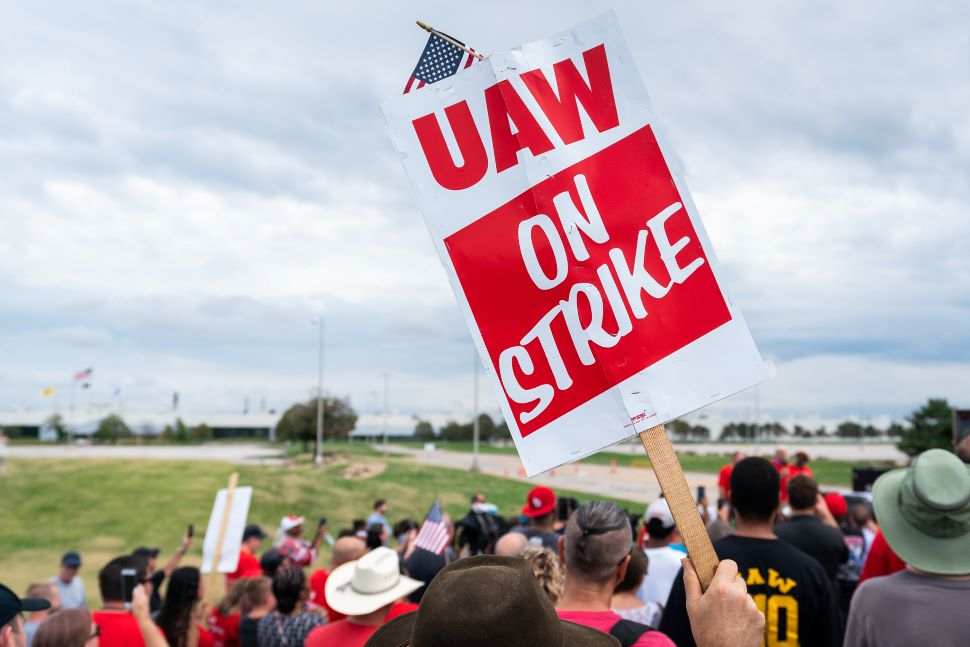

The Washington Post has a long history of hating on powerful unions, like the United Auto Workers (UAW), or any factor that allows blue-collar workers to earn a decent living. In keeping with that tradition, editorial writer and columnist Charles Lane argued that the UAW strike is highlighting the “contradictions” in Bidenomics.

Lane’s argument is that if we want to deal with climate change effectively, we should want to get the items needed for the green transition as cheaply as possible. This means we should want solar and wind installations produced at the lowest possible cost, as well as electric cars. According to Lane, that means we should not have import tariffs and be happy if these items are produced with low-cost non-union labor.

This is a plausible case in the short term, but that may not be true in the longer term. In the short term, obviously it is cheaper to get clean energy inputs at lower cost than at higher cost, but that may not be the case in the long term.

If the United States can build up its capacity and expertise as a top-line producer of solar panels, wind turbines, and electric cars, we may find that it is cheaper to produce these items here. There is evidence that unionized workers are more productive than poorly paid non-union workers.

Unionized workers switch jobs much less frequently and, when they know they will share in the gains of productivity-enhancing innovations, have far more incentive to share their insights with management. Countries with far higher unionization rates than the United States, notably Germany and Denmark, have been quite successful in maintaining top-level manufacturing operations.

The Political Coalition for a Green Transition

But apart from the economics of ensuring that unions are part of a green transition, there is also a political issue. Good policy does not just happen. It would make great sense to change the basis for the corporate income tax to a tax on stock returns. It doesn’t happen because the people who gain from the tax gaming industry (corporate accountants, tax lawyers, and the companies that do it effectively) are much more powerful than the tiny group of people who actually care about collecting the corporate income tax.

Similarly, we can reduce bloated CEO pay, and radically lower the excessive pay of high-end executives more generally (leaving more for ordinary workers), if we give shareholders more control over setting pay. However, this change doesn’t happen because there is no notable political force behind it, and the CEOs and their friends scream “communism” at efforts to give shareholders more control of the companies they ostensibly own.

The point is that change does not just happen in this world. It needs a political force to push it. Most of the country’s unions, including the UAW, have been willing to support policies for a green transition, but they want to make sure that their workers are protected in the process. The fact that Biden is willing to take a risk, that he may be raising costs somewhat, at least in the short-term, to keep this important ally, simply reflects political reality.

If this point is too subtle for the people who own and control the Washington Post, if Donald Trump gets back in the White House, there will be no green transition in the United States. He and most of his Republican allies have made it clear that they intend to sabotage private efforts to move to clean energy, not subsidize them.

In this respect, it is also worth noting that the Washington Post and other major news outlets have played an important role in making a green transition more difficult. They regularly report assertions from Republican politicians on global warming as reflecting their sincere beliefs, saying things like these politicians “believe” that global warming is not a real problem.

In addition to being awful journalism (reporters don’t know what politicians actually have in their heads), it is almost certainly not true. Many of the country’s most prominent Republican politicians, like Ted Cruz, Ron DeSantis, and Josh Hawley, have educations from top universities. It is highly unlikely that they learned nothing about global warming or somehow came to views that contradict the nearly unanimous consensus among scientists who are not on the payroll of the fossil fuel industry.

For this reason, it is absurd to treat their assertions about global warming as reflecting their sincere beliefs. A simple and neutral way to describe their assertions is to simply report what they say, or that they “claim” global warming is not a problem. Reporters can stick to reporting what they know and leave it to readers to determine for themselves whether these politicians are being honest.

Higher Costs Due Patent Monopolies and Related Protections

The Washington Post, like other elite news outlets, is always happy to beat up any real or perceived market intervention that benefits ordinary workers, however, it insists it cannot see the more costly interventions that benefit many corporations and highly-educated workers. Specifically, it virtually never raises any questions, either in news articles or opinion pieces, about the costs imposed by government-granted patent monopolies and related protections.

This is especially important in the case of prescription drugs, where life-saving medicines, that likely would sell for a few dollars a prescription in a free market, can sell for hundreds or even thousands of dollars a prescription when they have government-granted patent monopolies. We will spend over $570 billion this year on drugs that would likely sell for less than $100 billion in a free market without patent monopolies.

While the WaPo would ordinarily be very concerned about a government expenditure of $470 billion a year (nearly $5 trillion over a decade), when the government effectively makes this expenditure by granting patent monopolies, there is no room for discussion in the paper. There is a similar story with patent monopolies in clean energy.

If we are actually facing an existential crisis with global warming (we are), we should be looking to ensure that all relevant technologies are available at the lowest possible cost. If it were not a question of political power, we would be suspending patents and related protections for the relevant technologies, allowing everyone everywhere in the world to use the latest technology at zero cost. We would also be open-sourcing the research behind the technology so researchers all over the world can benefit and build on innovations, wherever they occur.

We can compensate companies for the profits they lose as a result. Of course, if they consider compensation from whatever formula is used inadequate, they can sue after the fact, but we should not let their concerns about compensation slow the process of moving to a green economy. (Yes, we should have done this during the pandemic, but we know that in polite debate, profits and pay for high-end workers are far more important than human lives.)

There is also the issue of supporting research going forward. The United States, and other countries, should be paying out money directly, sort of like what we do now with military research and with biomedical research supported by the National Institutes of Health and other government agencies, in key areas for developing clean technologies.

This would require some agreements with other countries on sharing costs, but again, we can outline the plan and start the research now, and fight over the exact compensation formulas later. But that would only be if we cared about saving the planet. Again, all this newly supported research would be fully open-source with any patents in the public domain and all results posted on the web as quickly as possible.

Bottom Line: WaPo Cares About Beating Up Blue Collar Workers, not Saving the Planet

The story with Lane, the WaPo, and really the major media outlets more generally, is that they are more committed to maintaining class distinctions and ensuring that blue-collar workers don’t get a decent paycheck, than trying to contain global warming. They dump on policies that benefit blue-collar workers that could slow the green transition in the short-term, but are just fine ignoring policies that benefit major corporations and highly-educated workers, which also slow the transition. This is not a surprise, we know who owns and controls the Washington Post.

The Washington Post has a long history of hating on powerful unions, like the United Auto Workers (UAW), or any factor that allows blue-collar workers to earn a decent living. In keeping with that tradition, editorial writer and columnist Charles Lane argued that the UAW strike is highlighting the “contradictions” in Bidenomics.

Lane’s argument is that if we want to deal with climate change effectively, we should want to get the items needed for the green transition as cheaply as possible. This means we should want solar and wind installations produced at the lowest possible cost, as well as electric cars. According to Lane, that means we should not have import tariffs and be happy if these items are produced with low-cost non-union labor.

This is a plausible case in the short term, but that may not be true in the longer term. In the short term, obviously it is cheaper to get clean energy inputs at lower cost than at higher cost, but that may not be the case in the long term.

If the United States can build up its capacity and expertise as a top-line producer of solar panels, wind turbines, and electric cars, we may find that it is cheaper to produce these items here. There is evidence that unionized workers are more productive than poorly paid non-union workers.

Unionized workers switch jobs much less frequently and, when they know they will share in the gains of productivity-enhancing innovations, have far more incentive to share their insights with management. Countries with far higher unionization rates than the United States, notably Germany and Denmark, have been quite successful in maintaining top-level manufacturing operations.

The Political Coalition for a Green Transition

But apart from the economics of ensuring that unions are part of a green transition, there is also a political issue. Good policy does not just happen. It would make great sense to change the basis for the corporate income tax to a tax on stock returns. It doesn’t happen because the people who gain from the tax gaming industry (corporate accountants, tax lawyers, and the companies that do it effectively) are much more powerful than the tiny group of people who actually care about collecting the corporate income tax.

Similarly, we can reduce bloated CEO pay, and radically lower the excessive pay of high-end executives more generally (leaving more for ordinary workers), if we give shareholders more control over setting pay. However, this change doesn’t happen because there is no notable political force behind it, and the CEOs and their friends scream “communism” at efforts to give shareholders more control of the companies they ostensibly own.

The point is that change does not just happen in this world. It needs a political force to push it. Most of the country’s unions, including the UAW, have been willing to support policies for a green transition, but they want to make sure that their workers are protected in the process. The fact that Biden is willing to take a risk, that he may be raising costs somewhat, at least in the short-term, to keep this important ally, simply reflects political reality.

If this point is too subtle for the people who own and control the Washington Post, if Donald Trump gets back in the White House, there will be no green transition in the United States. He and most of his Republican allies have made it clear that they intend to sabotage private efforts to move to clean energy, not subsidize them.

In this respect, it is also worth noting that the Washington Post and other major news outlets have played an important role in making a green transition more difficult. They regularly report assertions from Republican politicians on global warming as reflecting their sincere beliefs, saying things like these politicians “believe” that global warming is not a real problem.

In addition to being awful journalism (reporters don’t know what politicians actually have in their heads), it is almost certainly not true. Many of the country’s most prominent Republican politicians, like Ted Cruz, Ron DeSantis, and Josh Hawley, have educations from top universities. It is highly unlikely that they learned nothing about global warming or somehow came to views that contradict the nearly unanimous consensus among scientists who are not on the payroll of the fossil fuel industry.

For this reason, it is absurd to treat their assertions about global warming as reflecting their sincere beliefs. A simple and neutral way to describe their assertions is to simply report what they say, or that they “claim” global warming is not a problem. Reporters can stick to reporting what they know and leave it to readers to determine for themselves whether these politicians are being honest.

Higher Costs Due Patent Monopolies and Related Protections

The Washington Post, like other elite news outlets, is always happy to beat up any real or perceived market intervention that benefits ordinary workers, however, it insists it cannot see the more costly interventions that benefit many corporations and highly-educated workers. Specifically, it virtually never raises any questions, either in news articles or opinion pieces, about the costs imposed by government-granted patent monopolies and related protections.

This is especially important in the case of prescription drugs, where life-saving medicines, that likely would sell for a few dollars a prescription in a free market, can sell for hundreds or even thousands of dollars a prescription when they have government-granted patent monopolies. We will spend over $570 billion this year on drugs that would likely sell for less than $100 billion in a free market without patent monopolies.

While the WaPo would ordinarily be very concerned about a government expenditure of $470 billion a year (nearly $5 trillion over a decade), when the government effectively makes this expenditure by granting patent monopolies, there is no room for discussion in the paper. There is a similar story with patent monopolies in clean energy.

If we are actually facing an existential crisis with global warming (we are), we should be looking to ensure that all relevant technologies are available at the lowest possible cost. If it were not a question of political power, we would be suspending patents and related protections for the relevant technologies, allowing everyone everywhere in the world to use the latest technology at zero cost. We would also be open-sourcing the research behind the technology so researchers all over the world can benefit and build on innovations, wherever they occur.

We can compensate companies for the profits they lose as a result. Of course, if they consider compensation from whatever formula is used inadequate, they can sue after the fact, but we should not let their concerns about compensation slow the process of moving to a green economy. (Yes, we should have done this during the pandemic, but we know that in polite debate, profits and pay for high-end workers are far more important than human lives.)

There is also the issue of supporting research going forward. The United States, and other countries, should be paying out money directly, sort of like what we do now with military research and with biomedical research supported by the National Institutes of Health and other government agencies, in key areas for developing clean technologies.

This would require some agreements with other countries on sharing costs, but again, we can outline the plan and start the research now, and fight over the exact compensation formulas later. But that would only be if we cared about saving the planet. Again, all this newly supported research would be fully open-source with any patents in the public domain and all results posted on the web as quickly as possible.

Bottom Line: WaPo Cares About Beating Up Blue Collar Workers, not Saving the Planet

The story with Lane, the WaPo, and really the major media outlets more generally, is that they are more committed to maintaining class distinctions and ensuring that blue-collar workers don’t get a decent paycheck, than trying to contain global warming. They dump on policies that benefit blue-collar workers that could slow the green transition in the short-term, but are just fine ignoring policies that benefit major corporations and highly-educated workers, which also slow the transition. This is not a surprise, we know who owns and controls the Washington Post.

Read More Leer más Join the discussion Participa en la discusión

Donald Trump claims that no one was harmed when he lied about the value of his assets on statements he made to lenders, because loans were paid off with interest. New York Times columnist, Peter Coy takes this claim far more seriously than he should.

The key point that Coy misses is that lenders base the interest rate they charge on the financial condition of their borrower. To see this point, suppose that you want to take out a mortgage but you are unemployed, have no assets, and already have vast amounts of debt. When you file your application, you tell the bank that you have a job with a 7-figure salary, have $5 million in the bank, and no debt.

Ten years later, you sell the home, and repay the mortgage, after having made all your mortgage payments on time. Was the bank harmed?

Well, if you had been truthful with the bank, they would have charged you a much higher interest rate, if they had chosen to make the loan at all. In effect, the bank was being subjected to much greater risk than it realized. It would have charged for this risk, if it had realized it was taking it.

By lying, Trump was able to get his loans at a lower interest rate than if he had been truthful. This likely saved him many millions in interest payments, at least assuming that lenders took him seriously.

In his deposition, Trump seemed to maintain that lenders know everything he says is a lie. That is perhaps true, but the forms he signed did not indicate that. Perhaps everyone should know that everything Trump says is a lie, but it seems that many people are not yet in on the joke.

Donald Trump claims that no one was harmed when he lied about the value of his assets on statements he made to lenders, because loans were paid off with interest. New York Times columnist, Peter Coy takes this claim far more seriously than he should.

The key point that Coy misses is that lenders base the interest rate they charge on the financial condition of their borrower. To see this point, suppose that you want to take out a mortgage but you are unemployed, have no assets, and already have vast amounts of debt. When you file your application, you tell the bank that you have a job with a 7-figure salary, have $5 million in the bank, and no debt.

Ten years later, you sell the home, and repay the mortgage, after having made all your mortgage payments on time. Was the bank harmed?

Well, if you had been truthful with the bank, they would have charged you a much higher interest rate, if they had chosen to make the loan at all. In effect, the bank was being subjected to much greater risk than it realized. It would have charged for this risk, if it had realized it was taking it.

By lying, Trump was able to get his loans at a lower interest rate than if he had been truthful. This likely saved him many millions in interest payments, at least assuming that lenders took him seriously.

In his deposition, Trump seemed to maintain that lenders know everything he says is a lie. That is perhaps true, but the forms he signed did not indicate that. Perhaps everyone should know that everything Trump says is a lie, but it seems that many people are not yet in on the joke.

Read More Leer más Join the discussion Participa en la discusión

The New York Times decided to celebrate Greece’s economy with an article headlined “Greece, battered a decade ago, is booming.” The piece touts a tourist and investment boom, which does seem to be a marked improvement for the economy after almost a decade of austerity.

Still, the case it makes is weaker than it may appear. It tells readers:

“The economy is growing at twice the eurozone average, and unemployment, while still high at 11 percent, is the lowest in over a decade.”

Since the eurozone growth rate for 2023 is projected to be 0.8 percent, growing twice as fast is a rather low bar. (The projected Greek growth rate of 2.6 percent is respectable.) The 11 percent unemployment rate is far higher than the rest of the European Union, which has a 5.9 percent unemployment rate (6.4 percent for the eurozone).

The recent growth in GDP should be put in a longer-term context. If we take the longer picture, Greece’s real per capita GDP on a purchasing power parity basis is projected to be $32,204 this year, which is more than 14 percent below its peak in 2008.

The media in the United States were highlighting the difficulty that people in the United States were having putting food on the table and paying rent in 2022 when real income was down by around 1.0 percent from pre-pandemic levels. The people in Greece are obviously doing better with their economy growing at a healthy pace than if it were not, but the data do not indicate they have much to celebrate.

The New York Times decided to celebrate Greece’s economy with an article headlined “Greece, battered a decade ago, is booming.” The piece touts a tourist and investment boom, which does seem to be a marked improvement for the economy after almost a decade of austerity.

Still, the case it makes is weaker than it may appear. It tells readers:

“The economy is growing at twice the eurozone average, and unemployment, while still high at 11 percent, is the lowest in over a decade.”

Since the eurozone growth rate for 2023 is projected to be 0.8 percent, growing twice as fast is a rather low bar. (The projected Greek growth rate of 2.6 percent is respectable.) The 11 percent unemployment rate is far higher than the rest of the European Union, which has a 5.9 percent unemployment rate (6.4 percent for the eurozone).

The recent growth in GDP should be put in a longer-term context. If we take the longer picture, Greece’s real per capita GDP on a purchasing power parity basis is projected to be $32,204 this year, which is more than 14 percent below its peak in 2008.

The media in the United States were highlighting the difficulty that people in the United States were having putting food on the table and paying rent in 2022 when real income was down by around 1.0 percent from pre-pandemic levels. The people in Greece are obviously doing better with their economy growing at a healthy pace than if it were not, but the data do not indicate they have much to celebrate.

Read More Leer más Join the discussion Participa en la discusión

Catherine Rampell had an interesting column dealing with the question of when prices will “come back down?” Rampell correctly answered “never,” but I am not convinced this is the real question people are posing.

Rampell deals with the question as being one about the overall Consumer Price Index (CPI). She is explicitly not talking about the price of the everyday items, like food and gas, that people purchase regularly.

This distinction is my reason for skepticism. First, the price of many food items has come back down. Overall food prices have not, but it actually is plausible that we will see further declines in the food basket.

The prices of most commodities, like wheat and corn, are pretty much back to their pre-pandemic level. Shipping costs have also fallen back to roughly pre-pandemic levels. And, corporations are complaining that they are losing some of the pricing power that they had during the pandemic.

All of this translates into a picture where the rate of inflation in food prices may drop further (the annual rate was 1.6 percent over the last three months) and could possibly turn negative. I doubt that food prices will fall back to pre-pandemic levels, but we may see the overall index decline for a period of time.

We see a different picture with gas prices. Production cutbacks by Saudi Arabia (was there a “perfect phone call” from Donald Trump?) have sent crude oil prices from $70 a barrel to $90 a barrel, raising gas prices back to almost $3.90 a gallon as a nationwide average.

However, it is plausible that these prices will fall again. For better or worse (obviously worse from a climate perspective), U.S. oil production is at a record high. Exploding growth in the EV market, especially in China and Europe, will reduce demand. Maybe Saudi Arabia will respond with further cuts (I don’t have a crystal ball), but it is not absurd to think that gas prices will come back down.

Anyhow, the point here is that the prices that are most directly in people’s faces can come back down. When we move beyond these prices to items like rent, owners’ equivalent rent (the rent you would pay yourself for living in a home you own), and new car purchases, I’m not sure that these fit well into most people’s conceptions of inflation.

Owners’ equivalent rent accounts for over a quarter of the CPI, do the two-thirds of households who own their home actively think about how much it would cost them to rent the place? Most people rarely buy a new car, and even used car purchases are not frequent (used car prices have been falling over the last year).

I also doubt that many people other than economists and people who write on economics have a clear vision of the overall CPI or the price index of their choosing. For this reason, I’m not sure that many people really expect prices to come back down. Average hourly wages have risen by almost 20 percent since the start of the pandemic, do people really expect that they will pay the same for stuff as they did in 2019?

It is also worth noting that prices never came back down in the 1980s. Ronald Reagan was singing about “Morning in America” in his 1984 re-election campaign when inflation was still over 4.0 percent.

My guess here is that the concern for prices coming back down is being fueled by the Fox News gang and their allied politicians. This is a theme they endlessly tout. I know this because Elon Musk has decided that I have to see the tweets of every right-wing politician and pundit in the country in my Twitter feed. (I have blocked most of them, but I still see plenty.)

As is often the case, Fox can have a huge impact on the national political agenda. We see this all the time, most obviously with the absurdity around Biden’s impeachment. Months of extensive investigation have produced absolutely nothing in terms of serious evidence and shot down most of the right-wing theories of President Biden’s corruption. Yet, the House is prepared to move forward, and close to half the country actually says they think there is a plausible basis for impeachment.

Anyhow, we know that Fox and its friends endlessly harp on out-of-control inflation. This may not correspond to reality, but that is not a big factor for many people. In short, I don’t think the issue is whether inflation will flip over to deflation, the question Rampell addresses, I think the issue is when, if ever, the right stops whining about inflation.

The Myths of Deflation

As long as we’re on the topic, I want to beat up on one of the myths about the problem of deflation. Rampell repeats the widely circulated story that when we see deflation, like what Japan had in the 1990s and 2000s, consumers will delay their purchases, leading to less demand and a weak economy.

I’m afraid this story does not make much sense. Deflation peaked in Japan at around a 1.0 percent annual rate, but it usually was a smaller decline. Would people really delay buying a $40 shirt or pair of pants because it might cost 20 cents less in six months? Even with a big-ticket item like a $30,000 car, would it make sense to delay the purchase six months to save $150?

Also, focusing on the overall index misses the fact that when inflation is close to zero the prices of many items are already falling. In fact, car prices often fell here in the decades before the pandemic, even as the overall inflation rate was positive. If the inflation rate falls from a rate of positive 1.0 percent to negative 1.0 percent, it just means that the balance of items with falling prices has increased.

There is a plausible story that falling prices hurt investment. If an auto manufacturer is looking to build a new factory, it is asking about how much it can expect to sell its cars for over the next ten or twenty years. If it believes that prices will be lower five or ten years out, then it will be less likely to build the factory.

For this reason, we can certainly tell the story that deflation would be bad news for the economy, but it is bad news in the same way that 1.0 percent inflation is worse than 2.0 percent inflation, crossing the zero mark means nothing. (We could tell a story of a deflationary spiral, but Japan never saw anything like that, nor has almost anyone else since the start of the Great Depression.) In short, deflation can be bad, but only in the same way, that very low inflation can be bad. Zero is not the problem.

Catherine Rampell had an interesting column dealing with the question of when prices will “come back down?” Rampell correctly answered “never,” but I am not convinced this is the real question people are posing.

Rampell deals with the question as being one about the overall Consumer Price Index (CPI). She is explicitly not talking about the price of the everyday items, like food and gas, that people purchase regularly.

This distinction is my reason for skepticism. First, the price of many food items has come back down. Overall food prices have not, but it actually is plausible that we will see further declines in the food basket.

The prices of most commodities, like wheat and corn, are pretty much back to their pre-pandemic level. Shipping costs have also fallen back to roughly pre-pandemic levels. And, corporations are complaining that they are losing some of the pricing power that they had during the pandemic.

All of this translates into a picture where the rate of inflation in food prices may drop further (the annual rate was 1.6 percent over the last three months) and could possibly turn negative. I doubt that food prices will fall back to pre-pandemic levels, but we may see the overall index decline for a period of time.

We see a different picture with gas prices. Production cutbacks by Saudi Arabia (was there a “perfect phone call” from Donald Trump?) have sent crude oil prices from $70 a barrel to $90 a barrel, raising gas prices back to almost $3.90 a gallon as a nationwide average.

However, it is plausible that these prices will fall again. For better or worse (obviously worse from a climate perspective), U.S. oil production is at a record high. Exploding growth in the EV market, especially in China and Europe, will reduce demand. Maybe Saudi Arabia will respond with further cuts (I don’t have a crystal ball), but it is not absurd to think that gas prices will come back down.

Anyhow, the point here is that the prices that are most directly in people’s faces can come back down. When we move beyond these prices to items like rent, owners’ equivalent rent (the rent you would pay yourself for living in a home you own), and new car purchases, I’m not sure that these fit well into most people’s conceptions of inflation.

Owners’ equivalent rent accounts for over a quarter of the CPI, do the two-thirds of households who own their home actively think about how much it would cost them to rent the place? Most people rarely buy a new car, and even used car purchases are not frequent (used car prices have been falling over the last year).

I also doubt that many people other than economists and people who write on economics have a clear vision of the overall CPI or the price index of their choosing. For this reason, I’m not sure that many people really expect prices to come back down. Average hourly wages have risen by almost 20 percent since the start of the pandemic, do people really expect that they will pay the same for stuff as they did in 2019?

It is also worth noting that prices never came back down in the 1980s. Ronald Reagan was singing about “Morning in America” in his 1984 re-election campaign when inflation was still over 4.0 percent.

My guess here is that the concern for prices coming back down is being fueled by the Fox News gang and their allied politicians. This is a theme they endlessly tout. I know this because Elon Musk has decided that I have to see the tweets of every right-wing politician and pundit in the country in my Twitter feed. (I have blocked most of them, but I still see plenty.)

As is often the case, Fox can have a huge impact on the national political agenda. We see this all the time, most obviously with the absurdity around Biden’s impeachment. Months of extensive investigation have produced absolutely nothing in terms of serious evidence and shot down most of the right-wing theories of President Biden’s corruption. Yet, the House is prepared to move forward, and close to half the country actually says they think there is a plausible basis for impeachment.

Anyhow, we know that Fox and its friends endlessly harp on out-of-control inflation. This may not correspond to reality, but that is not a big factor for many people. In short, I don’t think the issue is whether inflation will flip over to deflation, the question Rampell addresses, I think the issue is when, if ever, the right stops whining about inflation.

The Myths of Deflation

As long as we’re on the topic, I want to beat up on one of the myths about the problem of deflation. Rampell repeats the widely circulated story that when we see deflation, like what Japan had in the 1990s and 2000s, consumers will delay their purchases, leading to less demand and a weak economy.

I’m afraid this story does not make much sense. Deflation peaked in Japan at around a 1.0 percent annual rate, but it usually was a smaller decline. Would people really delay buying a $40 shirt or pair of pants because it might cost 20 cents less in six months? Even with a big-ticket item like a $30,000 car, would it make sense to delay the purchase six months to save $150?

Also, focusing on the overall index misses the fact that when inflation is close to zero the prices of many items are already falling. In fact, car prices often fell here in the decades before the pandemic, even as the overall inflation rate was positive. If the inflation rate falls from a rate of positive 1.0 percent to negative 1.0 percent, it just means that the balance of items with falling prices has increased.

There is a plausible story that falling prices hurt investment. If an auto manufacturer is looking to build a new factory, it is asking about how much it can expect to sell its cars for over the next ten or twenty years. If it believes that prices will be lower five or ten years out, then it will be less likely to build the factory.

For this reason, we can certainly tell the story that deflation would be bad news for the economy, but it is bad news in the same way that 1.0 percent inflation is worse than 2.0 percent inflation, crossing the zero mark means nothing. (We could tell a story of a deflationary spiral, but Japan never saw anything like that, nor has almost anyone else since the start of the Great Depression.) In short, deflation can be bad, but only in the same way, that very low inflation can be bad. Zero is not the problem.

Read More Leer más Join the discussion Participa en la discusión

The media have been giving considerable attention to the national debt in the last year or so. They have some cause, it has been rising rapidly, and more importantly, the interest burden of the debt has increased sharply since the Fed began raising rates last year. But, if we want to be serious, rather than just write scary headlines, we have to ask why the debt is a problem.

The first concern to dispel is the idea that the country somehow has to pay off its debt. Our national debt is in dollars, which the government prints. Unless something truly bizarre happens, we will always be able to print the dollars needed to pay interest and principal on government bonds.

We could have some story that if our economy collapses people could lose confidence in our debt. That is true, but a bit nuts. If our economy collapses, we should be worried about our economy collapsing, the debt is really beside the point.

The more serious issue is that rising interest payments will be a burden. This is a real issue, but there are several important qualifications. First, in spite of the large debt, even relative to the size of the economy, interest payments relative to GDP are not especially high. Currently, interest payments relative to GDP were just hitting 2.8 percent last quarter. They are still below the 4.4 percent share reached in the early 1990s. And, for history fans, this burden did not prevent the 1990s from being a period of general prosperity.

Military Spending

The second point is that we do need to put this burden in a bit of perspective since it is often treated as a generational issue. Suppose the interest burden does rise to three or four percent of GDP, or even higher. Is that an unbearable burden?

Back in my younger days, we used to spend a much larger share of the budget on the military. In the 1950s and 1960s military spending was generally over 8.0 percent of GDP. At the peak of the Vietnam War, it exceeded 10.0 percent of GDP. It dropped in the 1970s, but the Cold War buildup under Reagan again pushed it above 6.0 percent of GDP.

Military spending is currently under 3.0 percent of GDP. Suppose a magician came down and eliminated the national debt so we no longer had to pay any interest, but forced us to increase spending on the military to 6.0 percent of GDP. Are we now better off? Can we tell our children that they should be happy?

What we should care about with military spending is that we are secure as a country. If that can be accomplished by spending less than 3.0 percent of GDP on the military, then we are much better off than in a world where we are spending 6.0 percent of GDP on the military.

The amount of spending it takes to make us secure, and what that means, are obviously debatable points, but the basic logic is not. From the standpoint of maintaining and improving our living standards, spending on the military is the same thing as throwing money down the toilet.

This is an important point that needs to be yelled loudly at the people anxious to have a New Cold War with China. They also need to recognize that the Soviet economy peaked at around 60 percent of the size of the U.S. economy. The Chinese economy is already more than 20 percent larger using a purchasing power parity measure of GDP. This means that Cold War-type competition with China is likely to be incredibly expensive, even assuming we never get into an actual hot war.

Global Warming: Will We Celebrate Containing the Debt if the Planet Burns?

The third point on this generational issue is that we need to look around at the country and the world. Global warming is having a large and devastating effect on the environment. We are seeing an unprecedented wave of extreme weather events, including droughts, dangerous heat waves, hurricanes, and flooding. This will only get worse through time.

It is great that Biden put the country on a path toward clean energy with the Inflation Reduction Act, but we will need to do much more. Thankfully, the rest of the world, and especially China, is far ahead of us. The idea that somehow the debt is an overriding generational issue, when we are facing the destruction of the planet, is something that can only be taken seriously by our policy elites. Our success in limiting global warming will have infinitely more relevance to the quality of the lives seen by our children and grandchildren than anything that happens with the national debt.

Why Spend Money When We Can Just Issue Patent Monopolies?

The fourth point is that direct spending is only one way the government pays for things. The government supports a huge amount of innovation and creative work by awarding patent and copyright monopolies. While these monopolies are one way to provide incentives, they also carry an enormous cost. In the case of prescription drugs alone, they likely cost the country more than $400 billion a year (more than $3,000 per family, each year) in higher drug prices. We will spend over $570 billion this year for drugs that would likely cost us less than $100 billion if they were sold in a free market without patent monopolies or related protections.

If we look at the impact of these government-granted monopolies in other industries, like medical equipment, computers, software, video games, and movies, they almost certainly add more than $1 trillion a year to what households pay for goods and services. For some reason, the people screaming about the debt literally never say a word about the costs the government imposes on us by issuing patent and copyright monopolies.

And, these costs are interchangeable. For example, we can spend more money on government-funded research in developing prescription drugs and require that drugs developed as a result are available as generics sold in a free market. In the standard deficit accounting, we would only pick up the extra cost from the government-funded research. We would not see the savings from cheaper drugs, except insofar as the government paid less for buying drugs.

We could also go the other way. We could give out patent or copyright monopolies as a way to fund various government services. For example, we could give the Social Security trust fund a patent monopoly on ice that lasts for 1000 years. It could finance benefits by charging licensing fees for using ice. That would save the government around $1 trillion a year in Social Security spending. That should make the deficit hawks very happy.

Yeah, that would be absurdly inefficient and be a license for all sorts of corruption. But so is our current patent system, which does things like encourage drug companies to push opioids and lie about the effectiveness of their drugs. But, we know the deficit hawks, and many in the media who push their handouts, don’t care about efficiency, they just want lower debt. So, the patent monopoly on ice should be good with them.

Debt and Stock Prices

Okay, but I promised to say how a higher debt can be bad news like higher stock prices. This requires a little bit of Econ 101. The serious story of how higher debt is bad is that it can lead to higher interest payments.

The “can” here is important. The debt-to-GDP ratio rose considerably in the Great Recession and the years immediately following, but the ratio of interest payments to GDP fell. This was because we had very low-interest rates in these years. The Fed deliberately kept rates near zero because it was combatting weak growth and high unemployment, as we faced a period of secular stagnation.

We don’t know yet whether the economy will return to something like secular stagnation as the impact of the pandemic fades into the distance. Some of the factors that led to this stagnation, most notably slower population and labor force growth, and an upward skewed distribution of income, are still present. However, we have seen some reversal of the upward redistribution of income, as wage growth has been strongest for those at the bottom of the wage ladder. But, we don’t know how far this trend will go. We also don’t know if the full increase in profit shares will be reversed.

The impact of new technologies, most notably AI, is still very much unclear. If they do have a substantial impact on productivity growth, then we may again see rising unemployment and a need for the Fed to push rates lower. Also, as we switch to clean technologies, there will be less demand for fossil fuels and many of the associated services. Of course, these technologies may also be associated with an investment boom that will increase demand for labor.

There are reasonable arguments on both sides of the secular stagnation issue, but let’s assume that the Fed does not return to its zero-interest policy, but rather we get an interest rate structure that looks something like what we saw just before the pandemic. In that context, we will see higher interest payments as a share of GDP.

It is worth thinking for a moment why this would be bad. As the Modern Monetary Theory people remind us, the problem of a government deficit is not the financing – we can always print the money – the problem is that it can be inflationary since it can lead to too much demand in the economy.

Interest payments on the debt don’t directly create demand in the economy. They create demand only when people spend the interest payments. Insofar as the payments are made to high-income people with low propensities to consume, they will have a relatively limited impact on spending and demand. But not all interest payments go to rich people, and even rich people will spend some fraction of their interest.

So, the problem of higher interest payments on the debt is increased consumption demand, which can create inflationary pressures in the economy. This gets us to the problem of a rising stock market.

While some people think of the stock market as a way to raise money for investment, most firms rarely raise money through this channel. In fact, companies typically go public as a way for the initial investors to cash out their gains. The main economic impact of a rising stock market is not on investment but rather on consumption.

There is a well-known, stock wealth effect that is usually estimated at between 3 to 4 percent. This means that an additional dollar of stock wealth leads to an increase in annual consumption of 3 to 4 cents. Households currently hold around $30 trillion in stock wealth. If the stock market rises by 20 percent, that would create another $6 trillion in stock wealth.

Assuming that people spend 3-4 percent of this new wealth, we would see an increase in annual consumption of between $180 billion and $240 billion. If we are concerned about excess demand creating inflationary pressures in the economy, then we should be worried about the impact of this rise in stock wealth.

In that sense, a rising stock market is bad news for the economy in the same way as increased interest payments on government debt. If we assume that 70 percent of interest payments are spent, then a 20 percent rise in the stock market will create roughly the same inflationary pressure as $300 billion in additional interest payments.

So, if we are worried that interest on the debt will lead to inflation, we should also be reporting the bad news on inflation every time we see a big run-up in stock prices. In short, interest on the debt can be a problem, but it gets far more attention than items that are much bigger problems in any realistic assessment of the situation.

The media have been giving considerable attention to the national debt in the last year or so. They have some cause, it has been rising rapidly, and more importantly, the interest burden of the debt has increased sharply since the Fed began raising rates last year. But, if we want to be serious, rather than just write scary headlines, we have to ask why the debt is a problem.

The first concern to dispel is the idea that the country somehow has to pay off its debt. Our national debt is in dollars, which the government prints. Unless something truly bizarre happens, we will always be able to print the dollars needed to pay interest and principal on government bonds.

We could have some story that if our economy collapses people could lose confidence in our debt. That is true, but a bit nuts. If our economy collapses, we should be worried about our economy collapsing, the debt is really beside the point.

The more serious issue is that rising interest payments will be a burden. This is a real issue, but there are several important qualifications. First, in spite of the large debt, even relative to the size of the economy, interest payments relative to GDP are not especially high. Currently, interest payments relative to GDP were just hitting 2.8 percent last quarter. They are still below the 4.4 percent share reached in the early 1990s. And, for history fans, this burden did not prevent the 1990s from being a period of general prosperity.

Military Spending

The second point is that we do need to put this burden in a bit of perspective since it is often treated as a generational issue. Suppose the interest burden does rise to three or four percent of GDP, or even higher. Is that an unbearable burden?

Back in my younger days, we used to spend a much larger share of the budget on the military. In the 1950s and 1960s military spending was generally over 8.0 percent of GDP. At the peak of the Vietnam War, it exceeded 10.0 percent of GDP. It dropped in the 1970s, but the Cold War buildup under Reagan again pushed it above 6.0 percent of GDP.

Military spending is currently under 3.0 percent of GDP. Suppose a magician came down and eliminated the national debt so we no longer had to pay any interest, but forced us to increase spending on the military to 6.0 percent of GDP. Are we now better off? Can we tell our children that they should be happy?

What we should care about with military spending is that we are secure as a country. If that can be accomplished by spending less than 3.0 percent of GDP on the military, then we are much better off than in a world where we are spending 6.0 percent of GDP on the military.

The amount of spending it takes to make us secure, and what that means, are obviously debatable points, but the basic logic is not. From the standpoint of maintaining and improving our living standards, spending on the military is the same thing as throwing money down the toilet.

This is an important point that needs to be yelled loudly at the people anxious to have a New Cold War with China. They also need to recognize that the Soviet economy peaked at around 60 percent of the size of the U.S. economy. The Chinese economy is already more than 20 percent larger using a purchasing power parity measure of GDP. This means that Cold War-type competition with China is likely to be incredibly expensive, even assuming we never get into an actual hot war.

Global Warming: Will We Celebrate Containing the Debt if the Planet Burns?

The third point on this generational issue is that we need to look around at the country and the world. Global warming is having a large and devastating effect on the environment. We are seeing an unprecedented wave of extreme weather events, including droughts, dangerous heat waves, hurricanes, and flooding. This will only get worse through time.

It is great that Biden put the country on a path toward clean energy with the Inflation Reduction Act, but we will need to do much more. Thankfully, the rest of the world, and especially China, is far ahead of us. The idea that somehow the debt is an overriding generational issue, when we are facing the destruction of the planet, is something that can only be taken seriously by our policy elites. Our success in limiting global warming will have infinitely more relevance to the quality of the lives seen by our children and grandchildren than anything that happens with the national debt.

Why Spend Money When We Can Just Issue Patent Monopolies?

The fourth point is that direct spending is only one way the government pays for things. The government supports a huge amount of innovation and creative work by awarding patent and copyright monopolies. While these monopolies are one way to provide incentives, they also carry an enormous cost. In the case of prescription drugs alone, they likely cost the country more than $400 billion a year (more than $3,000 per family, each year) in higher drug prices. We will spend over $570 billion this year for drugs that would likely cost us less than $100 billion if they were sold in a free market without patent monopolies or related protections.

If we look at the impact of these government-granted monopolies in other industries, like medical equipment, computers, software, video games, and movies, they almost certainly add more than $1 trillion a year to what households pay for goods and services. For some reason, the people screaming about the debt literally never say a word about the costs the government imposes on us by issuing patent and copyright monopolies.

And, these costs are interchangeable. For example, we can spend more money on government-funded research in developing prescription drugs and require that drugs developed as a result are available as generics sold in a free market. In the standard deficit accounting, we would only pick up the extra cost from the government-funded research. We would not see the savings from cheaper drugs, except insofar as the government paid less for buying drugs.

We could also go the other way. We could give out patent or copyright monopolies as a way to fund various government services. For example, we could give the Social Security trust fund a patent monopoly on ice that lasts for 1000 years. It could finance benefits by charging licensing fees for using ice. That would save the government around $1 trillion a year in Social Security spending. That should make the deficit hawks very happy.

Yeah, that would be absurdly inefficient and be a license for all sorts of corruption. But so is our current patent system, which does things like encourage drug companies to push opioids and lie about the effectiveness of their drugs. But, we know the deficit hawks, and many in the media who push their handouts, don’t care about efficiency, they just want lower debt. So, the patent monopoly on ice should be good with them.

Debt and Stock Prices

Okay, but I promised to say how a higher debt can be bad news like higher stock prices. This requires a little bit of Econ 101. The serious story of how higher debt is bad is that it can lead to higher interest payments.

The “can” here is important. The debt-to-GDP ratio rose considerably in the Great Recession and the years immediately following, but the ratio of interest payments to GDP fell. This was because we had very low-interest rates in these years. The Fed deliberately kept rates near zero because it was combatting weak growth and high unemployment, as we faced a period of secular stagnation.

We don’t know yet whether the economy will return to something like secular stagnation as the impact of the pandemic fades into the distance. Some of the factors that led to this stagnation, most notably slower population and labor force growth, and an upward skewed distribution of income, are still present. However, we have seen some reversal of the upward redistribution of income, as wage growth has been strongest for those at the bottom of the wage ladder. But, we don’t know how far this trend will go. We also don’t know if the full increase in profit shares will be reversed.

The impact of new technologies, most notably AI, is still very much unclear. If they do have a substantial impact on productivity growth, then we may again see rising unemployment and a need for the Fed to push rates lower. Also, as we switch to clean technologies, there will be less demand for fossil fuels and many of the associated services. Of course, these technologies may also be associated with an investment boom that will increase demand for labor.

There are reasonable arguments on both sides of the secular stagnation issue, but let’s assume that the Fed does not return to its zero-interest policy, but rather we get an interest rate structure that looks something like what we saw just before the pandemic. In that context, we will see higher interest payments as a share of GDP.

It is worth thinking for a moment why this would be bad. As the Modern Monetary Theory people remind us, the problem of a government deficit is not the financing – we can always print the money – the problem is that it can be inflationary since it can lead to too much demand in the economy.

Interest payments on the debt don’t directly create demand in the economy. They create demand only when people spend the interest payments. Insofar as the payments are made to high-income people with low propensities to consume, they will have a relatively limited impact on spending and demand. But not all interest payments go to rich people, and even rich people will spend some fraction of their interest.

So, the problem of higher interest payments on the debt is increased consumption demand, which can create inflationary pressures in the economy. This gets us to the problem of a rising stock market.

While some people think of the stock market as a way to raise money for investment, most firms rarely raise money through this channel. In fact, companies typically go public as a way for the initial investors to cash out their gains. The main economic impact of a rising stock market is not on investment but rather on consumption.

There is a well-known, stock wealth effect that is usually estimated at between 3 to 4 percent. This means that an additional dollar of stock wealth leads to an increase in annual consumption of 3 to 4 cents. Households currently hold around $30 trillion in stock wealth. If the stock market rises by 20 percent, that would create another $6 trillion in stock wealth.

Assuming that people spend 3-4 percent of this new wealth, we would see an increase in annual consumption of between $180 billion and $240 billion. If we are concerned about excess demand creating inflationary pressures in the economy, then we should be worried about the impact of this rise in stock wealth.

In that sense, a rising stock market is bad news for the economy in the same way as increased interest payments on government debt. If we assume that 70 percent of interest payments are spent, then a 20 percent rise in the stock market will create roughly the same inflationary pressure as $300 billion in additional interest payments.

So, if we are worried that interest on the debt will lead to inflation, we should also be reporting the bad news on inflation every time we see a big run-up in stock prices. In short, interest on the debt can be a problem, but it gets far more attention than items that are much bigger problems in any realistic assessment of the situation.

Read More Leer más Join the discussion Participa en la discusión

• UnionsSindicatoUnited StatesEE. UU.Wage InequalityWorkersSector del trabajo

The strike of the UAW against the Big Three automakers raises many important issues that go well beyond the auto industry. It is worth taking a closer look at some of them. As I go through these, I should be clear that I have no inside knowledge about the negotiations, I just know what has been reported in the media.

Low Pay of Autoworkers

The first thing that is striking is how much the pay of many unionized autoworkers has fallen relative to economywide productivity. Going back forty years, a UAW job in the auto industry would have been a real prize for a worker without a college degree. The pay of an autoworker was sufficient to raise a family on a single income and send kids to college. It also covered health care and provided for a comfortable pension in retirement.

To be clear, there is nothing golden about a single-earner family. It is great that there are increased opportunities for women so that most are in the paid labor force. But, we would expect to see a two-earner household have a considerable income dividend over a one-earner household. This is often not the case.

According to reports in the media, many of the “temporary” workers in the industry are getting just $18 an hour. From 1938 to its peak purchasing power in 1968, the minimum wage rose not just in step with prices but also with productivity growth. This meant that minimum wage workers got their share of a growing economy.

After 1968, the minimum wage failed to keep pace with prices, with workers falling behind inflation. If the minimum wage had continued to keep pace with rising productivity, it would be over $25 an hour today. This means that many UAW workers are now being paid less than a minimum wage worker would have received in 2023 if Congress had kept raising the minimum wage in step with productivity, as it had done from 1938 to 1968.

Higher Productivity Can Mean Less Work, Not Fewer Workers

When the media are not hyperventilating about declining populations leading to a labor shortage, they are hyperventilating about how AI and robots will lead to mass unemployment. (Yes, those are complete opposites.) In fact, AI and robots are just newer versions of our old friend, productivity growth.

Productivity growth is the reason why most people do not have to work on farms growing our food. Productivity in agriculture has exploded over the last two centuries so that we can feed our population and even export food, with less than 2.0 percent of our workforce working in agriculture.

There are similar stories in other sectors. Productivity growth has radically reduced the need for workers in most sectors. It is why manufacturing now employs just over 8.3 percent of the workforce. (Yes, the trade deficit also reduces manufacturing employment, but even if we increase the figure by 20 percent, assuming something close to balanced trade, that still only gets us to 10.0 percent.)

Anyhow, we should not think of the technologies coming on the horizon as alien creatures. They are like the steam engine, electricity, the computer — new technologies that allow us to produce more with fewer labor hours.

Productivity growth has provided the basis for higher wages and living standards over time. It also can provide the basis for more leisure in the form of shorter workweeks, more vacations, and longer retirements. In the United States in the last four decades, we have taken the benefits of productivity growth (insofar as workers have seen them) primarily in the form of higher pay. In other countries, a much larger share of the benefits has been in the form of more leisure.

This has meant not only longer vacations (five or six weeks of paid vacation a year is now standard in Europe), but also paid family leave and paid sick days. Also, most other wealthy countries have lower ages at which workers qualify for Social Security benefits.

The UAW has put a 32-hour workweek on the table as one possible response to improvements in technology in the auto industry, specifically the shift to electric cars, which will require less labor. This is a great way of keeping workers employed as productivity improvements going forward allow us to produce more with less labor. If we can apply this formula more generally, then we can ensure that the benefits of adopting AI and the more widespread use of robots are widely shared.

In this context, it is worth debunking a foolish myth that enjoys great currency in elite circles. It is not technology that shifted income upward in the last half-century. It was our rules on technology that shifted income upward, most notably government-granted patent and copyright monopolies. There are alternative mechanisms for supporting innovation and creative work that would not lead to so much inequality.

CEO Pay is a Rip-off

The UAW has highlighted the issue of exploding CEO pay, pointing out that it has risen 40 percent over the last decade, with the CEO of GM now getting $27 million a year. This is a huge deal, and not just in a moral sense that we should be outraged about the inequality of CEOs getting paid 200 or 300 times as much as ordinary workers.

Unlike the case with ordinary workers, there is no real check on CEO pay. Ostensibly, corporate boards of directors are supposed to limit CEO pay to ensure that they are not ripping off the companies they work for. However, most directors don’t even see it as their job to limit CEO pay. Directors say that they see their job as serving top management. In that context, it is unsurprising that CEOs have seen their pay explode, going from 20 to 30 times the pay of ordinary workers to 200 to 300 times the pay of ordinary workers.

And, the issue is not just outlandish pay for the CEO. If the CEO is getting $27 million, the other top executives are likely getting $10 to $15 million, and third-tier executives are likely pocketing $2 million to $3 million. This also affects many structures outside the corporate sector. It is now common for presidents of universities and major foundations or charities to earn $2 to $3 million a year. Their second tier of management can pocket close to $1 million.

Imagine a world where CEOs still earn 20 to 30 times the compensation of ordinary employees, $2 million to $3 million a year. These pay structures would look very different. And, with less going to the top, there is more for everyone else. Suppose that in a world where the CEO of GM got $3 million and the pay of other top management was adjusted downward accordingly. This might free up around $200 million a year for ordinary workers. That would come to $4,000 annually for each of GM’s 50,000 UAW members. That doesn’t completely reverse forty years of stagnating wages, but it’s a good start.

Also, if the point is not obvious, there is nothing intrinsic to the market or capitalism that says CEO pay has to go through the roof. CEO pay has gone through the roof because of how we have structured the rules of corporate governance. Rules that gave shareholders (or anyone) better ability to contain CEO pay would result in a much different pay structure both at the top and in the economy as a whole.

Auto Industry Profits Provide Some Room for Higher Pay

It has been widely reported that GM made over $20 billion last year, with much of this being paid out to shareholders in the form of share buybacks or dividends. (For reasons I don’t understand, people get more upset about money paid out to shareholders as buybacks than dividends. I will add that Biden’s buyback tax is great news.) They jump from this number to saying that GM, and the other two auto giants, have plenty of money to pay their workers more.

Some important qualifications must be considered before giving workers all of GM’s profits. (That’s a joke, no one is proposing this.) First, GM’s net income, which is after-tax, was reported as $10.1 billion last year. Furthermore, this is a considerable jump from pre-pandemic levels when it was less than $7 billion a year.

In principle, it is net income that GM has available to finance its new investment. I said “in principle” because GM’s accountants tell us what GM’s net income is. There is reason to believe that it is fudged considerably, but the fact that the money they have left, after paying taxes and other expenses, is considerably less than gross profits is not disputable.

Anyhow, it seems that the profit figure reported for 2022 may have been somewhat inflated due to GM taking advantage of pandemic-related supply chain issues to raise margins. We may expect profits to return to something like pre-pandemic levels as supply conditions in the industry normalize.

The other fact that is not disputable is that GM does have to worry about its stock price. This is not because it matters much for its ongoing operations, whether it goes up or down by 10 percent or 20 percent, but an extraordinarily low stock price can leave the company vulnerable to a takeover. Paying out money to shareholders, as buybacks or dividends, helps to maintain the stock price.

Currently, GM’s market capitalization is $46.7 billion. Ford’s market cap is $50.5 billion. That means Elon Musk could buy both companies and still have half his fortune left to buy more social media companies and send people to Mars.

I couldn’t care less about the shareholders of these companies. But, if their stock prices fell sharply from current levels, these companies would be very vulnerable to takeovers. Union contracts stick in the event of a takeover, but contracts do expire. It would not be good for the UAW if some PE company committed to smashing the union were to take over GM and Ford. (We have seen this story many times.) For this reason, the UAW does have an interest in ensuring that these companies continue to maintain reasonable levels of profitability.

Just for some simple arithmetic, if GM raised pay for its 50,000 UAW members by an average of $10k each, that comes to $500 million a year. GM can surely afford that. An increase of $20k a year comes to $1 billion. Given that some of this will be passed on in higher prices, that still looks affordable. Getting much beyond that, I don’t know.

Inflated Stock Prices for Tesla and Other Wall Street Favorites Have a Cost

The flip side of the relatively low stock price for GM and Ford is the crazy price for Tesla. It now has a market cap close to $860 billion, almost 80 times its annual earnings. (GM’s price-to-earnings ratio is less than five.) This means that Elon Musk can raise capital at almost no cost by selling stock. That makes it difficult for other automakers to compete.

I haven’t tried to analyze Tesla’s stock price but I will say it looks high. (Brad DeLong did analyze it and came to this conclusion.) Anyhow, if the high price is just a case of irrational exuberance, the workers at the traditional car companies will pay a price.

We have seen this story many times in the past. My favorite example is when Time Warner, then the largest media company in the world, sold itself to AOL for AOL stock. AOL stock quickly plummeted, which means that the largest media company in the world essentially sold itself for nothing.

That made Steve Case and other big AOL shareholders incredibly rich but did nothing useful for the economy or Time Warner shareholders. These people now can enjoy lavish lifestyles – putting pressure on inflation – having essentially just pulled off an elaborate con. Anyhow, we do pay a price for irrational exuberance.

It Is Not an Issue of Electric vs. Gas-Powered Cars

Much of the media discussion has implied that UAW members stand to lose jobs from the Big Three’s conversion to electric cars. This is not true in any plausible universe. The Big Three currently have around 40 percent of the U.S. vehicle market, meaning the rest of the industry has around 60 percent.

The other manufacturers are rapidly adopting electric cars. The price of these cars is falling rapidly. Their ranges are improving and charging networks are being established nationwide. If the Big Three don’t also move rapidly to producing electric cars and compete in this market, their share of the total market is virtually certain to plummet.

Suppose the UAW were to block the Big Three’s shift to electric cars. If we can then envision a future ten or fifteen years out where their market share is down to 20 or 25 percent, is there any plausible story where that means more jobs, even if these are all gas-powered, than if their market share stays at 40 percent and half or more are electric? That seems a pretty hard story to tell.

In short, the Big Three have no choice but to move aggressively into producing electric vehicles. The UAW needs to fight to preserve as many jobs as possible, but blocking this shift is not a route that will do it.

The UAW and Big Three Are Still a Really Big Deal

The UAW contracts with the Big Three set a pattern for much of corporate America in the decades immediately following World War II. The auto industry is a much smaller part of the economy today than it was seventy-five years ago, and the Big Three have a much smaller share of the auto market. Nonetheless, the UAW’s negotiations are still drawing considerable attention. The outcome will likely have a major impact on the extent to which ordinary workers can share in the gains from productivity growth in the decades ahead.

The strike of the UAW against the Big Three automakers raises many important issues that go well beyond the auto industry. It is worth taking a closer look at some of them. As I go through these, I should be clear that I have no inside knowledge about the negotiations, I just know what has been reported in the media.

Low Pay of Autoworkers

The first thing that is striking is how much the pay of many unionized autoworkers has fallen relative to economywide productivity. Going back forty years, a UAW job in the auto industry would have been a real prize for a worker without a college degree. The pay of an autoworker was sufficient to raise a family on a single income and send kids to college. It also covered health care and provided for a comfortable pension in retirement.

To be clear, there is nothing golden about a single-earner family. It is great that there are increased opportunities for women so that most are in the paid labor force. But, we would expect to see a two-earner household have a considerable income dividend over a one-earner household. This is often not the case.

According to reports in the media, many of the “temporary” workers in the industry are getting just $18 an hour. From 1938 to its peak purchasing power in 1968, the minimum wage rose not just in step with prices but also with productivity growth. This meant that minimum wage workers got their share of a growing economy.

After 1968, the minimum wage failed to keep pace with prices, with workers falling behind inflation. If the minimum wage had continued to keep pace with rising productivity, it would be over $25 an hour today. This means that many UAW workers are now being paid less than a minimum wage worker would have received in 2023 if Congress had kept raising the minimum wage in step with productivity, as it had done from 1938 to 1968.

Higher Productivity Can Mean Less Work, Not Fewer Workers

When the media are not hyperventilating about declining populations leading to a labor shortage, they are hyperventilating about how AI and robots will lead to mass unemployment. (Yes, those are complete opposites.) In fact, AI and robots are just newer versions of our old friend, productivity growth.

Productivity growth is the reason why most people do not have to work on farms growing our food. Productivity in agriculture has exploded over the last two centuries so that we can feed our population and even export food, with less than 2.0 percent of our workforce working in agriculture.

There are similar stories in other sectors. Productivity growth has radically reduced the need for workers in most sectors. It is why manufacturing now employs just over 8.3 percent of the workforce. (Yes, the trade deficit also reduces manufacturing employment, but even if we increase the figure by 20 percent, assuming something close to balanced trade, that still only gets us to 10.0 percent.)

Anyhow, we should not think of the technologies coming on the horizon as alien creatures. They are like the steam engine, electricity, the computer — new technologies that allow us to produce more with fewer labor hours.

Productivity growth has provided the basis for higher wages and living standards over time. It also can provide the basis for more leisure in the form of shorter workweeks, more vacations, and longer retirements. In the United States in the last four decades, we have taken the benefits of productivity growth (insofar as workers have seen them) primarily in the form of higher pay. In other countries, a much larger share of the benefits has been in the form of more leisure.

This has meant not only longer vacations (five or six weeks of paid vacation a year is now standard in Europe), but also paid family leave and paid sick days. Also, most other wealthy countries have lower ages at which workers qualify for Social Security benefits.

The UAW has put a 32-hour workweek on the table as one possible response to improvements in technology in the auto industry, specifically the shift to electric cars, which will require less labor. This is a great way of keeping workers employed as productivity improvements going forward allow us to produce more with less labor. If we can apply this formula more generally, then we can ensure that the benefits of adopting AI and the more widespread use of robots are widely shared.

In this context, it is worth debunking a foolish myth that enjoys great currency in elite circles. It is not technology that shifted income upward in the last half-century. It was our rules on technology that shifted income upward, most notably government-granted patent and copyright monopolies. There are alternative mechanisms for supporting innovation and creative work that would not lead to so much inequality.

CEO Pay is a Rip-off

The UAW has highlighted the issue of exploding CEO pay, pointing out that it has risen 40 percent over the last decade, with the CEO of GM now getting $27 million a year. This is a huge deal, and not just in a moral sense that we should be outraged about the inequality of CEOs getting paid 200 or 300 times as much as ordinary workers.

Unlike the case with ordinary workers, there is no real check on CEO pay. Ostensibly, corporate boards of directors are supposed to limit CEO pay to ensure that they are not ripping off the companies they work for. However, most directors don’t even see it as their job to limit CEO pay. Directors say that they see their job as serving top management. In that context, it is unsurprising that CEOs have seen their pay explode, going from 20 to 30 times the pay of ordinary workers to 200 to 300 times the pay of ordinary workers.

And, the issue is not just outlandish pay for the CEO. If the CEO is getting $27 million, the other top executives are likely getting $10 to $15 million, and third-tier executives are likely pocketing $2 million to $3 million. This also affects many structures outside the corporate sector. It is now common for presidents of universities and major foundations or charities to earn $2 to $3 million a year. Their second tier of management can pocket close to $1 million.