The NYT caught this one itself, but it still is worth noting. An article discussing hospitals’ efforts to promote themselves included a quote from Dr. Eric Topol, chief academic officer at Scripps Health in California:

“We’re pushing $3 trillion in health expenditures, and one-third of that is waste.”

The piece originally said $3 billion in health expenditures. Of course mistakes happen, but you have to wonder if the NYT’s editors would have missed the error if the original sentence told readers that:

“We’re pushing $3 billion in health expenditures [0.0188 percent of GDP], and one-third of that is waste.”

It seems unlikely that one would have found its way into print. Just as the $3 billion or $ 3 trillion number, without any context, are not meaningful to the vast majority of NYT readers, they also are not very meaningful to the NYT’s editors either.

Thanks to Francois Furstenberg for calling this one to my attention.

The NYT caught this one itself, but it still is worth noting. An article discussing hospitals’ efforts to promote themselves included a quote from Dr. Eric Topol, chief academic officer at Scripps Health in California:

“We’re pushing $3 trillion in health expenditures, and one-third of that is waste.”

The piece originally said $3 billion in health expenditures. Of course mistakes happen, but you have to wonder if the NYT’s editors would have missed the error if the original sentence told readers that:

“We’re pushing $3 billion in health expenditures [0.0188 percent of GDP], and one-third of that is waste.”

It seems unlikely that one would have found its way into print. Just as the $3 billion or $ 3 trillion number, without any context, are not meaningful to the vast majority of NYT readers, they also are not very meaningful to the NYT’s editors either.

Thanks to Francois Furstenberg for calling this one to my attention.

Read More Leer más Join the discussion Participa en la discusión

Inspired by Noah Smith’s tweets, I thought I would give a quick response to Brad DeLong’s post arguing that better housing policy offers a quick way to fill much of the gap created by the collapse of the bubble. Brad has two contentions. First that years of very low building has led to huge pent-up demand for new housing units and second that if underwater homeowners could refinance their homes then we would see much more consumption.

Taking these in turn, Brad uses a trend line for housing construction to say that netting out the oversupply of the bubble years and the undersupply of more recent years, that we are way below trend. I would question the accuracy of the trend since the aging of the population might suggest a sharply lower rate of construction. (Also the increasing share of income going to medical care logically implies a decreasing share to everything else — presumably housing would be affected by this.)

Anyhow, we have direct data on the extent of over or underbuilding, the vacancy data compiled by the Census. This shows that vacancy rates are down from the peaks reached in 2009-2010, but still well above pre-bubble levels. That doesn’t sound like a market with lots of pent-up demand.

As far as the consumption story from allowing underwater homeowners to refinance and write-down debt, a little arithmetic would quickly destroy the illusions here. There are roughly 10 million underwater homeowners. Suppose they all refinanced tomorrow. How much more would they then consume?

The median income for homeowners is around $70,000. (I’m assuming that the average income for underwater homeowners is close to the median, meaning that it’s below the overall average.) Suppose that refinancing and coming above water allowed them to increase their annual consumption by $5,000 each on average, which would be a huge increase for a family with an income of $70k.

This would imply an increase in annual consumption of $50 billion. If we assume a multiplier of 1.5 that will add $75 billion, or a bit less than 0.5 percentage points, to annual GDP. This would be helpful, but not exactly a game-changer.

Long and short, we absolutely should have done more to help underwater homeowners as a matter of fairness, as I advocated from the beginning of the crisis. But it is unrealistic to imagine that this would have hugely altered the course of the recession.

Inspired by Noah Smith’s tweets, I thought I would give a quick response to Brad DeLong’s post arguing that better housing policy offers a quick way to fill much of the gap created by the collapse of the bubble. Brad has two contentions. First that years of very low building has led to huge pent-up demand for new housing units and second that if underwater homeowners could refinance their homes then we would see much more consumption.

Taking these in turn, Brad uses a trend line for housing construction to say that netting out the oversupply of the bubble years and the undersupply of more recent years, that we are way below trend. I would question the accuracy of the trend since the aging of the population might suggest a sharply lower rate of construction. (Also the increasing share of income going to medical care logically implies a decreasing share to everything else — presumably housing would be affected by this.)

Anyhow, we have direct data on the extent of over or underbuilding, the vacancy data compiled by the Census. This shows that vacancy rates are down from the peaks reached in 2009-2010, but still well above pre-bubble levels. That doesn’t sound like a market with lots of pent-up demand.

As far as the consumption story from allowing underwater homeowners to refinance and write-down debt, a little arithmetic would quickly destroy the illusions here. There are roughly 10 million underwater homeowners. Suppose they all refinanced tomorrow. How much more would they then consume?

The median income for homeowners is around $70,000. (I’m assuming that the average income for underwater homeowners is close to the median, meaning that it’s below the overall average.) Suppose that refinancing and coming above water allowed them to increase their annual consumption by $5,000 each on average, which would be a huge increase for a family with an income of $70k.

This would imply an increase in annual consumption of $50 billion. If we assume a multiplier of 1.5 that will add $75 billion, or a bit less than 0.5 percentage points, to annual GDP. This would be helpful, but not exactly a game-changer.

Long and short, we absolutely should have done more to help underwater homeowners as a matter of fairness, as I advocated from the beginning of the crisis. But it is unrealistic to imagine that this would have hugely altered the course of the recession.

Read More Leer más Join the discussion Participa en la discusión

Does God speak directly to the NYT? If not, how can it justify telling readers in a news article:

“But some basic decisions need to be made, starting with whether to try again for a broader deal to tackle deficit spending long term with significant changes to entitlement programs and more tax revenue.”

Those of us who just look at the data and official projections would never know such things. The deficit is currently at relatively modest levels compared to the size of the economy and is projected to remain so for the next decade. That would suggest that no basic decisions need to be made any time soon. Congress can go this year doing nothing about entitlement programs, it can go next year doing nothing about entitlement programs, and the year after and the year after.

In fact, current projections for government spending and deficits suggest that there is no urgency whatsoever about making changes to entitlement programs. So unless God has spoken, the NYT is misleading readers when it asserts that “some basic decisions need to be made.”

This piece also apparently suffers from the same sort of inability to say “cuts” in Social Security and Medicare that often afflicts politicians advocating such cuts.

In the fifth paragraph it tells readers:

“In the Senate, a glimmer of hope has appeared for a bipartisan deal to end the automatic across-the-board spending cuts known as sequestration and shift some of those savings to entitlement programs like Medicare and Social Security.”

So in this case it expresses “hope” that the sequestration “cuts” will be replaced by “savings” in programs like Medicare and Social Security.

In the fourth to the last paragraph, the piece presents the possibility that “cuts” can be offset with “subtle changes” to Social Security and Medicare:

“The group [of Republican and Democratic senators] appears to be closing in on a modest agreement to replace deep and automatic cuts to defense and domestic programs at Congress’s annual funding discretion with more subtle changes to entitlement — or ‘mandatory’ — programs.”

Then after quoting Senator Corker [a member of the group] referring to “mandatory savings,” the piece comes back with its grand pronouncement about the need for decisions about “significant changes.”

Of course outside of euphemism land, “cuts” will be needed to replace “cuts” if the goal is to leave the deficit the same. Generic changes will not suffice.

Thanks to Robert Salzberg for calling this one to my attention.

Does God speak directly to the NYT? If not, how can it justify telling readers in a news article:

“But some basic decisions need to be made, starting with whether to try again for a broader deal to tackle deficit spending long term with significant changes to entitlement programs and more tax revenue.”

Those of us who just look at the data and official projections would never know such things. The deficit is currently at relatively modest levels compared to the size of the economy and is projected to remain so for the next decade. That would suggest that no basic decisions need to be made any time soon. Congress can go this year doing nothing about entitlement programs, it can go next year doing nothing about entitlement programs, and the year after and the year after.

In fact, current projections for government spending and deficits suggest that there is no urgency whatsoever about making changes to entitlement programs. So unless God has spoken, the NYT is misleading readers when it asserts that “some basic decisions need to be made.”

This piece also apparently suffers from the same sort of inability to say “cuts” in Social Security and Medicare that often afflicts politicians advocating such cuts.

In the fifth paragraph it tells readers:

“In the Senate, a glimmer of hope has appeared for a bipartisan deal to end the automatic across-the-board spending cuts known as sequestration and shift some of those savings to entitlement programs like Medicare and Social Security.”

So in this case it expresses “hope” that the sequestration “cuts” will be replaced by “savings” in programs like Medicare and Social Security.

In the fourth to the last paragraph, the piece presents the possibility that “cuts” can be offset with “subtle changes” to Social Security and Medicare:

“The group [of Republican and Democratic senators] appears to be closing in on a modest agreement to replace deep and automatic cuts to defense and domestic programs at Congress’s annual funding discretion with more subtle changes to entitlement — or ‘mandatory’ — programs.”

Then after quoting Senator Corker [a member of the group] referring to “mandatory savings,” the piece comes back with its grand pronouncement about the need for decisions about “significant changes.”

Of course outside of euphemism land, “cuts” will be needed to replace “cuts” if the goal is to leave the deficit the same. Generic changes will not suffice.

Thanks to Robert Salzberg for calling this one to my attention.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had a piece discussing views at the Fed about the prospect of either vice-chair Janet Yellen or Larry Summers taking over as chair. At one point the piece discusses the arithmetic of votes on the 12 person open market committee that decides monetary policy. It tells readers:

“The chair sets the tone of the discussion. The Fed staff members who prepare economic projections and the range of policy options work directly for the chair. And the Washington-based governors usually go along with the Fed leader’s wishes (none has dissented since 2005), giving the chair a head start in putting together a majority.

“So, at the end of the day, the Fed chairman can get the policy that he or she wishes. But the ability to persuade and firm up support still matters. If a policy change was regularly enacted on close votes, say 7 to 5, it would send a message to markets that no one was really in charge.”

This is a bit misleading. First votes are usually, unanimous so there are not a lot of dissenting votes to examine. Furthermore, Bernanke took over as Fed chair in January 2006, so most of the votes since 2005 have been during his tenure. Of course Bernanke has made a point of consulting closely with his colleagues, as the piece notes, so it is not surprising that he would not have pushed positions that prompted one of the other governors to dissent.

Finally, the arithmetic is likely to be a bit different than is implied in this piece if Summers is appointed. There is already one vacancy on the board of governors. Another governor, Sarah Bloom Raskin, is reportedly considering a top position at Treasury. If she were to take this appointment that would create a second vacancy. Finally, there is a reasonably chance that Yellen would leave if she were passed over for Summers. That would create a third vacancy.

This administration has been very slow in filling Fed vacancies. This is partly due to Republican obstruction tactics and partly to a slow nomination process within the administration. Given this history, it is entirely possible that the vacancies could remain for well over a year. That would mean that the Open Market Committee would include 5 district bank presidents with voting power (all 12 presidents sit in on the meetings) and 4 governors. If Summers tried to get his way without pulling along any bank presidents he would face a serious risk of being outvoted.

The Washington Post had a piece discussing views at the Fed about the prospect of either vice-chair Janet Yellen or Larry Summers taking over as chair. At one point the piece discusses the arithmetic of votes on the 12 person open market committee that decides monetary policy. It tells readers:

“The chair sets the tone of the discussion. The Fed staff members who prepare economic projections and the range of policy options work directly for the chair. And the Washington-based governors usually go along with the Fed leader’s wishes (none has dissented since 2005), giving the chair a head start in putting together a majority.

“So, at the end of the day, the Fed chairman can get the policy that he or she wishes. But the ability to persuade and firm up support still matters. If a policy change was regularly enacted on close votes, say 7 to 5, it would send a message to markets that no one was really in charge.”

This is a bit misleading. First votes are usually, unanimous so there are not a lot of dissenting votes to examine. Furthermore, Bernanke took over as Fed chair in January 2006, so most of the votes since 2005 have been during his tenure. Of course Bernanke has made a point of consulting closely with his colleagues, as the piece notes, so it is not surprising that he would not have pushed positions that prompted one of the other governors to dissent.

Finally, the arithmetic is likely to be a bit different than is implied in this piece if Summers is appointed. There is already one vacancy on the board of governors. Another governor, Sarah Bloom Raskin, is reportedly considering a top position at Treasury. If she were to take this appointment that would create a second vacancy. Finally, there is a reasonably chance that Yellen would leave if she were passed over for Summers. That would create a third vacancy.

This administration has been very slow in filling Fed vacancies. This is partly due to Republican obstruction tactics and partly to a slow nomination process within the administration. Given this history, it is entirely possible that the vacancies could remain for well over a year. That would mean that the Open Market Committee would include 5 district bank presidents with voting power (all 12 presidents sit in on the meetings) and 4 governors. If Summers tried to get his way without pulling along any bank presidents he would face a serious risk of being outvoted.

Read More Leer más Join the discussion Participa en la discusión

“Which way is up?” reporting makes a big-time appearance in this Washington Post article telling us that Obamacare will create a boom in jobs since workers will have to be hired to steer people through the system. The article reports:

“About 7,000 to 9,000 new customer service agents will be needed to man phones and Web chats for the marketplace, called an exchange, the federal government will run for more than half of the states, a spokesman for the Centers for Medicare and Medicaid Services said. Additional agents will be needed for exchanges run by the states themselves.”

The next paragraph raises the stakes to:

“Altogether, tens of thousands of people could be hired over the next several years to set up and support the online marketplaces, according to some estimates.”

Okay, let’s make it three tens of thousands (a.k.a. 30,000). If we continue to create jobs at the rate of 170,000 a month (an assumption, not a forecast), then we will create 6.1 million jobs. This means that our 30,000 Obamacare jobs will be a bit less than 0.5 percent of net job creation over this period. That’s a plus, but not exactly a boom.

More importantly, the jobs needed to steer people through the system are a waste from the standpoint of the economy as a whole. In an efficient system people can figure out how to get their health care without needing a consultant to guide them through a complex process. The fact that Obamacare may require people for this task means that it is adding waste to the health care system.

In a recession, anything that employs people can be seen as positive since otherwise they would sit home doing nothing. However if we envision at some point that we will be back to something resembling full employment, it would be much better to have a health care system that did not require tens of thousands of workers to explain insurance options to people.

“Which way is up?” reporting makes a big-time appearance in this Washington Post article telling us that Obamacare will create a boom in jobs since workers will have to be hired to steer people through the system. The article reports:

“About 7,000 to 9,000 new customer service agents will be needed to man phones and Web chats for the marketplace, called an exchange, the federal government will run for more than half of the states, a spokesman for the Centers for Medicare and Medicaid Services said. Additional agents will be needed for exchanges run by the states themselves.”

The next paragraph raises the stakes to:

“Altogether, tens of thousands of people could be hired over the next several years to set up and support the online marketplaces, according to some estimates.”

Okay, let’s make it three tens of thousands (a.k.a. 30,000). If we continue to create jobs at the rate of 170,000 a month (an assumption, not a forecast), then we will create 6.1 million jobs. This means that our 30,000 Obamacare jobs will be a bit less than 0.5 percent of net job creation over this period. That’s a plus, but not exactly a boom.

More importantly, the jobs needed to steer people through the system are a waste from the standpoint of the economy as a whole. In an efficient system people can figure out how to get their health care without needing a consultant to guide them through a complex process. The fact that Obamacare may require people for this task means that it is adding waste to the health care system.

In a recession, anything that employs people can be seen as positive since otherwise they would sit home doing nothing. However if we envision at some point that we will be back to something resembling full employment, it would be much better to have a health care system that did not require tens of thousands of workers to explain insurance options to people.

Read More Leer más Join the discussion Participa en la discusión

An AP story that ran in the NYT told readers:

“business investment is not likely to help economic growth in the April-June quarter, economists said. That is because the government measures shipments, rather than orders, when calculating business investments’ contribution to growth. Shipments fell in June. But the increase in orders this spring suggests shipments will rise in the July-September quarter and add to growth.”

The first part of this is wrong and the second part is questionable. The data for the months April, May, and June show shipments of non-defense capital goods increasing at a 5.4 percent annual rate compared with shipments in the first quarter. This is a nominal figure, but since inflation in investment goods has been close to zero, this number is likely to be close to the real growth rate for the quarter.

The predicted growth for the third quarter based on the rise in orders in June is also dubious. The main reason for the rise was a jump in aircraft orders. These orders are placed well ahead of expected delivery dates. Aircraft manufacturers will not necessarily up their production schedules in the third quarter simply because they have more orders for planes that may not be delivered until 2016 or even later.

An AP story that ran in the NYT told readers:

“business investment is not likely to help economic growth in the April-June quarter, economists said. That is because the government measures shipments, rather than orders, when calculating business investments’ contribution to growth. Shipments fell in June. But the increase in orders this spring suggests shipments will rise in the July-September quarter and add to growth.”

The first part of this is wrong and the second part is questionable. The data for the months April, May, and June show shipments of non-defense capital goods increasing at a 5.4 percent annual rate compared with shipments in the first quarter. This is a nominal figure, but since inflation in investment goods has been close to zero, this number is likely to be close to the real growth rate for the quarter.

The predicted growth for the third quarter based on the rise in orders in June is also dubious. The main reason for the rise was a jump in aircraft orders. These orders are placed well ahead of expected delivery dates. Aircraft manufacturers will not necessarily up their production schedules in the third quarter simply because they have more orders for planes that may not be delivered until 2016 or even later.

Read More Leer más Join the discussion Participa en la discusión

A Washington Post article noting the IMF’s projections for weak growth and rising unemployment in the euro zone told readers:

“For 2014 as a whole, growth of 0.9 percent is forecast.

That is not only weak, it also masks the continued wide divergence in outcomes among the euro countries, with some nations likely to remain in recession and some growing at a faster pace. The gap in performance — between Germany’s globally competitive export sector and the stalled economies of southern Europe — is one of the region’s chief problems.”

Actually, there is not much of a difference in projected growth across countries for 2014. Germany’s economy is not exactly booming. The IMF projects that it will grow just 1.5 percent in 2014. That is compared to projected growth of 0.7 percent in Spain and 0.5 percent in Italy. The real gap is that Germany has managed to sustain growth since 2009, whereas the economies of Italy and Spain and other peripheral countries have stagnated or shrank.

It is also worth noting that the IMF’s growth projections for the peripheral countries have consistently proved to be overly optimistic because it has underestimated the negative impact that fiscal contraction has on growth.

A Washington Post article noting the IMF’s projections for weak growth and rising unemployment in the euro zone told readers:

“For 2014 as a whole, growth of 0.9 percent is forecast.

That is not only weak, it also masks the continued wide divergence in outcomes among the euro countries, with some nations likely to remain in recession and some growing at a faster pace. The gap in performance — between Germany’s globally competitive export sector and the stalled economies of southern Europe — is one of the region’s chief problems.”

Actually, there is not much of a difference in projected growth across countries for 2014. Germany’s economy is not exactly booming. The IMF projects that it will grow just 1.5 percent in 2014. That is compared to projected growth of 0.7 percent in Spain and 0.5 percent in Italy. The real gap is that Germany has managed to sustain growth since 2009, whereas the economies of Italy and Spain and other peripheral countries have stagnated or shrank.

It is also worth noting that the IMF’s growth projections for the peripheral countries have consistently proved to be overly optimistic because it has underestimated the negative impact that fiscal contraction has on growth.

Read More Leer más Join the discussion Participa en la discusión

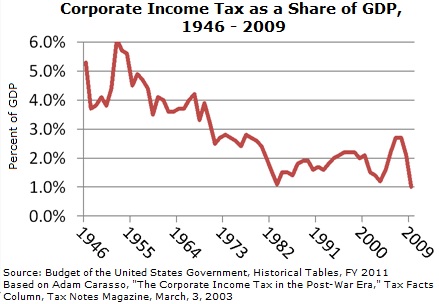

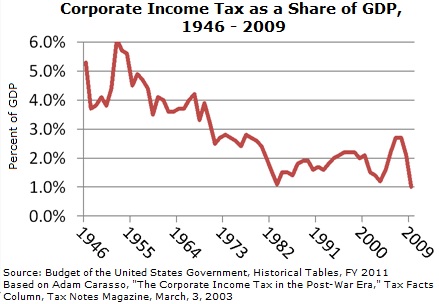

The Post had a chart showing that corporate income taxes have risen as a share of GDP across the OECD over the last 45 years. This is somewhat misleading. The chart is showing an unweighted average. This means that the sharp rise in the tax share in Norway would have the same weight as the sharp decline in the tax share of GDP in the United States. As a practical matter, the OECD data shows sharp declines in the corporate tax share of total tax revenue in most of the large countries.

For example, in the United States corporate income taxes as a share of GDP dropped from 4.1 percent in 1965 to 2.7 percent in 2010. In Japan the share declined from 4.0 percent to 3.2 percent. In Germany the drop was from 2.5 percent to 1.5 percent. In Canada corporate income taxes declined as a share of GDP from 3.8 percent in 1965 to 3.3 percent in 2010. In the United Kingdom there was a rise over this period from 1.3 percent of GDP to 3.1 percent, but the latter is down sharply from a 4.7 percent share of corporate income taxes in GDP in 1985, so there has not been an upward trend there either.

For those interested, here is the long-term picture in the United States.

Note: Spelling errors corrected from earlier version.

The Post had a chart showing that corporate income taxes have risen as a share of GDP across the OECD over the last 45 years. This is somewhat misleading. The chart is showing an unweighted average. This means that the sharp rise in the tax share in Norway would have the same weight as the sharp decline in the tax share of GDP in the United States. As a practical matter, the OECD data shows sharp declines in the corporate tax share of total tax revenue in most of the large countries.

For example, in the United States corporate income taxes as a share of GDP dropped from 4.1 percent in 1965 to 2.7 percent in 2010. In Japan the share declined from 4.0 percent to 3.2 percent. In Germany the drop was from 2.5 percent to 1.5 percent. In Canada corporate income taxes declined as a share of GDP from 3.8 percent in 1965 to 3.3 percent in 2010. In the United Kingdom there was a rise over this period from 1.3 percent of GDP to 3.1 percent, but the latter is down sharply from a 4.7 percent share of corporate income taxes in GDP in 1985, so there has not been an upward trend there either.

For those interested, here is the long-term picture in the United States.

Note: Spelling errors corrected from earlier version.

Read More Leer más Join the discussion Participa en la discusión

The current efforts by Larry Summers’ acolytes to have him replace Ben Bernanke as Fed Chair reminded me of a past battle. Back in the first term of the Clinton administration it was not assumed that Alan Greenspan had a lifetime position as Fed chair. Some folks thought that the Democratic president might want to take the opportunity to appoint a Democrat as Fed chair. The Vice-Chair at the time, Alan Blinder, was an obvious choice. Blinder had been a highly respected Princeton professor before joining President Clinton’s Council of Economic Advisers and then moving over to the Fed at the start of 1994.

Anyhow, Alan Greenspan wanted to head off this possibility. Towards this end, he managed to get a major piece in the NYT over a Blinder scandal. At a speech at the annual meeting of central bankers in Jackson Hole, Blinder suggested that central banks, instead of focusing exclusively on inflation, might actually worry a bit about unemployment (the horrors). Anyhow, the resulting outcry sent Blinder back to Princeton and left Greenspan in charge of the Fed for another decade.

Ah, the good old days!

Addendum: I had originally linked to the wrong article. The correct piece is from August 29, 1994.

The current efforts by Larry Summers’ acolytes to have him replace Ben Bernanke as Fed Chair reminded me of a past battle. Back in the first term of the Clinton administration it was not assumed that Alan Greenspan had a lifetime position as Fed chair. Some folks thought that the Democratic president might want to take the opportunity to appoint a Democrat as Fed chair. The Vice-Chair at the time, Alan Blinder, was an obvious choice. Blinder had been a highly respected Princeton professor before joining President Clinton’s Council of Economic Advisers and then moving over to the Fed at the start of 1994.

Anyhow, Alan Greenspan wanted to head off this possibility. Towards this end, he managed to get a major piece in the NYT over a Blinder scandal. At a speech at the annual meeting of central bankers in Jackson Hole, Blinder suggested that central banks, instead of focusing exclusively on inflation, might actually worry a bit about unemployment (the horrors). Anyhow, the resulting outcry sent Blinder back to Princeton and left Greenspan in charge of the Fed for another decade.

Ah, the good old days!

Addendum: I had originally linked to the wrong article. The correct piece is from August 29, 1994.

Read More Leer más Join the discussion Participa en la discusión

Yet another which way is up problem in the NYT. A NYT article on a killing in China turned to the country’s one-child country, concluding by telling readers:

“The policy has also begun to shrink the number of young workers in the labor force, putting sharp upward pressure on factory wages while raising concerns about how to accommodate and financially support the steady growth in the number of elderly dependents.”

Sorry, but that one makes no sense. Suppose it said that:

“investment bankers are getting very rich raising questions about how they will be able to support their parents.”

This is effectively what the piece is saying. If wages are rising rapidly then workers will be able to easily absorb whatever tax increases are needed to pay for a growing population of retirees. The impact of rising wages in China is at least an order of magnitude greater than the impact of demographics in reducing them.

Arithmetic fans will quickly recognize this fact. According to the International Labor Organization real wages in China tripled over the last decade. Even if this overstates the actual wage gain by a factor of two, this still swamps any possible impact of a falling ratio of workers to retirees.

For example, suppose the ratio of workers to retirees drops from 5 to 1 to just 2 to 1 over a period where wages triple (a far faster decline than China is actually seeing), and the benefits paid to retirees is 70 percent of the average worker’s wage (a high benefit). In this case, the necessary tax rate on wages would have to increase from 0.12 to 0.26. If before-tax wages triple, even in this extreme scenario the after-tax wage would rise by 150 percent.

It seems that the primary concern in this piece is that hundreds of millions of workers in China are likely to see higher wages as their labor becomes in short supply and the people who want to hire them, either for profit or as personal servants, will have to pay more for their work. That might be a problem for wealthier people in China, but that is not a concern that the vast majority of people in the world are likely to share.

Yet another which way is up problem in the NYT. A NYT article on a killing in China turned to the country’s one-child country, concluding by telling readers:

“The policy has also begun to shrink the number of young workers in the labor force, putting sharp upward pressure on factory wages while raising concerns about how to accommodate and financially support the steady growth in the number of elderly dependents.”

Sorry, but that one makes no sense. Suppose it said that:

“investment bankers are getting very rich raising questions about how they will be able to support their parents.”

This is effectively what the piece is saying. If wages are rising rapidly then workers will be able to easily absorb whatever tax increases are needed to pay for a growing population of retirees. The impact of rising wages in China is at least an order of magnitude greater than the impact of demographics in reducing them.

Arithmetic fans will quickly recognize this fact. According to the International Labor Organization real wages in China tripled over the last decade. Even if this overstates the actual wage gain by a factor of two, this still swamps any possible impact of a falling ratio of workers to retirees.

For example, suppose the ratio of workers to retirees drops from 5 to 1 to just 2 to 1 over a period where wages triple (a far faster decline than China is actually seeing), and the benefits paid to retirees is 70 percent of the average worker’s wage (a high benefit). In this case, the necessary tax rate on wages would have to increase from 0.12 to 0.26. If before-tax wages triple, even in this extreme scenario the after-tax wage would rise by 150 percent.

It seems that the primary concern in this piece is that hundreds of millions of workers in China are likely to see higher wages as their labor becomes in short supply and the people who want to hire them, either for profit or as personal servants, will have to pay more for their work. That might be a problem for wealthier people in China, but that is not a concern that the vast majority of people in the world are likely to share.

Read More Leer más Join the discussion Participa en la discusión