Binyamin Appelbaum had an interesting interview in the NYT with Boston Fed bank president Eric Rosengren. In the interview he argued that it was important to keep the unemployment rate from falling too low. In a response to Appelbaum saying “low unemployment sounds like a good thing,” Rosengren said:

“During periods when the unemployment rate has gotten to the low 4s, we haven’t stayed there for a real long time. And that’s because we do start seeing wages picking up, and we do see prices start picking up, and we do see asset prices picking up. In that environment we start to tighten and when we tighten we’re not so good at getting it exactly right.

“The problem is the dynamics of how firms and individuals start thinking about the tightening process. Those dynamics make it very hard to calibrate the monetary policy process. People understand tightening. But convincing them of how much you’re going to tighten and that you’re going to hit it exactly right — particularly given that you haven’t hit it exactly right in the past, it’s pretty tough to convince people of that. Not surprisingly, they start worrying about: “Well, they’re starting to tighten, they may tighten too much. What do I do? I start pulling in in terms of my own spending.” Firms start pulling in, saying, “We want to be prepared in case they don’t get this quite right.” Those kinds of actions — which are very hard to predict, and individually everyone behaves a little differently — in aggregate, cause a problem where we sometimes slow down the economy more than we intend.

“So you don’t see instances where we go from 4.2 percent to 4.7 or 5 percent and level off. What you actually see is when we start tightening we end up with a recession.”

Actually, we have very little experience of the unemployment rate falling to the low fours in the last 45 years. The one time it did fall that low was in the late 1990s. In that period, the unemployment rate fell to 4.3 percent in April of 1998. The economy experienced almost three years subsequent years of solid growth, with almost no uptick in inflation, until the collapse of the stock bubble threw it into recession in March of 2001.

The unemployment rate was in the mid-fours in 2007, hitting 4.4 percent in March and May of that year. There was little increase in the inflation rate, but a collapse of the housing bubble did throw the economy into a recession at the end of the year.

In short, there is little evidence of wage price inflation associated with low unemployment rates that Rosengren mentions. There is an issue of asset price inflation (i.e. bubbles) but this has little direct relationship with the unemployment rate. In the case of the housing bubble, prices peaked in the summer of 2006 and were already falling rapidly by the spring of 2007 when unemployment hit its low. The bubble began to form as early was 1996 and with prices rising rapidly in 2002 and 2003, when the unemployment rate was at its recession peak and the economy was still shedding jobs.

Binyamin Appelbaum had an interesting interview in the NYT with Boston Fed bank president Eric Rosengren. In the interview he argued that it was important to keep the unemployment rate from falling too low. In a response to Appelbaum saying “low unemployment sounds like a good thing,” Rosengren said:

“During periods when the unemployment rate has gotten to the low 4s, we haven’t stayed there for a real long time. And that’s because we do start seeing wages picking up, and we do see prices start picking up, and we do see asset prices picking up. In that environment we start to tighten and when we tighten we’re not so good at getting it exactly right.

“The problem is the dynamics of how firms and individuals start thinking about the tightening process. Those dynamics make it very hard to calibrate the monetary policy process. People understand tightening. But convincing them of how much you’re going to tighten and that you’re going to hit it exactly right — particularly given that you haven’t hit it exactly right in the past, it’s pretty tough to convince people of that. Not surprisingly, they start worrying about: “Well, they’re starting to tighten, they may tighten too much. What do I do? I start pulling in in terms of my own spending.” Firms start pulling in, saying, “We want to be prepared in case they don’t get this quite right.” Those kinds of actions — which are very hard to predict, and individually everyone behaves a little differently — in aggregate, cause a problem where we sometimes slow down the economy more than we intend.

“So you don’t see instances where we go from 4.2 percent to 4.7 or 5 percent and level off. What you actually see is when we start tightening we end up with a recession.”

Actually, we have very little experience of the unemployment rate falling to the low fours in the last 45 years. The one time it did fall that low was in the late 1990s. In that period, the unemployment rate fell to 4.3 percent in April of 1998. The economy experienced almost three years subsequent years of solid growth, with almost no uptick in inflation, until the collapse of the stock bubble threw it into recession in March of 2001.

The unemployment rate was in the mid-fours in 2007, hitting 4.4 percent in March and May of that year. There was little increase in the inflation rate, but a collapse of the housing bubble did throw the economy into a recession at the end of the year.

In short, there is little evidence of wage price inflation associated with low unemployment rates that Rosengren mentions. There is an issue of asset price inflation (i.e. bubbles) but this has little direct relationship with the unemployment rate. In the case of the housing bubble, prices peaked in the summer of 2006 and were already falling rapidly by the spring of 2007 when unemployment hit its low. The bubble began to form as early was 1996 and with prices rising rapidly in 2002 and 2003, when the unemployment rate was at its recession peak and the economy was still shedding jobs.

Read More Leer más Join the discussion Participa en la discusión

The NYT had an editorial highlighting new work by Alan Krueger that examined prime-age men (ages 25–54) who are not working or looking for work. The work shows that 40 percent of the men who have dropped out of the labor force report feeling pain that keeps them from taking jobs. It reports that 44 percent report taking pain medication the previous day. Both Krueger and the editorial make it clear that the causation could go in both directions.

While this is interesting work, implying that the problem of people dropping out of the labor force is a story about men is seriously misleading. Both prime-age men and women have been increasingly dropping out of the labor force in the last 15 years. The falloff since the peak year of 2000 is somewhat sharper for men than women, but it is important to note that labor force participation rates had been rising for women prior to 2000 and were almost universally projected to continue to rise. The employment rate for prime-age men fell by 4.1 percentage points from 2000 to 2015, while the employment rate for prime-age women fell by 3.2 percentage points. (Employment rates are a cleaner measure, since the decision to look for work, and therefore stay in the labor force, is affected by eligibility for unemployment benefits.)

The reason this matters is that clearly the employment rate is dropping for reasons not related to any behavior or conditions unique to men since the drop has occurred for women as well. The more obvious source of the problem lies with the people (disproportionately men) designing economic policy.

The NYT had an editorial highlighting new work by Alan Krueger that examined prime-age men (ages 25–54) who are not working or looking for work. The work shows that 40 percent of the men who have dropped out of the labor force report feeling pain that keeps them from taking jobs. It reports that 44 percent report taking pain medication the previous day. Both Krueger and the editorial make it clear that the causation could go in both directions.

While this is interesting work, implying that the problem of people dropping out of the labor force is a story about men is seriously misleading. Both prime-age men and women have been increasingly dropping out of the labor force in the last 15 years. The falloff since the peak year of 2000 is somewhat sharper for men than women, but it is important to note that labor force participation rates had been rising for women prior to 2000 and were almost universally projected to continue to rise. The employment rate for prime-age men fell by 4.1 percentage points from 2000 to 2015, while the employment rate for prime-age women fell by 3.2 percentage points. (Employment rates are a cleaner measure, since the decision to look for work, and therefore stay in the labor force, is affected by eligibility for unemployment benefits.)

The reason this matters is that clearly the employment rate is dropping for reasons not related to any behavior or conditions unique to men since the drop has occurred for women as well. The more obvious source of the problem lies with the people (disproportionately men) designing economic policy.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Many people are aware of the increase the number of people insured as a result of the Affordable Care Act. Some also know about the slower rate of growth of health care costs. (Yes folks, that is slower growth in costs, not a decline — no one promised a miracle.) Anyhow, it is worth putting these two together to see the pattern in health care costs per insured person under Obamacare. Here’s the picture.

Source: Bureau of Economic Analysis and Centers for Disease Control and Prevention.

As can be seen, there is a sharp slowing in the rate of growth of health care costs per person in 2010, just as the Affordable Care Act is passed into law. In the years from 1999 to 2010, health care costs per insured person rose at an average annual rate of 5.7 percent. In the years from 2010 to 2015 costs per insured person rose at an average rate of just 2.3 percent.

Undoubtedly, the ACA is not the full explanation for the slowdown in cost growth, but it certainly contributed to the slowdown. Furthermore, as a political matter, does anyone doubt for a second that if cost growth had accelerated that the ACA would be given the blame even if there was no evidence that it was a major factor?

Anyhow, this is a good story. It doesn’t mean anyone should be happy with our health care system as it is now. We pay ridiculous sums for prescription drugs that would be cheap in a free market. Our doctors are paid twice as much as their counterparts in other wealthy countries. And, the insurance industry is a major source of needless waste. But the health care system is much better today than it was when President Obama took office, and that is a big deal.

Note: I realize that some folks are getting the wrong graph with this post. The correct one (which shows up on my computers) is an index of health care costs per insured person with 1999 set equal to 100. I have no idea where the other graph came from, but we will investigate.

Many people are aware of the increase the number of people insured as a result of the Affordable Care Act. Some also know about the slower rate of growth of health care costs. (Yes folks, that is slower growth in costs, not a decline — no one promised a miracle.) Anyhow, it is worth putting these two together to see the pattern in health care costs per insured person under Obamacare. Here’s the picture.

Source: Bureau of Economic Analysis and Centers for Disease Control and Prevention.

As can be seen, there is a sharp slowing in the rate of growth of health care costs per person in 2010, just as the Affordable Care Act is passed into law. In the years from 1999 to 2010, health care costs per insured person rose at an average annual rate of 5.7 percent. In the years from 2010 to 2015 costs per insured person rose at an average rate of just 2.3 percent.

Undoubtedly, the ACA is not the full explanation for the slowdown in cost growth, but it certainly contributed to the slowdown. Furthermore, as a political matter, does anyone doubt for a second that if cost growth had accelerated that the ACA would be given the blame even if there was no evidence that it was a major factor?

Anyhow, this is a good story. It doesn’t mean anyone should be happy with our health care system as it is now. We pay ridiculous sums for prescription drugs that would be cheap in a free market. Our doctors are paid twice as much as their counterparts in other wealthy countries. And, the insurance industry is a major source of needless waste. But the health care system is much better today than it was when President Obama took office, and that is a big deal.

Note: I realize that some folks are getting the wrong graph with this post. The correct one (which shows up on my computers) is an index of health care costs per insured person with 1999 set equal to 100. I have no idea where the other graph came from, but we will investigate.

Read More Leer más Join the discussion Participa en la discusión

The reason for asking is that the Congressional Budget Office (CBO) has recently put out some very pessimistic projections for Social Security. These projections got some attention from the media because they were considerably more pessimistic than the projections from the Social Security Trustees, implying a somewhat larger gap between projected benefit payments and projected revenue.

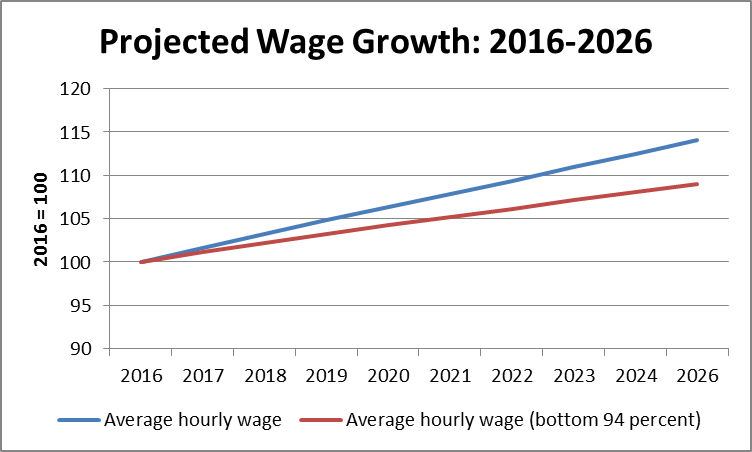

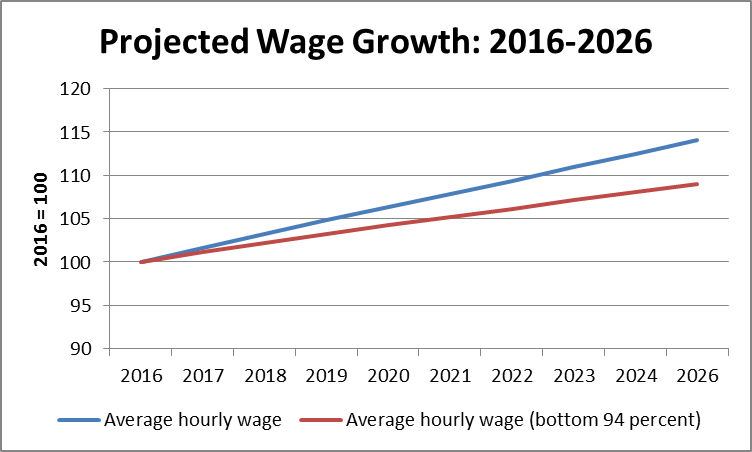

While most of the attention was on the differences in the program’s finances, what actually would mean more to most people is the difference in projected wage growth between the two programs. The CBO projections show a considerably slower path of wage growth than the Social Security trustees projections.

The main reason for this difference is that CBO projects that wage income will be further redistributed upward over the next decade, while the trustees project a small reversal of some of the upward redistribution of the last three decades. While the share of wage income that went over the taxable cap (currently $118,500) was just 10 percent in 1980, this had risen to 18 percent by 2015. This is one of the main reasons that Social Security’s finances look worse now than had been projected three decades ago.

CBO projects that the share of wage income going to those earning above the cap (@ 6.0 percent of workers) will increase to more than 22 percent by 2026. This worsens the finances of the program, since it is not collected taxes on this money, but more importantly it means that most workers will see little wage growth over the next decade. The figure below shows average real wage growth projected by CBO for the next decade (Figure 2-9 from the Budget and Economic Outlook) and the average for the bottom 94 percent of wage earners.

Source: Congressional Budget Office and author’s calculations.

Source: Congressional Budget Office and author’s calculations.

The CBO projections imply that real wages will rise by an average of 9.0 percent over the next decade for bottom 94 percent of workers. The upward redistribution projected by CBO would cost the typical worker just over 4.4 percent of their wages. This means that for a worker who would otherwise be earning $50,000 in 2026 (in 2016 dollars), the upward redistribution projected by CBO will mean a loss of wages of $2,200, so that they would only be earning $47,800.

As a practical matter, most workers are likely to do considerably worse under the CBO scenario. If past trends continue, the workers closer to the taxable cap (e.g. the 90th percentile worker) are likely to see somewhat higher wage growth than workers near the middle and bottom of the wage distribution. In other words, the CBO projections imply that most workers will see little or no wage growth over the next decade as the overwhelming majority of wage gains go to those at the top of the income distribution.

This should be of great concern to Hillary Clinton since she has committed herself to pushing through an agenda that ensures most workers share in the benefits of wage growth. The CBO projections imply that this is clearly not the case and the projected upward redistribution of income will matter much more to workers’ living standards than any conceivable increase in Social Security taxes — even if the media will do their best to ensure that the public only hears about the taxes.

The reason for asking is that the Congressional Budget Office (CBO) has recently put out some very pessimistic projections for Social Security. These projections got some attention from the media because they were considerably more pessimistic than the projections from the Social Security Trustees, implying a somewhat larger gap between projected benefit payments and projected revenue.

While most of the attention was on the differences in the program’s finances, what actually would mean more to most people is the difference in projected wage growth between the two programs. The CBO projections show a considerably slower path of wage growth than the Social Security trustees projections.

The main reason for this difference is that CBO projects that wage income will be further redistributed upward over the next decade, while the trustees project a small reversal of some of the upward redistribution of the last three decades. While the share of wage income that went over the taxable cap (currently $118,500) was just 10 percent in 1980, this had risen to 18 percent by 2015. This is one of the main reasons that Social Security’s finances look worse now than had been projected three decades ago.

CBO projects that the share of wage income going to those earning above the cap (@ 6.0 percent of workers) will increase to more than 22 percent by 2026. This worsens the finances of the program, since it is not collected taxes on this money, but more importantly it means that most workers will see little wage growth over the next decade. The figure below shows average real wage growth projected by CBO for the next decade (Figure 2-9 from the Budget and Economic Outlook) and the average for the bottom 94 percent of wage earners.

Source: Congressional Budget Office and author’s calculations.

Source: Congressional Budget Office and author’s calculations.

The CBO projections imply that real wages will rise by an average of 9.0 percent over the next decade for bottom 94 percent of workers. The upward redistribution projected by CBO would cost the typical worker just over 4.4 percent of their wages. This means that for a worker who would otherwise be earning $50,000 in 2026 (in 2016 dollars), the upward redistribution projected by CBO will mean a loss of wages of $2,200, so that they would only be earning $47,800.

As a practical matter, most workers are likely to do considerably worse under the CBO scenario. If past trends continue, the workers closer to the taxable cap (e.g. the 90th percentile worker) are likely to see somewhat higher wage growth than workers near the middle and bottom of the wage distribution. In other words, the CBO projections imply that most workers will see little or no wage growth over the next decade as the overwhelming majority of wage gains go to those at the top of the income distribution.

This should be of great concern to Hillary Clinton since she has committed herself to pushing through an agenda that ensures most workers share in the benefits of wage growth. The CBO projections imply that this is clearly not the case and the projected upward redistribution of income will matter much more to workers’ living standards than any conceivable increase in Social Security taxes — even if the media will do their best to ensure that the public only hears about the taxes.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

That’s right, Friedman is actually supporting measures that would help to reverse the upward redistribution of the last four decades. In his column today Friedman identifies himself as a citizen “who believes that America needs a healthy center-right party that offers more market-based solutions to problems; keeps the pressure on for deregulation, freer trade and smaller government.”

Of course, reducing the length and strength of patent and copyright monopolies would be a big step towards freer trade. If we paid free market prices for prescription drugs instead of today’s protected prices, we would save in the neighborhood of $360 billion a year (@ 2.0 percent of GDP).

Currently, doctors have to complete a residency program in the United States to practice medicine here. If we replaced this requirement with one designed to ensure that doctors practicing in the United States were competent, it could save us around $100 billion annually in medical expenses.

As can be seen, there are enormous potential gains to the public from freer trade. It’s good to see Friedman’s interest in turning policy in that direction. It would be nice if people in positions of political power shared his point of view.

That’s right, Friedman is actually supporting measures that would help to reverse the upward redistribution of the last four decades. In his column today Friedman identifies himself as a citizen “who believes that America needs a healthy center-right party that offers more market-based solutions to problems; keeps the pressure on for deregulation, freer trade and smaller government.”

Of course, reducing the length and strength of patent and copyright monopolies would be a big step towards freer trade. If we paid free market prices for prescription drugs instead of today’s protected prices, we would save in the neighborhood of $360 billion a year (@ 2.0 percent of GDP).

Currently, doctors have to complete a residency program in the United States to practice medicine here. If we replaced this requirement with one designed to ensure that doctors practicing in the United States were competent, it could save us around $100 billion annually in medical expenses.

As can be seen, there are enormous potential gains to the public from freer trade. It’s good to see Friedman’s interest in turning policy in that direction. It would be nice if people in positions of political power shared his point of view.

Read More Leer más Join the discussion Participa en la discusión

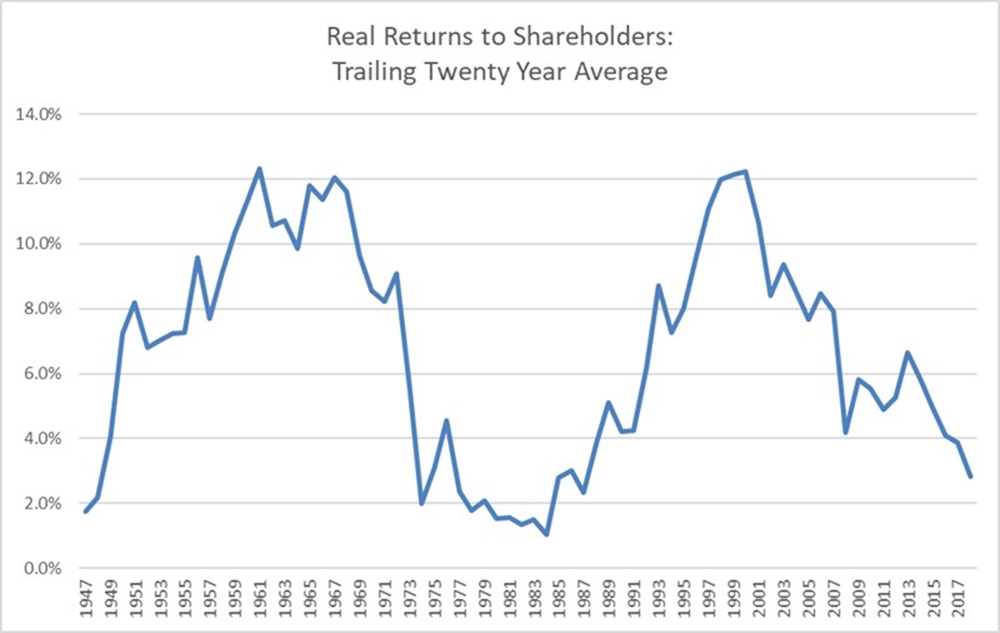

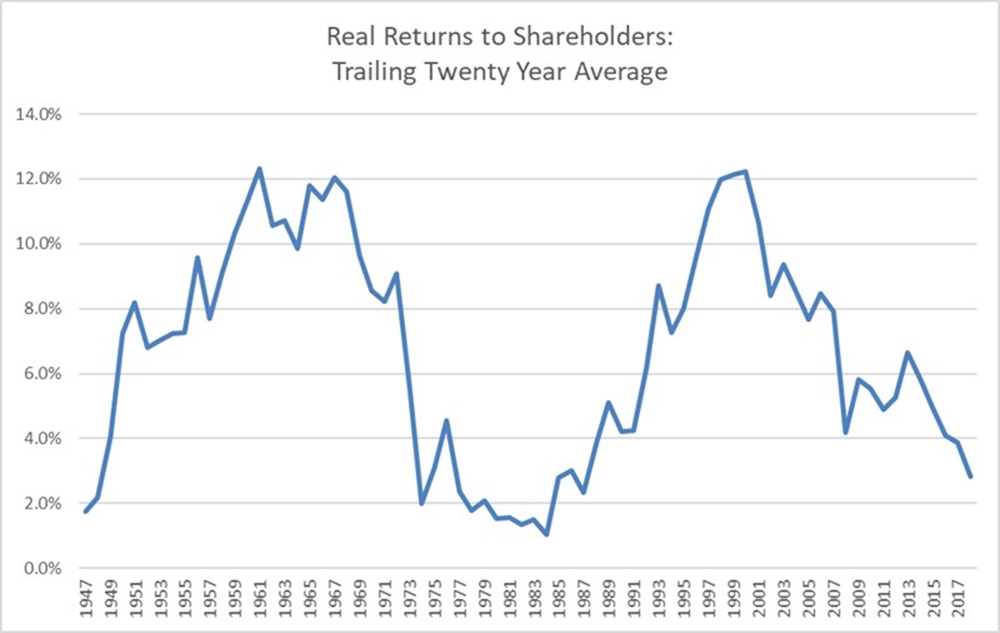

Most sectors within manufacturing have seen serious downsizing and restructuring over the last four decades. Many have gone bankrupt. Much of this story was not pretty for the workers directly affected. Many lost the only good-paying jobs they ever held. Some also lost pensions and health care benefits.

Nonetheless, the conventional wisdom among economists was that this process was good. It was associated with growing efficiency in the manufacturing sector as the least productive firms went out of business, other firms became more productive in order to survive. The net effect was that we are able to buy a wide range of manufactured goods for much lower prices than would be the case if the manufacturing sector had not gone through this period of downsizing and transition.

With this as background, it was striking to see the Wall Street Journal bemoaning what appears to be a comparable period of adjustment in the banking industry. The central point is that the banking industry appears to be less profitable than it was before the crisis. Apparently tighter regulations are playing a major role in this decline in profitability.

This drop in profitability is presented as a bad thing, but it is hard to see why those of us outside of the banking industry should see it that way. If the sector had become badly bloated prior to the crisis then we should want to see it downsized. The workers who lose their jobs can be redeployed to sectors where they will be more productive. (The same argument that economists gave for manufacturing firms.) Declining profitability is a necessary part of this story.

Maybe the banks will also stop paying their CEOs tens of millions of dollars to issue phony accounts to customers. Lower pay for CEOs and other top executives will leave more money for shareholders.

There is a risk that the bankruptcy of a major bank could cause a serious disruption to the economy. Of course, that would imply that we still need to be concerned about “too big to fail” banks, in spite of the endless assurances to the contrary. If we have in fact fixed the too big to fail problem, then the rest of us should be celebrating the downsizing of the banking industry as the market working its magic. Too bad the WSJ doesn’t like the market.

Most sectors within manufacturing have seen serious downsizing and restructuring over the last four decades. Many have gone bankrupt. Much of this story was not pretty for the workers directly affected. Many lost the only good-paying jobs they ever held. Some also lost pensions and health care benefits.

Nonetheless, the conventional wisdom among economists was that this process was good. It was associated with growing efficiency in the manufacturing sector as the least productive firms went out of business, other firms became more productive in order to survive. The net effect was that we are able to buy a wide range of manufactured goods for much lower prices than would be the case if the manufacturing sector had not gone through this period of downsizing and transition.

With this as background, it was striking to see the Wall Street Journal bemoaning what appears to be a comparable period of adjustment in the banking industry. The central point is that the banking industry appears to be less profitable than it was before the crisis. Apparently tighter regulations are playing a major role in this decline in profitability.

This drop in profitability is presented as a bad thing, but it is hard to see why those of us outside of the banking industry should see it that way. If the sector had become badly bloated prior to the crisis then we should want to see it downsized. The workers who lose their jobs can be redeployed to sectors where they will be more productive. (The same argument that economists gave for manufacturing firms.) Declining profitability is a necessary part of this story.

Maybe the banks will also stop paying their CEOs tens of millions of dollars to issue phony accounts to customers. Lower pay for CEOs and other top executives will leave more money for shareholders.

There is a risk that the bankruptcy of a major bank could cause a serious disruption to the economy. Of course, that would imply that we still need to be concerned about “too big to fail” banks, in spite of the endless assurances to the contrary. If we have in fact fixed the too big to fail problem, then the rest of us should be celebrating the downsizing of the banking industry as the market working its magic. Too bad the WSJ doesn’t like the market.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión