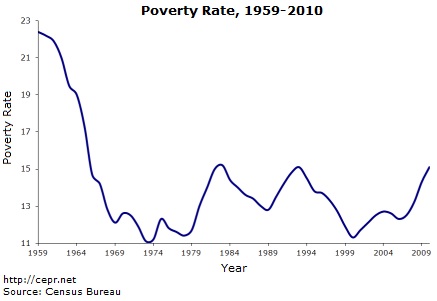

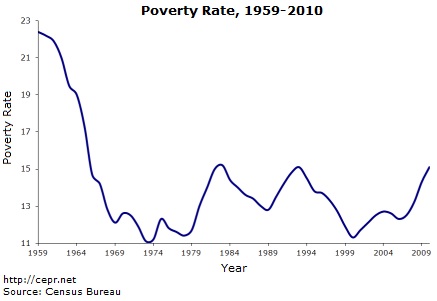

The NYT had a retrospective on the 50th anniversary of the war on poverty. One item that is worth noting is that the poverty rate actually fell sharply through the sixties and into the early seventies. Then the economy was derailed by the oil price shocks and the recessions that followed in 1974-75 and then again at the end of the 1970s. Then President Reagan got elected and surrendered.

Since the poverty rate is ostensibly based on an absolute living standard, the failure to make any progress over the last fifty years really is striking. If we had seen the same growth rate over this period with no increase in inequality, poverty would have been almost completely eliminated. The rise in inequality over the last three decades explains the lack of progress on reducing poverty.

The NYT had a retrospective on the 50th anniversary of the war on poverty. One item that is worth noting is that the poverty rate actually fell sharply through the sixties and into the early seventies. Then the economy was derailed by the oil price shocks and the recessions that followed in 1974-75 and then again at the end of the 1970s. Then President Reagan got elected and surrendered.

Since the poverty rate is ostensibly based on an absolute living standard, the failure to make any progress over the last fifty years really is striking. If we had seen the same growth rate over this period with no increase in inequality, poverty would have been almost completely eliminated. The rise in inequality over the last three decades explains the lack of progress on reducing poverty.

Read More Leer más Join the discussion Participa en la discusión

Thomas Friedman once again pronounces a pox on both their houses, demanding that Republicans and Democrats compromise and embrace his agenda for moving the country forward. The big problem is that because Thomas Friedman apparently doesn’t believe in doing homework, he doesn’t actually have an agenda that would move the country forward.

Taking his items in turn, he calls for an investment agenda, with the qualification:

“But this near-term investment should be paired with long-term entitlement reductions, defense cuts and tax reform that would be phased in gradually as the economy improves, so we do not add to the already heavy fiscal burden on our children, deprive them of future investment resources or leave our economy vulnerable to unforeseen shocks, future recessions or the stresses that are sure to come when all the baby boomers retire.”

Now the folks who have done their homework know that projections for Medicare and Medicaid spending have been sharply reduced in the last five years as the Congressional Budget Office and other forecasters have incorporated part of the slowdown in cost growth that we have seen over this period. This means that the deficit projections for 10-15 years out don’t look nearly as scary as they did in the recent past. The reduction in projected cost growth exceeds the savings from almost any remotely feasible cut that might have been proposed five years ago.

On the Social Security side of the entitlement ledger, most older workers have almost nothing saved for retirement because people with names like Greenspan, Rubin, and Summers are not very competent at running an economy (another example of the skills shortage). This means that it is not practical to talk about cuts to Social Security for anyone retiring in the near future since this is the bulk of what most retirees will be living on. In fact, those who did their homework know that many people in Congress and across the country are now talking about increasing benefits. We can cut our children and grandchildren’s Social Security, but this is a dubious way to propose to help them.

Then we have Thomas Friedman’s energy agenda:

“We should exploit our new natural gas bounty, but only by pairing it with the highest environmental extraction rules and a national, steadily rising, renewable energy portfolio standard that would ensure that natural gas replaces coal — not solar, wind or other renewables. That way shale gas becomes a bridge to a cleaner energy future, not just an addiction to a less dirty, climate-destabilizing fossil fuel.”

Friedman apparently has not done his homework here either. Andrew Revkin, who certainly is not a knee-jerk enviro-type, devoted a blogpost to a new study indicating that fracking results in much higher emissions of methane gas than had previously been believed. While this study is not conclusive, its findings certainly deserve to be taken seriously. Unless they can be shown to be mistaken, it is wrong to imagine shale gas to be the bridge fuel Friedman claims.

Then we are told:

“In some cities, teachers’ unions really are holding up education reform.”

Really, the problem is teachers’ unions? Well, large chunks of the country don’t have any teachers’ unions to block reform. Yet, we don’t hear of Texas and Alabama beating out Finland (which does have teachers’ unions) for top rankings on standardized tests or other measures of student performance. Teachers’ unions have often come into conflict with self-proclaimed reformers. While the unions may have obstructed their agenda (which often seems largely focused on weakening teachers’ unions), it is far from clear that this has had negative outcomes for students. In the Chicago teachers’ strike in 2012, the most noteworthy recent confrontation, the parents overwhelmingly sided with the teachers, so apparently they haven’t been clued in on the benefits of reform.

Next we get Thomas Friedman’s theory of wage inequality:

“Finally, the merger of globalization and the information-technology revolution has shrunk the basis of the old middle class — the high-wage, middle-skilled job. Increasingly, there are only high-wage, high-skilled jobs.”

That’s a nice try, but the data don’t fit Thoams Friedman’s little hyper-connected technology driven story. My friends Larry Mishel, John Schmitt, and Heidi Shierholz looked at this issue very carefully. In the last decade the jobs that have been growing most rapidly are actually low-skilled occupations. If we want to look for reasons for wage inequality we might try items like declining unionization rates and high unemployment.

So Friedman is surely right that we should not view compromise as a 4-letter word, but that doesn’t mean we should agree on a policy agenda that is not grounded in evidence.

Thomas Friedman once again pronounces a pox on both their houses, demanding that Republicans and Democrats compromise and embrace his agenda for moving the country forward. The big problem is that because Thomas Friedman apparently doesn’t believe in doing homework, he doesn’t actually have an agenda that would move the country forward.

Taking his items in turn, he calls for an investment agenda, with the qualification:

“But this near-term investment should be paired with long-term entitlement reductions, defense cuts and tax reform that would be phased in gradually as the economy improves, so we do not add to the already heavy fiscal burden on our children, deprive them of future investment resources or leave our economy vulnerable to unforeseen shocks, future recessions or the stresses that are sure to come when all the baby boomers retire.”

Now the folks who have done their homework know that projections for Medicare and Medicaid spending have been sharply reduced in the last five years as the Congressional Budget Office and other forecasters have incorporated part of the slowdown in cost growth that we have seen over this period. This means that the deficit projections for 10-15 years out don’t look nearly as scary as they did in the recent past. The reduction in projected cost growth exceeds the savings from almost any remotely feasible cut that might have been proposed five years ago.

On the Social Security side of the entitlement ledger, most older workers have almost nothing saved for retirement because people with names like Greenspan, Rubin, and Summers are not very competent at running an economy (another example of the skills shortage). This means that it is not practical to talk about cuts to Social Security for anyone retiring in the near future since this is the bulk of what most retirees will be living on. In fact, those who did their homework know that many people in Congress and across the country are now talking about increasing benefits. We can cut our children and grandchildren’s Social Security, but this is a dubious way to propose to help them.

Then we have Thomas Friedman’s energy agenda:

“We should exploit our new natural gas bounty, but only by pairing it with the highest environmental extraction rules and a national, steadily rising, renewable energy portfolio standard that would ensure that natural gas replaces coal — not solar, wind or other renewables. That way shale gas becomes a bridge to a cleaner energy future, not just an addiction to a less dirty, climate-destabilizing fossil fuel.”

Friedman apparently has not done his homework here either. Andrew Revkin, who certainly is not a knee-jerk enviro-type, devoted a blogpost to a new study indicating that fracking results in much higher emissions of methane gas than had previously been believed. While this study is not conclusive, its findings certainly deserve to be taken seriously. Unless they can be shown to be mistaken, it is wrong to imagine shale gas to be the bridge fuel Friedman claims.

Then we are told:

“In some cities, teachers’ unions really are holding up education reform.”

Really, the problem is teachers’ unions? Well, large chunks of the country don’t have any teachers’ unions to block reform. Yet, we don’t hear of Texas and Alabama beating out Finland (which does have teachers’ unions) for top rankings on standardized tests or other measures of student performance. Teachers’ unions have often come into conflict with self-proclaimed reformers. While the unions may have obstructed their agenda (which often seems largely focused on weakening teachers’ unions), it is far from clear that this has had negative outcomes for students. In the Chicago teachers’ strike in 2012, the most noteworthy recent confrontation, the parents overwhelmingly sided with the teachers, so apparently they haven’t been clued in on the benefits of reform.

Next we get Thomas Friedman’s theory of wage inequality:

“Finally, the merger of globalization and the information-technology revolution has shrunk the basis of the old middle class — the high-wage, middle-skilled job. Increasingly, there are only high-wage, high-skilled jobs.”

That’s a nice try, but the data don’t fit Thoams Friedman’s little hyper-connected technology driven story. My friends Larry Mishel, John Schmitt, and Heidi Shierholz looked at this issue very carefully. In the last decade the jobs that have been growing most rapidly are actually low-skilled occupations. If we want to look for reasons for wage inequality we might try items like declining unionization rates and high unemployment.

So Friedman is surely right that we should not view compromise as a 4-letter word, but that doesn’t mean we should agree on a policy agenda that is not grounded in evidence.

Read More Leer más Join the discussion Participa en la discusión

I can’t find a doctor to work for me for $30 an hour. According to the NYT this would mean that the United States has a doctor shortage. That appears to be the logic of a major article asserting that Europe’s economy is suffering from a shortage of skilled workers even as its unemployment rate is near 12 percent.

The piece never once mentions the trends in wages for workers with the skills that are allegedly in short supply. As a practical matter, there has been a shift from wages to profits over the last three decades which accelerated with the downturn. In the United States, which also supposedly suffers from a skills shortage, even workers with degrees in science, math, and engineering, are not seeing their wages keep pace with economy-wide productivity growth.

It is understandable that employers will always want lower cost labor just as most of us would be happy to save money by having qualified doctors work for us at $30 an hour. However the desire of companies to increase profits further doesn’t mean there is a shortage of skilled workers anymore than the lack of doctors willing to work for $30 an hour implies a shortage of doctors.

I can’t find a doctor to work for me for $30 an hour. According to the NYT this would mean that the United States has a doctor shortage. That appears to be the logic of a major article asserting that Europe’s economy is suffering from a shortage of skilled workers even as its unemployment rate is near 12 percent.

The piece never once mentions the trends in wages for workers with the skills that are allegedly in short supply. As a practical matter, there has been a shift from wages to profits over the last three decades which accelerated with the downturn. In the United States, which also supposedly suffers from a skills shortage, even workers with degrees in science, math, and engineering, are not seeing their wages keep pace with economy-wide productivity growth.

It is understandable that employers will always want lower cost labor just as most of us would be happy to save money by having qualified doctors work for us at $30 an hour. However the desire of companies to increase profits further doesn’t mean there is a shortage of skilled workers anymore than the lack of doctors willing to work for $30 an hour implies a shortage of doctors.

Read More Leer más Join the discussion Participa en la discusión

Uwe Reinhardt has a useful blogpost taking issue with a Wall Street Journal editorial on the Affordable Care Act (ACA). The editorial had complained that the ACA steals $156 billion from the Medicare Advantage program, the portion of Medicare run by private insurers.

Reinhardt points out that this $156 billion in reduced payments is over a ten year period, a point missing from the editorial. That’s around 2.0 percent of projected Medicare spending over this period. The other key point in Reinhardt’s piece is that this reduction in payments for Medicare Advantage simply involves leveling the playing field so that the federal government will pay the same amount for each beneficiary in the Medicare Advantage program as in the traditional fee for service program.

Towards the end of the piece Reinhardt notes that, given the WSJ’s ideology, it is understandable that it would object to this leveling of the playing field. While this is true, this is not where a market oriented ideology would take them. If the WSJ editors were confident in the superiority of private sector insurers, they would not feel that they needed a subsidy compared with the traditional government program. The WSJ position only makes sense if the view of the editors is that it is the responsibility of government to redistribute money to the private insurers and implicitly their shareholders and top executives.

Uwe Reinhardt has a useful blogpost taking issue with a Wall Street Journal editorial on the Affordable Care Act (ACA). The editorial had complained that the ACA steals $156 billion from the Medicare Advantage program, the portion of Medicare run by private insurers.

Reinhardt points out that this $156 billion in reduced payments is over a ten year period, a point missing from the editorial. That’s around 2.0 percent of projected Medicare spending over this period. The other key point in Reinhardt’s piece is that this reduction in payments for Medicare Advantage simply involves leveling the playing field so that the federal government will pay the same amount for each beneficiary in the Medicare Advantage program as in the traditional fee for service program.

Towards the end of the piece Reinhardt notes that, given the WSJ’s ideology, it is understandable that it would object to this leveling of the playing field. While this is true, this is not where a market oriented ideology would take them. If the WSJ editors were confident in the superiority of private sector insurers, they would not feel that they needed a subsidy compared with the traditional government program. The WSJ position only makes sense if the view of the editors is that it is the responsibility of government to redistribute money to the private insurers and implicitly their shareholders and top executives.

Read More Leer más Join the discussion Participa en la discusión

Simon Johnson has a good post on how a bloated financial sector is often a curse to rich countries like the United States. The piece can use a small correction.

It gives South Korea as an example of a middle income country in which manufacturing still is a dominant force. South Korea really should be viewed as an advanced country. It’s per capita income is higher than Italy’s and only about 10 percent lower than the United Kingdom’s.

Simon Johnson has a good post on how a bloated financial sector is often a curse to rich countries like the United States. The piece can use a small correction.

It gives South Korea as an example of a middle income country in which manufacturing still is a dominant force. South Korea really should be viewed as an advanced country. It’s per capita income is higher than Italy’s and only about 10 percent lower than the United Kingdom’s.

Read More Leer más Join the discussion Participa en la discusión

Sarah Kliff has a useful discussion of the changes in the insurance market brought about by Obamacare. It points out that Obamacare will end discrimination based on pre-existing conditions. While there will still be substantial differences in cost based on age, people will pay the same premiums regardless of their health.

However the piece is a bit misleading in its exclusive focus on the individual insurance market. The vast majority of the working age population gets insurance through their employer. With employer based insurance workers effectively pay the same for their insurance regardless of their health. (The premium paid by the employer is ultimately paid by the worker, since it comes out of wages. Employers don’t just give away insurance.)

This is important in the context of the debate around Obamacare since there has been considerable attention given the fact that the young to some extent subsidize the old, since the premium structure does not fully reflect the differences in average costs by age. Insofar as this cross-subsidy exists, Obamacare is just replicating a situation that has long been present in the much larger employer provided insurance system.

It is also worth noting that the subsidy from the healthy of all ages to the less healthy dwarfs the age-based subsidy. This is of course the purpose of the program: to make insurance affordable to the people who need it.

Sarah Kliff has a useful discussion of the changes in the insurance market brought about by Obamacare. It points out that Obamacare will end discrimination based on pre-existing conditions. While there will still be substantial differences in cost based on age, people will pay the same premiums regardless of their health.

However the piece is a bit misleading in its exclusive focus on the individual insurance market. The vast majority of the working age population gets insurance through their employer. With employer based insurance workers effectively pay the same for their insurance regardless of their health. (The premium paid by the employer is ultimately paid by the worker, since it comes out of wages. Employers don’t just give away insurance.)

This is important in the context of the debate around Obamacare since there has been considerable attention given the fact that the young to some extent subsidize the old, since the premium structure does not fully reflect the differences in average costs by age. Insofar as this cross-subsidy exists, Obamacare is just replicating a situation that has long been present in the much larger employer provided insurance system.

It is also worth noting that the subsidy from the healthy of all ages to the less healthy dwarfs the age-based subsidy. This is of course the purpose of the program: to make insurance affordable to the people who need it.

Read More Leer más Join the discussion Participa en la discusión

That is not exactly what he said, but that is what his comments in a Washington Post interview mean. Dimon said that the United States is suffering from a skills gap where firms can’t find workers with the skills they need. Dimon claimed that this skills shortage could be raising the unemployment rate by 1-2 percentage points.

In a market economy when there is a shortage of particular item, in this case skilled workers, the price is supposed to rise. There is no substantial sector of labor market seeing wages that are even keeping pace with overall productivity growth, much less rising due to shortages.

If firms really have slots going open because they can’t find workers with the skills they need then the problem is that we have employers who don’t understand how markets work. If they raised wages firms could attract skilled workers away from their competitors and more workers would try to acquire the necessary skills for their open positions. Perhaps if CEOs were required to take introductory economics courses we could solve this problem.

As a practical matter, we see no evidence to support Dimon’s assertion. There are no major occupational groupings with high ratios of vacancies to unemployed workers, nor do we see increases in the length of workweeks, which is another way that employers would deal with a shortage of skilled workers.

That is not exactly what he said, but that is what his comments in a Washington Post interview mean. Dimon said that the United States is suffering from a skills gap where firms can’t find workers with the skills they need. Dimon claimed that this skills shortage could be raising the unemployment rate by 1-2 percentage points.

In a market economy when there is a shortage of particular item, in this case skilled workers, the price is supposed to rise. There is no substantial sector of labor market seeing wages that are even keeping pace with overall productivity growth, much less rising due to shortages.

If firms really have slots going open because they can’t find workers with the skills they need then the problem is that we have employers who don’t understand how markets work. If they raised wages firms could attract skilled workers away from their competitors and more workers would try to acquire the necessary skills for their open positions. Perhaps if CEOs were required to take introductory economics courses we could solve this problem.

As a practical matter, we see no evidence to support Dimon’s assertion. There are no major occupational groupings with high ratios of vacancies to unemployed workers, nor do we see increases in the length of workweeks, which is another way that employers would deal with a shortage of skilled workers.

Read More Leer más Join the discussion Participa en la discusión

That’s what readers of a Reuters article on complaints from a German business group must be asking themselves. At one point the article told readers:

“Major unions negotiated inflation-busting hikes in pay checks last year after years of wage restraint, although the Statistics Office said last month real wages across Germany were likely to have fallen in 2013.”

It’s not clear what the definition of “inflation-busting” is in this context, but it doesn’t sound like it involved large pay increases if wages did not even keep pace with inflation. Usually, they would be expected to rise somewhat in excess of inflation to reflect productivity growth in Germany’s economy.

That’s what readers of a Reuters article on complaints from a German business group must be asking themselves. At one point the article told readers:

“Major unions negotiated inflation-busting hikes in pay checks last year after years of wage restraint, although the Statistics Office said last month real wages across Germany were likely to have fallen in 2013.”

It’s not clear what the definition of “inflation-busting” is in this context, but it doesn’t sound like it involved large pay increases if wages did not even keep pace with inflation. Usually, they would be expected to rise somewhat in excess of inflation to reflect productivity growth in Germany’s economy.

Read More Leer más Join the discussion Participa en la discusión

The media were filled with euphoric accounts about the run-up in the stock market in 2013. This was certainly good news for the people who own lots of stock, less so for everyone else. (The generational warriors who yap about government debt hurting our kids would also be yelling about the stock market run-up transferring resources from young to old, if they were honest.)

Anyhow, it would be reasonable if this reporting included some discussion of the implications of higher stock prices for future returns. With the ratio of stock prices to trend corporate earnings now in the neighborhood of 20 to 1, the expected return for the future is around 5 percent annually in real terms. By contrast, the historic average for stocks in the United States is over 7 percent.

Unless future growth vastly exceeds anyone’s predictions, given its current value it is not possible for the market to sustain 7 percent real returns for any substantial period of time. This means that investors in stock must be willing to accept lower than historic rates of return.

The media were filled with euphoric accounts about the run-up in the stock market in 2013. This was certainly good news for the people who own lots of stock, less so for everyone else. (The generational warriors who yap about government debt hurting our kids would also be yelling about the stock market run-up transferring resources from young to old, if they were honest.)

Anyhow, it would be reasonable if this reporting included some discussion of the implications of higher stock prices for future returns. With the ratio of stock prices to trend corporate earnings now in the neighborhood of 20 to 1, the expected return for the future is around 5 percent annually in real terms. By contrast, the historic average for stocks in the United States is over 7 percent.

Unless future growth vastly exceeds anyone’s predictions, given its current value it is not possible for the market to sustain 7 percent real returns for any substantial period of time. This means that investors in stock must be willing to accept lower than historic rates of return.

Read More Leer más Join the discussion Participa en la discusión

That’s what readers of a NYT article on Latvia entering the euro would assume. The piece presented it as good news that the euro had risen against the dollar over the last year. This increase will make the goods and services produced by euro zone countries less competitive in the world economy, reducing their exports and increasing their imports. With nearly all of the euro zone countries operating at levels of output well below potential GDP, it is difficult to see why they would view this loss of demand as a positive development.

The article also quoted a statement by Olli Rehn, vice president of the European Commission responsible for economic and monetary affairs, in which he referred to Latvia’s strong recovery. It would have been useful to note that even with the recent growth it has experienced Lativia’s economy is still almost 10 percent smaller than its pre-recession peak in 2007.

That’s what readers of a NYT article on Latvia entering the euro would assume. The piece presented it as good news that the euro had risen against the dollar over the last year. This increase will make the goods and services produced by euro zone countries less competitive in the world economy, reducing their exports and increasing their imports. With nearly all of the euro zone countries operating at levels of output well below potential GDP, it is difficult to see why they would view this loss of demand as a positive development.

The article also quoted a statement by Olli Rehn, vice president of the European Commission responsible for economic and monetary affairs, in which he referred to Latvia’s strong recovery. It would have been useful to note that even with the recent growth it has experienced Lativia’s economy is still almost 10 percent smaller than its pre-recession peak in 2007.

Read More Leer más Join the discussion Participa en la discusión