Ezra Klein gives us a graph from the Center on Budget and Policy Priorities that shows the ratio of debt to GDP from 2001 to 2019. The graph attributes the rise in the debt to various causes. The Bush tax cuts and the wars in Iraq and Afghanistan are shown to be major culprits.

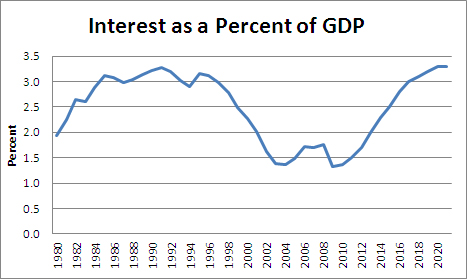

There actually is a much better graph that people can use. This is the graph showing interest on the debt as a share of GDP.

Source: Congressional Budget Office.

Note that this one looks considerably less scary. We don’t get back to the same devastating interest burdens we faced in the early 90s until 2019. Yes folks, that was snark. Unless I’ve gone senile the interest burden we faced in the early 90s did not prevent us from having a decade of solid growth and low unemployment at the end of the period.

Am I pulling a fast one here by switching from debt to interest payments? Not at all. Suppose we issue $4 trillion in 30-year bonds in 2012 at 2.75 percent interest (roughly the going yield). Suppose the economy recovers, as CBO predicts, and the interest rate is up around 6.0 percent in 4-5 years. The federal government would be able to buy back the $4 trillion in bonds it had issued for roughly $2 trillion, immediately eliminating $2 trillion of its debt. This will make those who fixate on the debt hysterically happy, but will not affect the government’s finances in the least. It will still face the same interest obligation.

The point here is that the fixation on the debt by both parties has paralyzed economic policy so that tens of millions of people are now being needlessly forced to suffer the effects of unemployment. We need graphs that focus on the economy, not silliness that distracts from real issues in order to assign partisan blame. (Yes, the Bush tax cuts were stupid and the wars should not have been fought, but they did not get us in this mess.)

Ezra Klein gives us a graph from the Center on Budget and Policy Priorities that shows the ratio of debt to GDP from 2001 to 2019. The graph attributes the rise in the debt to various causes. The Bush tax cuts and the wars in Iraq and Afghanistan are shown to be major culprits.

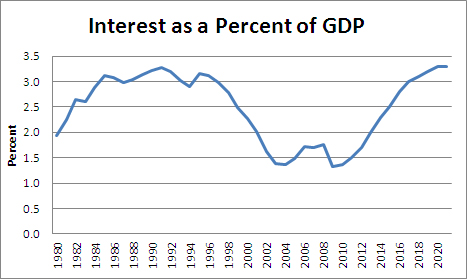

There actually is a much better graph that people can use. This is the graph showing interest on the debt as a share of GDP.

Source: Congressional Budget Office.

Note that this one looks considerably less scary. We don’t get back to the same devastating interest burdens we faced in the early 90s until 2019. Yes folks, that was snark. Unless I’ve gone senile the interest burden we faced in the early 90s did not prevent us from having a decade of solid growth and low unemployment at the end of the period.

Am I pulling a fast one here by switching from debt to interest payments? Not at all. Suppose we issue $4 trillion in 30-year bonds in 2012 at 2.75 percent interest (roughly the going yield). Suppose the economy recovers, as CBO predicts, and the interest rate is up around 6.0 percent in 4-5 years. The federal government would be able to buy back the $4 trillion in bonds it had issued for roughly $2 trillion, immediately eliminating $2 trillion of its debt. This will make those who fixate on the debt hysterically happy, but will not affect the government’s finances in the least. It will still face the same interest obligation.

The point here is that the fixation on the debt by both parties has paralyzed economic policy so that tens of millions of people are now being needlessly forced to suffer the effects of unemployment. We need graphs that focus on the economy, not silliness that distracts from real issues in order to assign partisan blame. (Yes, the Bush tax cuts were stupid and the wars should not have been fought, but they did not get us in this mess.)

Read More Leer más Join the discussion Participa en la discusión

The economics profession tends to be bipolar. It swings from periods of wild optimism to wild pessimism while rarely stopping anywhere in the mild. Hence we had the new economy optimists in the late 90s who insisted that all the problems of scarcity had been solved forever by the wonders of the information age. Now we have Paul Krugman citing new work by Robert Gordon which tells us that growth is dead.

Wow, that’s quite a shift in a relatively short period of time. Let’s back up a second.

First, we should distinguish between two diametrically opposite problems, too few jobs and too many jobs. We have a lot of people today concerned with the problem of too few jobs. This is because we can produce everything we are now consuming with somewhere close to 18 percent of the potential labor force unemployed, underemployed, or out of the labor force altogether. In this context, if we snapped our fingers and productivity fell everywhere by 10 percent, it could actually be a good thing. We would suddenly have more people employed.

Of course in a rational world there would be other ways to employ these people since there are certainly useful things that they could do. Alternatively, we could have everyone work fewer hours, which would also be a good thing. But our problem at the moment is clearly not one of inadequate productivity, our problem is too few jobs.

Some folks may recall seeing a NYT piece last week on the new generation of robots being deployed in factories. According to the article, these robots effectively have sight so they can do very detailed tasks that previously required human labor. Many readers of this piece reacted by expressing concern that we would have no need for workers in the future.

Those who expressed such concerns (which are in fact needless) should be cheered by Krugman’s column. Insofar as Gordon is right about slow productivity growth, the fears that a robotic revolution will displace tens of millions of workers will prove to be wrong. But seriously, is there any reason to believe that Gordon’s analysis is correct; that productivity growth will grind to a halt?

It’s hard to see if you take the step of looking at the places where people work. A bit less than 12 percent of our current workforce is employed in the retail sector. Are there no opportunities for productivity gains here? What about the self-service checkout counters that many stores have now? As the costs of these counters fall and wages of clerks rise (the response to a labor shortage — remember inadequate productivity growth means workers are in high demand), wouldn’t we expect to see these counters displace workers? How about robots in the stocking department? Will we never be able to design robots that can go up and down aisles after hours and restock the items that are in short supply? That seems unlikely.

Moving on, we have about 10 million workers, or 8 percent of the labor force, employed in restaurants. There aren’t possibilities for productivity gains there? Have you heard the word “cafeteria?” In our world of labor shortages we might expect that cafeterias will come to displace sit down restaurants as wages rise. I’m not scared yet.

We have about 11 percent of our workforce employed in health care. Are there opportunities for efficiencies there? How about if we adopted a universal Medicare system so that hospitals and doctors offices didn’t have to employ so many people in the payments department. Yeah, this is politically difficult, but that doesn’t mean that it is not economically possible.

In the same vein, we can probably reduce the 800,000 people employed in the securities and commodities trading sector (i.e. investment banking) by 50 percent with a modest financial speculation tax. This would hugely improve the efficiency of this sector with no cost to the economy. Again, the obstacle is powerful interest groups, not anything inherent to the economy’s potential for growth.

Manufacturing still employs more than 9 percent of the workforce. Presumably people do not need to be convinced that there are still opportunities for productivity gains in that sector.

Also, a major way that the economy experiences productivity gains is that demand switches to areas that achieve large gains from areas that don’t. This means that if we can’t improve the productivity of cab drivers, then we will likely see fewer people taking cabs in the future. They will instead spend their money on other things. And before we despair too much about the lack of productivity growth, remember we still have all those unemployed people who could be doing productive work, making us all richer.

There is a slightly different story that what Krugman, or at least Gordon, is telling. The problem would not be that in general we are suffering from an inability to increase productivity, but rather we will run into bottlenecks in the form of labor shortages for skills that are desperately needed. This can in principle impede growth.

The problem with this story is that there is zero evidence for any such shortage now (in what sector of the economy are wage growing rapidly?) and it is difficult to see a story where one develops in the future. What are the jobs for which we will be unable to train people or attract immigrants from India, China or elsewhere? It is difficult to imagine what that would look like.

My take away on this, as someone who was never a new economy optimist, is that with good economic policy we will be able to maintain solid rates of productivity growth over any time horizon that we can intelligently discuss. (Sorry folks, none of us knows anything about the 22nd century.) Let’s get the policy right and get people back to work.

The economics profession tends to be bipolar. It swings from periods of wild optimism to wild pessimism while rarely stopping anywhere in the mild. Hence we had the new economy optimists in the late 90s who insisted that all the problems of scarcity had been solved forever by the wonders of the information age. Now we have Paul Krugman citing new work by Robert Gordon which tells us that growth is dead.

Wow, that’s quite a shift in a relatively short period of time. Let’s back up a second.

First, we should distinguish between two diametrically opposite problems, too few jobs and too many jobs. We have a lot of people today concerned with the problem of too few jobs. This is because we can produce everything we are now consuming with somewhere close to 18 percent of the potential labor force unemployed, underemployed, or out of the labor force altogether. In this context, if we snapped our fingers and productivity fell everywhere by 10 percent, it could actually be a good thing. We would suddenly have more people employed.

Of course in a rational world there would be other ways to employ these people since there are certainly useful things that they could do. Alternatively, we could have everyone work fewer hours, which would also be a good thing. But our problem at the moment is clearly not one of inadequate productivity, our problem is too few jobs.

Some folks may recall seeing a NYT piece last week on the new generation of robots being deployed in factories. According to the article, these robots effectively have sight so they can do very detailed tasks that previously required human labor. Many readers of this piece reacted by expressing concern that we would have no need for workers in the future.

Those who expressed such concerns (which are in fact needless) should be cheered by Krugman’s column. Insofar as Gordon is right about slow productivity growth, the fears that a robotic revolution will displace tens of millions of workers will prove to be wrong. But seriously, is there any reason to believe that Gordon’s analysis is correct; that productivity growth will grind to a halt?

It’s hard to see if you take the step of looking at the places where people work. A bit less than 12 percent of our current workforce is employed in the retail sector. Are there no opportunities for productivity gains here? What about the self-service checkout counters that many stores have now? As the costs of these counters fall and wages of clerks rise (the response to a labor shortage — remember inadequate productivity growth means workers are in high demand), wouldn’t we expect to see these counters displace workers? How about robots in the stocking department? Will we never be able to design robots that can go up and down aisles after hours and restock the items that are in short supply? That seems unlikely.

Moving on, we have about 10 million workers, or 8 percent of the labor force, employed in restaurants. There aren’t possibilities for productivity gains there? Have you heard the word “cafeteria?” In our world of labor shortages we might expect that cafeterias will come to displace sit down restaurants as wages rise. I’m not scared yet.

We have about 11 percent of our workforce employed in health care. Are there opportunities for efficiencies there? How about if we adopted a universal Medicare system so that hospitals and doctors offices didn’t have to employ so many people in the payments department. Yeah, this is politically difficult, but that doesn’t mean that it is not economically possible.

In the same vein, we can probably reduce the 800,000 people employed in the securities and commodities trading sector (i.e. investment banking) by 50 percent with a modest financial speculation tax. This would hugely improve the efficiency of this sector with no cost to the economy. Again, the obstacle is powerful interest groups, not anything inherent to the economy’s potential for growth.

Manufacturing still employs more than 9 percent of the workforce. Presumably people do not need to be convinced that there are still opportunities for productivity gains in that sector.

Also, a major way that the economy experiences productivity gains is that demand switches to areas that achieve large gains from areas that don’t. This means that if we can’t improve the productivity of cab drivers, then we will likely see fewer people taking cabs in the future. They will instead spend their money on other things. And before we despair too much about the lack of productivity growth, remember we still have all those unemployed people who could be doing productive work, making us all richer.

There is a slightly different story that what Krugman, or at least Gordon, is telling. The problem would not be that in general we are suffering from an inability to increase productivity, but rather we will run into bottlenecks in the form of labor shortages for skills that are desperately needed. This can in principle impede growth.

The problem with this story is that there is zero evidence for any such shortage now (in what sector of the economy are wage growing rapidly?) and it is difficult to see a story where one develops in the future. What are the jobs for which we will be unable to train people or attract immigrants from India, China or elsewhere? It is difficult to imagine what that would look like.

My take away on this, as someone who was never a new economy optimist, is that with good economic policy we will be able to maintain solid rates of productivity growth over any time horizon that we can intelligently discuss. (Sorry folks, none of us knows anything about the 22nd century.) Let’s get the policy right and get people back to work.

Read More Leer más Join the discussion Participa en la discusión

The Post had an interesting piece discussing the structural problems in the construction of the euro. While the basic points are largely accurate, it does misrepresent a couple of issues.

First, contrary to what the piece suggests, there was no general recognition at the time that the euro was created that Germany’s economy would somehow dominate the euro zone. In fact, in the 90s and even at the start of the last decade, Germany’s economy was viewed as seriously troubled. For example, Adam Posen, a prominent economist who now sits on the Bank of England’s monetary policy committee worried in 2002 that Germany was turning Japanese (that wasn’t a compliment).

The fact that Germany’s economy did turn out to dominate the euro zone was a major surprise. This shows the ability of economies to turn around quickly or at least in ways that are unexpected by economists (i.e. the people who are the expert sources for these pieces).

The other major misrepresentation or understatement in the piece was that the euro’s founders did not anticipate that the European Central Bank (ECB) would be run by ungodly incompetent people. The ECB ignored the growth of enormous housing bubbles in Spain and Ireland that were leading to enormous imbalances in the euro zone economies. It was 100 percent predictable that these bubbles would collapse and lead to enormous adjustment problems when they did. However the ECB opted to ignore their growth.

Remarkably, even today it takes zero responsibility for the failure to recognize the dangers posed by these bubbles and the consequences from their collapse. Any currency needs competent people to manage its central bank. If these cannot be found (a skills mismatch?), then the currency will face serious problems.

The Post had an interesting piece discussing the structural problems in the construction of the euro. While the basic points are largely accurate, it does misrepresent a couple of issues.

First, contrary to what the piece suggests, there was no general recognition at the time that the euro was created that Germany’s economy would somehow dominate the euro zone. In fact, in the 90s and even at the start of the last decade, Germany’s economy was viewed as seriously troubled. For example, Adam Posen, a prominent economist who now sits on the Bank of England’s monetary policy committee worried in 2002 that Germany was turning Japanese (that wasn’t a compliment).

The fact that Germany’s economy did turn out to dominate the euro zone was a major surprise. This shows the ability of economies to turn around quickly or at least in ways that are unexpected by economists (i.e. the people who are the expert sources for these pieces).

The other major misrepresentation or understatement in the piece was that the euro’s founders did not anticipate that the European Central Bank (ECB) would be run by ungodly incompetent people. The ECB ignored the growth of enormous housing bubbles in Spain and Ireland that were leading to enormous imbalances in the euro zone economies. It was 100 percent predictable that these bubbles would collapse and lead to enormous adjustment problems when they did. However the ECB opted to ignore their growth.

Remarkably, even today it takes zero responsibility for the failure to recognize the dangers posed by these bubbles and the consequences from their collapse. Any currency needs competent people to manage its central bank. If these cannot be found (a skills mismatch?), then the currency will face serious problems.

Read More Leer más Join the discussion Participa en la discusión

A NYT article on Governor Romney’s approach to the economy discussed his attitude toward regulation. It tells readers that Romney:

“stopped talking about the benefits of regulation, focusing instead on its costs. His campaign platform includes proposals to curtail rule making, like capping the total cost of regulation at the current level, without adjusting for inflation.”

What does a limit on the cost of regulation mean? Suppose that I have more oil than Saudi Arabia underneath my backyard, but recovering it requires an incredibly hazardous chemical that will cause the death of everyone in a 10-mile radius. (I live within DC, that’s a lot of people.)

Does Governor Romney give me the green light to wipe out the DC metro area because the regulation prohibiting drilling would be very costly? That would seem to be the implication of an approach to regulation that only looks at the cost.

This would be an absurd approach to regulation. If that is really what Romney is proposing then the NYT should feature a front page article on his crazy views on regulation. Voters should be made aware of how wildly out of line Romney is with current practices.

Alternatively, if this is not what Romney is saying, then the NYT should get his approach to regulation right.

A NYT article on Governor Romney’s approach to the economy discussed his attitude toward regulation. It tells readers that Romney:

“stopped talking about the benefits of regulation, focusing instead on its costs. His campaign platform includes proposals to curtail rule making, like capping the total cost of regulation at the current level, without adjusting for inflation.”

What does a limit on the cost of regulation mean? Suppose that I have more oil than Saudi Arabia underneath my backyard, but recovering it requires an incredibly hazardous chemical that will cause the death of everyone in a 10-mile radius. (I live within DC, that’s a lot of people.)

Does Governor Romney give me the green light to wipe out the DC metro area because the regulation prohibiting drilling would be very costly? That would seem to be the implication of an approach to regulation that only looks at the cost.

This would be an absurd approach to regulation. If that is really what Romney is proposing then the NYT should feature a front page article on his crazy views on regulation. Voters should be made aware of how wildly out of line Romney is with current practices.

Alternatively, if this is not what Romney is saying, then the NYT should get his approach to regulation right.

Read More Leer más Join the discussion Participa en la discusión

Annie Lowry has a nice blogpost in the Economix section of the NYT listing some of the areas where Republicans and Democrats seem to largely agree (meaning the leadership, not the base). I’d agree with her list and add a few more items.

Both parties seem to agree on an uncompetitive dollar, having the Fed and Treasury maintain the dollar at a level that prices U.S. goods out of many markets. The result is a large trade deficit (currently around 4 percent of GDP or $600 billion a year) and the loss of around 5 million jobs in manufacturing. This is a major source of downward pressure on the wages of the bulk of the workforce.

Both parties seem to agree on extending patent and copyright protections both in the U.S. and around the world. These are incredibly costly forms of protectionism and have the effect of redistributing income upward since very few people in the bottom 90 percent draw their income from patent rents.

And both parties seem intent on preserving too big to fail banks which get a subsidy of tens of billions of dollars a year from their implicit government insurance.

I could list others, but these items amount to substantial transfers from the rest of us to those on top. It is worth noting the agreement on these issues by both parties’ leaders.

Annie Lowry has a nice blogpost in the Economix section of the NYT listing some of the areas where Republicans and Democrats seem to largely agree (meaning the leadership, not the base). I’d agree with her list and add a few more items.

Both parties seem to agree on an uncompetitive dollar, having the Fed and Treasury maintain the dollar at a level that prices U.S. goods out of many markets. The result is a large trade deficit (currently around 4 percent of GDP or $600 billion a year) and the loss of around 5 million jobs in manufacturing. This is a major source of downward pressure on the wages of the bulk of the workforce.

Both parties seem to agree on extending patent and copyright protections both in the U.S. and around the world. These are incredibly costly forms of protectionism and have the effect of redistributing income upward since very few people in the bottom 90 percent draw their income from patent rents.

And both parties seem intent on preserving too big to fail banks which get a subsidy of tens of billions of dollars a year from their implicit government insurance.

I could list others, but these items amount to substantial transfers from the rest of us to those on top. It is worth noting the agreement on these issues by both parties’ leaders.

Read More Leer más Join the discussion Participa en la discusión

There may be a temptation by some in the business media to make a big issue out of the sharp decline in the Conference Board’s measure of consumer confidence. Those so tempted would be wrong.

The key point to note is that almost all of the decline was in the future expectations index. The current conditions index was essentially unchanged, edging down from 45.9 to 45.8. While current conditions index does fit reasonably well with current consumption, there is little correlation between the future expectations index and consumption. This index is highly erratic and therefore not a good predictor of consumption either present or future.

There may be a temptation by some in the business media to make a big issue out of the sharp decline in the Conference Board’s measure of consumer confidence. Those so tempted would be wrong.

The key point to note is that almost all of the decline was in the future expectations index. The current conditions index was essentially unchanged, edging down from 45.9 to 45.8. While current conditions index does fit reasonably well with current consumption, there is little correlation between the future expectations index and consumption. This index is highly erratic and therefore not a good predictor of consumption either present or future.

Read More Leer más Join the discussion Participa en la discusión

Mitt Romney has made a big deal out of President Obama’s decision to grant requests by governors from both parties for more flexibility in the work requirement in TANF, the reformed welfare program. The question that millions are now asking is whether the NYT has a work requirement for its reporters. David Leonhardt’s piece on Mitt Romney’s first 100 days suggests otherwise.

One of the big questions that serious people have been raising is how Governor Romney proposes to pay for the large tax cuts for the wealthy that his plan would provide. Romney has claimed that he would pay for these tax cuts by eliminating tax deductions. The Tax Policy Center of the Brookings Institution and the Urban Institute claim that this plan does not add up. It would be necessary to substantially reduce or eliminate the mortgage interest deduction, the deduction for employer provided health care and other deductions for middle income taxpayers to make up the lost revenue.

In dealing with this problem, which implies that Romney would impose a substantial tax increase on millions of middle income families, Leonhardt refers us to a proposal by Representative Ryan which would allow people to pay taxes under the current schedule or use the new lower tax rates. Does this add up? Can a plan that provides a tax cut to everyone who knows arithmetic (or knows someone who knows arithmetic) produce the same amount of revenue as the current tax system?

It’s Leonhardt’s job to investigate this issue. I’m sure that he is a busy guy, but he has more time and probably more expertise to examine this issue than most of his readers. It is incredibly irresponsible to pretend that numbers add up when they don’t. If Leonhardt didn’t have the time to assess this key point, then he didn’t have time to write the piece.

Mitt Romney has made a big deal out of President Obama’s decision to grant requests by governors from both parties for more flexibility in the work requirement in TANF, the reformed welfare program. The question that millions are now asking is whether the NYT has a work requirement for its reporters. David Leonhardt’s piece on Mitt Romney’s first 100 days suggests otherwise.

One of the big questions that serious people have been raising is how Governor Romney proposes to pay for the large tax cuts for the wealthy that his plan would provide. Romney has claimed that he would pay for these tax cuts by eliminating tax deductions. The Tax Policy Center of the Brookings Institution and the Urban Institute claim that this plan does not add up. It would be necessary to substantially reduce or eliminate the mortgage interest deduction, the deduction for employer provided health care and other deductions for middle income taxpayers to make up the lost revenue.

In dealing with this problem, which implies that Romney would impose a substantial tax increase on millions of middle income families, Leonhardt refers us to a proposal by Representative Ryan which would allow people to pay taxes under the current schedule or use the new lower tax rates. Does this add up? Can a plan that provides a tax cut to everyone who knows arithmetic (or knows someone who knows arithmetic) produce the same amount of revenue as the current tax system?

It’s Leonhardt’s job to investigate this issue. I’m sure that he is a busy guy, but he has more time and probably more expertise to examine this issue than most of his readers. It is incredibly irresponsible to pretend that numbers add up when they don’t. If Leonhardt didn’t have the time to assess this key point, then he didn’t have time to write the piece.

Read More Leer más Join the discussion Participa en la discusión

It is remarkable that in a campaign season where the media are constantly telling us that the election is a referendum about the size and role of government, no one seems to have noticed that the jury’s verdict in the Apple-Samsung case is a big victory for big government. The ruling gives strong protection to Apple’s patents, which means that it will be able to charge more money for its iPad, iPhone and other related products in the years ahead. The additional charges could well run into the hundreds of billions of dollars over the next decade.

From the standpoint of consumers this has the same effect as if the government imposed a large tax on these products. However in this case, the government is simply agreeing to arrest competitors so that Apple can effectively impose the tax.

This is big government interference in the free market. Remarkably no reporters treat it as such. For some reason if it is not tax or spending policy, reporters generally fail to recognize the hand of the government. This is unfortunate since the impact of the government’s actions in setting the ground rules for the market swamps the impact of the tax and spending decisions that dominate public debate.

[Addendum: For the record, I don’t have strong views on this case. In general I am not a fan of strong patent/copyright protection, but I haven’t studied this one enough to see the extent to which Apple has a serious case. On the other hand, there is zero doubt that if the ruling holds, Apple will be charging more for its products than if doesn’t.]

It is remarkable that in a campaign season where the media are constantly telling us that the election is a referendum about the size and role of government, no one seems to have noticed that the jury’s verdict in the Apple-Samsung case is a big victory for big government. The ruling gives strong protection to Apple’s patents, which means that it will be able to charge more money for its iPad, iPhone and other related products in the years ahead. The additional charges could well run into the hundreds of billions of dollars over the next decade.

From the standpoint of consumers this has the same effect as if the government imposed a large tax on these products. However in this case, the government is simply agreeing to arrest competitors so that Apple can effectively impose the tax.

This is big government interference in the free market. Remarkably no reporters treat it as such. For some reason if it is not tax or spending policy, reporters generally fail to recognize the hand of the government. This is unfortunate since the impact of the government’s actions in setting the ground rules for the market swamps the impact of the tax and spending decisions that dominate public debate.

[Addendum: For the record, I don’t have strong views on this case. In general I am not a fan of strong patent/copyright protection, but I haven’t studied this one enough to see the extent to which Apple has a serious case. On the other hand, there is zero doubt that if the ruling holds, Apple will be charging more for its products than if doesn’t.]

Read More Leer más Join the discussion Participa en la discusión

Okay folks, mark August 25, 2012 in your calendar. That is the day that Matt Miller clearly stated on the Washington Post op-ed page that the problem is not Medicare, but the broken U.S. health care system. Miller noted that we spend more than twice as large a share of our GDP on health care as the average for other wealthy countries and have little to show for it in terms of outcomes.

He attributes this additional expense to the medical-industrial complex. Miller tells readers:

“It’s [health care entitlement reform] about weaning the members of our medical-industrial complex from their entitlement to far higher payments, despite shabby results, than their counterparts abroad get.”

Oh yeah, there it is folks, sitting there for all to see on the op-ed page of the Washington Post, truly amazing. (In fairness, Ezra Klein has made this point many times on his blog.)

So Matt Miller deserves a warm welcome to the reality based community. And the Post op-ed page editors should be congratulated for allowing a serious discussion of health care.

The next question is whether we can talk about some measures to address the problem. My favorite starting point is some free trade in health care: allow Medicare beneficiaries buy into the more efficient programs elsewhere and split the savings in the government. Unfortunately the Post is probably too ideologically committed to protectionism to ever allow an idea like this to appear in the paper.

Okay folks, mark August 25, 2012 in your calendar. That is the day that Matt Miller clearly stated on the Washington Post op-ed page that the problem is not Medicare, but the broken U.S. health care system. Miller noted that we spend more than twice as large a share of our GDP on health care as the average for other wealthy countries and have little to show for it in terms of outcomes.

He attributes this additional expense to the medical-industrial complex. Miller tells readers:

“It’s [health care entitlement reform] about weaning the members of our medical-industrial complex from their entitlement to far higher payments, despite shabby results, than their counterparts abroad get.”

Oh yeah, there it is folks, sitting there for all to see on the op-ed page of the Washington Post, truly amazing. (In fairness, Ezra Klein has made this point many times on his blog.)

So Matt Miller deserves a warm welcome to the reality based community. And the Post op-ed page editors should be congratulated for allowing a serious discussion of health care.

The next question is whether we can talk about some measures to address the problem. My favorite starting point is some free trade in health care: allow Medicare beneficiaries buy into the more efficient programs elsewhere and split the savings in the government. Unfortunately the Post is probably too ideologically committed to protectionism to ever allow an idea like this to appear in the paper.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post has long been known for its sycophantic coverage of the rich and powerful but it may have hit a new low today. The theme of an article on the presidential race was that Representative Paul Ryan, the Republican vice-presidential candidate, used the word “baseline” in a discussion of the budget with reporters. The reporter and/or editor was just incredibly impressed with this fact.

Real reporters might ask Ryan to identify some of the loopholes that he plans to close to make up for his tax cuts to the wealthy (e.g. mortgage interest deduction, deduction for employer provided health insurance etc.). A real reporter might also ask him to be more specific about the programs he plans to cut or eliminate over the next decade to meet his spending targets. And, they might ask him if he really intends to eliminate the whole federal government by 2040, except for Social Security, health care and the Defense Department as the Congressional Budget Office’s analysis of his budget implies.

But hey, those would be questions raised by real reporters. The Post is just so awed by the fact that Ryan used the word “baseline,” wow!

The Washington Post has long been known for its sycophantic coverage of the rich and powerful but it may have hit a new low today. The theme of an article on the presidential race was that Representative Paul Ryan, the Republican vice-presidential candidate, used the word “baseline” in a discussion of the budget with reporters. The reporter and/or editor was just incredibly impressed with this fact.

Real reporters might ask Ryan to identify some of the loopholes that he plans to close to make up for his tax cuts to the wealthy (e.g. mortgage interest deduction, deduction for employer provided health insurance etc.). A real reporter might also ask him to be more specific about the programs he plans to cut or eliminate over the next decade to meet his spending targets. And, they might ask him if he really intends to eliminate the whole federal government by 2040, except for Social Security, health care and the Defense Department as the Congressional Budget Office’s analysis of his budget implies.

But hey, those would be questions raised by real reporters. The Post is just so awed by the fact that Ryan used the word “baseline,” wow!

Read More Leer más Join the discussion Participa en la discusión