Wow this is really getting incredible, yet another piece about how China is going to be suffering because it has a declining labor force. The big problem seems to be that we may not be able to count on cheap tee-shirts from China. The prescription is that Chinese people should have more kids so that we can have more cheap labor. The downside is that it will take 20 years before the kids born today will be able to join the labor force.

That is only a slight caricature of the blogpost by the usually insightful Vikas Bajaj. The obsession with the declining labor force in China, and the nearly universal conviction that it is bad, displays a seriously confused view of economics.

Let’s say that China’s labor force declines at the rate of 1 percent annually for the next four decades. So what? This means that the price of labor will rise and the least productive jobs will go unfilled. This is what happened in the United States when people left the farms for better paying jobs in manufacturing. Farmers no doubt felt there was a labor shortage, but that is how market economies work. Less productive businesses go under, do Bajaj and his fellow China worriers want to stop technological progress?

In terms of being able to support a rising population of dependents, it is important to keep productivity growth in this picture. China’s economy had been growing at the rate of 10 percent a year. Even if this slows to 7 percent as many predict, it will allow workers to enjoy much higher after tax income even if an increasing portion of their wage is diverted to supporting China’s elderly population.

The arithmetic here is simple. If wages rise in step with productivity growth, then after 20 years wages will have risen by 287 percent. Even if the tax burden on workers increased by 20 percentage points over this period they would still have far more after-tax income than they had when the dependency rate was lower and the economy was less productive.

What is especially bizarre is that the obsession with the prospect of a declining population takes no notice of the horrible pollution problem that China faces in Beijing and other major cities and also the problem of global warming. A declining population will help to directly address both problems. The fact that China slowed its population growth was an enormous service to humanity.

Wow this is really getting incredible, yet another piece about how China is going to be suffering because it has a declining labor force. The big problem seems to be that we may not be able to count on cheap tee-shirts from China. The prescription is that Chinese people should have more kids so that we can have more cheap labor. The downside is that it will take 20 years before the kids born today will be able to join the labor force.

That is only a slight caricature of the blogpost by the usually insightful Vikas Bajaj. The obsession with the declining labor force in China, and the nearly universal conviction that it is bad, displays a seriously confused view of economics.

Let’s say that China’s labor force declines at the rate of 1 percent annually for the next four decades. So what? This means that the price of labor will rise and the least productive jobs will go unfilled. This is what happened in the United States when people left the farms for better paying jobs in manufacturing. Farmers no doubt felt there was a labor shortage, but that is how market economies work. Less productive businesses go under, do Bajaj and his fellow China worriers want to stop technological progress?

In terms of being able to support a rising population of dependents, it is important to keep productivity growth in this picture. China’s economy had been growing at the rate of 10 percent a year. Even if this slows to 7 percent as many predict, it will allow workers to enjoy much higher after tax income even if an increasing portion of their wage is diverted to supporting China’s elderly population.

The arithmetic here is simple. If wages rise in step with productivity growth, then after 20 years wages will have risen by 287 percent. Even if the tax burden on workers increased by 20 percentage points over this period they would still have far more after-tax income than they had when the dependency rate was lower and the economy was less productive.

What is especially bizarre is that the obsession with the prospect of a declining population takes no notice of the horrible pollution problem that China faces in Beijing and other major cities and also the problem of global warming. A declining population will help to directly address both problems. The fact that China slowed its population growth was an enormous service to humanity.

Read More Leer más Join the discussion Participa en la discusión

You gotta love a guy sitting around thinking of ways to kill a bill that extends health insurance to people who don’t have it and ensures that people who have insurance and then lose their job due to illness, can continue to be insured. That’s what George Will does for a living and he is very happy today because he thinks he has a way to kill the Affordable Care Act (ACA).

Will looked at Chief Justice Roberts’ rationale for casting the 5th and deciding vote in support of the constitutionality of the ACA. He says that it rested on the idea that the penalty for not buying insurance was relatively modest. Therefore people might opt to pay the penalty rather than buy insurance, which means it was not actually forcing people to buy insurance. Will argues that this logic will prevent Congress from ever increasing the size of the penalty.

Will then does some arithmetic and points out that for someone earning $100,000 a year the penalty for not buying insurance will be $200 a month whereas a basic insurance policy would cost $400. He then notes that if someone gets seriously ill they could always then opt to buy insurance. Since $200 is less than $400, Will says large numbers of healthy people will opt not to buy insurance. This will force up the price, since the people buying insurance are relatively unhealthy, leading more people to pay the penalty. This will cause more healthy people to opt out and pay the penalty, giving us a wonderful death spiral and making George Will very happy.

There are two problems with Will’s logic. First, the insurance will likely pay for many non-serious illnesses that even healthy people would otherwise have to cover out of pocket. In other words, it is not a question of paying $400 for nothing as opposed to paying $200 for nothing. It is a question of paying $400 for insurance or $200 for nothing. It is not clear that many people will make the choice that Will wants them to make.

The more important problem with Will’s thinking is that there are an endless number of ways to slice and dice the restrictions so that the option of not buying insurance is less attractive. For example, the cost of buying insurance can be made higher for those who had previously opted not to buy into the system. Suppose the cost of later buying into the system rose 25 percent for each year that a person opted not to buy in. (Medicare Part B works this way and the vast majority of beneficiaries do chose to buy in when they first become eligible.) This would make the arithmetic of opting out much less favorable.

The rules can also be changed to make pre-existing conditions uncovered for the first 2 years after buying insurance for those who opted to pay the penalty rather than buy into the system. Neither of these measures would in any obvious way run afoul of Justice Roberts’ argument for the constitutionality of the ACA.

Of course if the Republicans continue to maintain a majority in the House and they are determined to prevent any legislation that can address problems that arise with the ACA, then Will may get his wish and the ACA may be undermined. However that route would have nothing to do with the constitutional restrictions put in place by Roberts. So score this one as a big strikeout for George Will.

You gotta love a guy sitting around thinking of ways to kill a bill that extends health insurance to people who don’t have it and ensures that people who have insurance and then lose their job due to illness, can continue to be insured. That’s what George Will does for a living and he is very happy today because he thinks he has a way to kill the Affordable Care Act (ACA).

Will looked at Chief Justice Roberts’ rationale for casting the 5th and deciding vote in support of the constitutionality of the ACA. He says that it rested on the idea that the penalty for not buying insurance was relatively modest. Therefore people might opt to pay the penalty rather than buy insurance, which means it was not actually forcing people to buy insurance. Will argues that this logic will prevent Congress from ever increasing the size of the penalty.

Will then does some arithmetic and points out that for someone earning $100,000 a year the penalty for not buying insurance will be $200 a month whereas a basic insurance policy would cost $400. He then notes that if someone gets seriously ill they could always then opt to buy insurance. Since $200 is less than $400, Will says large numbers of healthy people will opt not to buy insurance. This will force up the price, since the people buying insurance are relatively unhealthy, leading more people to pay the penalty. This will cause more healthy people to opt out and pay the penalty, giving us a wonderful death spiral and making George Will very happy.

There are two problems with Will’s logic. First, the insurance will likely pay for many non-serious illnesses that even healthy people would otherwise have to cover out of pocket. In other words, it is not a question of paying $400 for nothing as opposed to paying $200 for nothing. It is a question of paying $400 for insurance or $200 for nothing. It is not clear that many people will make the choice that Will wants them to make.

The more important problem with Will’s thinking is that there are an endless number of ways to slice and dice the restrictions so that the option of not buying insurance is less attractive. For example, the cost of buying insurance can be made higher for those who had previously opted not to buy into the system. Suppose the cost of later buying into the system rose 25 percent for each year that a person opted not to buy in. (Medicare Part B works this way and the vast majority of beneficiaries do chose to buy in when they first become eligible.) This would make the arithmetic of opting out much less favorable.

The rules can also be changed to make pre-existing conditions uncovered for the first 2 years after buying insurance for those who opted to pay the penalty rather than buy into the system. Neither of these measures would in any obvious way run afoul of Justice Roberts’ argument for the constitutionality of the ACA.

Of course if the Republicans continue to maintain a majority in the House and they are determined to prevent any legislation that can address problems that arise with the ACA, then Will may get his wish and the ACA may be undermined. However that route would have nothing to do with the constitutional restrictions put in place by Roberts. So score this one as a big strikeout for George Will.

Read More Leer más Join the discussion Participa en la discusión

The Fed reported a sharp jump in manufacturing output in December, demonstrating that factory owners were too dumb to realize that they were supposed to be cutting back production because of worries over the fiscal cliff. Earlier in the week the Commerce Department reported that consumers were also too stupid to realize that they were supposed to be cutting back their purchases over such concerns. Clearly the economy has serious problems when manufacturers and consumers refuse to act in the way that leading economists say they should be acting.

The Fed reported a sharp jump in manufacturing output in December, demonstrating that factory owners were too dumb to realize that they were supposed to be cutting back production because of worries over the fiscal cliff. Earlier in the week the Commerce Department reported that consumers were also too stupid to realize that they were supposed to be cutting back their purchases over such concerns. Clearly the economy has serious problems when manufacturers and consumers refuse to act in the way that leading economists say they should be acting.

Read More Leer más Join the discussion Participa en la discusión

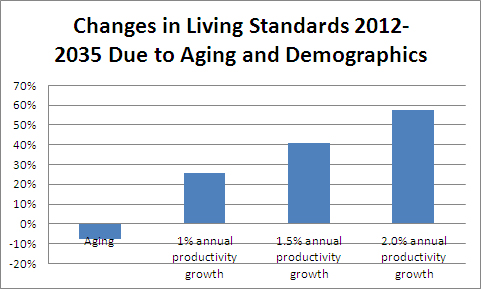

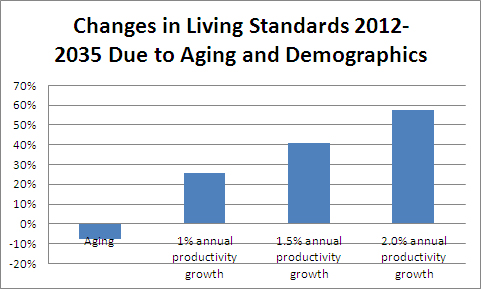

Thomas Edsall devotes his blog post this week to Walter Russell Mead and a number of others who tell him that demographic change is going to wipe out the welfare state. The problem is that the projections don’t support this story. The impact of projected future demographic change on the budget is actually fairly limited.

In 2001 Social Security cost 4.1 percent of GDP (Table F-5). It current costs 5.1 percent of GDP (Table 3-1). Over the next two decades the cost is projected to increase by roughly the same amount as it did in the last dozen years. That doesn’t seem like an insurmountable burden. In fact, if the projected shortfall in Social Security funding for the rest of the century were filled entirely through an increase in the payroll tax, the necessary tax increase would amount to 7 percent of projected wage growth over the next two decades and just 4.0 percent of the wage growth over the next 40 years. (This assumes that workers get their share of productivity gains, which is a key issue that has little to do with demographics.) The tax burden would be lessened insofar as part of the projected shortfall was filled by making the tax more progressive (e.g. raising the cap) or cutting benefits.

The rise in Medicare costs is projected to be larger, but this is due to the projected rise in per person health care costs, not demographics. (People don’t age any more rapidly in the Medicare program than in Social Security.) This emphasizes the need to control health care costs, which are already more than twice as much per person in the United States as the average for other wealthy countries. This ratio is projected to grow to 3 or 4 to 1 in the decades ahead.

It is wrong to refer to the projected explosion of health care costs as a demographic issue. It stems from an inability to confront the powerful lobbies (drug companies, medical equipment companies and doctors) who profit from the waste in the U.S. health care system. The actual impact of demographic change is swamped by productivity growth. It is probably also worth noting in the context of this piece that the ratio of interest on the government debt to GDP is near a post-World War II low.

Source: Social Security Trustees Reports and Author’s Calculations.

This blogpost also refers to the projected shortfall in state and local pension funds, telling readers:

“Dozens of city and state public employee pension plans are on the verge of bankruptcy – or are actually bankrupt – from Rhode Island to California; in 2010, a survey of 126 state and local plans showed assets of $2.7 trillion and liabilities of $3.5 trillion, an $800 billion shortfall.”

This $800 billion shortfall is less than 0.4 percent of projected GDP over the next 30 years, the time horizon in which most of these benefits are projected to be paid. That is less than one fourth of the increase in military spending associated with the wars in Iraq and Afghanistan or the additional money projected to flow to the pharmaceutical industry as a result of government granted patent monopolies.

Thomas Edsall devotes his blog post this week to Walter Russell Mead and a number of others who tell him that demographic change is going to wipe out the welfare state. The problem is that the projections don’t support this story. The impact of projected future demographic change on the budget is actually fairly limited.

In 2001 Social Security cost 4.1 percent of GDP (Table F-5). It current costs 5.1 percent of GDP (Table 3-1). Over the next two decades the cost is projected to increase by roughly the same amount as it did in the last dozen years. That doesn’t seem like an insurmountable burden. In fact, if the projected shortfall in Social Security funding for the rest of the century were filled entirely through an increase in the payroll tax, the necessary tax increase would amount to 7 percent of projected wage growth over the next two decades and just 4.0 percent of the wage growth over the next 40 years. (This assumes that workers get their share of productivity gains, which is a key issue that has little to do with demographics.) The tax burden would be lessened insofar as part of the projected shortfall was filled by making the tax more progressive (e.g. raising the cap) or cutting benefits.

The rise in Medicare costs is projected to be larger, but this is due to the projected rise in per person health care costs, not demographics. (People don’t age any more rapidly in the Medicare program than in Social Security.) This emphasizes the need to control health care costs, which are already more than twice as much per person in the United States as the average for other wealthy countries. This ratio is projected to grow to 3 or 4 to 1 in the decades ahead.

It is wrong to refer to the projected explosion of health care costs as a demographic issue. It stems from an inability to confront the powerful lobbies (drug companies, medical equipment companies and doctors) who profit from the waste in the U.S. health care system. The actual impact of demographic change is swamped by productivity growth. It is probably also worth noting in the context of this piece that the ratio of interest on the government debt to GDP is near a post-World War II low.

Source: Social Security Trustees Reports and Author’s Calculations.

This blogpost also refers to the projected shortfall in state and local pension funds, telling readers:

“Dozens of city and state public employee pension plans are on the verge of bankruptcy – or are actually bankrupt – from Rhode Island to California; in 2010, a survey of 126 state and local plans showed assets of $2.7 trillion and liabilities of $3.5 trillion, an $800 billion shortfall.”

This $800 billion shortfall is less than 0.4 percent of projected GDP over the next 30 years, the time horizon in which most of these benefits are projected to be paid. That is less than one fourth of the increase in military spending associated with the wars in Iraq and Afghanistan or the additional money projected to flow to the pharmaceutical industry as a result of government granted patent monopolies.

Read More Leer más Join the discussion Participa en la discusión

A NYT article that reported on the surge in college education in China told readers, “Japan’s experience shows that having more graduates does not guarantee entrepreneurial creativity,” referring to the growth slowdown of the last two decades. While it is possible that a lack of innovation is a factor in this slowdown, it is far from obvious that this is the case. Japan does still have a large trade surplus with the United States, suggesting that U.S. consumers like the things produced in Japan more than Japanese consumers like the things produced in the United States.

It is also very plausible that Japan’s weak growth is attributable to inept economic policy. Deficit scolds of the sort that dominate U.S. policy debate have restrained the government from running larger deficits even though its ratio of interest payments to GDP is less than 1.0 percent and it remains plagued by deflation. It is rather presumptuous to assert that a failure of innovation is a major problem in this context when no evidence is presented to support this contention.

A NYT article that reported on the surge in college education in China told readers, “Japan’s experience shows that having more graduates does not guarantee entrepreneurial creativity,” referring to the growth slowdown of the last two decades. While it is possible that a lack of innovation is a factor in this slowdown, it is far from obvious that this is the case. Japan does still have a large trade surplus with the United States, suggesting that U.S. consumers like the things produced in Japan more than Japanese consumers like the things produced in the United States.

It is also very plausible that Japan’s weak growth is attributable to inept economic policy. Deficit scolds of the sort that dominate U.S. policy debate have restrained the government from running larger deficits even though its ratio of interest payments to GDP is less than 1.0 percent and it remains plagued by deflation. It is rather presumptuous to assert that a failure of innovation is a major problem in this context when no evidence is presented to support this contention.

Read More Leer más Join the discussion Participa en la discusión

That is what readers of an article on the state of the French economy must have concluded. The piece paints a very dire picture of France’s economy, comparing it unfavorable with Spain, which is praised for instituting severe austerity measures.

While Spain’s austerity measures have succeeded in raising its unemployment rate to more than 25 percent, the highest in Europe, they have not brought about growth. Its economy shrank this year and is projected by the IMF to shrink by another 1.3 percent next year. France’s economy is projected to grow by 0.4 percent. In fact, the IMF projects that France’s growth will modestly outpace Spain’s through the remainder of its forecast period (2014-2017) as well.

In short, given the evidence on their relative economic performances it is unlikely that anyone in France would envy Spain, unless of course they viewed unemployment as an end in itself.

That is what readers of an article on the state of the French economy must have concluded. The piece paints a very dire picture of France’s economy, comparing it unfavorable with Spain, which is praised for instituting severe austerity measures.

While Spain’s austerity measures have succeeded in raising its unemployment rate to more than 25 percent, the highest in Europe, they have not brought about growth. Its economy shrank this year and is projected by the IMF to shrink by another 1.3 percent next year. France’s economy is projected to grow by 0.4 percent. In fact, the IMF projects that France’s growth will modestly outpace Spain’s through the remainder of its forecast period (2014-2017) as well.

In short, given the evidence on their relative economic performances it is unlikely that anyone in France would envy Spain, unless of course they viewed unemployment as an end in itself.

Read More Leer más Join the discussion Participa en la discusión

The NYT ran a piece telling readers that business leaders do not have the same influence with Republicans in Congress that they had in the past, noting in particular their differences on using the debt ceiling as a bargaining chip in budget negotiations. It is important to note that the fact that politicians are willing to say that they would be prepared to push the government to a default doesn’t mean that they actually would push the government to default.

It is relatively costless for a politician to publicly say that he/she feels so strongly about excessive spending that she would let the government default when the country is at least a month away from any deadline. Such appeals are popular with many voters. However this does not mean that these politicians would vote against raising the debt ceiling when the government actually faced default. The history has been that the Republican leadership has been able to get the necessary support on votes that were deemed important for business, such as the TARP. This article presents no reason to believe that situation has changed.

The NYT ran a piece telling readers that business leaders do not have the same influence with Republicans in Congress that they had in the past, noting in particular their differences on using the debt ceiling as a bargaining chip in budget negotiations. It is important to note that the fact that politicians are willing to say that they would be prepared to push the government to a default doesn’t mean that they actually would push the government to default.

It is relatively costless for a politician to publicly say that he/she feels so strongly about excessive spending that she would let the government default when the country is at least a month away from any deadline. Such appeals are popular with many voters. However this does not mean that these politicians would vote against raising the debt ceiling when the government actually faced default. The history has been that the Republican leadership has been able to get the necessary support on votes that were deemed important for business, such as the TARP. This article presents no reason to believe that situation has changed.

Read More Leer más Join the discussion Participa en la discusión

Eduardo Porter had a nice piece in the NYT making the point that privatized services will often be less efficient than publicly provided services. Porter notes research that argues that when the service in question is not well-defined and easily measured it is likely to better provided directly by the public sector. This would be the case with education, health care and other major services that are largely provided by the government.

Eduardo Porter had a nice piece in the NYT making the point that privatized services will often be less efficient than publicly provided services. Porter notes research that argues that when the service in question is not well-defined and easily measured it is likely to better provided directly by the public sector. This would be the case with education, health care and other major services that are largely provided by the government.

Read More Leer más Join the discussion Participa en la discusión

The answer is $11.5 million, at least if you work at J.P. Morgan. That is what Jamie Dimon took home last year according to the WSJ. This was half of his prior year’s take, apparently this is the punishment for allowing his London Whale crew to engage in risky trading that cost the bank $6.2 billion.

The answer is $11.5 million, at least if you work at J.P. Morgan. That is what Jamie Dimon took home last year according to the WSJ. This was half of his prior year’s take, apparently this is the punishment for allowing his London Whale crew to engage in risky trading that cost the bank $6.2 billion.

Read More Leer más Join the discussion Participa en la discusión

For some reason it was hard to find news about December retail sales in the papers. The Census Department reported they were up a healthy 0.5 percent. Remember all those stories from worried economists that told us how the fiscal cliff was already taking a toll. They told us about plunging confidence levels and consumers who were putting off purchases because of uncertainty about the resolution of the standoff.

Yes, some of us did ridicule the cliff mongers at the time. Consumers are used to the boys and girls in Washington getting silly. They will adjust their spending when they actually feel the impact in their paycheck.

Anyhow, some of us were right. Get out a heaping helping of ridicule for everyone else.

For some reason it was hard to find news about December retail sales in the papers. The Census Department reported they were up a healthy 0.5 percent. Remember all those stories from worried economists that told us how the fiscal cliff was already taking a toll. They told us about plunging confidence levels and consumers who were putting off purchases because of uncertainty about the resolution of the standoff.

Yes, some of us did ridicule the cliff mongers at the time. Consumers are used to the boys and girls in Washington getting silly. They will adjust their spending when they actually feel the impact in their paycheck.

Anyhow, some of us were right. Get out a heaping helping of ridicule for everyone else.

Read More Leer más Join the discussion Participa en la discusión