Is everyone in the news business a frustrated mind reader? Given their often demonstrated tendency to tell us what politicians think, we might believe this to be the case.

The NYT was doing some mind reading in its coverage of the vice presidential debate when it told readers:

“Mr. Ryan believes competition will drive down the cost of health care, keeping the voucher’s value up to date.”

(“Up to date” in this context means large enough to cover the cost of a Medicare equivalent policy.) Of course the NYT gives no explanation of how it knows what Ryan “believes” about the effectiveness of competition in keeping costs down. The very next sentence in the article reports the assessment of the Congressional Budget Office:

“The Congressional Budget Office projected that over time, the value of the voucher would erode, shifting the extra costs to seniors.”

So does Ryan have access to information that the Congressional Budget Office does not have? Does he have a different way to interpret the data? After all, we have more than a half century of experience with the private insurance market, including experiments with including private insurers in Medicare. This experience has shown that private insurers raise, not lower, costs.

In the absence of any evidence otherwise, we might reasonably conclude that Representative Ryan wants to cut the cost of Medicare in order to maintain lower tax rates. We might also conclude that Ryan wants to give money to insurers who would profit enormously from the voucher system that he has proposed. The insurance industry is a major contributor to the Republican party.

It would of course be irresponsible for the NYT to report as a fact that Ryan is pushing his voucher plan as a way to redistribute tax dollars to the insurance industry. It is similarly irresponsible to report as a fact that he believes that his voucher plan will reduce costs.

Is everyone in the news business a frustrated mind reader? Given their often demonstrated tendency to tell us what politicians think, we might believe this to be the case.

The NYT was doing some mind reading in its coverage of the vice presidential debate when it told readers:

“Mr. Ryan believes competition will drive down the cost of health care, keeping the voucher’s value up to date.”

(“Up to date” in this context means large enough to cover the cost of a Medicare equivalent policy.) Of course the NYT gives no explanation of how it knows what Ryan “believes” about the effectiveness of competition in keeping costs down. The very next sentence in the article reports the assessment of the Congressional Budget Office:

“The Congressional Budget Office projected that over time, the value of the voucher would erode, shifting the extra costs to seniors.”

So does Ryan have access to information that the Congressional Budget Office does not have? Does he have a different way to interpret the data? After all, we have more than a half century of experience with the private insurance market, including experiments with including private insurers in Medicare. This experience has shown that private insurers raise, not lower, costs.

In the absence of any evidence otherwise, we might reasonably conclude that Representative Ryan wants to cut the cost of Medicare in order to maintain lower tax rates. We might also conclude that Ryan wants to give money to insurers who would profit enormously from the voucher system that he has proposed. The insurance industry is a major contributor to the Republican party.

It would of course be irresponsible for the NYT to report as a fact that Ryan is pushing his voucher plan as a way to redistribute tax dollars to the insurance industry. It is similarly irresponsible to report as a fact that he believes that his voucher plan will reduce costs.

Read More Leer más Join the discussion Participa en la discusión

During the vice-presidential debate Martha Raddatz used her position as debate moderator to ask the candidates about the impending bankruptcies of Social Security and Medicare. It was incredibly irresponsible to use such a loaded term to refer to the financial problems facing these programs.

Both Social Security and Medicare are projected to face shortfalls over their 75-year planning horizon, however these shortfalls are not accurately described as “bankruptcy.” This phrase undoubtedly leads many people to believe that there is a prospect that the programs would go out of business.

Polls consistently show that a majority of young people believe that they stand to get nothing back from Social Security when they retire. That is of course not true unless Congress were to vote to eliminate the program. Under the latest projections they would stand to get a larger benefit than current retirees even if nothing is ever done to change the program’s finances. It is unlikely that listeners would understand this to be the case based on Raddatz’s comment.

It is also unlikely that viewers would have realized that the changes put in place by the Affordable Care Act extended the date when Medicare is first projected to face a shortfall from 2016 to 2024 and reduced the projected shortfall over the program’s 75-year planning period by more than two thirds. The remaining gap could be filled by a tax increase that is less than 2 percent of projected wage growth over the next 30 years.

It is the job of the moderator to try to provide their audience with information and to draw out the candidates’ views. It is incredibly irresponsible to use this platform to push their personal agenda for the country’s two most important social programs.

During the vice-presidential debate Martha Raddatz used her position as debate moderator to ask the candidates about the impending bankruptcies of Social Security and Medicare. It was incredibly irresponsible to use such a loaded term to refer to the financial problems facing these programs.

Both Social Security and Medicare are projected to face shortfalls over their 75-year planning horizon, however these shortfalls are not accurately described as “bankruptcy.” This phrase undoubtedly leads many people to believe that there is a prospect that the programs would go out of business.

Polls consistently show that a majority of young people believe that they stand to get nothing back from Social Security when they retire. That is of course not true unless Congress were to vote to eliminate the program. Under the latest projections they would stand to get a larger benefit than current retirees even if nothing is ever done to change the program’s finances. It is unlikely that listeners would understand this to be the case based on Raddatz’s comment.

It is also unlikely that viewers would have realized that the changes put in place by the Affordable Care Act extended the date when Medicare is first projected to face a shortfall from 2016 to 2024 and reduced the projected shortfall over the program’s 75-year planning period by more than two thirds. The remaining gap could be filled by a tax increase that is less than 2 percent of projected wage growth over the next 30 years.

It is the job of the moderator to try to provide their audience with information and to draw out the candidates’ views. It is incredibly irresponsible to use this platform to push their personal agenda for the country’s two most important social programs.

Read More Leer más Join the discussion Participa en la discusión

This is what readers of an article on the U.S. trade situation would conclude. The article notes the large U.S. trade deficit, but then focuses exclusively on the role of increased exports in reducing the deficit. In fact, in order to get the deficit down to a more sustainable level we will almost certainly need both higher exports and lower imports.

Incredibly, the article never once mentioned the value of the dollar. This is by far the most important determinant of both our exports and our trade deficit. If the dollar were to fall by 20 percent against other currencies, as a first approximation it will reduce the price of U.S. exports by 20 percent relative to the price of goods produced elsewhere. All economists agree that lower prices increase demand. It is bizarre that the piece never discusses the over-valuation of the dollar which is the cause of the trade deficit.

The piece was somewhat misleading when it told readers:

“Last year, U.S. exports totaled $2.1 trillion, a 14 percent rise from 2010. That activity accounted for many millions of jobs and about 14 percent of the nation’s economic output.”

Exports do not necessarily lead to jobs. For example, if GM moves a car assembly plant from Ohio to Mexico, we are not getting more jobs because part that used to go to Ohio are now exported to Mexico for assembly there. While exports do create jobs, many exports are intermediate goods like the car parts in this story and do not result in additional jobs in the United States.

This is what readers of an article on the U.S. trade situation would conclude. The article notes the large U.S. trade deficit, but then focuses exclusively on the role of increased exports in reducing the deficit. In fact, in order to get the deficit down to a more sustainable level we will almost certainly need both higher exports and lower imports.

Incredibly, the article never once mentioned the value of the dollar. This is by far the most important determinant of both our exports and our trade deficit. If the dollar were to fall by 20 percent against other currencies, as a first approximation it will reduce the price of U.S. exports by 20 percent relative to the price of goods produced elsewhere. All economists agree that lower prices increase demand. It is bizarre that the piece never discusses the over-valuation of the dollar which is the cause of the trade deficit.

The piece was somewhat misleading when it told readers:

“Last year, U.S. exports totaled $2.1 trillion, a 14 percent rise from 2010. That activity accounted for many millions of jobs and about 14 percent of the nation’s economic output.”

Exports do not necessarily lead to jobs. For example, if GM moves a car assembly plant from Ohio to Mexico, we are not getting more jobs because part that used to go to Ohio are now exported to Mexico for assembly there. While exports do create jobs, many exports are intermediate goods like the car parts in this story and do not result in additional jobs in the United States.

Read More Leer más Join the discussion Participa en la discusión

I saw that Nick Rowe was unhappy that I was saying that the government debt is not a burden to future generations since they will also own the debt as an asset. I had planned to write a response, but I see that Brad DeLong got there first. I would agree with pretty much everything Brad said. The burden of the debt only exists if there is reason to believe that debt is somehow displacing investment in private capital, which is certainly not true at present.

I would probably argue the case even more strongly. In a depressed economy like we have today, there is reason to believe that the deficit, by boosting demand, is actually increasing investment, thereby making future generations wealthier. There is also the issue of human capital, that by keeping workers employed and keeping families intact, it is improving the productive capacities of the labor force in the future.

Perhaps most importantly, it is essential that people understand that the measure of the burden of the debt in future generations is not the size of the debt, but the extent to which we believe the debt has reduced output in the future compared to a counter-factual where we did not run the debt. If the debt did not reduce the economies’ future productive capabilities (or even raised them) then there is no burden of the debt. In any case, how well we are treating our children is measured first and foremost by the health and the economy and the society we pass on to them, not the amount of government debt.

It is also important to add that government borrowing (if it does divert capital from private investment) is just one way in which we can reduce the economy’s productive capacities in the future. Suppose we don’t borrow but instead sell off government assets like park land or highways which are then turned into toll roads. The sale of assets (including oil leases on government property) has roughly the same effect as government borrowing.

This also applies to other ways in which the government can raise money which may not be thought of as asset sales, but have a similar impact on future output. Foremost in this category is patent and copyright protection. In these cases the government is effectively paying people for innovations and creative work by promising to give patent and copyright holders a monopoly in certain markets in the future. This is using the government’s power to allow copyright and patent holders to collect a tax on specific products. In this sense, it has a similar impact on future generations’ well-being as if the government borrowed several trillion dollars to pay innovators and creative workers and then allowed their products to be sold in a free market.

Other factors not related to the debt also can make future generations poorer in important ways. If we get other countries or people angry at us so that we have to spend more on defense to keep the country safe, then we will have imposed a large burden on future generations. If we impose harsh penalties for minor offenses so that millions of people will be tied up in the penal system, then we are also imposing a large burden on future generations.

These and a long list of other policies (did I mention the environment and global warming?) all can impose substantial burdens on future generations in ways that are not at all captured by the debt. Therefore the debt does not in any way present a measure of the burden that we are imposing on future generations.

In fact, the debt we have today does not even give us a good measure of the debt. Suppose that we issue $4 trillion in 30-year bonds at 2.75 percent interest. If interest rates return to more normal level (say 6.0 percent on 30-year bonds) in 3 years we would be able to buy the bonds back for around $2.2 trillion, eliminating $1.8 trillion on debt. This would not change our interest burden one iota, but those who worship the debt as a measure of inter-generational equity would then be able to go to the alter in their basement and offer thanks for having reduced our debt to GDP ratio by more than 10 percentage points of GDP.

I saw that Nick Rowe was unhappy that I was saying that the government debt is not a burden to future generations since they will also own the debt as an asset. I had planned to write a response, but I see that Brad DeLong got there first. I would agree with pretty much everything Brad said. The burden of the debt only exists if there is reason to believe that debt is somehow displacing investment in private capital, which is certainly not true at present.

I would probably argue the case even more strongly. In a depressed economy like we have today, there is reason to believe that the deficit, by boosting demand, is actually increasing investment, thereby making future generations wealthier. There is also the issue of human capital, that by keeping workers employed and keeping families intact, it is improving the productive capacities of the labor force in the future.

Perhaps most importantly, it is essential that people understand that the measure of the burden of the debt in future generations is not the size of the debt, but the extent to which we believe the debt has reduced output in the future compared to a counter-factual where we did not run the debt. If the debt did not reduce the economies’ future productive capabilities (or even raised them) then there is no burden of the debt. In any case, how well we are treating our children is measured first and foremost by the health and the economy and the society we pass on to them, not the amount of government debt.

It is also important to add that government borrowing (if it does divert capital from private investment) is just one way in which we can reduce the economy’s productive capacities in the future. Suppose we don’t borrow but instead sell off government assets like park land or highways which are then turned into toll roads. The sale of assets (including oil leases on government property) has roughly the same effect as government borrowing.

This also applies to other ways in which the government can raise money which may not be thought of as asset sales, but have a similar impact on future output. Foremost in this category is patent and copyright protection. In these cases the government is effectively paying people for innovations and creative work by promising to give patent and copyright holders a monopoly in certain markets in the future. This is using the government’s power to allow copyright and patent holders to collect a tax on specific products. In this sense, it has a similar impact on future generations’ well-being as if the government borrowed several trillion dollars to pay innovators and creative workers and then allowed their products to be sold in a free market.

Other factors not related to the debt also can make future generations poorer in important ways. If we get other countries or people angry at us so that we have to spend more on defense to keep the country safe, then we will have imposed a large burden on future generations. If we impose harsh penalties for minor offenses so that millions of people will be tied up in the penal system, then we are also imposing a large burden on future generations.

These and a long list of other policies (did I mention the environment and global warming?) all can impose substantial burdens on future generations in ways that are not at all captured by the debt. Therefore the debt does not in any way present a measure of the burden that we are imposing on future generations.

In fact, the debt we have today does not even give us a good measure of the debt. Suppose that we issue $4 trillion in 30-year bonds at 2.75 percent interest. If interest rates return to more normal level (say 6.0 percent on 30-year bonds) in 3 years we would be able to buy the bonds back for around $2.2 trillion, eliminating $1.8 trillion on debt. This would not change our interest burden one iota, but those who worship the debt as a measure of inter-generational equity would then be able to go to the alter in their basement and offer thanks for having reduced our debt to GDP ratio by more than 10 percentage points of GDP.

Read More Leer más Join the discussion Participa en la discusión

As part of the NYT’s affirmative action program for right-wingers, it ran an oped column by Gary E. MacDougal, a former business consultant and executive and advisor to former Illinois Governor Jim Edgar. The main point of the piece is that we spend almost $1 trillion a year on anti-poverty programs (combining spending at all levels of government), yet we still have 46 million people in poverty. MacDougal does the arithmetic and points out that this comes to over $23,000 a year for each person in poverty. He then concludes that we would be much better off blockgranting all this money to state governments, who we know to be wizards in dealing with poverty.

Apart from the questionable assessment of the effectiveness of state governments, the main problem with MacDougal’s argument is the arithmetic. A large portion of his $1 trillion goes to people who are above the poverty line. For example, more than a quarter of the money is the $250 billion spent each year on Medicaid and other health care programs. Eligibility for Medicaid varies by state but in all cases has cutoffs well above the poverty line. The same is true of the Earned Income Tax Credit (EITC), which has a cutoff for a family of four of more than $40,000, nearly twice the official poverty line. This means that MacDougal’s $1 trillion is going to a population that is more than twice the size of the poverty population, so his arithmetic is wrong by a very large factor.

It’s also worth noting that much of this money is dedicated to educational programs of different sorts where payments are made to school districts and educational institutions, it is never seen by the families themselves. The money that the government spends on public education for poor children is not included in the calculation of the poverty line.

The urge to just hand money to the states may seem less compelling when we consider that more than half of the $668 billion in federal spending (18 percent of total spending) targeted by MacDougal consists of health care programs that are already administered by the states, the EITC which is paid directly to working families through the tax code and Pell grants. (Food stamps account for roughly a quarter of the rest of the money.)

While many anti-poverty programs are undoubtedly wasteful and should be reformed or eliminated, the notion that the government spends a massive amount on poverty programs is an invention of the right-wing that has no basis in reality.

As part of the NYT’s affirmative action program for right-wingers, it ran an oped column by Gary E. MacDougal, a former business consultant and executive and advisor to former Illinois Governor Jim Edgar. The main point of the piece is that we spend almost $1 trillion a year on anti-poverty programs (combining spending at all levels of government), yet we still have 46 million people in poverty. MacDougal does the arithmetic and points out that this comes to over $23,000 a year for each person in poverty. He then concludes that we would be much better off blockgranting all this money to state governments, who we know to be wizards in dealing with poverty.

Apart from the questionable assessment of the effectiveness of state governments, the main problem with MacDougal’s argument is the arithmetic. A large portion of his $1 trillion goes to people who are above the poverty line. For example, more than a quarter of the money is the $250 billion spent each year on Medicaid and other health care programs. Eligibility for Medicaid varies by state but in all cases has cutoffs well above the poverty line. The same is true of the Earned Income Tax Credit (EITC), which has a cutoff for a family of four of more than $40,000, nearly twice the official poverty line. This means that MacDougal’s $1 trillion is going to a population that is more than twice the size of the poverty population, so his arithmetic is wrong by a very large factor.

It’s also worth noting that much of this money is dedicated to educational programs of different sorts where payments are made to school districts and educational institutions, it is never seen by the families themselves. The money that the government spends on public education for poor children is not included in the calculation of the poverty line.

The urge to just hand money to the states may seem less compelling when we consider that more than half of the $668 billion in federal spending (18 percent of total spending) targeted by MacDougal consists of health care programs that are already administered by the states, the EITC which is paid directly to working families through the tax code and Pell grants. (Food stamps account for roughly a quarter of the rest of the money.)

While many anti-poverty programs are undoubtedly wasteful and should be reformed or eliminated, the notion that the government spends a massive amount on poverty programs is an invention of the right-wing that has no basis in reality.

Read More Leer más Join the discussion Participa en la discusión

The NYT has a nice piece pointing out that the notion of a “fiscal cliff” hitting the country at the end of the year is fundamentally wrong. The immediate impact of leaving the scheduled tax increases and spending cuts in place through the end of the year will be almost zero. As the piece points out, the dire projections of sharply slower growth or even a recession are not based on letting the December 31 deadline pass, but rather leaving the higher taxes and lower spending in place for the whole year. If Congress and the president were to reach an agreement in January or even February, the impact on the economy would be limited.

The NYT has a nice piece pointing out that the notion of a “fiscal cliff” hitting the country at the end of the year is fundamentally wrong. The immediate impact of leaving the scheduled tax increases and spending cuts in place through the end of the year will be almost zero. As the piece points out, the dire projections of sharply slower growth or even a recession are not based on letting the December 31 deadline pass, but rather leaving the higher taxes and lower spending in place for the whole year. If Congress and the president were to reach an agreement in January or even February, the impact on the economy would be limited.

Read More Leer más Join the discussion Participa en la discusión

Politicians, especially those who want to cut programs like Social Security and Medicare, are fond of telling people that our children and grandchildren will pay the national debt. That one may sell well with focus groups, but it is complete nonsense. Unfortunately, Eduardo Porter repeats this line in his column today.

A moment’s reflection shows why the debt is not a measure of inter-generational equity. At some point everyone alive today will be dead. At that point, the bonds that comprise the debt will be held entirely by our children or grandchildren. The debt will be an asset for the members of future generations that hold these bonds. This can raise distributional issues within a generation. For example, if Bill Gates’ grandchildren own the entire U.S. debt there will be important within generation distributional consequences, however this says nothing about inter-generational distribution.

There is the issue of foreign ownership of the debt, but this is an issue of the trade deficit, not the budget deficit. If the country continues to run large trade deficits, then foreigners will continue to accumulate large amounts of U.S. assets, including government debt, even if we had balanced budgets. The key issue with the trade deficit is the over-valued dollar. In this respect, both candidates have effectively committed the country to large trade deficits by indicating that they will try to maintain the over-valuation of the dollar (a.k.a. “the strong dollar”).

As a generational matter, we pass a whole economy, society and environment to our children. Unless we have given them a really bad education, they would be crazy to opt for a government with a lower national debt in exchange for a weaker economy, a worse infrastructure or more damaged environment. As a practical matter, the sharp upturn in productivity growth in 1995 has virtually assured our children and grandchildren that they will enjoy far higher living standards than anything we could have done by way of lower deficits (and thereby boosting investment) had productivity growth remained at its much slower pre-1995 rate. (The fact that longstanding deficit hawks like Peter Peterson never acknowledge the impact of this uptick on productivity growth suggests that their agenda has little to do with the living standards of future generations.)

The column also contrasts the money paid out in Social Security and Medicare benefits to the money paid out for programs helping the young. While some may like to pit the old against the young, it is also possible to contrast payments to the wealthy to the young. We pay out hundreds of billions of dollars of interest on government debt each year, much of which goes to some of the wealthiest people in the country. These wealthy people surely don’t need the money.

Of course the wealthy paid for the government bonds they own, so they have a strong argument that they should get the interest. Similarly, retirees paid for their Social Security benefits. In addition, the government will save almost no money by taking away the Social Security benefits of the Warren Buffetts and the Bill Gates of the world. They are too few of them and they don’t get large checks. To have any substantial savings it would be necessary to cut benefits for retirees with incomes of around $40,000 a year.

While the government does pay out far more for Medicare than workers paid in taxes, the distributional issue here is with doctors, drug companies and other providers. We pay more than twice as much per person for our health care than people in other wealthy countries even though we have nothing obvious to show for this in terms of outcome. The reason is that we pay our providers far more for the same services. If we want to crack down on inequities here we would make bring pay for doctors and other providers in line with payments in other wealthy countries. It is bizarre to imply that we have done seniors some great favor because we make our doctors rich treating them.

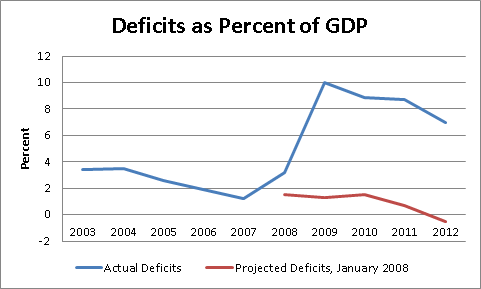

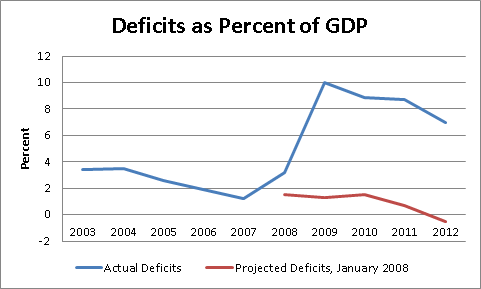

Finally, it is important to note that the large deficits of recent years are entirely the result of the economic slump that followed the collapse of the housing bubble. This is easy to see by comparing the deficit projections from the Congressional Budget Office from January 2008, before the impact of the housing crash was recognized, with actual deficits.

Source: Congressional Budget Office.

There were no major new programs created in 2008 or 2009 nor were there permanent cuts in taxes put in place. The explosion of the deficit was either directly the result of the economy’s collapse (e.g. lower taxes and higher transfers like unemployment benefits) or temporary measures intended to counteract the downturn, like the payroll tax cut. Implying that large deficits have been a chronic problem is just wrong.

Politicians, especially those who want to cut programs like Social Security and Medicare, are fond of telling people that our children and grandchildren will pay the national debt. That one may sell well with focus groups, but it is complete nonsense. Unfortunately, Eduardo Porter repeats this line in his column today.

A moment’s reflection shows why the debt is not a measure of inter-generational equity. At some point everyone alive today will be dead. At that point, the bonds that comprise the debt will be held entirely by our children or grandchildren. The debt will be an asset for the members of future generations that hold these bonds. This can raise distributional issues within a generation. For example, if Bill Gates’ grandchildren own the entire U.S. debt there will be important within generation distributional consequences, however this says nothing about inter-generational distribution.

There is the issue of foreign ownership of the debt, but this is an issue of the trade deficit, not the budget deficit. If the country continues to run large trade deficits, then foreigners will continue to accumulate large amounts of U.S. assets, including government debt, even if we had balanced budgets. The key issue with the trade deficit is the over-valued dollar. In this respect, both candidates have effectively committed the country to large trade deficits by indicating that they will try to maintain the over-valuation of the dollar (a.k.a. “the strong dollar”).

As a generational matter, we pass a whole economy, society and environment to our children. Unless we have given them a really bad education, they would be crazy to opt for a government with a lower national debt in exchange for a weaker economy, a worse infrastructure or more damaged environment. As a practical matter, the sharp upturn in productivity growth in 1995 has virtually assured our children and grandchildren that they will enjoy far higher living standards than anything we could have done by way of lower deficits (and thereby boosting investment) had productivity growth remained at its much slower pre-1995 rate. (The fact that longstanding deficit hawks like Peter Peterson never acknowledge the impact of this uptick on productivity growth suggests that their agenda has little to do with the living standards of future generations.)

The column also contrasts the money paid out in Social Security and Medicare benefits to the money paid out for programs helping the young. While some may like to pit the old against the young, it is also possible to contrast payments to the wealthy to the young. We pay out hundreds of billions of dollars of interest on government debt each year, much of which goes to some of the wealthiest people in the country. These wealthy people surely don’t need the money.

Of course the wealthy paid for the government bonds they own, so they have a strong argument that they should get the interest. Similarly, retirees paid for their Social Security benefits. In addition, the government will save almost no money by taking away the Social Security benefits of the Warren Buffetts and the Bill Gates of the world. They are too few of them and they don’t get large checks. To have any substantial savings it would be necessary to cut benefits for retirees with incomes of around $40,000 a year.

While the government does pay out far more for Medicare than workers paid in taxes, the distributional issue here is with doctors, drug companies and other providers. We pay more than twice as much per person for our health care than people in other wealthy countries even though we have nothing obvious to show for this in terms of outcome. The reason is that we pay our providers far more for the same services. If we want to crack down on inequities here we would make bring pay for doctors and other providers in line with payments in other wealthy countries. It is bizarre to imply that we have done seniors some great favor because we make our doctors rich treating them.

Finally, it is important to note that the large deficits of recent years are entirely the result of the economic slump that followed the collapse of the housing bubble. This is easy to see by comparing the deficit projections from the Congressional Budget Office from January 2008, before the impact of the housing crash was recognized, with actual deficits.

Source: Congressional Budget Office.

There were no major new programs created in 2008 or 2009 nor were there permanent cuts in taxes put in place. The explosion of the deficit was either directly the result of the economy’s collapse (e.g. lower taxes and higher transfers like unemployment benefits) or temporary measures intended to counteract the downturn, like the payroll tax cut. Implying that large deficits have been a chronic problem is just wrong.

Read More Leer más Join the discussion Participa en la discusión

The piece, titled “understanding the fiscal cliff” never once mentions the fact that there is not really a cliff. Almost nothing happens to the economy if we reach the end of the year without an agreement on taxes and spending. This point is well explained in another NYT piece today.

The piece, titled “understanding the fiscal cliff” never once mentions the fact that there is not really a cliff. Almost nothing happens to the economy if we reach the end of the year without an agreement on taxes and spending. This point is well explained in another NYT piece today.

Read More Leer más Join the discussion Participa en la discusión

The NYT has a major article today that begins by telling readers about Asimco Technologies, which it describes as: “an auto parts manufacturer whose plants dot eastern China, would seem to underscore Mitt Romney’s campaign-trail complaint that China’s manufacturing juggernaut is costing America jobs.”

The piece then tells the story of two Michigan factors that Asimco bought and then shut down. Then we get the big punchline, Asimco is owned by Bain Capital. There you have it, Mitt Romney who complains about policies that lead to job loss to China, profited from job loss to China.

This gottcha doesn’t pass the laugh test. Romney’s point is that we have policies in place, the most important of which is an over-valued dollar, that make it profitable to ship jobs to China. The issue is the policies that make it more profitable to manufacture in China than in the United States.

We generally expect businesses to try to make it money, so it really should not be surprising that businesses move manufacturing to China if it is more profitable to produce goods there. In that context it is not especially surprising or in any obvious way contradictory for Romney to be associated with a company that has shipped jobs to China.

If we have policies that make manufacturing in China more profitable than manufacturing in the United States it would be foolish to think that jobs will stay in the United States because businesses are committed to their U.S. workforce. If this sort of ethic ever existed, it has long since passed. The key to keeping manufacturing or any other type of job in this country is to have policies that make it more profitable to produce in the United States.

The NYT has a major article today that begins by telling readers about Asimco Technologies, which it describes as: “an auto parts manufacturer whose plants dot eastern China, would seem to underscore Mitt Romney’s campaign-trail complaint that China’s manufacturing juggernaut is costing America jobs.”

The piece then tells the story of two Michigan factors that Asimco bought and then shut down. Then we get the big punchline, Asimco is owned by Bain Capital. There you have it, Mitt Romney who complains about policies that lead to job loss to China, profited from job loss to China.

This gottcha doesn’t pass the laugh test. Romney’s point is that we have policies in place, the most important of which is an over-valued dollar, that make it profitable to ship jobs to China. The issue is the policies that make it more profitable to manufacture in China than in the United States.

We generally expect businesses to try to make it money, so it really should not be surprising that businesses move manufacturing to China if it is more profitable to produce goods there. In that context it is not especially surprising or in any obvious way contradictory for Romney to be associated with a company that has shipped jobs to China.

If we have policies that make manufacturing in China more profitable than manufacturing in the United States it would be foolish to think that jobs will stay in the United States because businesses are committed to their U.S. workforce. If this sort of ethic ever existed, it has long since passed. The key to keeping manufacturing or any other type of job in this country is to have policies that make it more profitable to produce in the United States.

Read More Leer más Join the discussion Participa en la discusión

Adam Davidson has an interesting piece in the NYT Magazine that highlights the similarities in the economic positions of President Obama and Governor Romney. While many of the points are likely true, some are less clear.

For example, if Governor Romney follows his budget plan, then he will have to dismantle most of the federal government after two terms in office. (Odds are that he won’t.) If he follows his campaign pledge he would also have to dismantle the health care plan that President Obama took from him. In this and other cases, whether the candidates are viewed as similar depends on what we think Governor Romney will actually do if he were elected.

However one area in which the piece clearly errs is in saying:

“both men strongly support expanding free trade.”

While both Obama and Romney are likely to push more trade agreements along the lines of NAFTA, it would be inaccurate to call this “free trade.” At this point most of the tariffs or quotas that would be viewed as obstacles to free trade have been removed. The issues that fill current trade agreements generally involve rules on investment, environmental and safety restrictions and intellectual property.

These are not traditional free trade issues. In fact, intellectual property is the opposite of free trade since it involves government granted monopolies. This is the reason that some conservative proponents of free trade have objected to the inclusion of intellectual property issues in trade agreements.

It is standard for political figures to wrap all these items into deals that they label as “free trade” agreements because educated people are scared to be opposed to anything that is called “free trade.” But this is not Alice in Wonderland, politicians don’t get to make words mean whatever they want them to mean.

Obama and Romney both support a pro-business trade agenda. They do not support expanding free trade.

Adam Davidson has an interesting piece in the NYT Magazine that highlights the similarities in the economic positions of President Obama and Governor Romney. While many of the points are likely true, some are less clear.

For example, if Governor Romney follows his budget plan, then he will have to dismantle most of the federal government after two terms in office. (Odds are that he won’t.) If he follows his campaign pledge he would also have to dismantle the health care plan that President Obama took from him. In this and other cases, whether the candidates are viewed as similar depends on what we think Governor Romney will actually do if he were elected.

However one area in which the piece clearly errs is in saying:

“both men strongly support expanding free trade.”

While both Obama and Romney are likely to push more trade agreements along the lines of NAFTA, it would be inaccurate to call this “free trade.” At this point most of the tariffs or quotas that would be viewed as obstacles to free trade have been removed. The issues that fill current trade agreements generally involve rules on investment, environmental and safety restrictions and intellectual property.

These are not traditional free trade issues. In fact, intellectual property is the opposite of free trade since it involves government granted monopolies. This is the reason that some conservative proponents of free trade have objected to the inclusion of intellectual property issues in trade agreements.

It is standard for political figures to wrap all these items into deals that they label as “free trade” agreements because educated people are scared to be opposed to anything that is called “free trade.” But this is not Alice in Wonderland, politicians don’t get to make words mean whatever they want them to mean.

Obama and Romney both support a pro-business trade agenda. They do not support expanding free trade.

Read More Leer más Join the discussion Participa en la discusión