The normally astute Martin Wolf failed to do his homework for a column yesterday in which he described the deficit reduction plan put forward by Morgan Stanley director Erskine Bowles and former Senator Alan Simpson as “the only politically realistic long-term fiscal solution.”

Actually there is a much politically viable solution: do nothing. Yes, this will make the deficit hawks at the Washington Post and other such places yell and scream, but it is both politically viable and economically solid. Unlike Bowles-Simpson, the do-nothing plan would not further slow the economy. (Remember, Bowles-Simpson as originally designed would have begun deficit reduction on October 1, 2011.) The do-nothing plan is obviously politically viable since it is currently what we are doing, more or less. (We’ll have to see how the end of 2012 issues get resolved.)

The economic reality is that we face no urgency to do anything on the deficit. We will undoubtedly need some additional revenues over the longer term, in addition to reversing the Bush tax cuts for the richest 2 percent, but it is possible that other better solutions will become politically viable, for example a Wall Street speculation tax that would hit big banks like the one where Mr. Bowles serves as a director. (It’s funny how they never considered taxing Wall Street.)

It’s also possible that we will fix the health care system so it doesn’t take an absurdly large share of GDP. That would require that folks like the insurers, drug companies and doctors take a hit, but it is principle possible that we could see enough political pressure in the future that this tiny elite is forced to take the hit rather than tens of millions of seniors living on $20,000 a year.

The normally astute Martin Wolf failed to do his homework for a column yesterday in which he described the deficit reduction plan put forward by Morgan Stanley director Erskine Bowles and former Senator Alan Simpson as “the only politically realistic long-term fiscal solution.”

Actually there is a much politically viable solution: do nothing. Yes, this will make the deficit hawks at the Washington Post and other such places yell and scream, but it is both politically viable and economically solid. Unlike Bowles-Simpson, the do-nothing plan would not further slow the economy. (Remember, Bowles-Simpson as originally designed would have begun deficit reduction on October 1, 2011.) The do-nothing plan is obviously politically viable since it is currently what we are doing, more or less. (We’ll have to see how the end of 2012 issues get resolved.)

The economic reality is that we face no urgency to do anything on the deficit. We will undoubtedly need some additional revenues over the longer term, in addition to reversing the Bush tax cuts for the richest 2 percent, but it is possible that other better solutions will become politically viable, for example a Wall Street speculation tax that would hit big banks like the one where Mr. Bowles serves as a director. (It’s funny how they never considered taxing Wall Street.)

It’s also possible that we will fix the health care system so it doesn’t take an absurdly large share of GDP. That would require that folks like the insurers, drug companies and doctors take a hit, but it is principle possible that we could see enough political pressure in the future that this tiny elite is forced to take the hit rather than tens of millions of seniors living on $20,000 a year.

Read More Leer más Join the discussion Participa en la discusión

The NYT ran a promotion for Representative Paul Ryan as a news story. The piece did not include a single critical comment from any of the people interviewed.

This is truly remarkable since many of Ryan proposals would add enormous costs to the economy and/or don’t seem to add up. For example, according to the Congressional Budget Office’s projections, his 2011 Medicare proposal would have increased the cost to the country of providing Medicare equivalent insurance policies by $34 trillion over Medicare’s 75-year planning period. His proposal for Social Security privatization would have added tens of billions of dollars annually to the administrative costs of Social Security.

In addition, his latest Medicare plan claims to save the same $750 billion over the next decade in Medicare as President Obama, but it does not include any of the cost control provisions. (Ryan says that he will repeal the Affordable Care Act.) He also has a budget that projects that government spending outside of Social Security and health care will be reduced to 3.75 percent of GDP by 2050. This is less than current spending on the military, which Representative Ryan claims he wants to maintain at or above current levels. This implies that he wants to eliminate the rest of the federal government, if it is taken seriously.

If it was not possible to find any conservatives who care about needless economic waste or blatant errors in arithmetic, the NYT should have found people with a different ideological perspective who could have made these points. Newspapers are not supposed to be used for fluff pieces for candidates, these are supposed to be written by their campaigns.

Addendum: Paul Ryan could not even figure out that it did not make sense to blame President Obama for the closure of a large GM plant in his district that took place while President Bush was still in the White House. Is this what passes as an “intellectual” in conservative circles?

The NYT ran a promotion for Representative Paul Ryan as a news story. The piece did not include a single critical comment from any of the people interviewed.

This is truly remarkable since many of Ryan proposals would add enormous costs to the economy and/or don’t seem to add up. For example, according to the Congressional Budget Office’s projections, his 2011 Medicare proposal would have increased the cost to the country of providing Medicare equivalent insurance policies by $34 trillion over Medicare’s 75-year planning period. His proposal for Social Security privatization would have added tens of billions of dollars annually to the administrative costs of Social Security.

In addition, his latest Medicare plan claims to save the same $750 billion over the next decade in Medicare as President Obama, but it does not include any of the cost control provisions. (Ryan says that he will repeal the Affordable Care Act.) He also has a budget that projects that government spending outside of Social Security and health care will be reduced to 3.75 percent of GDP by 2050. This is less than current spending on the military, which Representative Ryan claims he wants to maintain at or above current levels. This implies that he wants to eliminate the rest of the federal government, if it is taken seriously.

If it was not possible to find any conservatives who care about needless economic waste or blatant errors in arithmetic, the NYT should have found people with a different ideological perspective who could have made these points. Newspapers are not supposed to be used for fluff pieces for candidates, these are supposed to be written by their campaigns.

Addendum: Paul Ryan could not even figure out that it did not make sense to blame President Obama for the closure of a large GM plant in his district that took place while President Bush was still in the White House. Is this what passes as an “intellectual” in conservative circles?

Read More Leer más Join the discussion Participa en la discusión

A New York Times article on “Europe’s lost decade” could have easily had a headline like this. The piece talks about the high unemployment and weak growth across the euro zone, but never notes the obvious cause, major cutbacks in government spending and tax increases. The predicted result of such austerity measures is a contraction in demand.

This is even more likely to be the outcome of austerity in the euro zone than in the United States, since the private sector is a smaller share of the economy. (If the private sector is two-thirds of the economy, then it must expand by 1.5 percent to make up a 1 percentage point drop in GDP. If it’s 50 percent of the economy, then it has to grow by 2.0 percent to make up for a 1 percent drop in GDP.)

At one point the article implies that austerity would somehow help to promote growth, telling readers:

“Leaders in Brussels and European capitals have pledged to improve budgetary discipline, remove government obstacles to growth and strengthen the banking system by establishing a common regulator at the E.C.B.”

This one seems to be telling us that further budget cuts (i.e. “budgetary discipline”) would somehow boost demand.

Only at the very end of the article does the piece acknowledge that deficit reduction could be hurting growth:

“Some of the decline in euro zone economic output reflects lower government spending, as political leaders struggle to cut national deficits.”

Really?

A New York Times article on “Europe’s lost decade” could have easily had a headline like this. The piece talks about the high unemployment and weak growth across the euro zone, but never notes the obvious cause, major cutbacks in government spending and tax increases. The predicted result of such austerity measures is a contraction in demand.

This is even more likely to be the outcome of austerity in the euro zone than in the United States, since the private sector is a smaller share of the economy. (If the private sector is two-thirds of the economy, then it must expand by 1.5 percent to make up a 1 percentage point drop in GDP. If it’s 50 percent of the economy, then it has to grow by 2.0 percent to make up for a 1 percent drop in GDP.)

At one point the article implies that austerity would somehow help to promote growth, telling readers:

“Leaders in Brussels and European capitals have pledged to improve budgetary discipline, remove government obstacles to growth and strengthen the banking system by establishing a common regulator at the E.C.B.”

This one seems to be telling us that further budget cuts (i.e. “budgetary discipline”) would somehow boost demand.

Only at the very end of the article does the piece acknowledge that deficit reduction could be hurting growth:

“Some of the decline in euro zone economic output reflects lower government spending, as political leaders struggle to cut national deficits.”

Really?

Read More Leer más Join the discussion Participa en la discusión

The WAPO has a nicely graphed blog post telling us that there was no recession for college grads. It shows that employment for college grads has risen at a strong pace since the start of the recovery and is well above its pre- recession level. The problem is that we need a denominator in this story. (This seems to be a recurring problem at the WAPO, like when they tell us about the multi-trillion dollar shortfall projected for Social Security without pointing out that it is equal to around 0.6 percent of future GDP.) Anyhow fans of fractions can see that there was in fact a serious recession for college grads which still lingers today. As the graph shows, the unemployment rate for college grads rose from less than 2.0 percent before the downturn to a peak of more than 5.0 percent in 2009. Currently it is hovering near 4.0 percent, more than twice its pre-recession level.

Unemployment Rate for People With at Least a College Degree

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

So how do we get a doubling of unemployment at a time when college grads are scooping up millions of new jobs? Yes folks, this is where our old friend the denominator comes in. It seems that there has been an even more rapid rise in the number of college grads in the labor force over the last five years as shown below.

People with a College Degree or Higher in the Labor Force

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

So even though college grads were getting more jobs, they were not getting them at a fast enough pace to keep up with the growth in the number of college grads in the labor force. Just to be clear, college grads were still doing well in the scheme of things. Here’s the picture for those at the other end of the educational spectrum, people without high school degrees.

Unemployment Rate for People with Less than a High School Degree

Source: Bureau of Labor Statistics.

As can be seen unemployment also doubled for people with less than a high school degree, but the starting point was much higher at close to 7.0 percent. In fact, this rise in unemployment understates the true impact of the downturn, since many people without high school degrees simply left the labor force as a result of their bleak job prospects. (This undoubtedly happened with some college grads too, but the effect was likely much smaller.)

The moral of this story is that the recession has hit everyone. This is important because some folks could be led to believe from this employment story that the problem is that we just need more people to get college degrees and then they will be able to find good paying jobs. However, when we bring in our old friend the denominator we can see that this is not true. The problem is simply a lack of demand in the economy. Education helps in a downturn as it does during normal times, but even the most highly educated workers are getting whacked by this recession.

The WAPO has a nicely graphed blog post telling us that there was no recession for college grads. It shows that employment for college grads has risen at a strong pace since the start of the recovery and is well above its pre- recession level. The problem is that we need a denominator in this story. (This seems to be a recurring problem at the WAPO, like when they tell us about the multi-trillion dollar shortfall projected for Social Security without pointing out that it is equal to around 0.6 percent of future GDP.) Anyhow fans of fractions can see that there was in fact a serious recession for college grads which still lingers today. As the graph shows, the unemployment rate for college grads rose from less than 2.0 percent before the downturn to a peak of more than 5.0 percent in 2009. Currently it is hovering near 4.0 percent, more than twice its pre-recession level.

Unemployment Rate for People With at Least a College Degree

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

So how do we get a doubling of unemployment at a time when college grads are scooping up millions of new jobs? Yes folks, this is where our old friend the denominator comes in. It seems that there has been an even more rapid rise in the number of college grads in the labor force over the last five years as shown below.

People with a College Degree or Higher in the Labor Force

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

So even though college grads were getting more jobs, they were not getting them at a fast enough pace to keep up with the growth in the number of college grads in the labor force. Just to be clear, college grads were still doing well in the scheme of things. Here’s the picture for those at the other end of the educational spectrum, people without high school degrees.

Unemployment Rate for People with Less than a High School Degree

Source: Bureau of Labor Statistics.

As can be seen unemployment also doubled for people with less than a high school degree, but the starting point was much higher at close to 7.0 percent. In fact, this rise in unemployment understates the true impact of the downturn, since many people without high school degrees simply left the labor force as a result of their bleak job prospects. (This undoubtedly happened with some college grads too, but the effect was likely much smaller.)

The moral of this story is that the recession has hit everyone. This is important because some folks could be led to believe from this employment story that the problem is that we just need more people to get college degrees and then they will be able to find good paying jobs. However, when we bring in our old friend the denominator we can see that this is not true. The problem is simply a lack of demand in the economy. Education helps in a downturn as it does during normal times, but even the most highly educated workers are getting whacked by this recession.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post once again confounded its critics who insisted that it couldn’t get any worse. Yesterday the paper ran an editorial that criticized Vice President Joe Biden for his lack of courage when he committed the administration to a policy of not cutting Social Security. Biden repeatedly told an audience in Southern Virginia that he guaranteed there would be no cuts to Social Security in a second Obama administration.

The paper then laid out its case for cuts to the program and outlined its plan:

“Tweak the inflation calculator and moderately raise the income limit for applying the payroll tax, and you can shore up Social Security with no harm to the safety net.”

Did you catch the cuts in that sentence? If not, that is what “tweak the inflation adjustment” means. It means reducing the size of the benefit by 0.3 percent annually. This cut accumulates over time to roughly 3 percent after 10 years, 6 percent after 20 years, and for those who collect benefits long enough, 9 percent after 30 years. Certainly many people might think that a 9 percent cut in benefits for 10 percent of retirees who rely solely on Social Security for their income, or the 30 percent of retirees who rely on it for more than 90 percent of their income, does some harm to the safety net.

The great part of this story is that in an editorial condemning Biden’s lack of courage on Social Security, the Post used a euphemism for cuts that probably eluded most readers. After all, cutting benefits for retirees by 0.3 percent a year doesn’t sound very nice, tweaking the inflation adjustment is much friendlier.

Only in the Washington Post.

The Washington Post once again confounded its critics who insisted that it couldn’t get any worse. Yesterday the paper ran an editorial that criticized Vice President Joe Biden for his lack of courage when he committed the administration to a policy of not cutting Social Security. Biden repeatedly told an audience in Southern Virginia that he guaranteed there would be no cuts to Social Security in a second Obama administration.

The paper then laid out its case for cuts to the program and outlined its plan:

“Tweak the inflation calculator and moderately raise the income limit for applying the payroll tax, and you can shore up Social Security with no harm to the safety net.”

Did you catch the cuts in that sentence? If not, that is what “tweak the inflation adjustment” means. It means reducing the size of the benefit by 0.3 percent annually. This cut accumulates over time to roughly 3 percent after 10 years, 6 percent after 20 years, and for those who collect benefits long enough, 9 percent after 30 years. Certainly many people might think that a 9 percent cut in benefits for 10 percent of retirees who rely solely on Social Security for their income, or the 30 percent of retirees who rely on it for more than 90 percent of their income, does some harm to the safety net.

The great part of this story is that in an editorial condemning Biden’s lack of courage on Social Security, the Post used a euphemism for cuts that probably eluded most readers. After all, cutting benefits for retirees by 0.3 percent a year doesn’t sound very nice, tweaking the inflation adjustment is much friendlier.

Only in the Washington Post.

Read More Leer más Join the discussion Participa en la discusión

It is standard in the United States to report GDP growth at annual rates. This is not true everywhere in the world, where growth rates are often expressed at quarterly rates.

This is where reporters and editors come in. Using the magic of modern mathematics, quarterly growth rates can be converted into annual rates. Usually multiplying by 4 will do the trick, but to be strictly kosher one should take the growth rate to the fourth power.

This means that when the NYT reported data from the Bank of England showing the UK economy shrinking by 0.7 percent in the second quarter it should have pointed out to readers that this implied a 2.8 percent annual rate of decline. By failing to convert the quarterly growth rate into an annual rate, the NYT led most of its readers to believe that the UK’s recession is only one fourth as severe as is actually the case.

It is standard in the United States to report GDP growth at annual rates. This is not true everywhere in the world, where growth rates are often expressed at quarterly rates.

This is where reporters and editors come in. Using the magic of modern mathematics, quarterly growth rates can be converted into annual rates. Usually multiplying by 4 will do the trick, but to be strictly kosher one should take the growth rate to the fourth power.

This means that when the NYT reported data from the Bank of England showing the UK economy shrinking by 0.7 percent in the second quarter it should have pointed out to readers that this implied a 2.8 percent annual rate of decline. By failing to convert the quarterly growth rate into an annual rate, the NYT led most of its readers to believe that the UK’s recession is only one fourth as severe as is actually the case.

Read More Leer más Join the discussion Participa en la discusión

Casey Mulligan misrepresented President Obama’s claims on unemployment insurance, making his plans to have deficit spending analogous to Governor Romney’s trickle down economics. Mulligan claims the two plans are analogous in the sense that Romney argues that ordinary workers can be made better off by redistributing income upwards, while Obama argues that business owners can be made better off by giving unemployed workers more generous unemployment benefits.

There is a fundamental difference in these arguments that Mulligan’s discussion conceals. Romney is claiming that he does not want to increase the deficit. His tax cuts for the wealthy would come at the expense of higher taxes on middle income workers.

By contrast, President Obama is proposing to keep higher levels of unemployment benefits that will be financed by larger budget deficits. This does not amount to a claim that a redistribution from one group to another will make the loser in this story better off, it depends on the idea that deficits in a downturn can boost economic growth.

It is possible to make an argument that deficits imply higher future tax burdens and that people will recognize this fact and reduce their spending accordingly, but that is a very strong assumption that seems to be implicit in Mulligan’s argument. For people who do not believe that most households factor the government’s debt into their spending and saving decisions, Obama’s argument is simply that putting more money into the hands of unemployed workers will lead to more spending and therefore more growth.

Casey Mulligan misrepresented President Obama’s claims on unemployment insurance, making his plans to have deficit spending analogous to Governor Romney’s trickle down economics. Mulligan claims the two plans are analogous in the sense that Romney argues that ordinary workers can be made better off by redistributing income upwards, while Obama argues that business owners can be made better off by giving unemployed workers more generous unemployment benefits.

There is a fundamental difference in these arguments that Mulligan’s discussion conceals. Romney is claiming that he does not want to increase the deficit. His tax cuts for the wealthy would come at the expense of higher taxes on middle income workers.

By contrast, President Obama is proposing to keep higher levels of unemployment benefits that will be financed by larger budget deficits. This does not amount to a claim that a redistribution from one group to another will make the loser in this story better off, it depends on the idea that deficits in a downturn can boost economic growth.

It is possible to make an argument that deficits imply higher future tax burdens and that people will recognize this fact and reduce their spending accordingly, but that is a very strong assumption that seems to be implicit in Mulligan’s argument. For people who do not believe that most households factor the government’s debt into their spending and saving decisions, Obama’s argument is simply that putting more money into the hands of unemployed workers will lead to more spending and therefore more growth.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post long ago ended the separation of its news and editorial departments, therefore it was not surprising to see the page three article complaining that “experts” are worried that the rhetoric of the presidential campaign will make it harder to find a “solution” for Medicare. As is standard practice, the Post’s corral of experts were exclusively people who largely agree with its editorial position on Medicare: that there have to be large cuts to the program.

The three people presented as experts in the piece are Robert Bixby, the executive director of the Peter Peterson funded Concord Coalition, Steve Bell, economic policy director at the Peter Peterson funded Bipartisan Policy Center and a former Republican congressional staffer, Dougas Holtz-Eakin, a former director of the Congressional Budget Office and the top economic advisor to John McCain in his 2008 campaign. All three present views of Medicare and budget deficits that are very similar to the views expressed in the Post editorials.

It would have been easy to find experts presenting a broader range of views if the Post had wanted to write this piece as a real news story. For example, they could have spoken to Henry Aaron at the Brookings Institution who has written extensively on health care policy for decades. Or, they could have talked to M.I.T. economist Jon Gruber who played a central role in designing both Governor Romney’s health care plan for Massachusetts and President Obama’s health care plan.

A broader group of experts could have explained to readers that most of Medicare’s projected shortfall has already been eliminated by the cost control measures that President Obama put in place in the Affordable Care Act. The projected shortfall over 75 years fell from 3.88 percent of taxable payroll in the 2009 Medicare Trustees Report to 1.35 percent of taxable payroll in the 2012 Medicare Trustees Report. The experts the Post relied upon apparently neglected to mention the sharp reduction in the projected deficit as a result of President Obama’s policies.

A broader group of experts might also have reminded Post readers that the underlying problem is not the cost of Medicare but rather the cost of health care more generally in the United States. If we paid the same amount per person as people in any other wealthy country, there would be no Medicare problem whatsoever and the long-term projections would show huge surpluses rather than deficits. Readers of an article that purports to give the view of experts should know this information.

The Washington Post long ago ended the separation of its news and editorial departments, therefore it was not surprising to see the page three article complaining that “experts” are worried that the rhetoric of the presidential campaign will make it harder to find a “solution” for Medicare. As is standard practice, the Post’s corral of experts were exclusively people who largely agree with its editorial position on Medicare: that there have to be large cuts to the program.

The three people presented as experts in the piece are Robert Bixby, the executive director of the Peter Peterson funded Concord Coalition, Steve Bell, economic policy director at the Peter Peterson funded Bipartisan Policy Center and a former Republican congressional staffer, Dougas Holtz-Eakin, a former director of the Congressional Budget Office and the top economic advisor to John McCain in his 2008 campaign. All three present views of Medicare and budget deficits that are very similar to the views expressed in the Post editorials.

It would have been easy to find experts presenting a broader range of views if the Post had wanted to write this piece as a real news story. For example, they could have spoken to Henry Aaron at the Brookings Institution who has written extensively on health care policy for decades. Or, they could have talked to M.I.T. economist Jon Gruber who played a central role in designing both Governor Romney’s health care plan for Massachusetts and President Obama’s health care plan.

A broader group of experts could have explained to readers that most of Medicare’s projected shortfall has already been eliminated by the cost control measures that President Obama put in place in the Affordable Care Act. The projected shortfall over 75 years fell from 3.88 percent of taxable payroll in the 2009 Medicare Trustees Report to 1.35 percent of taxable payroll in the 2012 Medicare Trustees Report. The experts the Post relied upon apparently neglected to mention the sharp reduction in the projected deficit as a result of President Obama’s policies.

A broader group of experts might also have reminded Post readers that the underlying problem is not the cost of Medicare but rather the cost of health care more generally in the United States. If we paid the same amount per person as people in any other wealthy country, there would be no Medicare problem whatsoever and the long-term projections would show huge surpluses rather than deficits. Readers of an article that purports to give the view of experts should know this information.

Read More Leer más Join the discussion Participa en la discusión

In a Washington Post column today, Kevin Hassett and Glenn Hubbard, two of the top economists on Governor Romney’s economic team, rightly take President Obama to task for blaming the weakness of the economy since the downturn on the financial crisis. They cite a recent study from the Federal Reserve Bank of Cleveland as showing that recoveries following financial crises tend to be stronger not weaker than other recoveries.

While there are some questions that can be raised about this study (was the financial crisis in the 1990 recession really comparable to what we saw in the fall of 2008?) the basic point seems right. After all, we do know how to set an economy in motion again following a financial crisis. Argentina managed to regain all the ground lost after a complete financial meltdown in December of 2001 in just 1.5 years. Our financial policy crew can’t be that much less competent than the folks calling the shots in Argentina. The idea that a financial crisis puts a mysterious curse on an economy was always more than a bit suspect.

However the Cleveland Fed study doesn’t quite say that this recovery should be like any other recovery, as Hassett and Hubbard imply. The study goes on to note the extraordinary weakness in housing in this recovery and point out that this weakness could explain much of the weakness of the recovery.

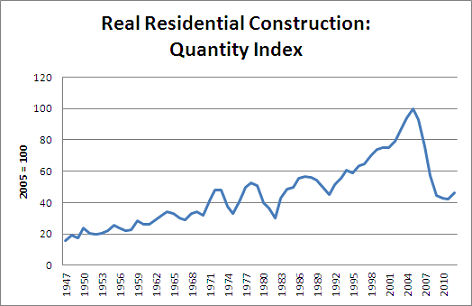

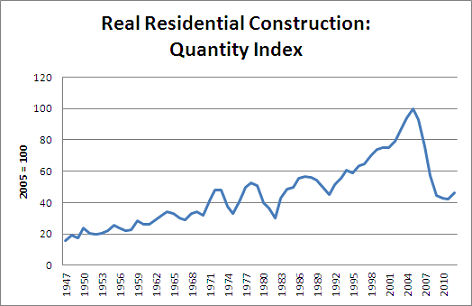

While the study notes that there are questions of causation (a weak recovery could lead to weakness in housing), there can be little doubt that if residential construction had returned to its pre-recession level, as had been the case by this point in all prior post-war recoveries, the economy would be back near full employment.

Source: Bureau of Economic Analysis.

Of course it is not hard to understand why housing has not recovered. The massive over-building of housing during the bubble years lead to an enormous over-supply of housing, which shows up in the data as a record vacancy rate in the years 2006-10. In the last couple of years the vacancy rate has begun to decline which can explain the recent uptick in housing over the last few quarters.

This housing story explains why we should have expected a long and drawn out recovery. There is no easy way to replace the massive loss in demand associated with the collapse of the housing sector. And, it is hard to blame the collapse on President Obama, since the overbuilding took place in the years 2000-2006 and the collapse was already well underway at the point where he took office.

The housing story also puts a kink in the three phases of stimulus story that Hassett and Hubbard outline, where the stimulus becomes contractionary when it is withdrawn after a short initial boost, and then slows the economy further after recovery as a result of a higher future tax burdens. The implication of the housing crash story is that we didn’t want a short initial boost, but rather needed a longer term stimulus that could sustain demand until some other component of consumption could fill the gap.

Obviously Hassett and Hubbard want us to believe that additional investment from the tax cuts proposed by Governor Romney would do the trick, however there is little evidence to believe that they would make much difference. With investment in equipment and software already pretty much back to its pre-recession share of GDP, we would have to see an unprecedented explosion in this category of investment to come close to making up the gap created by the falloff in residential construction. That doesn’t seem likely.

Ultimately we will need an increase in foreign demand, meaning a lower trade deficit, to fill the gap. This will require a lower valued dollar which will make U.S. goods more competitive internationally. Unfortunately, neither candidate seems willing to make the case for a lower valued dollar, which means that we can probably expect a weak economy for many years into the future, regardless of who gets elected.

In a Washington Post column today, Kevin Hassett and Glenn Hubbard, two of the top economists on Governor Romney’s economic team, rightly take President Obama to task for blaming the weakness of the economy since the downturn on the financial crisis. They cite a recent study from the Federal Reserve Bank of Cleveland as showing that recoveries following financial crises tend to be stronger not weaker than other recoveries.

While there are some questions that can be raised about this study (was the financial crisis in the 1990 recession really comparable to what we saw in the fall of 2008?) the basic point seems right. After all, we do know how to set an economy in motion again following a financial crisis. Argentina managed to regain all the ground lost after a complete financial meltdown in December of 2001 in just 1.5 years. Our financial policy crew can’t be that much less competent than the folks calling the shots in Argentina. The idea that a financial crisis puts a mysterious curse on an economy was always more than a bit suspect.

However the Cleveland Fed study doesn’t quite say that this recovery should be like any other recovery, as Hassett and Hubbard imply. The study goes on to note the extraordinary weakness in housing in this recovery and point out that this weakness could explain much of the weakness of the recovery.

While the study notes that there are questions of causation (a weak recovery could lead to weakness in housing), there can be little doubt that if residential construction had returned to its pre-recession level, as had been the case by this point in all prior post-war recoveries, the economy would be back near full employment.

Source: Bureau of Economic Analysis.

Of course it is not hard to understand why housing has not recovered. The massive over-building of housing during the bubble years lead to an enormous over-supply of housing, which shows up in the data as a record vacancy rate in the years 2006-10. In the last couple of years the vacancy rate has begun to decline which can explain the recent uptick in housing over the last few quarters.

This housing story explains why we should have expected a long and drawn out recovery. There is no easy way to replace the massive loss in demand associated with the collapse of the housing sector. And, it is hard to blame the collapse on President Obama, since the overbuilding took place in the years 2000-2006 and the collapse was already well underway at the point where he took office.

The housing story also puts a kink in the three phases of stimulus story that Hassett and Hubbard outline, where the stimulus becomes contractionary when it is withdrawn after a short initial boost, and then slows the economy further after recovery as a result of a higher future tax burdens. The implication of the housing crash story is that we didn’t want a short initial boost, but rather needed a longer term stimulus that could sustain demand until some other component of consumption could fill the gap.

Obviously Hassett and Hubbard want us to believe that additional investment from the tax cuts proposed by Governor Romney would do the trick, however there is little evidence to believe that they would make much difference. With investment in equipment and software already pretty much back to its pre-recession share of GDP, we would have to see an unprecedented explosion in this category of investment to come close to making up the gap created by the falloff in residential construction. That doesn’t seem likely.

Ultimately we will need an increase in foreign demand, meaning a lower trade deficit, to fill the gap. This will require a lower valued dollar which will make U.S. goods more competitive internationally. Unfortunately, neither candidate seems willing to make the case for a lower valued dollar, which means that we can probably expect a weak economy for many years into the future, regardless of who gets elected.

Read More Leer más Join the discussion Participa en la discusión

It is popular among Washington elite types to tut-tut criticisms of the plan put forward by Representative Ryan and the Republicans to replace Medicare with a voucher program by claiming that “at least he has a plan.” This is supposed to be in contrast to President Obama and the Democrats who have no plan to deal with Medicare’s projected shortfall.

It’s possible that these Washington insiders missed it, but President Obama and the Democrats pushed through a piece of legislation called the “Affordable Care Act.” This bill proposes a number of mechanisms for containing costs within the Medicare program. As a result the projected shortfall has fallen by almost two-thirds, from 3.88 percent of taxable payroll in the 2009 Medicare Trustees Report to 1.35 percent of taxable payroll in the 2012 Medicare Trustees Report.

People can criticize the mechanisms the ACA put in place or complain that they did not go far enough, but to claim that President Obama and the Democrats did nothing to address the projected shortfall in Medicare is not true.

It is popular among Washington elite types to tut-tut criticisms of the plan put forward by Representative Ryan and the Republicans to replace Medicare with a voucher program by claiming that “at least he has a plan.” This is supposed to be in contrast to President Obama and the Democrats who have no plan to deal with Medicare’s projected shortfall.

It’s possible that these Washington insiders missed it, but President Obama and the Democrats pushed through a piece of legislation called the “Affordable Care Act.” This bill proposes a number of mechanisms for containing costs within the Medicare program. As a result the projected shortfall has fallen by almost two-thirds, from 3.88 percent of taxable payroll in the 2009 Medicare Trustees Report to 1.35 percent of taxable payroll in the 2012 Medicare Trustees Report.

People can criticize the mechanisms the ACA put in place or complain that they did not go far enough, but to claim that President Obama and the Democrats did nothing to address the projected shortfall in Medicare is not true.

Read More Leer más Join the discussion Participa en la discusión