January 19, 2012

January 19, 2012 (Prices Byte)

Energy prices have decreased at an 18 percent annualized rate since September.

The Consumer Price Index was unchanged in December. This was the third straight month without an increase, bringing the three-month annualized rate of headline inflation to -0.4 percent, compared with 4.8 percent from June to September. Food and energy prices normally account for much of the variation in inflation rates, and recent history is no different. Energy prices fell 1.3 percent in December and fell at an 18 percent annualized rate since September, compared with a 26.6 percent rate increase over the three months prior.

Outside of food and energy, consumer prices rose 0.1 percent in December. These core prices have seen much more stable rates of inflation, rising at a 1.8 percent annualized rate over the last three months and 2.1 percent over the three months ending in September.

Transportation prices contributed to the low rate of core inflation as new vehicle prices fell for the third consecutive month. The price of used cars and trucks fell 0.9 percent—the fourth month in a row. As discussed in earlier reports, this is likely due in part to the late 2011 model year that delayed new car purchases.

Like food and energy, apparel prices are also volatile, but account for much less of the overall inflation index—3.6 percent, compared with 14.8 and 9.1 percent for food and energy, respectively. Apparel prices fell 0.1 percent in December after a gain in November of 0.6 percent.

Elsewhere in core prices, medical care inflation continues to run steadily higher than most any other component. Medical care prices rose 0.4 percent last month, including a 0.5 percent increase in hospital services. Over the last three months, these components respectively have seen annualized inflation rates of 3.9 and 5.6 percent.

As mentioned in last month’s report, there was an unusual jump of 0.7 percent in the price of personal computers and peripherals. In December, this gain was reversed by a 2.5 percent fall. Though large, such a fall is not uncommon. Over the last three months these prices have fallen at a 9.9 percent annualized rate, compared with a 16.4 percent annualized rate of decline over the three months prior.

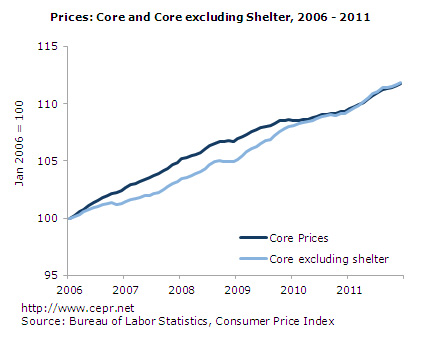

Finally, the price of owners’ equivalent rent rose 0.2 percent in December, helping to keep low the core rate of inflation. Owners’ equivalent rent of primary residences is the single largest component in the consumer price index— accounting for nearly one-quarter of the overall total. With very high vacancy rates resulting from the housing bubble, shelter prices had grown slowly and even fell. Thus, core prices excluding shelter had grown faster than core prices in general. More recently, a slightly faster rate of growth in rent prices and a slower rate of growth outside of rent have brought the two more in line.

The Producer Price Index fell 0.1 percent in December with food and energy prices falling 0.8 percent. Having reversed almost all of last month’s 1.0 percent gain, finished consumer food prices have run at a 1.2 percent annualized rate over the last three months. Core finished goods rose 0.3 percent in price in December, bringing the three-month rate of inflation to 1.8 percent annualized, and 2.4 percent annualized over the last six months.

Core intermediate goods prices fell for the third consecutive month and have not fallen at a 2.3 percent annualized rate since June. Core crude prices, flat in December, have increased at a 7.6 percent annualized rate over the last six months. Though it is not clear that this trend will continue, such swings tend to be smoothed out at later stages of production.

This significant lack of price pressure at early stages of production should continue to help keep consumer prices low for some time. The real hourly wage for production and nonsupervisory employees remained flat in December. Though this may be in small part due to the creation of a few low-paying jobs, the low rate of wage growth will also help keep low the rate of inflation and make it difficult for consumers to repay their debts. In all, this report once again indicates that a high rate of inflation is far removed as a threat to the economy.