The Washington Post was quick to do a fact check on the debate claiming that President Obama had misrepresented the budget plan put forward by Morgan Stanley director Erskine Bowles and former Senator Alan Simpson, the co-chairs of the deficit commission. The fact check wrongly describes the plan as the “Simpson-Bowles deficit commission proposal.”

In fact there was no proposal from the commission. According the commission’s by-laws a plan would have needed the support of 14 of the 18 commissioners to have been approved. This plan never had the support of more than 10 of the commissioners. It is therefore inaccurate to describe it as a plan of the commission.

The Washington Post was quick to do a fact check on the debate claiming that President Obama had misrepresented the budget plan put forward by Morgan Stanley director Erskine Bowles and former Senator Alan Simpson, the co-chairs of the deficit commission. The fact check wrongly describes the plan as the “Simpson-Bowles deficit commission proposal.”

In fact there was no proposal from the commission. According the commission’s by-laws a plan would have needed the support of 14 of the 18 commissioners to have been approved. This plan never had the support of more than 10 of the commissioners. It is therefore inaccurate to describe it as a plan of the commission.

Read More Leer más Join the discussion Participa en la discusión

The NYT is badly confused. While most of us recognize President Obama and Governor Romney as politicians, the NYT somehow came to believe that they are political philosophers. That is the inevitable conclusion that would be drawn from a front page piece headlined:

“a clash of philosophies.”

The first paragraph tells readers:

“Somewhere in the wonky blizzard of facts, statistics and studies thrown out on stage here on Wednesday night was a fundamental philosophical choice about the future of America, quite possibly the starkest in nearly three decades.”

This theme is repeated throughout the piece.

Of course neither candidate has gotten their position based on their political philosophy. They both managed to get their party’s nomination as a result of their ability to appeal to powerful interest groups.

The effort by the article to imply clear philosophical distinctions falls on its face. For example, the piece reports that

“Mr. Obama expressed worry about those who would lose out if government programs are cut too deeply, while Mr. Romney talked about those who feel constrained by excessive government taxation and regulation.”

Mr. Romney presumably knows that taxes are no higher today than they were in the Bush administration and that they are considerably lower than they were when the economy was growing 4.0 percent annually in the last four years of the Clinton administration. He also knows that relatively few new regulations have been put in place in the Obama years, so this cannot be a major factor slowing growth. In other words, Romney is saying these things because he hopes that they will have some resonance with the public or at least people who will support his campaign, not because he actually believes them.

Later the piece tells readers:

“Mr. Romney talked about the impact of the continuing economic problems, noting that the cost of gasoline, electricity, food and health care has grown. ‘I’ll call it the economy tax,’ he said. ‘It’s been crushing.'”

In fact, gas prices have generally lagged behind the peaks reached in 2008, so Romney cannot “note” that the cost of gasoline has grown. Electricity prices have also fallen in many areas. Furthermore, Governor Romney surely knows that the price of gas is determined on world markets and the U.S. government’s actions have little or no impact on it. So these comments are being said for their political effect, it is implausible to believe that they reflect a political philosophy.

The same logic applies to the next paragraph:

“The Republican focused on the impact on small business of Mr. Obama’s policies. ‘It’s not just Donald Trump you’re taxing,’ he said. ‘It’s all those businesses that employ one-quarter of the workers in America.’ He added, ‘You raise taxes and you kill jobs.’”

Only a small percent of businesses are structured as proprietorships and owned by individuals who will be subject to the higher tax rate supported by President Obama. These businesses do not employ anywhere close to one-quarter of the workers in America. (If they did, they hardly could be considered “small.”) Romney surely knows these facts, so again these assertions cannot possibly reflect a political philosophy.

On the other side, the piece tells readers:

“Mr. Obama expressed worry about those who would lose out if government programs are cut too deeply.”

On several occasions, most notably the bailout of Wall Street banks and the promotion of trade agreements that will redistribute billions to the pharmaceutical and entertainment industries, President Obama has clearly put the interest of powerful corporate interests ahead of the interests of middle and lower income families.

In short, the effort to portray the contest between President Obama and Governor Romney as a debate over philosophy is an invention of the media. It has no basis in the world.

The NYT is badly confused. While most of us recognize President Obama and Governor Romney as politicians, the NYT somehow came to believe that they are political philosophers. That is the inevitable conclusion that would be drawn from a front page piece headlined:

“a clash of philosophies.”

The first paragraph tells readers:

“Somewhere in the wonky blizzard of facts, statistics and studies thrown out on stage here on Wednesday night was a fundamental philosophical choice about the future of America, quite possibly the starkest in nearly three decades.”

This theme is repeated throughout the piece.

Of course neither candidate has gotten their position based on their political philosophy. They both managed to get their party’s nomination as a result of their ability to appeal to powerful interest groups.

The effort by the article to imply clear philosophical distinctions falls on its face. For example, the piece reports that

“Mr. Obama expressed worry about those who would lose out if government programs are cut too deeply, while Mr. Romney talked about those who feel constrained by excessive government taxation and regulation.”

Mr. Romney presumably knows that taxes are no higher today than they were in the Bush administration and that they are considerably lower than they were when the economy was growing 4.0 percent annually in the last four years of the Clinton administration. He also knows that relatively few new regulations have been put in place in the Obama years, so this cannot be a major factor slowing growth. In other words, Romney is saying these things because he hopes that they will have some resonance with the public or at least people who will support his campaign, not because he actually believes them.

Later the piece tells readers:

“Mr. Romney talked about the impact of the continuing economic problems, noting that the cost of gasoline, electricity, food and health care has grown. ‘I’ll call it the economy tax,’ he said. ‘It’s been crushing.'”

In fact, gas prices have generally lagged behind the peaks reached in 2008, so Romney cannot “note” that the cost of gasoline has grown. Electricity prices have also fallen in many areas. Furthermore, Governor Romney surely knows that the price of gas is determined on world markets and the U.S. government’s actions have little or no impact on it. So these comments are being said for their political effect, it is implausible to believe that they reflect a political philosophy.

The same logic applies to the next paragraph:

“The Republican focused on the impact on small business of Mr. Obama’s policies. ‘It’s not just Donald Trump you’re taxing,’ he said. ‘It’s all those businesses that employ one-quarter of the workers in America.’ He added, ‘You raise taxes and you kill jobs.’”

Only a small percent of businesses are structured as proprietorships and owned by individuals who will be subject to the higher tax rate supported by President Obama. These businesses do not employ anywhere close to one-quarter of the workers in America. (If they did, they hardly could be considered “small.”) Romney surely knows these facts, so again these assertions cannot possibly reflect a political philosophy.

On the other side, the piece tells readers:

“Mr. Obama expressed worry about those who would lose out if government programs are cut too deeply.”

On several occasions, most notably the bailout of Wall Street banks and the promotion of trade agreements that will redistribute billions to the pharmaceutical and entertainment industries, President Obama has clearly put the interest of powerful corporate interests ahead of the interests of middle and lower income families.

In short, the effort to portray the contest between President Obama and Governor Romney as a debate over philosophy is an invention of the media. It has no basis in the world.

Read More Leer más Join the discussion Participa en la discusión

Morning Edition’s fact check of comments in the debate badly misled listeners by implying that choosing between reducing deficits between higher taxes and greater growth through tax cuts are alternative paths to deficit reduction that people can choose from like flavors of ice cream at the ice cream store. They are not.

There is no plausible path through which a tax cut will generate enough growth to even pay for itself, much less produce additional revenue. The best analysis of this issue was done by the Congressional Budget Office in 2005, when it was headed by Douglas Holtz-Eakin, a Republican who was the chief economic advisor to Senator McCain in his presidential campaign. His analysis found that using the most favorable set of assumptions, additional growth could temporarily replace one-third of lost revenue. This revenue increase was largely offset by slower growth in the longer term.

The country also had the opportunity to experiment with cutting taxes as a way to increase revenue when President Reagan cut taxes in the early 80s and President Bush cut them at the start of the last decade. In both cases, deficit rose considerably as revenue fell. It would have been helpful to supply this information to listeners who may be less familiar with economic research or recent economic history.

The analysis also said that both President Obama and Governor Romney believe in energy independence. That is unlikely since it is almost inconceivable that the United States will become energy independent any time in the foreseeable future unless it imposed huge protectionist barriers on imported oil. Presidents and presidential candidates have been talking about energy independence for 40 years, there is no reason to believe that these two candidates are any more serious than their predecessors.

Morning Edition’s fact check of comments in the debate badly misled listeners by implying that choosing between reducing deficits between higher taxes and greater growth through tax cuts are alternative paths to deficit reduction that people can choose from like flavors of ice cream at the ice cream store. They are not.

There is no plausible path through which a tax cut will generate enough growth to even pay for itself, much less produce additional revenue. The best analysis of this issue was done by the Congressional Budget Office in 2005, when it was headed by Douglas Holtz-Eakin, a Republican who was the chief economic advisor to Senator McCain in his presidential campaign. His analysis found that using the most favorable set of assumptions, additional growth could temporarily replace one-third of lost revenue. This revenue increase was largely offset by slower growth in the longer term.

The country also had the opportunity to experiment with cutting taxes as a way to increase revenue when President Reagan cut taxes in the early 80s and President Bush cut them at the start of the last decade. In both cases, deficit rose considerably as revenue fell. It would have been helpful to supply this information to listeners who may be less familiar with economic research or recent economic history.

The analysis also said that both President Obama and Governor Romney believe in energy independence. That is unlikely since it is almost inconceivable that the United States will become energy independent any time in the foreseeable future unless it imposed huge protectionist barriers on imported oil. Presidents and presidential candidates have been talking about energy independence for 40 years, there is no reason to believe that these two candidates are any more serious than their predecessors.

Read More Leer más Join the discussion Participa en la discusión

It will according to the Congressional Budget Office’s new method of measuring income as discussed in a column by Eduardo Porter. While Porter does present the view of Timothy Smeedling a critic of this new approach, it would have been worth expanding on some of the issues raised. In contrast to items that are directly under consumers’ control, we are measuring what the government pays for health care.

We know that the United States pays more than twice as much per person for care as the average for other wealthy countries with little obvious to show for this spending in terms of outcome. This suggests that the U.S. health care system has an enormous amount of waste. If that waste increases, say by paying specialists higher fees, paying drug companies more money, or paying for more unnecessary procedures, the new method would imply that we have lifted more poor people out of poverty.

Given the difficulty of measuring the benefits of health care it might be useful to have measure that looks at income net of health care spending and then looks at health care outcomes for different groups. Recent evidence suggests that the poor have not benefited much from the big bucks the government has been paying for their health care, since life expectancies have stagnated or even declined.

It will according to the Congressional Budget Office’s new method of measuring income as discussed in a column by Eduardo Porter. While Porter does present the view of Timothy Smeedling a critic of this new approach, it would have been worth expanding on some of the issues raised. In contrast to items that are directly under consumers’ control, we are measuring what the government pays for health care.

We know that the United States pays more than twice as much per person for care as the average for other wealthy countries with little obvious to show for this spending in terms of outcome. This suggests that the U.S. health care system has an enormous amount of waste. If that waste increases, say by paying specialists higher fees, paying drug companies more money, or paying for more unnecessary procedures, the new method would imply that we have lifted more poor people out of poverty.

Given the difficulty of measuring the benefits of health care it might be useful to have measure that looks at income net of health care spending and then looks at health care outcomes for different groups. Recent evidence suggests that the poor have not benefited much from the big bucks the government has been paying for their health care, since life expectancies have stagnated or even declined.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

A Washington Post piece on Jens Weidmann, the head of the Bundesbank, told readers of his anger over the European Central Bank’s bailout of debtor countries and his concerns about inflation. It then told readers:

“Many Germans fear that printing the money to buy the bonds will contribute to higher inflation in the long run — a violation of what they see as the ECB’s principal mandate and a bitter tonic for a country that gave up its cherished mark in exchange for assurances that the euro would be just as stable.”

It would have been helpful to remind readers that Germany enjoys low unemployment and a relatively healthy economy precisely because it has tied the southern European countries to the euro. If they still had their own currencies, they would have devalued against the “cherished mark.” This would make German goods less competitive, sharply reducing its trade surplus with the rest of Europe.

Apparently Weidmann and the Germans to whom the article refers are like little children who want everything their own way. Many Post readers may not understand the absurdity of their position so it would have been appropriate for the paper to point it out.

A Washington Post piece on Jens Weidmann, the head of the Bundesbank, told readers of his anger over the European Central Bank’s bailout of debtor countries and his concerns about inflation. It then told readers:

“Many Germans fear that printing the money to buy the bonds will contribute to higher inflation in the long run — a violation of what they see as the ECB’s principal mandate and a bitter tonic for a country that gave up its cherished mark in exchange for assurances that the euro would be just as stable.”

It would have been helpful to remind readers that Germany enjoys low unemployment and a relatively healthy economy precisely because it has tied the southern European countries to the euro. If they still had their own currencies, they would have devalued against the “cherished mark.” This would make German goods less competitive, sharply reducing its trade surplus with the rest of Europe.

Apparently Weidmann and the Germans to whom the article refers are like little children who want everything their own way. Many Post readers may not understand the absurdity of their position so it would have been appropriate for the paper to point it out.

Read More Leer más Join the discussion Participa en la discusión

Consumption amounts to 70 percent of the economy, so getting the basic facts right about consumption and savings is pretty central to understanding the economy. That’s why it is pretty incredible that the Post told readers today:

“Households began squirreling away cash in the midst of the recession. The savings rate, which was at 1 percent in 2005, generally fluctuated between 5 percent and 6 percent during the recent recession. This year it has hovered around 4 percent, still above historical norms.”

No, this is not true. The saving rate actually averaged above 8.0 percent through most of the post-war period. It began to fall in the late 80s when the wealth created by the stock market run-up led to more consumption. It fell as low as 2.0 percent in 2000 at the peak of the stock bubble. It then fell even lower at the peaks of the housing bubble in the last decade. While the saving rate has risen from its bubble driven lows, it is still well below historical norms. (Adjusted savings uses an adjustment to disposable income based on the statistical discrepancy.)

Source: Bureau of Economic Analysis.

The piece also badly misleads readers when it reports:

“the average household approaching retirement had only $120,000 in 401(k) or individual retirement account holdings in 2010, roughly the same as in 2007. That balance translates to about $575 in monthly income.”

This figure refers to the average holding among the group that has a 401(k) account. In fact, close to half of those near retirement have no account at all. Furthermore the holdings of the typical household even among with retirement accounts is far below the average.

An analysis by the Pew Research Center found that the typical household approaching retirement had just 164,000 in total wealth. This counts equity in their home, which is by the largest source of wealth for most middle income families. Since the price of the median home is slightly over $180,000, the Pew finding means that the median household approaching retirement has roughly enough money to pay off the mortgage on their house and then would be completely dependent on their Social Security benefits for income in retirement. The Post’s discussion would have grossly misled readers into thinking that the typical household approaching retirement could anticipate substantial non-Social Security income.

Consumption amounts to 70 percent of the economy, so getting the basic facts right about consumption and savings is pretty central to understanding the economy. That’s why it is pretty incredible that the Post told readers today:

“Households began squirreling away cash in the midst of the recession. The savings rate, which was at 1 percent in 2005, generally fluctuated between 5 percent and 6 percent during the recent recession. This year it has hovered around 4 percent, still above historical norms.”

No, this is not true. The saving rate actually averaged above 8.0 percent through most of the post-war period. It began to fall in the late 80s when the wealth created by the stock market run-up led to more consumption. It fell as low as 2.0 percent in 2000 at the peak of the stock bubble. It then fell even lower at the peaks of the housing bubble in the last decade. While the saving rate has risen from its bubble driven lows, it is still well below historical norms. (Adjusted savings uses an adjustment to disposable income based on the statistical discrepancy.)

Source: Bureau of Economic Analysis.

The piece also badly misleads readers when it reports:

“the average household approaching retirement had only $120,000 in 401(k) or individual retirement account holdings in 2010, roughly the same as in 2007. That balance translates to about $575 in monthly income.”

This figure refers to the average holding among the group that has a 401(k) account. In fact, close to half of those near retirement have no account at all. Furthermore the holdings of the typical household even among with retirement accounts is far below the average.

An analysis by the Pew Research Center found that the typical household approaching retirement had just 164,000 in total wealth. This counts equity in their home, which is by the largest source of wealth for most middle income families. Since the price of the median home is slightly over $180,000, the Pew finding means that the median household approaching retirement has roughly enough money to pay off the mortgage on their house and then would be completely dependent on their Social Security benefits for income in retirement. The Post’s discussion would have grossly misled readers into thinking that the typical household approaching retirement could anticipate substantial non-Social Security income.

Read More Leer más Join the discussion Participa en la discusión

Why does the media keep telling us that the Bowles-Simpson commission issued a report when it clearly did not. If we go to the commission’s website and read its bylaws we can quickly find:

“The Commission shall vote on the approval of a final report containing a set of recommendations to achieve the objectives set forth in the Charter no later than December 1, 2010. The issuance of a final report of the Commission shall require the approval of not less than 14 of the 18 members of the Commission.”

In fact, there was no vote on anything by December 1, 2010 and there was never a report that received the approval of 14 of the 18 commission members. Therefore, there was no report of the commission. That’s pretty simple, isn’t it?

Then why does the NYT refer to:

“the proposal by President Obama’s fiscal commission led by Erskine B. Bowles, the Clinton White House chief of staff, and former Senator Alan K. Simpson of Wyoming, a Republican.”

The plan being referred to in this piece was a proposal of the co-chairs, it was not a report of the fiscal commission.

Come on folks, we know that a lot of powerful people in Washington like this plan. (According to reports, they have a full hand-written copy kept in a gold laced tabernacle in the penthouse at the Washington Post.) It is widely praised in Wall Street circles as well.

But the plan’s advocates should have to push their plan the old-fashioned way — work for candidates who support the plan, give money to their campaigns, buy billions of dollars of deceptive TV ads — they should not use the news section of the NYT to give the Bowles-Simpson plan more credibility than it warrants.

Why does the media keep telling us that the Bowles-Simpson commission issued a report when it clearly did not. If we go to the commission’s website and read its bylaws we can quickly find:

“The Commission shall vote on the approval of a final report containing a set of recommendations to achieve the objectives set forth in the Charter no later than December 1, 2010. The issuance of a final report of the Commission shall require the approval of not less than 14 of the 18 members of the Commission.”

In fact, there was no vote on anything by December 1, 2010 and there was never a report that received the approval of 14 of the 18 commission members. Therefore, there was no report of the commission. That’s pretty simple, isn’t it?

Then why does the NYT refer to:

“the proposal by President Obama’s fiscal commission led by Erskine B. Bowles, the Clinton White House chief of staff, and former Senator Alan K. Simpson of Wyoming, a Republican.”

The plan being referred to in this piece was a proposal of the co-chairs, it was not a report of the fiscal commission.

Come on folks, we know that a lot of powerful people in Washington like this plan. (According to reports, they have a full hand-written copy kept in a gold laced tabernacle in the penthouse at the Washington Post.) It is widely praised in Wall Street circles as well.

But the plan’s advocates should have to push their plan the old-fashioned way — work for candidates who support the plan, give money to their campaigns, buy billions of dollars of deceptive TV ads — they should not use the news section of the NYT to give the Bowles-Simpson plan more credibility than it warrants.

Read More Leer más Join the discussion Participa en la discusión

It apparently is that time of year when columnists try out as speechwriters for the candidates. After Robert Samuelson tried his hand by writing speeches for both candidates in his Washington Post column yesterday, David Brooks took a shot in drafting a debate intro for Governor Romney today. Brooks’ speech is not especially truthful, but I suppose that is par for a presidential candidate.

He tells readers:

“The next president is going to face some wicked problems. The first is the “fiscal cliff.” The next president is going to have to forge a grand compromise on the budget. President Obama has tried and failed to do this over the past four years. There’s no reason to think he’d do any better over the next four.”

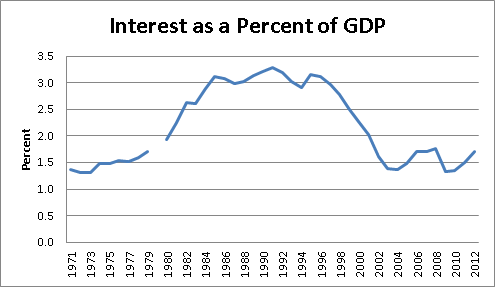

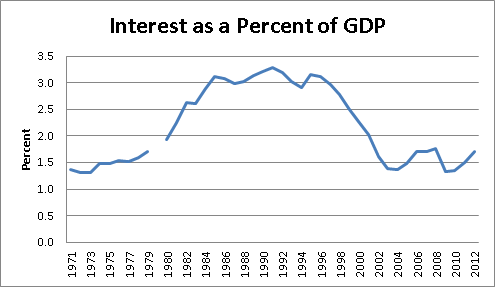

Actually there is no reason that the next president has to “forge a grand compromise on the budget.” Budget deficits were in fact quite modest until the collapse of the housing bubble tanked the economy. If the economy were back near full employment, deficits would again be quite modest. The ratio of interest payments to GDP is near its post-war low.

Source: Congressional Budget Office.

As Brooks’ speech continues, he has Romney say:

“the nations that successfully trim debt have raised $1 in new revenue for every $3 in spending cuts.”

So Brooks wants Governor Romney to assert with no basis in reality that the next president must have big budget cuts. This almost certainly means cuts to Social Security and Medicare (there ain’t much else in the non-defense budget), but Brooks would not have Romney be this honest in his opening debate statement.

He then has Romney go into a diatribe about regulatory horror stories under President Obama:

“The Obama administration, which is either hostile to or aloof from business, has made a thousand tax, regulatory and spending decisions that are biased away from growth and biased toward other priorities. American competitiveness has fallen in each of the past four years, according to the World Economic Forum. Medical device makers, for example, are being chased overseas. The economy in 2012 is worse than the economy in 2011. That’s inexcusable.”

Hmm, were the bailouts of Citigroup and Bank of America against business? How about the administration’s green light to fracking? How about a health care plan that was based on a 90s plan from the Heritage Foundation and the health care plan that Governor Romney put in place in Massachusetts?

We now know that most U.S. corporations are managed by big cry babies who are unhappy unless they are constantly told that they are wonderful people, but as a practical matter praise or criticism of the “job creators” doesn’t seem to have much economic consequence. Investment in equipment and software under our Kenyan socialist president is almost as high, measured as a share of GDP, as it was in the rein of the very business friendly George W. Bush. This is especially impressive since large segments of the economy are still suffering from substantial amounts of excess capacity.

Furthermore, we have the Brooks-Romney line that:

“Medical device makers, for example, are being chased overseas.”

This makes no sense. The comment is a reference to a small tax on medical devices that is being used to help finance the Affordable Care Act. The problem with the story is that the tax applies to the devices when they are sold in the United States. This means that manufacturers will not be able to evade the tax even if they move their operations overseas. Was Romney really this clueless when he ran Bain Capital?

Okay, the statement goes on, but you get the flavor. So, should Governor Romney hire David Brooks?

It apparently is that time of year when columnists try out as speechwriters for the candidates. After Robert Samuelson tried his hand by writing speeches for both candidates in his Washington Post column yesterday, David Brooks took a shot in drafting a debate intro for Governor Romney today. Brooks’ speech is not especially truthful, but I suppose that is par for a presidential candidate.

He tells readers:

“The next president is going to face some wicked problems. The first is the “fiscal cliff.” The next president is going to have to forge a grand compromise on the budget. President Obama has tried and failed to do this over the past four years. There’s no reason to think he’d do any better over the next four.”

Actually there is no reason that the next president has to “forge a grand compromise on the budget.” Budget deficits were in fact quite modest until the collapse of the housing bubble tanked the economy. If the economy were back near full employment, deficits would again be quite modest. The ratio of interest payments to GDP is near its post-war low.

Source: Congressional Budget Office.

As Brooks’ speech continues, he has Romney say:

“the nations that successfully trim debt have raised $1 in new revenue for every $3 in spending cuts.”

So Brooks wants Governor Romney to assert with no basis in reality that the next president must have big budget cuts. This almost certainly means cuts to Social Security and Medicare (there ain’t much else in the non-defense budget), but Brooks would not have Romney be this honest in his opening debate statement.

He then has Romney go into a diatribe about regulatory horror stories under President Obama:

“The Obama administration, which is either hostile to or aloof from business, has made a thousand tax, regulatory and spending decisions that are biased away from growth and biased toward other priorities. American competitiveness has fallen in each of the past four years, according to the World Economic Forum. Medical device makers, for example, are being chased overseas. The economy in 2012 is worse than the economy in 2011. That’s inexcusable.”

Hmm, were the bailouts of Citigroup and Bank of America against business? How about the administration’s green light to fracking? How about a health care plan that was based on a 90s plan from the Heritage Foundation and the health care plan that Governor Romney put in place in Massachusetts?

We now know that most U.S. corporations are managed by big cry babies who are unhappy unless they are constantly told that they are wonderful people, but as a practical matter praise or criticism of the “job creators” doesn’t seem to have much economic consequence. Investment in equipment and software under our Kenyan socialist president is almost as high, measured as a share of GDP, as it was in the rein of the very business friendly George W. Bush. This is especially impressive since large segments of the economy are still suffering from substantial amounts of excess capacity.

Furthermore, we have the Brooks-Romney line that:

“Medical device makers, for example, are being chased overseas.”

This makes no sense. The comment is a reference to a small tax on medical devices that is being used to help finance the Affordable Care Act. The problem with the story is that the tax applies to the devices when they are sold in the United States. This means that manufacturers will not be able to evade the tax even if they move their operations overseas. Was Romney really this clueless when he ran Bain Capital?

Okay, the statement goes on, but you get the flavor. So, should Governor Romney hire David Brooks?

Read More Leer más Join the discussion Participa en la discusión

I have always been a big fan of good headlines and let me begin by expressing my admiration for the folks at NPR for coming up with the title “Fiscal Cliff Notes” for their series on the budget standoff. But sometimes you can’t use a title even if it’s good. (My staff has restrained me from using many of my best titles and headlines.) “Fiscal Cliff Notes” belongs in that do not use box.

First and foremost the problem is that it is not accurate. It also helps push the Republican agenda on budget policy.

The reason that it is not accurate is that there is no cliff. Contrary to the image conveyed by the metaphor, pretty much nothing happens on January 1, 2013 if there is no budget deal in place. We will all be on a higher tax withholding schedule and in principle the government should be spending at a slower pace, but these effects will be virtually invisible on January 1. In fact, they will just barely be visible even if we go the whole month of January without a deal.

The tales of sharply slower growth and even a recession are based on Congress and the president going a whole year without a deal. At that point the economy will certainly feel the effects of higher with-holdings and slower spending, but that is not what happens from failing to reach a deal by January 1. (Here is a somewhat fuller discussion.)

This matters a great deal in the current context because the Republicans would very much like to force a deal before the end of the year when the immediate issue is raising taxes or not for various segments of the population. After January 1, the Bush tax cuts will have expired. At that point, the question will be who gets a tax cut. This would be a far more advantageous position for President Obama to negotiate from, assuming that he does win the election.

For this reason, wrongly implying an urgency to getting a deal before January 1 frames the debate on terms that are very advantageous to the Republicans in Congress. NPR should go back into the files and dig up a better headline for this series.

I have always been a big fan of good headlines and let me begin by expressing my admiration for the folks at NPR for coming up with the title “Fiscal Cliff Notes” for their series on the budget standoff. But sometimes you can’t use a title even if it’s good. (My staff has restrained me from using many of my best titles and headlines.) “Fiscal Cliff Notes” belongs in that do not use box.

First and foremost the problem is that it is not accurate. It also helps push the Republican agenda on budget policy.

The reason that it is not accurate is that there is no cliff. Contrary to the image conveyed by the metaphor, pretty much nothing happens on January 1, 2013 if there is no budget deal in place. We will all be on a higher tax withholding schedule and in principle the government should be spending at a slower pace, but these effects will be virtually invisible on January 1. In fact, they will just barely be visible even if we go the whole month of January without a deal.

The tales of sharply slower growth and even a recession are based on Congress and the president going a whole year without a deal. At that point the economy will certainly feel the effects of higher with-holdings and slower spending, but that is not what happens from failing to reach a deal by January 1. (Here is a somewhat fuller discussion.)

This matters a great deal in the current context because the Republicans would very much like to force a deal before the end of the year when the immediate issue is raising taxes or not for various segments of the population. After January 1, the Bush tax cuts will have expired. At that point, the question will be who gets a tax cut. This would be a far more advantageous position for President Obama to negotiate from, assuming that he does win the election.

For this reason, wrongly implying an urgency to getting a deal before January 1 frames the debate on terms that are very advantageous to the Republicans in Congress. NPR should go back into the files and dig up a better headline for this series.

Read More Leer más Join the discussion Participa en la discusión