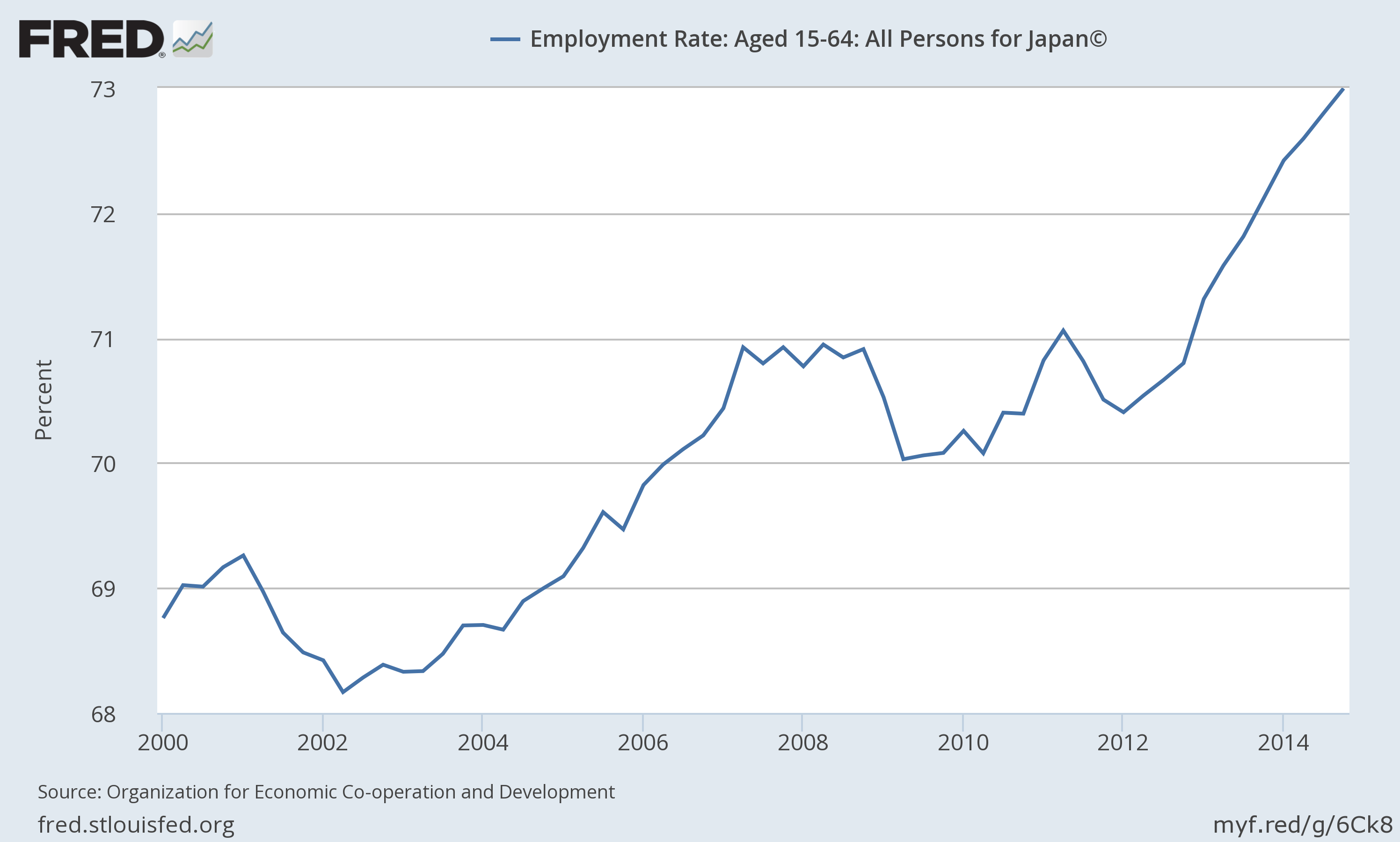

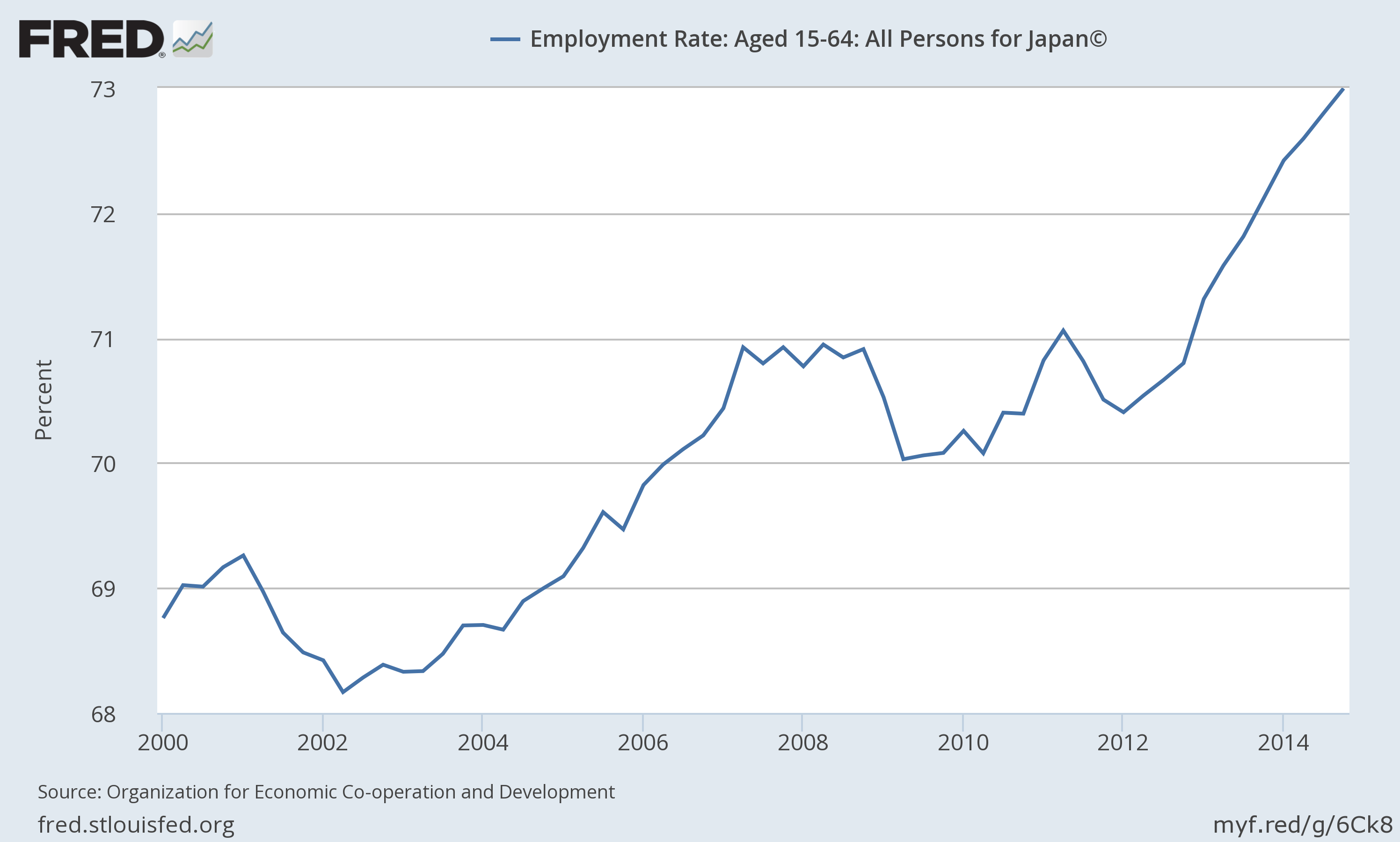

This short piece on Japan’s GDP growth reminded me that I wanted to post a graph showing the rise in Japan’s employment rate under Abe. Here’s the basic picture showing the employment-to-population ratio (EPOP) for people between the ages of 16 and 64 since 2000.

As can seen, Japan’s EPOP fell following the 2001 recession. It had made up lost ground by 2005 and continued to rise until 2007. It stagnated for roughly two years and then rose somewhat before starting to drop again in 2011. It was falling when Abe took over in December of 2012.

Since then the EPOP has risen by 2.5 percentage points. This is a huge gain that would be equivalent to another 6.2 million jobs in the United States. Japan’s growth has certainly not be inspiring under Abe, but this increase in employment is quite impressive. By this measure, Abenomics has been very successful.

This short piece on Japan’s GDP growth reminded me that I wanted to post a graph showing the rise in Japan’s employment rate under Abe. Here’s the basic picture showing the employment-to-population ratio (EPOP) for people between the ages of 16 and 64 since 2000.

As can seen, Japan’s EPOP fell following the 2001 recession. It had made up lost ground by 2005 and continued to rise until 2007. It stagnated for roughly two years and then rose somewhat before starting to drop again in 2011. It was falling when Abe took over in December of 2012.

Since then the EPOP has risen by 2.5 percentage points. This is a huge gain that would be equivalent to another 6.2 million jobs in the United States. Japan’s growth has certainly not be inspiring under Abe, but this increase in employment is quite impressive. By this measure, Abenomics has been very successful.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The NYT had an interesting piece charting the career paths of Bill and Hillary Clinton, and the extent to which they may have had financial concerns earlier in their lives. Unfortunately, the piece does not adjust for inflation, so it may have misled readers about how well off the Clinton’s actually were.

For example, the piece tells readers that after Bill Clinton lost his re-election bid in 1980:

“The Clintons had stretched their finances to afford the $112,000 home, which was down the hill from the city’s old-money mansions.”

That home would cost a bit more than $280,000 in today’s dollars.

A bit further down the piece tells readers that Hillary took a job at a law firm for $55,000 a year. That would be roughly $158,000 a year in today’s dollars. It also refers to them earning $18,000 a year each as law professors in Fayetteville in 1975. That would be a bit more than $135,000 in today’s dollars for their combined income.

The $100,000 that Hillary Clinton reportedly made speculating in cattle futures in 1978 would be more than $330,000 in today’s dollars.

The $33,500 that Bill Clinton earned Arkansas’s governor in 1978 would be just under $112,000 in today’s dollars and their combined income of $51,200 for that year would be just over $170,000. The $297,000 they reported as combined income 1992 would be equal to more than $490,000 in today’s dollars.

It is also worth noting that Arkansas is one of the poorest states in the country and has a much lower cost of living than wealthier areas like the Northeast or California.

Thanks to Keane Bhatt for calling this to my attention.

Note: The professor salary adjustment was corrected to clearly indicate it refers to their combined income.

The NYT had an interesting piece charting the career paths of Bill and Hillary Clinton, and the extent to which they may have had financial concerns earlier in their lives. Unfortunately, the piece does not adjust for inflation, so it may have misled readers about how well off the Clinton’s actually were.

For example, the piece tells readers that after Bill Clinton lost his re-election bid in 1980:

“The Clintons had stretched their finances to afford the $112,000 home, which was down the hill from the city’s old-money mansions.”

That home would cost a bit more than $280,000 in today’s dollars.

A bit further down the piece tells readers that Hillary took a job at a law firm for $55,000 a year. That would be roughly $158,000 a year in today’s dollars. It also refers to them earning $18,000 a year each as law professors in Fayetteville in 1975. That would be a bit more than $135,000 in today’s dollars for their combined income.

The $100,000 that Hillary Clinton reportedly made speculating in cattle futures in 1978 would be more than $330,000 in today’s dollars.

The $33,500 that Bill Clinton earned Arkansas’s governor in 1978 would be just under $112,000 in today’s dollars and their combined income of $51,200 for that year would be just over $170,000. The $297,000 they reported as combined income 1992 would be equal to more than $490,000 in today’s dollars.

It is also worth noting that Arkansas is one of the poorest states in the country and has a much lower cost of living than wealthier areas like the Northeast or California.

Thanks to Keane Bhatt for calling this to my attention.

Note: The professor salary adjustment was corrected to clearly indicate it refers to their combined income.

Read More Leer más Join the discussion Participa en la discusión

The NYT had an interesting piece on the pharmaceutical market in India, which just began recognizing patent monopolies on drugs a decade ago. Corruption and abusive sales practices of the sort described in the piece are exactly what economic theory predicts when tariffs of several hundred or several thousand percent are imposed in a market. While “free traders” like to ignore the harm from patent monopolies that raise the price of the protected items by these amounts, the market does not care whether the cause of an artifically high price is called a “patent” or a “tariff,” it has the same effect.

The NYT had an interesting piece on the pharmaceutical market in India, which just began recognizing patent monopolies on drugs a decade ago. Corruption and abusive sales practices of the sort described in the piece are exactly what economic theory predicts when tariffs of several hundred or several thousand percent are imposed in a market. While “free traders” like to ignore the harm from patent monopolies that raise the price of the protected items by these amounts, the market does not care whether the cause of an artifically high price is called a “patent” or a “tariff,” it has the same effect.

Read More Leer más Join the discussion Participa en la discusión

The NYT weakly posed this question in an article reporting on the proliferation of scripted TV shows coming largely from newcomers like Netflix. The concerns expressed about too much TV were more than a bit bizarre. For example, it told readers:

“sharing Mr. Landgraf’s [CEO at FX Networks] concern, some TV executives have said that they also felt audiences were becoming fatigued and having a difficult time finding the best shows out of the glut.”

Really? People are getting tired from going through the listings of all the shows? Do they get tired from going through listings of books? I suppose it’s possible, but it seems more likely that people would watch shows that they happen to hear good things about and ignore the rest.

There is a plausible story to tell about the proliferation of shows. With many more shows commanding an audience, there will be fewer shows that will command the sort of audience that would justify big budget productions. That means fewer writers, actors, directors will be able to command big paychecks.

This is certainly bad news for the tiny group in the big paycheck crowd, but it is great news for all writers, actors, directors that will be able to make a decent living in the smaller audience productions. And, since this will have been the result of people opting to watch the smaller audience productions, it’s hard to see why we should be troubled by the situation (unless we work for the big paycheck crowd).

The NYT weakly posed this question in an article reporting on the proliferation of scripted TV shows coming largely from newcomers like Netflix. The concerns expressed about too much TV were more than a bit bizarre. For example, it told readers:

“sharing Mr. Landgraf’s [CEO at FX Networks] concern, some TV executives have said that they also felt audiences were becoming fatigued and having a difficult time finding the best shows out of the glut.”

Really? People are getting tired from going through the listings of all the shows? Do they get tired from going through listings of books? I suppose it’s possible, but it seems more likely that people would watch shows that they happen to hear good things about and ignore the rest.

There is a plausible story to tell about the proliferation of shows. With many more shows commanding an audience, there will be fewer shows that will command the sort of audience that would justify big budget productions. That means fewer writers, actors, directors will be able to command big paychecks.

This is certainly bad news for the tiny group in the big paycheck crowd, but it is great news for all writers, actors, directors that will be able to make a decent living in the smaller audience productions. And, since this will have been the result of people opting to watch the smaller audience productions, it’s hard to see why we should be troubled by the situation (unless we work for the big paycheck crowd).

Read More Leer más Join the discussion Participa en la discusión

The NYT ran a Reuters piece on the future of drug pricing. Guess what? No one is talking about good old-fashioned free market prices. The word from Reuters is that in the future drug companies will be paid based on the benefits provided by their drugs, not a per pill charge. As described in the piece, drug companies would be compensated by insurers for the use of their drugs based on the average improvement in health per patient treated.

As the piece hints, this will be an incredible burden to calculate, especially for drugs that are used on limited numbers of patients who may also suffer from multiple conditions. The situation gets even more complicated when we take into account the possibility that a drug could have serious side-effects that won’t be discovered until many years after it is in use. I suppose in that situation we go back and collect the payments that were made to the company earlier from the shareholders and their children.

For some reason, the idea of just funding the research upfront and putting in the public domain seems to be out of bounds. Reuters, and implicitly the NYT, would apparently prefer all sorts of bizarre bureaucratic fixes rather than something that would almost certainly be far simpler and cheaper and not leave sick people struggling to find ways to pay for drugs that are necessary for their life or health.

The NYT ran a Reuters piece on the future of drug pricing. Guess what? No one is talking about good old-fashioned free market prices. The word from Reuters is that in the future drug companies will be paid based on the benefits provided by their drugs, not a per pill charge. As described in the piece, drug companies would be compensated by insurers for the use of their drugs based on the average improvement in health per patient treated.

As the piece hints, this will be an incredible burden to calculate, especially for drugs that are used on limited numbers of patients who may also suffer from multiple conditions. The situation gets even more complicated when we take into account the possibility that a drug could have serious side-effects that won’t be discovered until many years after it is in use. I suppose in that situation we go back and collect the payments that were made to the company earlier from the shareholders and their children.

For some reason, the idea of just funding the research upfront and putting in the public domain seems to be out of bounds. Reuters, and implicitly the NYT, would apparently prefer all sorts of bizarre bureaucratic fixes rather than something that would almost certainly be far simpler and cheaper and not leave sick people struggling to find ways to pay for drugs that are necessary for their life or health.

Read More Leer más Join the discussion Participa en la discusión

There is apparently a very big market for spreading the story that trade has not been a major factor behind manufacturing job loss and wage stagnation. How else to explain the massive supply of such pieces?

Robert Samuelson gave us his latest contribution is his weekly Washington Post column. The trick is to say that productivity has been the major factor costing us jobs in manufacturing therefore we shouldn’t be upset about job loss due to trade. This is one of those trivially true arguments. Yes, we have seen productivity growth in manufacturing throughout the post-war period, and that is a good thing. (It means we can see higher wages and living standards.) But the period in which we saw rapid job loss in manufacturing was the period in which the trade deficit grew rapidly from 2000–2007. (I deliberately left off the post-crash period to avoid confusion.)

Jobs in Manufacturing

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

We had productivity growth all through this period, but there was relatively little change in employment in manufacturing until the trade deficit began to explode due to the over-valued dollar at the end of the Clinton presidency. It’s cute how Samuelson and so many other elite types try to tell us that trade hasn’t been a big issue, but as he says in his piece, “we are being fed a largely false narrative on globalization.” It’s too bad our elites have such an aversion to dealing with the real world.

It is also important to note that the Samuelson types are the biggest protectionists in this story. These wall builders are not bothered by rules that prevent doctors from practicing medicine in the United States unless they have completed a residency program in the United States and prevents dentists from practicing unless they have gone to a U.S. dental school (or recently, a Canadian dental school). These protectionist barriers cause us to pay twice as much for our doctors and dentists as people in other wealthy countries, adding more than $100 billion a year (@ $700 per family) to our annual medical bill.

It would be nice if the Post and the rest of the media would occasionally provide some space to free traders.

Addendum:

I should mention that if we want to replace the jobs lost to a trade deficit, we should want to see a larger budget deficit. Unfortunately, deficit hawks like Robert Samuelson, the Washington Post, and the rest of the Peter Peterson crew have prevented us from running budget deficits large enough to get the economy back to full employment.

There is apparently a very big market for spreading the story that trade has not been a major factor behind manufacturing job loss and wage stagnation. How else to explain the massive supply of such pieces?

Robert Samuelson gave us his latest contribution is his weekly Washington Post column. The trick is to say that productivity has been the major factor costing us jobs in manufacturing therefore we shouldn’t be upset about job loss due to trade. This is one of those trivially true arguments. Yes, we have seen productivity growth in manufacturing throughout the post-war period, and that is a good thing. (It means we can see higher wages and living standards.) But the period in which we saw rapid job loss in manufacturing was the period in which the trade deficit grew rapidly from 2000–2007. (I deliberately left off the post-crash period to avoid confusion.)

Jobs in Manufacturing

Source: Bureau of Labor Statistics.

Source: Bureau of Labor Statistics.

We had productivity growth all through this period, but there was relatively little change in employment in manufacturing until the trade deficit began to explode due to the over-valued dollar at the end of the Clinton presidency. It’s cute how Samuelson and so many other elite types try to tell us that trade hasn’t been a big issue, but as he says in his piece, “we are being fed a largely false narrative on globalization.” It’s too bad our elites have such an aversion to dealing with the real world.

It is also important to note that the Samuelson types are the biggest protectionists in this story. These wall builders are not bothered by rules that prevent doctors from practicing medicine in the United States unless they have completed a residency program in the United States and prevents dentists from practicing unless they have gone to a U.S. dental school (or recently, a Canadian dental school). These protectionist barriers cause us to pay twice as much for our doctors and dentists as people in other wealthy countries, adding more than $100 billion a year (@ $700 per family) to our annual medical bill.

It would be nice if the Post and the rest of the media would occasionally provide some space to free traders.

Addendum:

I should mention that if we want to replace the jobs lost to a trade deficit, we should want to see a larger budget deficit. Unfortunately, deficit hawks like Robert Samuelson, the Washington Post, and the rest of the Peter Peterson crew have prevented us from running budget deficits large enough to get the economy back to full employment.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

That’s what folks who saw his letter to the editor in the Washington Post must be asking. The letter derided the idea of funding free college tuition with a modest tax on trades of stocks, bonds, and derivatives. Chilton tells readers:

“A tax on financial trading activity has been tried in other nations, where it failed miserably. Trading (and the jobs and economic activity associated with it) moves to nations without such a tax. Trading these days takes place on computers, not on physical trading floors. When market migration inevitably occurs, anticipated revenue to fund programs (free college or anything else) evaporates. That’s not conjecture. That’s what has transpired in Germany, Japan, Switzerland, Sweden and Italy. Why would we jeopardize what are the most coveted markets on the planet?”

That sounds pretty authoritative — guess a financial transactions tax (FTT) is a bad idea. Except, it doesn’t have any basis in reality. Many countries, including the United States, long raised substantial revenue from taxing financial transactions. Even now, the United States has a tax of 0.00218 percent on stock trades which raises $500 million a year to fund the Securities and Exchange Commission.

There are many other countries that still have FTTs in place and raise a substantial sum of money as a result. One notable financial backwater on this list is the United Kingdom, where the tax consistently raises a bit more than 0.2 percent of GDP (more than $40 billion a year in the U.S.). The markets in China, Hong Kong, and India also have FTTs, so it’s not clear where Mr. Chilton expects our trades will go. (A partial list of the money raised by FTTs in different countries can be found in Table 1.)

It’s true that a FTT will downsize our financial markets by eliminating excessive trading, but for fans of economics this is good news. We wouldn’t want five million truckers moving goods back and forth across the country if one million could do the job. The same story applies to financial markets. If we can effectively allocate capital with half as many trades as we have today, why wouldn’t we want to see the gain in efficiency?

Correction: The Securities and Exchange Commission fee was originally listed as 0.0042 percent.

That’s what folks who saw his letter to the editor in the Washington Post must be asking. The letter derided the idea of funding free college tuition with a modest tax on trades of stocks, bonds, and derivatives. Chilton tells readers:

“A tax on financial trading activity has been tried in other nations, where it failed miserably. Trading (and the jobs and economic activity associated with it) moves to nations without such a tax. Trading these days takes place on computers, not on physical trading floors. When market migration inevitably occurs, anticipated revenue to fund programs (free college or anything else) evaporates. That’s not conjecture. That’s what has transpired in Germany, Japan, Switzerland, Sweden and Italy. Why would we jeopardize what are the most coveted markets on the planet?”

That sounds pretty authoritative — guess a financial transactions tax (FTT) is a bad idea. Except, it doesn’t have any basis in reality. Many countries, including the United States, long raised substantial revenue from taxing financial transactions. Even now, the United States has a tax of 0.00218 percent on stock trades which raises $500 million a year to fund the Securities and Exchange Commission.

There are many other countries that still have FTTs in place and raise a substantial sum of money as a result. One notable financial backwater on this list is the United Kingdom, where the tax consistently raises a bit more than 0.2 percent of GDP (more than $40 billion a year in the U.S.). The markets in China, Hong Kong, and India also have FTTs, so it’s not clear where Mr. Chilton expects our trades will go. (A partial list of the money raised by FTTs in different countries can be found in Table 1.)

It’s true that a FTT will downsize our financial markets by eliminating excessive trading, but for fans of economics this is good news. We wouldn’t want five million truckers moving goods back and forth across the country if one million could do the job. The same story applies to financial markets. If we can effectively allocate capital with half as many trades as we have today, why wouldn’t we want to see the gain in efficiency?

Correction: The Securities and Exchange Commission fee was originally listed as 0.0042 percent.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had a good column on the soaring prices of orphan drugs. Orphan drugs are drugs to treat conditions that affect less than 200,000 people. To encourage drug companies to research these drugs, the government picks up the half the cost of the clinical testing, pays the fees to bring it through the FDA approval process and then gives the drug companies seven years of marketing exclusivity.

The piece reported on how drug companies are increasingly getting orphan status for their drugs, even for drugs that have long been on the market (new uses), and how the prices for these drugs is going through the roof. According to the piece, the average annual cost for newly approved orphan drugs is $112,000.

Remarkably, the piece never mentioned one obvious solution to this problem: the government could also pay for the other half of the cost of the clinical tests. In this case, the drug would be available at generic prices, which would likely be less than one percent of the cost of the average new orphan drugs. The marketing monopolies now given to drug companies create equivalent distortions and incentives for corruption as 10,000 percent tariffs. (The market doesn’t care whether the price is raised due to a tariff or a patent monopoly, the impact is the same.)

It is difficult to believe that the piece never mentioned the public funding option. The tests could still be performed by private companies, the difference is that all the results would be in the public domain for other researchers and doctors to see, and that the drug would likely sell for hundreds of dollars rather than more than a hundred thousand dollars. (It is probably worth mentioning in this context that the Washington Post gets considerable revenue from drug company ads.)

The Washington Post had a good column on the soaring prices of orphan drugs. Orphan drugs are drugs to treat conditions that affect less than 200,000 people. To encourage drug companies to research these drugs, the government picks up the half the cost of the clinical testing, pays the fees to bring it through the FDA approval process and then gives the drug companies seven years of marketing exclusivity.

The piece reported on how drug companies are increasingly getting orphan status for their drugs, even for drugs that have long been on the market (new uses), and how the prices for these drugs is going through the roof. According to the piece, the average annual cost for newly approved orphan drugs is $112,000.

Remarkably, the piece never mentioned one obvious solution to this problem: the government could also pay for the other half of the cost of the clinical tests. In this case, the drug would be available at generic prices, which would likely be less than one percent of the cost of the average new orphan drugs. The marketing monopolies now given to drug companies create equivalent distortions and incentives for corruption as 10,000 percent tariffs. (The market doesn’t care whether the price is raised due to a tariff or a patent monopoly, the impact is the same.)

It is difficult to believe that the piece never mentioned the public funding option. The tests could still be performed by private companies, the difference is that all the results would be in the public domain for other researchers and doctors to see, and that the drug would likely sell for hundreds of dollars rather than more than a hundred thousand dollars. (It is probably worth mentioning in this context that the Washington Post gets considerable revenue from drug company ads.)

Read More Leer más Join the discussion Participa en la discusión