The Washington Post published excerpts from reporter Neil Irwin’s new book, The Alchemists: Three Central Bankers and a World on Fire, under the headline, “three days that saved the world financial system.” The headline is seriously misleading since it may cause readers to believe the world somehow would have lacked a financial system if the central bankers in Irwin’s story had not succeeded in their efforts.

This is not true. Had a financial collapse actually been the outcome, the central banks had the ability to take over failed banks and restart the system. (This is what the FDIC does all the time.) We would most likely see something similar to what Argentina experienced when it defaulted on its debt in December 2001 and broke the link of its currency to the dollar or what Cyprus is seeing today.

Presumably banks would be shut for a relatively short period of time until the regulators could do some preliminary workarounds. Then people would only be allowed access to a limited portion of their deposits, as is now the case in Cyprus. This situation might persist for weeks or possibly months as more money would gradually be freed up for withdrawal.

If Argentina is viewed as the model, this situation would likely lead to a sharp downturn, but then a quick bounce back. By the summer of 2003 Argentina had made up all of the ground lost in the downturn. It was growing rapidly at the time and continued to grow rapidly until the world recession brought growth to a standstill in 2009.

Source: International Monetary Fund.

While the immediate hit from the financial collapse would have almost certainly been worse than what Europe and the rest of the world saw in the immediate wake of the initial euro zone crisis, the euro zone and world economy would almost certainly be much better off today if the central bankers had simply allowed the system to collapse. (This assumes that they are as competent as the economic policymakers in Argentina.)

In this sense, the heroes in Irwin’s book can be seen as saving the bankers, who would have been wiped out in a financial collapse, but not really doing much to benefit the rest of society.

The Washington Post published excerpts from reporter Neil Irwin’s new book, The Alchemists: Three Central Bankers and a World on Fire, under the headline, “three days that saved the world financial system.” The headline is seriously misleading since it may cause readers to believe the world somehow would have lacked a financial system if the central bankers in Irwin’s story had not succeeded in their efforts.

This is not true. Had a financial collapse actually been the outcome, the central banks had the ability to take over failed banks and restart the system. (This is what the FDIC does all the time.) We would most likely see something similar to what Argentina experienced when it defaulted on its debt in December 2001 and broke the link of its currency to the dollar or what Cyprus is seeing today.

Presumably banks would be shut for a relatively short period of time until the regulators could do some preliminary workarounds. Then people would only be allowed access to a limited portion of their deposits, as is now the case in Cyprus. This situation might persist for weeks or possibly months as more money would gradually be freed up for withdrawal.

If Argentina is viewed as the model, this situation would likely lead to a sharp downturn, but then a quick bounce back. By the summer of 2003 Argentina had made up all of the ground lost in the downturn. It was growing rapidly at the time and continued to grow rapidly until the world recession brought growth to a standstill in 2009.

Source: International Monetary Fund.

While the immediate hit from the financial collapse would have almost certainly been worse than what Europe and the rest of the world saw in the immediate wake of the initial euro zone crisis, the euro zone and world economy would almost certainly be much better off today if the central bankers had simply allowed the system to collapse. (This assumes that they are as competent as the economic policymakers in Argentina.)

In this sense, the heroes in Irwin’s book can be seen as saving the bankers, who would have been wiped out in a financial collapse, but not really doing much to benefit the rest of society.

Read More Leer más Join the discussion Participa en la discusión

The revised GDP data for the fourth quarter released yesterday showed the profit share of corporate income hitting 25.6 percent. This is the highest since it stood at 25.8 percent in 1951. However if we look at the after-tax share of 19.2 percent, we would have to go back to 20.8 percent share in 1930 to find a higher number, excepting of course the 19.3 percent number hit last year.

To put this in context, the after-tax profit share was just 14.5 percent in Reagan’s Morning in America days. The difference would have come to roughly $330 billion last year. To put this in the 10-year budgetary window that is the standard framework in Washington these days, the rise in after-tax corporate profits since the Reagan era can be seen as equivalent to a $5.0 trillion tax on the nation’s workers.

This surge in profits in a weak economy (profits tend to move with the cycle) is striking but readers of the Washington Post version of AP piece on the data wouldn’t know anything about it. This piece includes no mention of the jump in corporate profits in 2012.

There are a few other issues that the piece could have better presented to readers. It noted that:

“The fourth quarter was hurt by the sharpest fall in defense spending in 40 years.”

It would have been useful to point out that defense spending reportedly rose at an extraordinary 12.9 percent annual rate in the third quarter. Defense spending is often erratic from quarter to quarter; this is why it is important to put sharp changes in context. The same applies to the GDP growth numbers more generally. The 0.4 percent growth rate for the fourth quarter looks like a sharp slowdown from the 3.1 percent rate in the third quarter, but the growth rate of final demand (which excludes inventory fluctuations) was little changed, falling from 2.4 percent in the third quarter to 1.9 percent in the fourth quarter.

This piece also highlights the drop in unemployment claims in recent weeks to their lowest level since the downturn began (although there was a jump last week). While this decline is good news, there is an important caution. As the period of high unemployment drags on, a larger percentage of newly laid off workers will not qualify for unemployment benefits. The reason is that many of the people laid off are likely to have been unemployed for substantial stretches in last two years and therefore ineligible for benefits. It would require a careful analysis of data on individual work histories to determine the exact impact of recent stretches of unemployment on eligibility. But if the share of ineligible workers among the newly unemployed has increased by 5 percentage points since the start of the downturn, it would mean that the same number of layoffs would translate into roughly 20,000 fewer claims.

The revised GDP data for the fourth quarter released yesterday showed the profit share of corporate income hitting 25.6 percent. This is the highest since it stood at 25.8 percent in 1951. However if we look at the after-tax share of 19.2 percent, we would have to go back to 20.8 percent share in 1930 to find a higher number, excepting of course the 19.3 percent number hit last year.

To put this in context, the after-tax profit share was just 14.5 percent in Reagan’s Morning in America days. The difference would have come to roughly $330 billion last year. To put this in the 10-year budgetary window that is the standard framework in Washington these days, the rise in after-tax corporate profits since the Reagan era can be seen as equivalent to a $5.0 trillion tax on the nation’s workers.

This surge in profits in a weak economy (profits tend to move with the cycle) is striking but readers of the Washington Post version of AP piece on the data wouldn’t know anything about it. This piece includes no mention of the jump in corporate profits in 2012.

There are a few other issues that the piece could have better presented to readers. It noted that:

“The fourth quarter was hurt by the sharpest fall in defense spending in 40 years.”

It would have been useful to point out that defense spending reportedly rose at an extraordinary 12.9 percent annual rate in the third quarter. Defense spending is often erratic from quarter to quarter; this is why it is important to put sharp changes in context. The same applies to the GDP growth numbers more generally. The 0.4 percent growth rate for the fourth quarter looks like a sharp slowdown from the 3.1 percent rate in the third quarter, but the growth rate of final demand (which excludes inventory fluctuations) was little changed, falling from 2.4 percent in the third quarter to 1.9 percent in the fourth quarter.

This piece also highlights the drop in unemployment claims in recent weeks to their lowest level since the downturn began (although there was a jump last week). While this decline is good news, there is an important caution. As the period of high unemployment drags on, a larger percentage of newly laid off workers will not qualify for unemployment benefits. The reason is that many of the people laid off are likely to have been unemployed for substantial stretches in last two years and therefore ineligible for benefits. It would require a careful analysis of data on individual work histories to determine the exact impact of recent stretches of unemployment on eligibility. But if the share of ineligible workers among the newly unemployed has increased by 5 percentage points since the start of the downturn, it would mean that the same number of layoffs would translate into roughly 20,000 fewer claims.

Read More Leer más Join the discussion Participa en la discusión

The Conference Board’s index of consumer confidence fell in March. What is noteworthy for those following the economy is that the current conditions index dropped by 3.5 points to 57.9. This component is the one that actually tracks current consumption reasonably closely, so it is giving us information about the economy.

By contrast the future expectations component is highly erratic and bears little relationship to actual consumption patterns. Reporters generally don’t make a point of distinguishing between these two components. This can lead them to misinform the public about the economy.

For example there were many stories last fall highlighting falls in the index based on the future expectations index. These drops were undoubtedly attributable to media accounts warning of the end of the world if we went off the “fiscal cliff.” As we now know, consumption spending held up just fine through the fall.

The recent drop in the current conditions index however should be taken as a serious warning that consumers may be tightening their belts. That would not be a surprising response to the ending of the payroll tax cut, plus some amount of layoffs and cutbacks associated with the sequester.

This is just one report among many, but it does suggest that the recovery optimists singing about having finally turned the corner may be wrong.

The Conference Board’s index of consumer confidence fell in March. What is noteworthy for those following the economy is that the current conditions index dropped by 3.5 points to 57.9. This component is the one that actually tracks current consumption reasonably closely, so it is giving us information about the economy.

By contrast the future expectations component is highly erratic and bears little relationship to actual consumption patterns. Reporters generally don’t make a point of distinguishing between these two components. This can lead them to misinform the public about the economy.

For example there were many stories last fall highlighting falls in the index based on the future expectations index. These drops were undoubtedly attributable to media accounts warning of the end of the world if we went off the “fiscal cliff.” As we now know, consumption spending held up just fine through the fall.

The recent drop in the current conditions index however should be taken as a serious warning that consumers may be tightening their belts. That would not be a surprising response to the ending of the payroll tax cut, plus some amount of layoffs and cutbacks associated with the sequester.

This is just one report among many, but it does suggest that the recovery optimists singing about having finally turned the corner may be wrong.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The NYT commits the common sin of making such comparisons in an otherwise useful piece on the economic plight of millennials. It tells us:

“The average net worth of someone 29 to 37 has fallen 21 percent since 1983; the average net worth of someone 56 to 64 has more than doubled.”

Of course we should be looking at medians, not averages, since Bill Gates’ immense wealth doesn’t help the rest of his age cohort. When we look at medians, the rise in wealth for older workers is much smaller, trailing the growth of the economy over this period. However even this number (10 percent for workers between the ages of 55 and 64) hugely overstates the growth in wealth. In 1984 the typical older worker would have had a defined benefit pension, the value of which is not included in these data. A relatively small share of older workers today would have a defined benefit pension. Therefore, this comparison hugely overstates the gains in wealth for older workers over the last quarter century.

Median wealth for those approaching retirement, which includes the value of equity in their home, is roughly $170,000. This means that the median older household can use every penny they have to completely pay off their mortgage. Then they would have nothing left to support themselves in retirement except their Social Security. Everyone should understand this is the positive vision of wealth presented in this piece.

Young people never had much wealth (in 1983, median wealth for young people was around $10,000), so the drop in wealth is not a serious cause for concern. The loss of wealth shown in the Pew study is roughly equivalent to a reduction of $10 in future monthly income or a cut in pay of 7 cents an hour for a full-time worker or 3.5 cents an hour for a two worker household. Their labor market prospects, which are bleak, are the real issue for young people. It is unfortunate that major research centers like the Urban Institute and Pew have issued studies that imply otherwise.

The NYT commits the common sin of making such comparisons in an otherwise useful piece on the economic plight of millennials. It tells us:

“The average net worth of someone 29 to 37 has fallen 21 percent since 1983; the average net worth of someone 56 to 64 has more than doubled.”

Of course we should be looking at medians, not averages, since Bill Gates’ immense wealth doesn’t help the rest of his age cohort. When we look at medians, the rise in wealth for older workers is much smaller, trailing the growth of the economy over this period. However even this number (10 percent for workers between the ages of 55 and 64) hugely overstates the growth in wealth. In 1984 the typical older worker would have had a defined benefit pension, the value of which is not included in these data. A relatively small share of older workers today would have a defined benefit pension. Therefore, this comparison hugely overstates the gains in wealth for older workers over the last quarter century.

Median wealth for those approaching retirement, which includes the value of equity in their home, is roughly $170,000. This means that the median older household can use every penny they have to completely pay off their mortgage. Then they would have nothing left to support themselves in retirement except their Social Security. Everyone should understand this is the positive vision of wealth presented in this piece.

Young people never had much wealth (in 1983, median wealth for young people was around $10,000), so the drop in wealth is not a serious cause for concern. The loss of wealth shown in the Pew study is roughly equivalent to a reduction of $10 in future monthly income or a cut in pay of 7 cents an hour for a full-time worker or 3.5 cents an hour for a two worker household. Their labor market prospects, which are bleak, are the real issue for young people. It is unfortunate that major research centers like the Urban Institute and Pew have issued studies that imply otherwise.

Read More Leer más Join the discussion Participa en la discusión

It is bizarre that the idea of bringing in more foreign doctors as a way to drive down wages is never discussed. Readers of a front page Washington Post article on using nurses for some of tasks currently done by doctors must have been puzzled by this omission.

While allowing nurses to do work for which they are qualified would seem to be a win-win for everyone but doctors, it seems especially strange that this piece never raised the possibility of bringing in more foreign trained doctors as a way to drive down wages and save patients and the public money. This is done all the time in the case of nurses. Many nurses are brought in from developing countries, most notably the Philippines, as a way to drive down the wages of nurses.

There is no justification for not having the same approach to foreign doctors. Obviously doctors as a group are more wealthy and powerful than nurses, but news outlets are not supposed to adjust the news to suit the desires of the rich and powerful.

It is bizarre that the idea of bringing in more foreign doctors as a way to drive down wages is never discussed. Readers of a front page Washington Post article on using nurses for some of tasks currently done by doctors must have been puzzled by this omission.

While allowing nurses to do work for which they are qualified would seem to be a win-win for everyone but doctors, it seems especially strange that this piece never raised the possibility of bringing in more foreign trained doctors as a way to drive down wages and save patients and the public money. This is done all the time in the case of nurses. Many nurses are brought in from developing countries, most notably the Philippines, as a way to drive down the wages of nurses.

There is no justification for not having the same approach to foreign doctors. Obviously doctors as a group are more wealthy and powerful than nurses, but news outlets are not supposed to adjust the news to suit the desires of the rich and powerful.

Read More Leer más Join the discussion Participa en la discusión

The WSJ had a piece on lobbying efforts by high speed traders against a financial speculation tax that would badly damage their profits. At one point the article tells readers that:

“More-aggressive regulatory oversight and depressed trading volumes have weighed on valuations of trading outfits that have pondered selling stakes to outside investors, investment bankers and other people say.”

This might be the first appearance of “other people” as a news source in a major national newspaper. Perhaps the WSJ could be persuaded to identify its sources here.

The WSJ had a piece on lobbying efforts by high speed traders against a financial speculation tax that would badly damage their profits. At one point the article tells readers that:

“More-aggressive regulatory oversight and depressed trading volumes have weighed on valuations of trading outfits that have pondered selling stakes to outside investors, investment bankers and other people say.”

This might be the first appearance of “other people” as a news source in a major national newspaper. Perhaps the WSJ could be persuaded to identify its sources here.

Read More Leer más Join the discussion Participa en la discusión

Economists are used to talking about contagion, the idea that a financial crisis can spread from one country to another. Unfortunately it appears to be at least as serious a problem in news reporting.

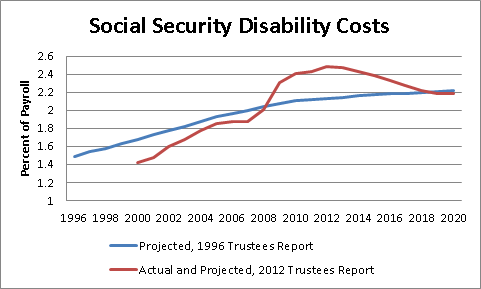

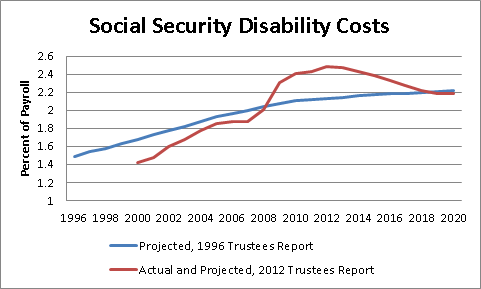

Last week This American Life ran a full hour long segment on the Social Security disability program. While the piece was well-done and provided much useful information about the difficulties facing people on the program, it fundamentally misrepresented the economic context. The piece implied that the program has seen a sustained explosion in costs as displaced workers seek it out as a lifeline. This theme has now been picked up in a piece in The Atlantic.

While there have been problems with the disability program for some time, these problems changed qualitatively as a result of the downturn. Disability payments actually had been somewhat below projections until the downturn. The downturn following the collapse of the housing bubble then sent costs soaring. The Trustees projections show that this rise is temporary and projected to fall back once the economy returns to something resembling full employment, as shown below.

Social Security Trustees Reports, 1996 and 2012.

You can get a somewhat fuller discussion of this point in my earlier blog post. Anyhow, before reporters just pick up the This American Life piece and start yapping about how disability costs have exploded out of control, they should take a moment and look at the projections in the Trustees report.

The reality is that the explosion in costs is just one more spin-off of the disastrous economic policy crafted in Washington. We have not suddenly become a nation of slackers or unemployable deadbeats.

Economists are used to talking about contagion, the idea that a financial crisis can spread from one country to another. Unfortunately it appears to be at least as serious a problem in news reporting.

Last week This American Life ran a full hour long segment on the Social Security disability program. While the piece was well-done and provided much useful information about the difficulties facing people on the program, it fundamentally misrepresented the economic context. The piece implied that the program has seen a sustained explosion in costs as displaced workers seek it out as a lifeline. This theme has now been picked up in a piece in The Atlantic.

While there have been problems with the disability program for some time, these problems changed qualitatively as a result of the downturn. Disability payments actually had been somewhat below projections until the downturn. The downturn following the collapse of the housing bubble then sent costs soaring. The Trustees projections show that this rise is temporary and projected to fall back once the economy returns to something resembling full employment, as shown below.

Social Security Trustees Reports, 1996 and 2012.

You can get a somewhat fuller discussion of this point in my earlier blog post. Anyhow, before reporters just pick up the This American Life piece and start yapping about how disability costs have exploded out of control, they should take a moment and look at the projections in the Trustees report.

The reality is that the explosion in costs is just one more spin-off of the disastrous economic policy crafted in Washington. We have not suddenly become a nation of slackers or unemployable deadbeats.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión