The inflation hawks are getting restless. They are anxious to seize on any evidence of rising inflation as an opportunity to push the Fed to raise interest rates.

For this reason, many may be excited by the latest data from the Commerce Department showing that the overall PCE deflator is up 2.1 percent over the last year, with the core (excluding food and energy prices) rising by 1.8 percent. As the headline of the AP article carried by the New York Times put it, “consumer spending slows; inflation pushing higher.”

The case for a rise in the inflation rate is a bit weaker if we move out a decimal. The inflation rate in the core PCE deflator over the last year was 1.753 percent. This rounds up to 1.8 percent, but not by much.

Furthermore, this is a rent story. The rent component of the PCE has risen by 3.6 percent over the last year. If we pull this out, inflation in the core PCE would be just 1.3 percent over the last 12 months. That’s not a lot to get excited over.

The inflation hawks are getting restless. They are anxious to seize on any evidence of rising inflation as an opportunity to push the Fed to raise interest rates.

For this reason, many may be excited by the latest data from the Commerce Department showing that the overall PCE deflator is up 2.1 percent over the last year, with the core (excluding food and energy prices) rising by 1.8 percent. As the headline of the AP article carried by the New York Times put it, “consumer spending slows; inflation pushing higher.”

The case for a rise in the inflation rate is a bit weaker if we move out a decimal. The inflation rate in the core PCE deflator over the last year was 1.753 percent. This rounds up to 1.8 percent, but not by much.

Furthermore, this is a rent story. The rent component of the PCE has risen by 3.6 percent over the last year. If we pull this out, inflation in the core PCE would be just 1.3 percent over the last 12 months. That’s not a lot to get excited over.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

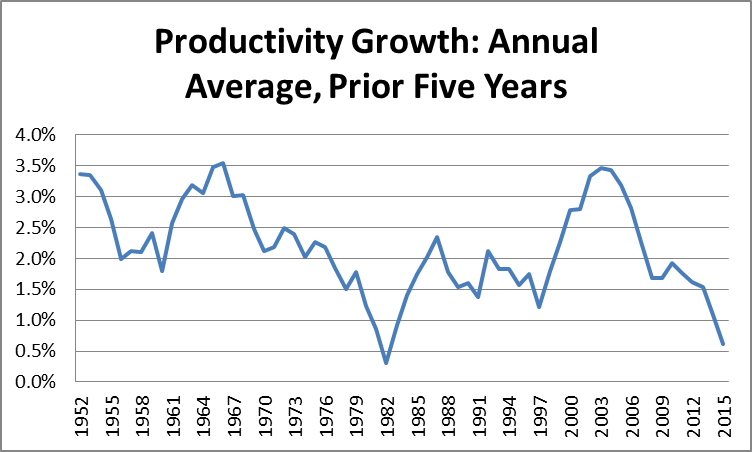

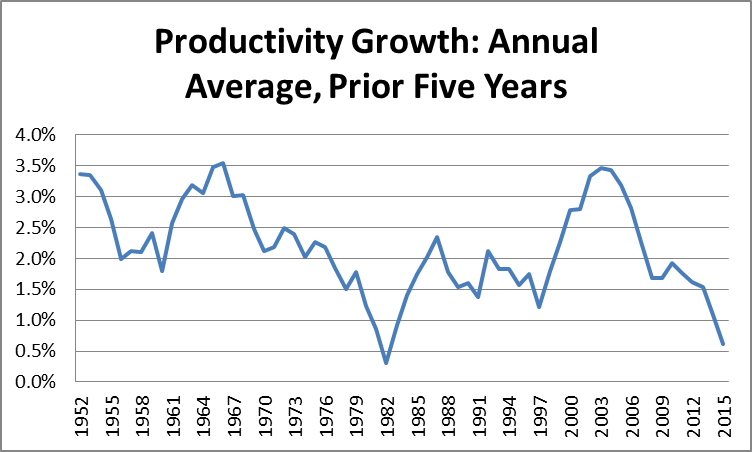

Marketplace radio had a peculiar piece asking what the world would have looked like if NAFTA never had been signed. The piece is odd because it dismisses job concerns associated with NAFTA by telling readers that automation (i.e. productivity growth) has been far more important in costing jobs.

“As in, ATMs replacing bankers, robots displacing welders. Automation is a very old story that goes back 250 years, but it has really picked up in the last couple decades.

“‘We economic developers have an old joke,’ said Charles Hayes of the Research Triangle Regional Partnership in an interview with Marketplace in 2010. ‘The manufacturing facility of the future will employ two people: one will be a man, and one will be a dog. And the man will be there to feed the dog. And the dog will be there to make sure the man doesn’t touch the equipment.’

“Ouch. But it turns out technology replaced workers in the course of reporting this very story.”

Actually, the Bureau of Labor Statistics tells us the opposite. Productivity growth did pick up from 1995 to 2005, rising back to its 1947 to 1973 Golden Age pace (a period of low unemployment and rapidly rising wages), but has slowed sharply in the last dozen years.

Source: Bureau of Labor Statistics.

While more rapid productivity growth would allow for faster wage and overall economic growth, no one has a very clear path for raising the rate of productivity growth. It is strange that Marketplace thinks our problem is a too rapid pace of productivity growth.

The piece is right in saying that the jobs impact of NAFTA was relatively limited. Certainly trade with China displaced many more workers. NAFTA may nonetheless have had a negative impact on the wages of many manufacturing workers. It made the threat to move operations to Mexico far more credible and many employers took advantage of this opportunity to discourage workers from joining unions and to make wage concessions. It’s surprising that the piece did not discuss this effect of NAFTA.

Marketplace radio had a peculiar piece asking what the world would have looked like if NAFTA never had been signed. The piece is odd because it dismisses job concerns associated with NAFTA by telling readers that automation (i.e. productivity growth) has been far more important in costing jobs.

“As in, ATMs replacing bankers, robots displacing welders. Automation is a very old story that goes back 250 years, but it has really picked up in the last couple decades.

“‘We economic developers have an old joke,’ said Charles Hayes of the Research Triangle Regional Partnership in an interview with Marketplace in 2010. ‘The manufacturing facility of the future will employ two people: one will be a man, and one will be a dog. And the man will be there to feed the dog. And the dog will be there to make sure the man doesn’t touch the equipment.’

“Ouch. But it turns out technology replaced workers in the course of reporting this very story.”

Actually, the Bureau of Labor Statistics tells us the opposite. Productivity growth did pick up from 1995 to 2005, rising back to its 1947 to 1973 Golden Age pace (a period of low unemployment and rapidly rising wages), but has slowed sharply in the last dozen years.

Source: Bureau of Labor Statistics.

While more rapid productivity growth would allow for faster wage and overall economic growth, no one has a very clear path for raising the rate of productivity growth. It is strange that Marketplace thinks our problem is a too rapid pace of productivity growth.

The piece is right in saying that the jobs impact of NAFTA was relatively limited. Certainly trade with China displaced many more workers. NAFTA may nonetheless have had a negative impact on the wages of many manufacturing workers. It made the threat to move operations to Mexico far more credible and many employers took advantage of this opportunity to discourage workers from joining unions and to make wage concessions. It’s surprising that the piece did not discuss this effect of NAFTA.

Read More Leer más Join the discussion Participa en la discusión

Morning Edition had a segment on Republican efforts to repeal Obamacare which reported on the desire of many Republican members of Congress to reduce the number of essential health benefits that must be covered by insurance. While the piece noted that part of the reason for the required benefits is to ensure people are covered in important areas, this is probably the less important reason for imposing requirements.

If people are allowed to pick and choose what conditions get covered, many more healthy people may opt for plans that cover few conditions and cost very little. If this happens, then plans that offer more comprehensive coverage will have a less healthy pool of beneficiaries, and therefore have to charge high fees. This will make insurance unaffordable for the people who most need it.

Morning Edition had a segment on Republican efforts to repeal Obamacare which reported on the desire of many Republican members of Congress to reduce the number of essential health benefits that must be covered by insurance. While the piece noted that part of the reason for the required benefits is to ensure people are covered in important areas, this is probably the less important reason for imposing requirements.

If people are allowed to pick and choose what conditions get covered, many more healthy people may opt for plans that cover few conditions and cost very little. If this happens, then plans that offer more comprehensive coverage will have a less healthy pool of beneficiaries, and therefore have to charge high fees. This will make insurance unaffordable for the people who most need it.

Read More Leer más Join the discussion Participa en la discusión

It’s great that there are so many jobs for mind readers in the media. This morning Tamara Keith used her talents in this area to tell listeners that members of the Republican “Freedom Caucus” in the House “believe” that reducing the areas of mandated coverage is the key to reducing the cost of insurance.

It’s good that we have someone who can tell us what these Freedom Caucus members really believe. Otherwise, many people might think that they were trying to reduce the areas of mandated coverage in order to allow healthy people to avoid subsidizing less healthy people.

Someone in good health can buy a plan with very little coverage, since odds are they will not need coverage for most conditions. These plans would be relatively low cost, since they are paying out little in benefits. On the other hand, plans that did cover more conditions would be extremely expensive and unaffordable to most people. If we didn’t have a NPR mind reader to tell us otherwise, we might think that this is the situation that the Freedom Caucus members are trying to bring about.

It’s great that there are so many jobs for mind readers in the media. This morning Tamara Keith used her talents in this area to tell listeners that members of the Republican “Freedom Caucus” in the House “believe” that reducing the areas of mandated coverage is the key to reducing the cost of insurance.

It’s good that we have someone who can tell us what these Freedom Caucus members really believe. Otherwise, many people might think that they were trying to reduce the areas of mandated coverage in order to allow healthy people to avoid subsidizing less healthy people.

Someone in good health can buy a plan with very little coverage, since odds are they will not need coverage for most conditions. These plans would be relatively low cost, since they are paying out little in benefits. On the other hand, plans that did cover more conditions would be extremely expensive and unaffordable to most people. If we didn’t have a NPR mind reader to tell us otherwise, we might think that this is the situation that the Freedom Caucus members are trying to bring about.

Read More Leer más Join the discussion Participa en la discusión

When we have a guy in the White House who imagines that millions of non-citizens are illegally voting and going undetected and that the former president tapped his phones, we know we are in the crazy season. Therefore it is not surprising to see George Will touting some bizarre principle of “universal access” to health insurance in his Washington Post column. There is no price tag associated with Will’s “access” so an insurance policy that is completely unaffordable to almost everyone would satisfy Will’s moral principle.

This is not a philosophical debate over various hypotheticals in the world. Obamacare was designed so that plans were mandated to cover a large range of conditions. This meant that the vast majority of the population, who don’t have expensive health care conditions, were subsidizing the relatively small group of people who do.

However, if we allow insurers to slice and dice plans, so that people who don’t suffer from certain conditions and are unlikely to in the future (e.g. women will not get prostate cancer and men won’t get pregnant) don’t have to pay the costs for those who do, then we can end up with a situation where some plans only have people with expensive health conditions and therefore are very expensive.

We could envision, for example, that plans would exclude pancreatic cancer, which is believed to be largely hereditary. People without a history of pancreatic cancer in their family would face little risk getting insurance that excludes this coverage. On the other hand, those with a history would be able to buy a plan that covered pancreatic cancer, but they would just have to pay an extremely high price since the insurers would know there was a high probability that anyone buying the plan would get pancreatic cancer.

In George Will’s world, all is good, since the principle of universal access has been met. Of course, in the world where the rest of us live, almost no one with a family history of pancreatic cancer would actually have health insurance.

When we have a guy in the White House who imagines that millions of non-citizens are illegally voting and going undetected and that the former president tapped his phones, we know we are in the crazy season. Therefore it is not surprising to see George Will touting some bizarre principle of “universal access” to health insurance in his Washington Post column. There is no price tag associated with Will’s “access” so an insurance policy that is completely unaffordable to almost everyone would satisfy Will’s moral principle.

This is not a philosophical debate over various hypotheticals in the world. Obamacare was designed so that plans were mandated to cover a large range of conditions. This meant that the vast majority of the population, who don’t have expensive health care conditions, were subsidizing the relatively small group of people who do.

However, if we allow insurers to slice and dice plans, so that people who don’t suffer from certain conditions and are unlikely to in the future (e.g. women will not get prostate cancer and men won’t get pregnant) don’t have to pay the costs for those who do, then we can end up with a situation where some plans only have people with expensive health conditions and therefore are very expensive.

We could envision, for example, that plans would exclude pancreatic cancer, which is believed to be largely hereditary. People without a history of pancreatic cancer in their family would face little risk getting insurance that excludes this coverage. On the other hand, those with a history would be able to buy a plan that covered pancreatic cancer, but they would just have to pay an extremely high price since the insurers would know there was a high probability that anyone buying the plan would get pancreatic cancer.

In George Will’s world, all is good, since the principle of universal access has been met. Of course, in the world where the rest of us live, almost no one with a family history of pancreatic cancer would actually have health insurance.

Read More Leer más Join the discussion Participa en la discusión

The NYT might have wrongly lead readers to believe that presidents prior to Donald Trump supported free trade in an article noting his refusal to go along with a G-20 statement proclaiming the importance of free trade. This is not true.

Past administrations of both parties have been vigorous supporters of longer and stronger patent and copyright protections. These protections can raise the price of protected items by factors of ten or even a hundred, making them equivalent to tariffs of 1000 and 10,000 percent. These protections lead to the same sorts of economic distortion and corruption that economists would predict from tariffs of this size.

Past administrations have also supported barriers that protect our most highly paid professionals, such as doctors and dentists, from foreign competition. They apparently believed that these professionals lack the skills necessary to compete in the global economy and therefore must be protected from the international competition. The result is that the rest of us pay close to $100 billion more each year for our medical bills ($700 per family).

The NYT might have wrongly lead readers to believe that presidents prior to Donald Trump supported free trade in an article noting his refusal to go along with a G-20 statement proclaiming the importance of free trade. This is not true.

Past administrations of both parties have been vigorous supporters of longer and stronger patent and copyright protections. These protections can raise the price of protected items by factors of ten or even a hundred, making them equivalent to tariffs of 1000 and 10,000 percent. These protections lead to the same sorts of economic distortion and corruption that economists would predict from tariffs of this size.

Past administrations have also supported barriers that protect our most highly paid professionals, such as doctors and dentists, from foreign competition. They apparently believed that these professionals lack the skills necessary to compete in the global economy and therefore must be protected from the international competition. The result is that the rest of us pay close to $100 billion more each year for our medical bills ($700 per family).

Read More Leer más Join the discussion Participa en la discusión