices will keep pace with inflation. Residential construction remains near its post-World War II low as a share of GDP, but is finally on an upward trend. Still it will not reach its normal share until at least 2014.