February 19, 2016

Last month the Congressional Budget Office (CBO) released its Budget and Economic Outlook report for 2016 to 2026. While various aspects of the report have gotten major play in the media, one important yet overlooked detail is what CBO says about wage inequality. Specifically, CBO expects to see a “continued increase in the share of wages earned by higher-income taxpayers” (pg. 88). It indicates that another 4 percentage points of wage income will be redistributed from the bulk of the workforce to the roughly 7 percent of workers who earn more than the cap on wages subject to the Social Security tax (currently $118,500):

“The share of covered earnings above the taxable maximum amount is projected to rise to more than 20 percent in 2026, 4 percentage points more than the share in 2015…” (pg. 94)

This ceiling on the amount of wages subject to taxation rises in line with average wage growth every year. If inequality goes up and high-wage workers’ earnings rise faster than average, a greater share of overall wages are exempt from taxation. Due to rising inequality, the share of wages going untaxed has nearly doubled from one-tenth to nearly one-fifth over the past thirty years.

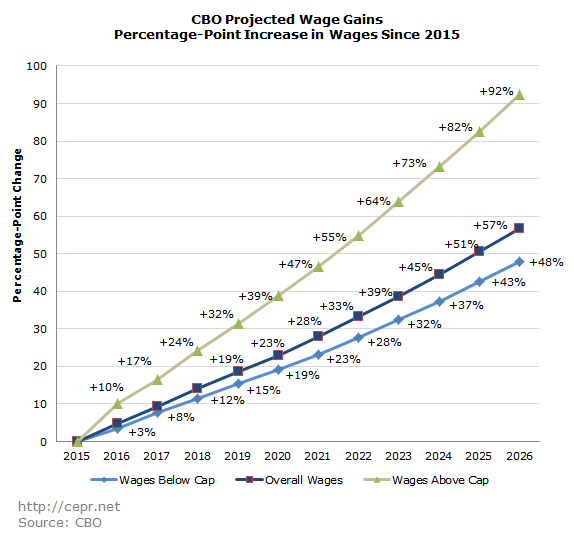

CBO expects that 33 percent of all wage growth between 2016 and 2026 will occur above the tax ceiling. As can be seen below, CBO’s projections imply that earnings above the ceiling will grow 92 percent between 2015 and 2026, while earnings below the ceiling will grow just 48 percent (in nominal dollars).

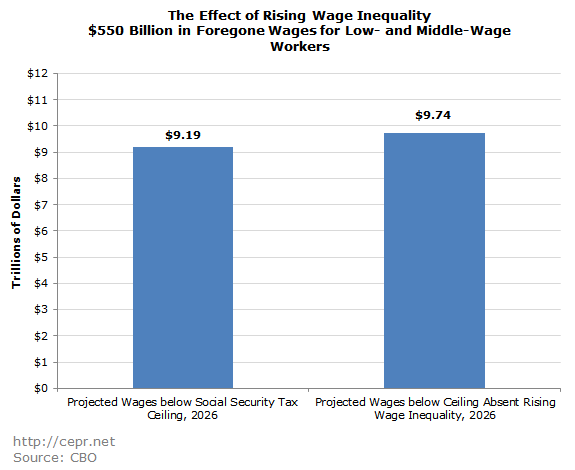

This translates to about a 6 percent wage cut for low- and middle-wage workers by 2026 compared to a scenario in which the wage distribution did not change: