By Dean Baker and Evan Butcher

We all know how hard it is to get by in today’s competitive economy. That’s why billionaires need special help. The Wall Street folks got their multi-trillion bailout in the form of below market interest rate loans when their greed and incompetence would otherwise have put them into bankruptcy. The drug companies get longer and stronger patent monopolies both here, and with trade deals like the Trans-Pacific Partnership, around the world. And, Jeff Bezos and Amazon get tens of billions of dollars in handouts in the form of an exemption from collecting the same sales tax as his mom and pop competitors.

The basic story here is simple. States require that stores collect sales tax on the items they sell. This applies to every mom and pop book store or clothing store, as well as huge retailers like Walmart and Costco. Amazon, along with other Internet only retailers, has been able to escape this requirement in most states through most of its existence.

While Amazon was acting legally, this loophole in the law makes zero sense from an economic perspective, and even less from a moral perspective. From an economic perspective, it makes no sense for the government to effectively subsidize on-line businesses that operate out of state at the expense of businesses that operate and employ people in the state.

And, make no mistake; the exemption from the requirement to collect sales tax is a subsidy. The tax is directed at the customer, the retailer is performing a service for the government. Effectively, the exemption is allowing the retailer to profit by charging a price that is equal to the price a competitor charges plus the tax. For example, if a television sells for $400 in a state with a 5 percent sales tax, the Internet competitors can sell the same television for $420 and be charging no more than its brick and mortar competitors. They then put the extra $20 in their pockets.

This is the story of duty-free shops at airports. Generally the price on tobacco and liquor at these stores is comparable to prices in other stores. The difference is that the money the other stores pay to the government in taxes instead goes into the pockets of the owners of the duty-free stores.

This is the same story with Internet retailers. Amazon has effectively been subsidized by the amount of the sales tax that it would have been required to collect had it been subject to the same rules as its brick and mortar competitors. Instead of putting the extra profits into its pockets, it appears that Amazon has largely followed the strategy of passing on the savings to win market share at the expense of its competitors. This has proven to be an effective strategy, as its sales volume has made it the world’s most valuable retailer by market capitalization.

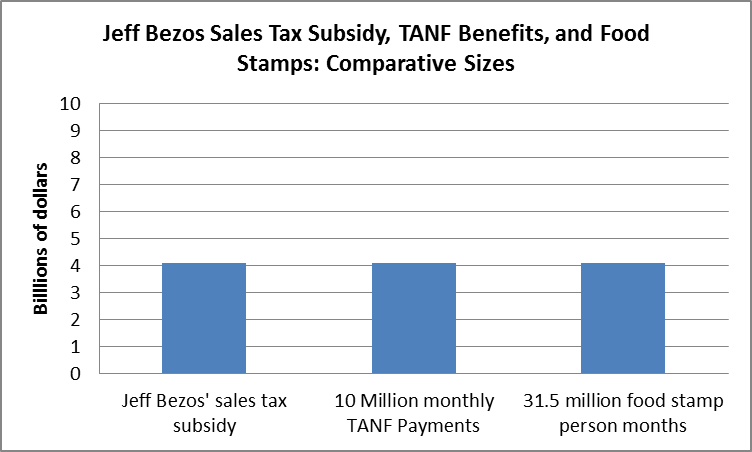

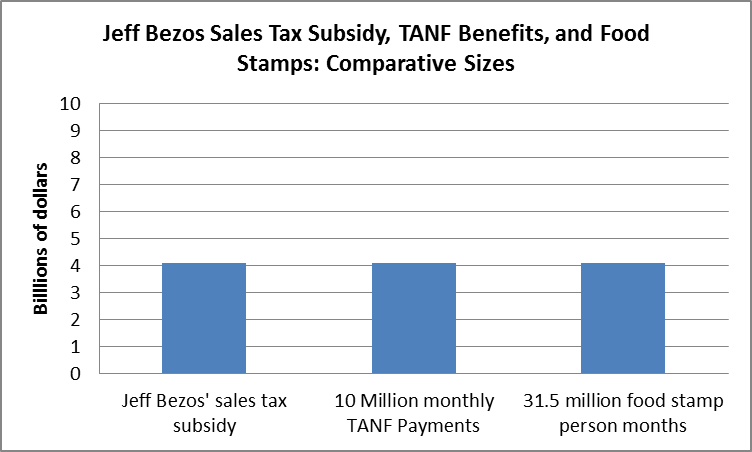

It is worth knowing how much taxpayers have given through the tax subsidy route to Jeff Bezos, now one of the world richest people. We calculated the amount that Amazon saved on sales tax through its existence. While many states no longer exempt Internet retailers from collecting taxes, 20 states still do. We added up the amount of tax that Amazon would have been required to collect in each state had it been subject to the same rules as it competitors for each year that it was able to avoid this requirement.[1] The total amount through 2014 comes to $20.4 billion. Bezos has gradually reduced his stake in the company over this period, but he still own close to 20 percent. If we apportion the subsidy accordingly, taxpayers have effectively handed $4.1 billion to Jeff Bezos over the last two decades.

In order to put this in perspective, the average monthly TANF payment to a family with one child is roughly $400. This means that taxpayers have given Jeff Bezos the equivalent of 10 million monthly TANF checks. The average food stamp payment is $127 per person per month. Jeff Bezo’s $4.1 billion in tax subsidies would amount to 31.5 million person months of food stamps.

Source: authors’ calculations, see text.

So, as we prepare to celebrate this holiday season, we should keep in mind one person, Jeff Bezos, to whom the rest of us have been very generous.

[1] For simplicity, the calculation assumes that Amazon’s sales in each state were proportional to the state’s share in 2014 GDP. It applies a 5 percent real discount rate to past savings.

By Dean Baker and Evan Butcher

We all know how hard it is to get by in today’s competitive economy. That’s why billionaires need special help. The Wall Street folks got their multi-trillion bailout in the form of below market interest rate loans when their greed and incompetence would otherwise have put them into bankruptcy. The drug companies get longer and stronger patent monopolies both here, and with trade deals like the Trans-Pacific Partnership, around the world. And, Jeff Bezos and Amazon get tens of billions of dollars in handouts in the form of an exemption from collecting the same sales tax as his mom and pop competitors.

The basic story here is simple. States require that stores collect sales tax on the items they sell. This applies to every mom and pop book store or clothing store, as well as huge retailers like Walmart and Costco. Amazon, along with other Internet only retailers, has been able to escape this requirement in most states through most of its existence.

While Amazon was acting legally, this loophole in the law makes zero sense from an economic perspective, and even less from a moral perspective. From an economic perspective, it makes no sense for the government to effectively subsidize on-line businesses that operate out of state at the expense of businesses that operate and employ people in the state.

And, make no mistake; the exemption from the requirement to collect sales tax is a subsidy. The tax is directed at the customer, the retailer is performing a service for the government. Effectively, the exemption is allowing the retailer to profit by charging a price that is equal to the price a competitor charges plus the tax. For example, if a television sells for $400 in a state with a 5 percent sales tax, the Internet competitors can sell the same television for $420 and be charging no more than its brick and mortar competitors. They then put the extra $20 in their pockets.

This is the story of duty-free shops at airports. Generally the price on tobacco and liquor at these stores is comparable to prices in other stores. The difference is that the money the other stores pay to the government in taxes instead goes into the pockets of the owners of the duty-free stores.

This is the same story with Internet retailers. Amazon has effectively been subsidized by the amount of the sales tax that it would have been required to collect had it been subject to the same rules as its brick and mortar competitors. Instead of putting the extra profits into its pockets, it appears that Amazon has largely followed the strategy of passing on the savings to win market share at the expense of its competitors. This has proven to be an effective strategy, as its sales volume has made it the world’s most valuable retailer by market capitalization.

It is worth knowing how much taxpayers have given through the tax subsidy route to Jeff Bezos, now one of the world richest people. We calculated the amount that Amazon saved on sales tax through its existence. While many states no longer exempt Internet retailers from collecting taxes, 20 states still do. We added up the amount of tax that Amazon would have been required to collect in each state had it been subject to the same rules as it competitors for each year that it was able to avoid this requirement.[1] The total amount through 2014 comes to $20.4 billion. Bezos has gradually reduced his stake in the company over this period, but he still own close to 20 percent. If we apportion the subsidy accordingly, taxpayers have effectively handed $4.1 billion to Jeff Bezos over the last two decades.

In order to put this in perspective, the average monthly TANF payment to a family with one child is roughly $400. This means that taxpayers have given Jeff Bezos the equivalent of 10 million monthly TANF checks. The average food stamp payment is $127 per person per month. Jeff Bezo’s $4.1 billion in tax subsidies would amount to 31.5 million person months of food stamps.

Source: authors’ calculations, see text.

So, as we prepare to celebrate this holiday season, we should keep in mind one person, Jeff Bezos, to whom the rest of us have been very generous.

[1] For simplicity, the calculation assumes that Amazon’s sales in each state were proportional to the state’s share in 2014 GDP. It applies a 5 percent real discount rate to past savings.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Adam Davidson has an interesting piece in the NYT Magazine on the effectiveness, or lack thereof, of U.S. foreign aid. He discusses various models of aid, noting that none of them has been a clear success.

In commenting on the issue, the article says in passing that the United States spends $30 billlion a year to help the world’s poor. This figure could be misleading. Most readers are probably unaware of the size of the overall budget, therefore they may think that $30 billion involves a major committment of federal dollars. In fact, since we are spending $3.5 trillion a year in total, this sum comes to less than 0.9 percent of the total federal budget.

In discussing foreign aid, it is probably also worth mentioning the risk of corruption in the aid granting agencies. Foreign aid is a substantial source of money. For this reason it attracts not only people interesting in helping the world’s poor, it also attracts contractors looking to line their pockets. As a result, much of the spending may not end up being very helpful for its intended targets. This has likely been an especially serious problem in Haiti, which is the focus of the piece.

Note: Typos corrected, thank Joe E. and Robert Salzberg.

Adam Davidson has an interesting piece in the NYT Magazine on the effectiveness, or lack thereof, of U.S. foreign aid. He discusses various models of aid, noting that none of them has been a clear success.

In commenting on the issue, the article says in passing that the United States spends $30 billlion a year to help the world’s poor. This figure could be misleading. Most readers are probably unaware of the size of the overall budget, therefore they may think that $30 billion involves a major committment of federal dollars. In fact, since we are spending $3.5 trillion a year in total, this sum comes to less than 0.9 percent of the total federal budget.

In discussing foreign aid, it is probably also worth mentioning the risk of corruption in the aid granting agencies. Foreign aid is a substantial source of money. For this reason it attracts not only people interesting in helping the world’s poor, it also attracts contractors looking to line their pockets. As a result, much of the spending may not end up being very helpful for its intended targets. This has likely been an especially serious problem in Haiti, which is the focus of the piece.

Note: Typos corrected, thank Joe E. and Robert Salzberg.

Read More Leer más Join the discussion Participa en la discusión

In today’s Washington Post, columnist Ruth Marcus contrasted the policies that Bernie Sanders advocates, which she characterizes as being about redistribution, with the policies advocated by the Wall Street funded policy group Third Way, which she describes as being about “expanding opportunity for participation.” While it is true that Third Way would like its policies to be described as being about expanding opportunity, it does not follow that this is true.

Third Way has promoted the macroeconomic, trade, and regulatory policies that gave us the Great Recession. While some of us were warning about the dangers of the housing bubble, Third Way was taking up space in the Washington Post and elsewhere warning about the dangers of retiring baby boomers. When the bubble burst, it left millions unemployed and tens of millions losing much or all of the equity in their homes. Low- and moderate-income families were especially hard hit. This did not expand opportunities for participation.

More generally Third Way has supported trade policies that have been designed to redistribute income upward and cost the country millions of good-paying middle income jobs. They also have refused to support measures that would address the ongoing trade deficit by adopting serious policies on currency management. It is understandable that Third Way would justify policies designed to redistribute income upward by saying they care about opportunity (“more money for Wall Street” is not a good political slogan), but that hardly makes the claim true.

On the other hand, policies advocated by Sanders, like a financial transactions tax and universal Medicare system, could provide a solid boost to growth by eliminating hundreds of billions of dollars of waste in the financial and health care sectors. These resources could be freed up to support productive investment, leading to an enormous boost to growth.

In today’s Washington Post, columnist Ruth Marcus contrasted the policies that Bernie Sanders advocates, which she characterizes as being about redistribution, with the policies advocated by the Wall Street funded policy group Third Way, which she describes as being about “expanding opportunity for participation.” While it is true that Third Way would like its policies to be described as being about expanding opportunity, it does not follow that this is true.

Third Way has promoted the macroeconomic, trade, and regulatory policies that gave us the Great Recession. While some of us were warning about the dangers of the housing bubble, Third Way was taking up space in the Washington Post and elsewhere warning about the dangers of retiring baby boomers. When the bubble burst, it left millions unemployed and tens of millions losing much or all of the equity in their homes. Low- and moderate-income families were especially hard hit. This did not expand opportunities for participation.

More generally Third Way has supported trade policies that have been designed to redistribute income upward and cost the country millions of good-paying middle income jobs. They also have refused to support measures that would address the ongoing trade deficit by adopting serious policies on currency management. It is understandable that Third Way would justify policies designed to redistribute income upward by saying they care about opportunity (“more money for Wall Street” is not a good political slogan), but that hardly makes the claim true.

On the other hand, policies advocated by Sanders, like a financial transactions tax and universal Medicare system, could provide a solid boost to growth by eliminating hundreds of billions of dollars of waste in the financial and health care sectors. These resources could be freed up to support productive investment, leading to an enormous boost to growth.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The Planet Money team had a nice segment pointing on the Trans-Pacific Partnership (TPP). The piece pointed out that the TPP has no enforceable language on currency management.

While the deal is ostensibly about eliminating tariffs and other trade barriers, controlling currency values can be an effective way to impose barriers to trade. If a country intervenes in currency markets to lower the value of its currency by 10 percent it has an impact that is comparable to imposing a 10 percent tariff on all imports and giving out a 10 percent subsidy on all exports. There is nothing in the TPP that will prevent the parties in the agreement from protecting their industry through this mechanism.

The Planet Money team had a nice segment pointing on the Trans-Pacific Partnership (TPP). The piece pointed out that the TPP has no enforceable language on currency management.

While the deal is ostensibly about eliminating tariffs and other trade barriers, controlling currency values can be an effective way to impose barriers to trade. If a country intervenes in currency markets to lower the value of its currency by 10 percent it has an impact that is comparable to imposing a 10 percent tariff on all imports and giving out a 10 percent subsidy on all exports. There is nothing in the TPP that will prevent the parties in the agreement from protecting their industry through this mechanism.

Read More Leer más Join the discussion Participa en la discusión

The NYT devoted an article to a report put out by the British Bankers’ Association that claimed that new regulations were making the British industry less competitive internationally. This is presented as being a serious problem that should concern people.

In fact, people who believe in free trade should not care any more about the possibility that the U.K. will lose jobs in finance to foreign competition than if it loses jobs in textile manufacturing to foreign competition. The standard free trade argument — that all right-minded people are supposed to accept — is that the economy operates at full employment. This means that if bankers lose their jobs to international competition they will simply shift over to the sectors in which the U.K. has a comparative advantage. Only a knuckle-dragging Neanderthal protectionist would worry about losing jobs in textile manufacturing or banking to international competition.

It also would have been helpful if the NYT included the views of a critic of the banking industry in this article.

The NYT devoted an article to a report put out by the British Bankers’ Association that claimed that new regulations were making the British industry less competitive internationally. This is presented as being a serious problem that should concern people.

In fact, people who believe in free trade should not care any more about the possibility that the U.K. will lose jobs in finance to foreign competition than if it loses jobs in textile manufacturing to foreign competition. The standard free trade argument — that all right-minded people are supposed to accept — is that the economy operates at full employment. This means that if bankers lose their jobs to international competition they will simply shift over to the sectors in which the U.K. has a comparative advantage. Only a knuckle-dragging Neanderthal protectionist would worry about losing jobs in textile manufacturing or banking to international competition.

It also would have been helpful if the NYT included the views of a critic of the banking industry in this article.

Read More Leer más Join the discussion Participa en la discusión