The Democrats’ discussion of the loss of the Clinton budget surpluses is a tale of paradise lost. Unfortunately, it was an illusory paradise that serious people should not concern themselves with. That is why it is disappointing to see Ezra Klein give us more tales of the evaporating budget surplus.

The huge surpluses of the last Clinton years were the result of a boom that was driven by a stock bubble. The boom was great. Millions of people got jobs who would not have otherwise. We also saw real wage gains up and down the income distribution for the first time since the early 70s.

The greatest minds in the economics profession had assured us that the unemployment rate could not get below 6.0 percent without touching off accelerating inflation. However the boom pushed the unemployment rate down to 4.0 percent as a year-round average in 2000. Guess what? There was no story of accelerating inflation. (Fortunately for economists, continued employment, and even standing in the profession, does not depend on performance.)

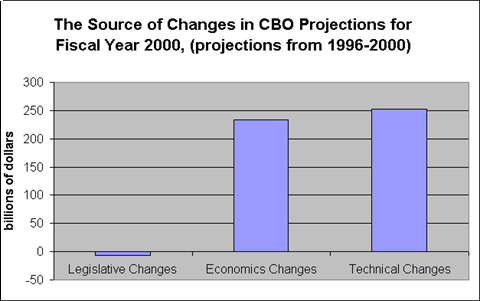

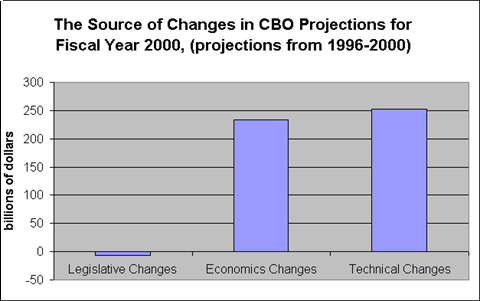

But the key point is that the surplus came from a boom that was not sustainable. Here’s the key chart that shows you how we went from the deficit of 2.7 percent of GDP that the Congressional Budget Office had projected in 1996 for 2000 to the surplus of 2.4 percent of GDP that we actually saw in 2000.

Source: Congressional Budget Office and author’s calculations.

This was not a story of tax increases and budget cuts, those had already been on the books by 1996. This was pure and simple a story of the bubble-based boom pushing the economy much further than CBO had expected. (Greenspan deserves a huge amount of credit for allowing the unemployment rate to fall. His Clinton appointed colleagues, Lawrence Meyer and Janet Yellen, wanted to raise interest rates in 1996 to keep unemployment from falling much below 6.0 percent.)

Anyhow, when the bubble burst, the surplus was destined to vanish. The Bush tax cuts and even the wars helped to stimulate the economy and maintain employment. There were much better ways to boost the economy, but it is absurd to imagine that the economy somehow would have been better off without this spending.

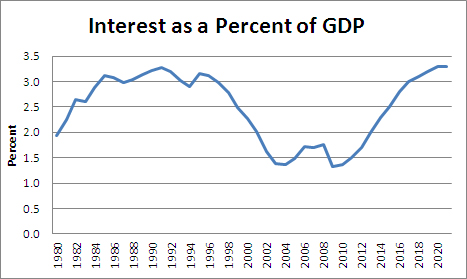

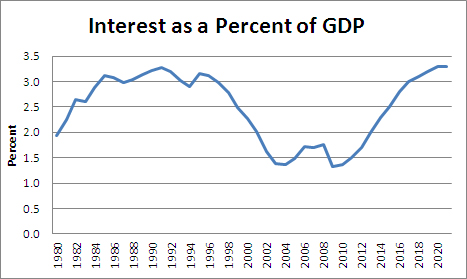

To repeat a post from last week, the real tragedy of both conventions is that policy is so obsessed with the deficit. No one apart from a few policy wonks in DC even has a clue as to the size of the deficit. (Quick, give it to me to the nearest hundred billion.) Contrary to the scare stories, the burden of the debt (a.k.a. interest payments) are near a post-war low as a share of GDP, not a record high.

Source: Congressional Budget Office.

Topics one, two, and three should be jobs, jobs, and jobs. The deficit is a distraction. And the tale of the vanishing Clinton era budget surpluses, well that’s something for retired budget wonks to reminisce over in their golden years.

Addendum:

Many good questions are raised below. I’ll just address a few points. First, I have zero interest in getting into debates on the budget deficit. I don’t care whether the government runs a budget surplus, so the particular accounting is of no interest to me apart from the fact that it needs to be consistent through time. I suppose we can have some good make work jobs having people design new budget methodologies, but I don’t intend to get involved myself.

In terms of the causes of the deficits/debt, a lot depends on the baseline. My baseline was 1996 since I wanted to show that Clinton did not give us a balanced budget/surplus, the stock market bubble did. The spending/tax cuts that followed the recession were needed to boost the economy. Unless you like to see people out of work, you should be happy for the deficit. Of course the tax cuts and money spent on the war could have been much better directed, but if the choice was no tax cuts and no additional military spending versus what we got, there can be little doubt that the latter created more jobs.

The Democrats’ discussion of the loss of the Clinton budget surpluses is a tale of paradise lost. Unfortunately, it was an illusory paradise that serious people should not concern themselves with. That is why it is disappointing to see Ezra Klein give us more tales of the evaporating budget surplus.

The huge surpluses of the last Clinton years were the result of a boom that was driven by a stock bubble. The boom was great. Millions of people got jobs who would not have otherwise. We also saw real wage gains up and down the income distribution for the first time since the early 70s.

The greatest minds in the economics profession had assured us that the unemployment rate could not get below 6.0 percent without touching off accelerating inflation. However the boom pushed the unemployment rate down to 4.0 percent as a year-round average in 2000. Guess what? There was no story of accelerating inflation. (Fortunately for economists, continued employment, and even standing in the profession, does not depend on performance.)

But the key point is that the surplus came from a boom that was not sustainable. Here’s the key chart that shows you how we went from the deficit of 2.7 percent of GDP that the Congressional Budget Office had projected in 1996 for 2000 to the surplus of 2.4 percent of GDP that we actually saw in 2000.

Source: Congressional Budget Office and author’s calculations.

This was not a story of tax increases and budget cuts, those had already been on the books by 1996. This was pure and simple a story of the bubble-based boom pushing the economy much further than CBO had expected. (Greenspan deserves a huge amount of credit for allowing the unemployment rate to fall. His Clinton appointed colleagues, Lawrence Meyer and Janet Yellen, wanted to raise interest rates in 1996 to keep unemployment from falling much below 6.0 percent.)

Anyhow, when the bubble burst, the surplus was destined to vanish. The Bush tax cuts and even the wars helped to stimulate the economy and maintain employment. There were much better ways to boost the economy, but it is absurd to imagine that the economy somehow would have been better off without this spending.

To repeat a post from last week, the real tragedy of both conventions is that policy is so obsessed with the deficit. No one apart from a few policy wonks in DC even has a clue as to the size of the deficit. (Quick, give it to me to the nearest hundred billion.) Contrary to the scare stories, the burden of the debt (a.k.a. interest payments) are near a post-war low as a share of GDP, not a record high.

Source: Congressional Budget Office.

Topics one, two, and three should be jobs, jobs, and jobs. The deficit is a distraction. And the tale of the vanishing Clinton era budget surpluses, well that’s something for retired budget wonks to reminisce over in their golden years.

Addendum:

Many good questions are raised below. I’ll just address a few points. First, I have zero interest in getting into debates on the budget deficit. I don’t care whether the government runs a budget surplus, so the particular accounting is of no interest to me apart from the fact that it needs to be consistent through time. I suppose we can have some good make work jobs having people design new budget methodologies, but I don’t intend to get involved myself.

In terms of the causes of the deficits/debt, a lot depends on the baseline. My baseline was 1996 since I wanted to show that Clinton did not give us a balanced budget/surplus, the stock market bubble did. The spending/tax cuts that followed the recession were needed to boost the economy. Unless you like to see people out of work, you should be happy for the deficit. Of course the tax cuts and money spent on the war could have been much better directed, but if the choice was no tax cuts and no additional military spending versus what we got, there can be little doubt that the latter created more jobs.

Read More Leer más Join the discussion Participa en la discusión

Eduardo Porter has an interesting piece pointing out that in many respects Richard Nixon’s economic policy was well to the left of Barack Obama’s (no doubt attributable to his Kenyan socialist background). Clearly the center of economic debate has moved well to the right.

Porter attributes much of this shift to the rise of global competition. Increased international competition can help to explain the desire to push down wages of ordinary workers, but it doesn’t explain why corporations have not felt the need to push down the wages of their lawyers, the doctors they indirectly pay through employer provided health insurance, or their CEOs. The pay for these groups are hugely out of line with international standards even though there is zero reason to believe that the professionals who fill these jobs in the United States perform their work any better than their peers elsewhere.

The explanation would seem to be that these professionals have been able to secure protection for themselves in ways that autoworkers and textile workers have not. In the case of CEOs, they essentially pay off board members to turn the other way as they pilfer the corporations they run. In short, the end of decent paying jobs for ordinary workers is not due to globalization, it is due to the fact that certain powerful interest groups have been able to use the forces of globalization to their advantage.

Eduardo Porter has an interesting piece pointing out that in many respects Richard Nixon’s economic policy was well to the left of Barack Obama’s (no doubt attributable to his Kenyan socialist background). Clearly the center of economic debate has moved well to the right.

Porter attributes much of this shift to the rise of global competition. Increased international competition can help to explain the desire to push down wages of ordinary workers, but it doesn’t explain why corporations have not felt the need to push down the wages of their lawyers, the doctors they indirectly pay through employer provided health insurance, or their CEOs. The pay for these groups are hugely out of line with international standards even though there is zero reason to believe that the professionals who fill these jobs in the United States perform their work any better than their peers elsewhere.

The explanation would seem to be that these professionals have been able to secure protection for themselves in ways that autoworkers and textile workers have not. In the case of CEOs, they essentially pay off board members to turn the other way as they pilfer the corporations they run. In short, the end of decent paying jobs for ordinary workers is not due to globalization, it is due to the fact that certain powerful interest groups have been able to use the forces of globalization to their advantage.

Read More Leer más Join the discussion Participa en la discusión

Newspapers are not supposed to do fluff pieces, that is the job of PR departments. Apparently the NYT does not know this, hence the fluff piece on former President Bill Clinton and the various charitable organizations that he has established since leaving the presidency. A serious news piece would have included some discussion of the TRIPS agreement that he inserted into the Uruguay Round of the WTO.

This agreement, which was inserted at the urging of Pfizer and other drug companies, required developing countries to adopt U.S. style patent and copyright protections. The resulting monopolies raise the price of prescription drugs and other protected products by several thousand percent above the free market price. It is a virtual certainty that this agreement will do far more to harm the health of people in Africa, by raising the price that the continent must pay for its drugs, than anything Bill Clinton’s charities can do to aid Africans.

Newspapers are not supposed to do fluff pieces, that is the job of PR departments. Apparently the NYT does not know this, hence the fluff piece on former President Bill Clinton and the various charitable organizations that he has established since leaving the presidency. A serious news piece would have included some discussion of the TRIPS agreement that he inserted into the Uruguay Round of the WTO.

This agreement, which was inserted at the urging of Pfizer and other drug companies, required developing countries to adopt U.S. style patent and copyright protections. The resulting monopolies raise the price of prescription drugs and other protected products by several thousand percent above the free market price. It is a virtual certainty that this agreement will do far more to harm the health of people in Africa, by raising the price that the continent must pay for its drugs, than anything Bill Clinton’s charities can do to aid Africans.

Read More Leer más Join the discussion Participa en la discusión

That is what readers of its lead editorial demanding that President Obama move to the right will undoubtedly conclude. After all, it begins by telling readers:

“THE BIGGEST CHALLENGE for the next president will be putting the nation’s long-term finances on sounder footing. The failure to do so is the biggest shortcoming of President Obama’s first term [capitalization in original].”

After all, people who had access to data on the labor market would have to believe that the fact that tens of millions of people are still unemployed or underemployed is the biggest failure of President Obama’s first term. These people and their families are seeing their lives ruined.

The worst part is that the devastation they are suffering is not due to their own failings. It’s due to the incompetence of people with names like Alan Greenspan, Ben Bernanke and Robert Rubin and the people who have the opportunity to express themselves in major media outlets like the Washington Post. This disaster would have been 100 percent preventable, if anyone in a position of authority had been able to recognize an $8 trillion housing bubble and understand that its collapse would have a devastating impact on the economy.

Unfortunately, in modern America, people rarely suffer the consequences of their own failures. As a result, the people responsible for this disaster have granted themselves a collective “who have known?” amnesty. Virtually all of them still hold their jobs.

The other part of the Post’s story is also wide of the mark. Rather than suffering from an imminent fiscal crisis, the ratio of interest payments to GDP is near a post-war low.

Source: Congressional Budget Office.

That is what readers of its lead editorial demanding that President Obama move to the right will undoubtedly conclude. After all, it begins by telling readers:

“THE BIGGEST CHALLENGE for the next president will be putting the nation’s long-term finances on sounder footing. The failure to do so is the biggest shortcoming of President Obama’s first term [capitalization in original].”

After all, people who had access to data on the labor market would have to believe that the fact that tens of millions of people are still unemployed or underemployed is the biggest failure of President Obama’s first term. These people and their families are seeing their lives ruined.

The worst part is that the devastation they are suffering is not due to their own failings. It’s due to the incompetence of people with names like Alan Greenspan, Ben Bernanke and Robert Rubin and the people who have the opportunity to express themselves in major media outlets like the Washington Post. This disaster would have been 100 percent preventable, if anyone in a position of authority had been able to recognize an $8 trillion housing bubble and understand that its collapse would have a devastating impact on the economy.

Unfortunately, in modern America, people rarely suffer the consequences of their own failures. As a result, the people responsible for this disaster have granted themselves a collective “who have known?” amnesty. Virtually all of them still hold their jobs.

The other part of the Post’s story is also wide of the mark. Rather than suffering from an imminent fiscal crisis, the ratio of interest payments to GDP is near a post-war low.

Source: Congressional Budget Office.

Read More Leer más Join the discussion Participa en la discusión

David Brooks tells us that Obama has three choices for “big ideas.” (Too bad he could only think of three, but that’s another matter.) Anyhow, his choice number 2, fixing a broken capitalism, sounds pretty good. The basic point is that the gains from growth have been going primarily to the richest 1 percent and that this could be reversed. (Why this can’t be merged with his idea number 1, slowing global warming, is a mystery to me.)

Anyhow, the idea seems solid, but the solutions are Brooksian silly. Brooks proposes strengthening unions, hiring more teachers and creating jobs rebuilding infrastructure. That part sounds good. We can strengthen unions by giving workers their day in court, let workers sue in real court for wrongful firing when they are involved in union organizing rather than sending them to children’s court (the National Labor Relations Board) where the penalties are a joke. In other words, strengthening unions is largely about not rigging the deck against workers who are trying to organize.

Firing teachers in the middle of a downturn was really bad economic policy, both short-term and long-term. Hiring them back would make lots of sense. Rebuilding infrastructure is a great idea when the real interest rate on government debt is negative. Let’s include retrofitting buildings, both public and private, to make them more energy efficient. (There we go, mixing Brooks’ idea #1 and #2, it’s so hard to get things right.)

Then we get a set of proposals from Brooks that are more mixed in their seriousness:

“He could cap the mortgage interest deduction, cap social security benefits, raise taxes on the rich, raise taxes on capital gains and embrace other measures to redistribute money from those who are prospering to those who are not.”

Let’s see, capping the mortgage interest deduction? And what exactly is the public benefit from subsidizing the purchase of a bigger home by a wealthy family? That should be a non-brainer. (This subsidy is likely larger than the welfare checks to poor people that seem to get Republicans so excited.)

Capping Social Security benefits? I don’t know that this one will hit the Peter Petersons of the world very hard. I do know that it won’t save any noticeable amount of money and will likely undermine support for the program. These are the reasons that no progressive/populist ever has means-testing for Social Security on their list.

Raising taxes on the wealthy sounds fine, but how about raising taxes in a way that eliminates economic waste. The obvious story here would be a financial speculation tax that would downsize the financial sector. This would both make it more efficient in carrying through its economic function (allocating capital from those who want to save to those who want to borrow) and help to reduce inequality by reducing the huge rents earned by some in this sector. Ending the subsidy provided by too big to fail insurance for the largest banks would also be a good item in this category.

A knowledgeable columnist would have these items on his populist agenda for Obama. Brooks either has not done his homework or just wants to make the agenda look silly.

Finally Brooks suggests:

“He could crack down on outsourcing and regulate trade.”

Brooks probably missed it, but we already regulate trade. A major item on Obama’s (and Bush and Clinton’s) trade agenda has been increasing patent and copyright protection throughout the world. This imposes enormous economic costs, often raising the price of protected items by a factor of 10 or even 100. Our trade negotiators have also sought to eliminate barriers on trade to manufacturing goods, which lowers the wages and costs the jobs of manufacturing workers, while leaving in place protectionist barriers for highly educated professionals like doctors and lawyers.

President Obama can actually push a free trade agenda that would mean millions of new manufacturing jobs. For example, he could pursue a competitive dollar policy that will push the dollar down to levels where U.S. goods and services are better able to compete internationally. This would bring our trade deficit closer to balance. This would be both good economics (it is the only way to end the borrowing that gets folks like Brooks so upset) and good politics since it would have huge appeal to the bulk of the population, although it would likely lose President Obama many big donors.

Of course Brooks volunteers that he wouldn’t like this route, but he also claims that it would alienate moderate voters. That is more difficult to see given the potential benefits to the non-rich from following this route.

David Brooks tells us that Obama has three choices for “big ideas.” (Too bad he could only think of three, but that’s another matter.) Anyhow, his choice number 2, fixing a broken capitalism, sounds pretty good. The basic point is that the gains from growth have been going primarily to the richest 1 percent and that this could be reversed. (Why this can’t be merged with his idea number 1, slowing global warming, is a mystery to me.)

Anyhow, the idea seems solid, but the solutions are Brooksian silly. Brooks proposes strengthening unions, hiring more teachers and creating jobs rebuilding infrastructure. That part sounds good. We can strengthen unions by giving workers their day in court, let workers sue in real court for wrongful firing when they are involved in union organizing rather than sending them to children’s court (the National Labor Relations Board) where the penalties are a joke. In other words, strengthening unions is largely about not rigging the deck against workers who are trying to organize.

Firing teachers in the middle of a downturn was really bad economic policy, both short-term and long-term. Hiring them back would make lots of sense. Rebuilding infrastructure is a great idea when the real interest rate on government debt is negative. Let’s include retrofitting buildings, both public and private, to make them more energy efficient. (There we go, mixing Brooks’ idea #1 and #2, it’s so hard to get things right.)

Then we get a set of proposals from Brooks that are more mixed in their seriousness:

“He could cap the mortgage interest deduction, cap social security benefits, raise taxes on the rich, raise taxes on capital gains and embrace other measures to redistribute money from those who are prospering to those who are not.”

Let’s see, capping the mortgage interest deduction? And what exactly is the public benefit from subsidizing the purchase of a bigger home by a wealthy family? That should be a non-brainer. (This subsidy is likely larger than the welfare checks to poor people that seem to get Republicans so excited.)

Capping Social Security benefits? I don’t know that this one will hit the Peter Petersons of the world very hard. I do know that it won’t save any noticeable amount of money and will likely undermine support for the program. These are the reasons that no progressive/populist ever has means-testing for Social Security on their list.

Raising taxes on the wealthy sounds fine, but how about raising taxes in a way that eliminates economic waste. The obvious story here would be a financial speculation tax that would downsize the financial sector. This would both make it more efficient in carrying through its economic function (allocating capital from those who want to save to those who want to borrow) and help to reduce inequality by reducing the huge rents earned by some in this sector. Ending the subsidy provided by too big to fail insurance for the largest banks would also be a good item in this category.

A knowledgeable columnist would have these items on his populist agenda for Obama. Brooks either has not done his homework or just wants to make the agenda look silly.

Finally Brooks suggests:

“He could crack down on outsourcing and regulate trade.”

Brooks probably missed it, but we already regulate trade. A major item on Obama’s (and Bush and Clinton’s) trade agenda has been increasing patent and copyright protection throughout the world. This imposes enormous economic costs, often raising the price of protected items by a factor of 10 or even 100. Our trade negotiators have also sought to eliminate barriers on trade to manufacturing goods, which lowers the wages and costs the jobs of manufacturing workers, while leaving in place protectionist barriers for highly educated professionals like doctors and lawyers.

President Obama can actually push a free trade agenda that would mean millions of new manufacturing jobs. For example, he could pursue a competitive dollar policy that will push the dollar down to levels where U.S. goods and services are better able to compete internationally. This would bring our trade deficit closer to balance. This would be both good economics (it is the only way to end the borrowing that gets folks like Brooks so upset) and good politics since it would have huge appeal to the bulk of the population, although it would likely lose President Obama many big donors.

Of course Brooks volunteers that he wouldn’t like this route, but he also claims that it would alienate moderate voters. That is more difficult to see given the potential benefits to the non-rich from following this route.

Read More Leer más Join the discussion Participa en la discusión

Yes, it’s hard to those who write for major news outlets to notice an $8 trillion housing bubble. This is the story of the downturn and the current “fiscal woes.” It would be nice if Cohen could do a little homework before writing a column like this one. In reality, the U.S. has no fiscal woes right now (the interest rate remains near post-war lows), we just have inadequate demand.

Yes, it’s hard to those who write for major news outlets to notice an $8 trillion housing bubble. This is the story of the downturn and the current “fiscal woes.” It would be nice if Cohen could do a little homework before writing a column like this one. In reality, the U.S. has no fiscal woes right now (the interest rate remains near post-war lows), we just have inadequate demand.

Read More Leer más Join the discussion Participa en la discusión

It’s often said that in Washington an intellectual is someone who discovers what everyone else has known for two decades. Hence we get Phillip Longman’s extremely confused piece in the Washington Monthly.

Ostensibly the piece is explaining how we got to a situation where tens of millions of baby boomers and Gen-Xers face retirement with almost nothing other than their Social Security and Medicare. However it detours to stop almost everywhere along the way, starting with the end of the baby boom. Somehow slower population growth is bad news, although it is difficult to see why. Do you feel the need for more traffic congestion, greenhouse gas emissions, more crowded parks and beaches? Do we have labor shortages? Yes, Social Security taxes might be 1-2 percentage points higher than if baby boom birthrates had continued in perpetuity, but if this is the biggest problem the country faces then we are in way better shape than it seems.

Then we get a visit to the 401(k) world which Longman does not quite get right. The 401(k) was sold as a supplement to traditional pensions. The idea was that many workers did not have defined benefit pensions, so the 401(k) was presented as a way that they too could save for retirement. It was not presented to Congress or the public as the replacement that it eventually became.

Of course people were ripped off in the fees for these plans, a point that some of us have been making for two decades. They also got caught up in the stock bubble. Yes, this was also a point that many of us made at the time. When people thought the stock market would just keep rising (an assumption that was explicit in all the privatization proposals put forward in the 90s, including Clinton’s plan to put Social Security money in the stock market), they did not save enough. They got killed when the market crashed.

They also foolishly listened to experts like Alan Greenspan who told them in the last decade that house prices would just keep rising. This meant that they did not save because their house was doing it for them.

Now they are hitting retirement with nothing. Longman says he doesn’t know what to do. Well there is no shortage of proposals for publicly managed pension plans that could even have a defined benefit. Getting the dollar down to a more competitive level could create millions of new manufacturing jobs, hugely improving the state of the labor market. It should not be that hard to fix our health care system, every other country has done it. If our leaders are not up to the task, we can always go the trade route.

Okay, Phillip Longman tells us he doesn’t know any answers. That is perhaps not surprising since he apparently never saw any of these problems coming, but that really should not bother the rest of us.

Addendum:

This piece is actually part of a Washington Monthly symposium that contains many ideas that are well worth considering.

It’s often said that in Washington an intellectual is someone who discovers what everyone else has known for two decades. Hence we get Phillip Longman’s extremely confused piece in the Washington Monthly.

Ostensibly the piece is explaining how we got to a situation where tens of millions of baby boomers and Gen-Xers face retirement with almost nothing other than their Social Security and Medicare. However it detours to stop almost everywhere along the way, starting with the end of the baby boom. Somehow slower population growth is bad news, although it is difficult to see why. Do you feel the need for more traffic congestion, greenhouse gas emissions, more crowded parks and beaches? Do we have labor shortages? Yes, Social Security taxes might be 1-2 percentage points higher than if baby boom birthrates had continued in perpetuity, but if this is the biggest problem the country faces then we are in way better shape than it seems.

Then we get a visit to the 401(k) world which Longman does not quite get right. The 401(k) was sold as a supplement to traditional pensions. The idea was that many workers did not have defined benefit pensions, so the 401(k) was presented as a way that they too could save for retirement. It was not presented to Congress or the public as the replacement that it eventually became.

Of course people were ripped off in the fees for these plans, a point that some of us have been making for two decades. They also got caught up in the stock bubble. Yes, this was also a point that many of us made at the time. When people thought the stock market would just keep rising (an assumption that was explicit in all the privatization proposals put forward in the 90s, including Clinton’s plan to put Social Security money in the stock market), they did not save enough. They got killed when the market crashed.

They also foolishly listened to experts like Alan Greenspan who told them in the last decade that house prices would just keep rising. This meant that they did not save because their house was doing it for them.

Now they are hitting retirement with nothing. Longman says he doesn’t know what to do. Well there is no shortage of proposals for publicly managed pension plans that could even have a defined benefit. Getting the dollar down to a more competitive level could create millions of new manufacturing jobs, hugely improving the state of the labor market. It should not be that hard to fix our health care system, every other country has done it. If our leaders are not up to the task, we can always go the trade route.

Okay, Phillip Longman tells us he doesn’t know any answers. That is perhaps not surprising since he apparently never saw any of these problems coming, but that really should not bother the rest of us.

Addendum:

This piece is actually part of a Washington Monthly symposium that contains many ideas that are well worth considering.

Read More Leer más Join the discussion Participa en la discusión

A Washington Post article referred to “$85 million in government loans to GM and Chrysler in 2009.” Oh well, no one gets everything right.

Addendum:

Of course this is a typo, but one that an editor should have quickly caught. However it is worth pointing out that if the Post had the habit of expressing numbers in a way that made them meaningful to readers, it is unlikely they would have missed this one. Specifically, if they described the number as a share of the budget (@ 2.4 percent, if written correctly), it would likely have caught their attention if they had written it as 0.0024 percent of federal spending.

Obviously the Post is not alone in writing out big numbers that are meaningless to 99 percent of their readers. This is the standard practice in reporting. However it really amounts to a silly fraternity ritual. The job of reporters is to provide information to their audience and this does not do it and they know it. I have never found a reporter who could tell me with a straight face that when they write that we are spending $210 billion on transportation over the next six years that this number has any meaning to their readers.

A Washington Post article referred to “$85 million in government loans to GM and Chrysler in 2009.” Oh well, no one gets everything right.

Addendum:

Of course this is a typo, but one that an editor should have quickly caught. However it is worth pointing out that if the Post had the habit of expressing numbers in a way that made them meaningful to readers, it is unlikely they would have missed this one. Specifically, if they described the number as a share of the budget (@ 2.4 percent, if written correctly), it would likely have caught their attention if they had written it as 0.0024 percent of federal spending.

Obviously the Post is not alone in writing out big numbers that are meaningless to 99 percent of their readers. This is the standard practice in reporting. However it really amounts to a silly fraternity ritual. The job of reporters is to provide information to their audience and this does not do it and they know it. I have never found a reporter who could tell me with a straight face that when they write that we are spending $210 billion on transportation over the next six years that this number has any meaning to their readers.

Read More Leer más Join the discussion Participa en la discusión

While the source is not clear, someone developed a simple way to identify incompetent news reporters. If you hear a reporter ask people in President Obama’s administration, ideally in a belligerent tone, “are the American people better off than they were four years ago?,”the reporter is trying to tell you that they are not qualified to do their job.

The reason we know that the questioners are incompetent reporters is that this is a pointless question. Suppose your house is on fire and the firefighters race to the scene. They set up their hoses and start spraying water on the blaze as quickly as possible. After the fire is put out, the courageous news reporter on the scene asks the chief firefighter, “is the house in better shape than when you got here?”

Yes, that would be a really ridiculous question. Hence George Stephanopoulos was being absurd when he posed this question to David Plouffe, a top political adviser to President Obama on ABC’s This Week. Bob Schieffer was being equally silly when he asked Martin O’Malley, the Chairman of the Democratic Governors Association, the same question on CBS’s Face the Nation.

A serious reporter asks the fire chief if he had brought a large enough crew, if they had enough hoses, if the water pressure was sufficient. That might require some minimal knowledge of how to put out fires.

Similarly, serious reporters would ask whether the stimulus was large enough, was it well-designed, and were there other measures that could have been taken like promoting shorter workweeks, as Germany has done. That would of course require some knowledge of economics, but it sure makes more sense than asking if a house is better off after it was nearly burnt to the ground.

[Typo corrected 9-4-12]

While the source is not clear, someone developed a simple way to identify incompetent news reporters. If you hear a reporter ask people in President Obama’s administration, ideally in a belligerent tone, “are the American people better off than they were four years ago?,”the reporter is trying to tell you that they are not qualified to do their job.

The reason we know that the questioners are incompetent reporters is that this is a pointless question. Suppose your house is on fire and the firefighters race to the scene. They set up their hoses and start spraying water on the blaze as quickly as possible. After the fire is put out, the courageous news reporter on the scene asks the chief firefighter, “is the house in better shape than when you got here?”

Yes, that would be a really ridiculous question. Hence George Stephanopoulos was being absurd when he posed this question to David Plouffe, a top political adviser to President Obama on ABC’s This Week. Bob Schieffer was being equally silly when he asked Martin O’Malley, the Chairman of the Democratic Governors Association, the same question on CBS’s Face the Nation.

A serious reporter asks the fire chief if he had brought a large enough crew, if they had enough hoses, if the water pressure was sufficient. That might require some minimal knowledge of how to put out fires.

Similarly, serious reporters would ask whether the stimulus was large enough, was it well-designed, and were there other measures that could have been taken like promoting shorter workweeks, as Germany has done. That would of course require some knowledge of economics, but it sure makes more sense than asking if a house is better off after it was nearly burnt to the ground.

[Typo corrected 9-4-12]

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión