It is so annoying when the economy refuses to listen to what the economists say it should be doing. In this case, it seems to be ignoring the insistence that new jobs require more education and typically a college degree.

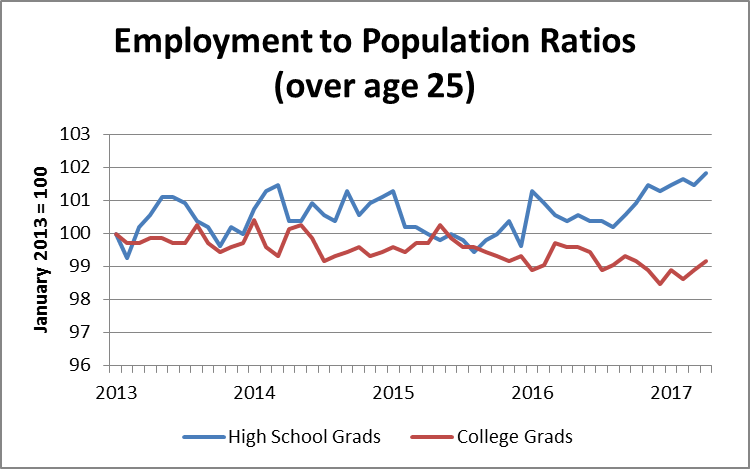

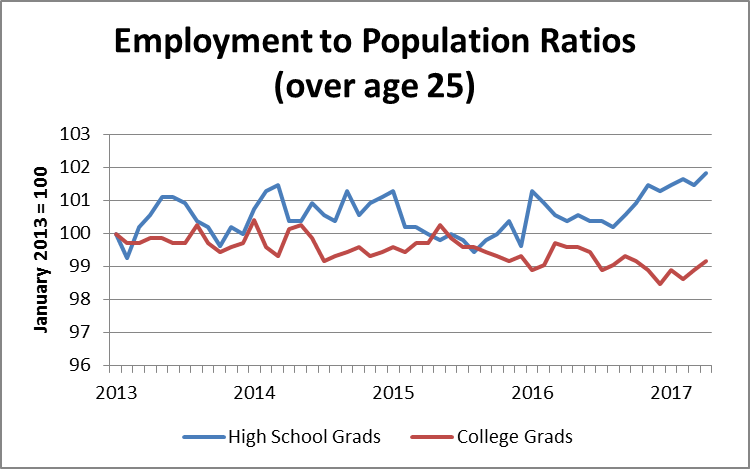

The problem is that in the last four years the employment-to-population ratio has actually been rising for people with just a high school degree while it is has fallen slightly for people with college degrees.

Since January of 2013, the employment-to-population ratio (EPOP) for people with just a high school degree has risen by almost two percentage points while it has fallen by almost one percentage point for college grads. This certainly doesn’t fit the simple story of people needing more education for the jobs being created in today’s economy.

Obviously, there are other factors at play here, but the most obvious one, the retirement of the baby boom generation, should work the other way. The people who reached retirement age during the last four years were disproportionately less educated, which should depress the EPOP of workers with just high school degrees relative to college grads.

To be clear, people with college degrees are undoubtedly better off in today’s labor market than those with less education. Their overall employment is 72 percent, compared to just 55 percent for high school grads. And, they get paid much more when they do work. But at least by the EPOP measure, it does not appear that the labor market is being increasingly tilted in their favor as often claimed.

It is so annoying when the economy refuses to listen to what the economists say it should be doing. In this case, it seems to be ignoring the insistence that new jobs require more education and typically a college degree.

The problem is that in the last four years the employment-to-population ratio has actually been rising for people with just a high school degree while it is has fallen slightly for people with college degrees.

Since January of 2013, the employment-to-population ratio (EPOP) for people with just a high school degree has risen by almost two percentage points while it has fallen by almost one percentage point for college grads. This certainly doesn’t fit the simple story of people needing more education for the jobs being created in today’s economy.

Obviously, there are other factors at play here, but the most obvious one, the retirement of the baby boom generation, should work the other way. The people who reached retirement age during the last four years were disproportionately less educated, which should depress the EPOP of workers with just high school degrees relative to college grads.

To be clear, people with college degrees are undoubtedly better off in today’s labor market than those with less education. Their overall employment is 72 percent, compared to just 55 percent for high school grads. And, they get paid much more when they do work. But at least by the EPOP measure, it does not appear that the labor market is being increasingly tilted in their favor as often claimed.

Read More Leer más Join the discussion Participa en la discusión

In his Washington Post column today George Will told readers that the problem of rising costs in the U.S. health care system is simply a case of Baumol’s disease. This refers to the problem identified by economist William Baumol (who recently died), that productivity in the service sector tends to rise less rapidly than productivity in the manufacturing sector. The implication is that if workers get paid the same in both sectors, then the cost of services will always rise relative to the cost of manufactured goods. Will tells us that this is the story of rapidly rising health care costs.

There are a couple of big problems with this story. First, it is not always the case that productivity in services rises less rapidly than productivity in manufacturing. ATMs have hugely increased the ability of banks to serve customers without tellers. Film developing became hugely more productive with digital cameras.

It is quite likely in the decades ahead that we will see innovations in technology that will lead to large increases in productivity in health care. For example, improvements in diagnostic technology will likely allow a skilled technician to diagnose illnesses with better accuracy than the best doctor. Similarly, robots will almost certainly be able to perform delicate surgeries with more precision than the best surgeon. In these and other areas of health care there is enormous potential for productivity gains, assuming that doctors and others who stand to lose don’t use their political power to block the technology.

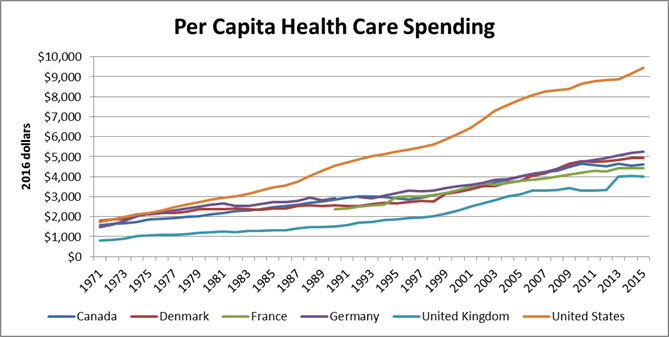

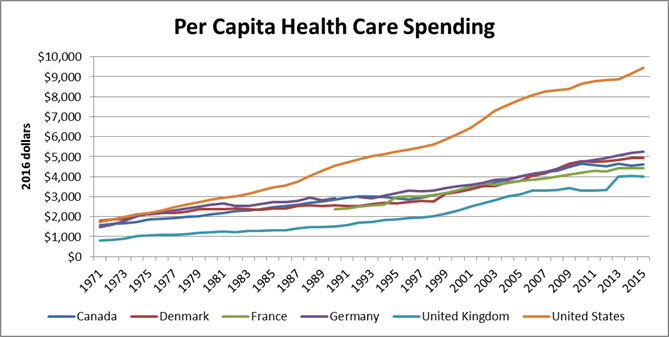

This brings up the second point. While health care costs have risen everywhere, no other country pays anything close to what we do in the United States, even though they have comparable outcomes. The figure below shows per capita health care spending in the United States and five other wealthy countries since 1971. (The numbers shown are from the OECD and expressed in purchasing power parity. I converted them to 2016 dollars using the PCE deflator.)

As can be seen, health care costs have been rising everywhere, but nowhere have they risen anywhere near as rapidly as in the United States. At the start of this period in 1971 the United States didn’t even lead the pack in per capita spending, coming in slightly below Denmark. In 2015, health care costs in the U.S. were more than twice as high as in Denmark and France and almost 2.4 times as high as in the United Kingdom. Even if we compare costs with Germany, the second most expensive country in this group, the savings would still be almost $4,200 a year per person, or more than $1.3 trillion for the country as a whole.

The reason our health care costs have risen so much more rapidly than anywhere else is not Baumol’s disease. Health care is a service everywhere, not just in the United States. The difference stems from the fact that doctors, insurers, drug companies, and medical equipment makers are far more capable of controlling the political process in the United States than in these other countries. They use their political power to restrict competition and get government subsidies. As a result, these actors are able to secure massive rents that come out of the pockets of the rest of us.

It is understandable that columnists and newspapers that would like to protect these rents would try to tell the public that high-cost health care is just a fact of nature, but it is not true.

In his Washington Post column today George Will told readers that the problem of rising costs in the U.S. health care system is simply a case of Baumol’s disease. This refers to the problem identified by economist William Baumol (who recently died), that productivity in the service sector tends to rise less rapidly than productivity in the manufacturing sector. The implication is that if workers get paid the same in both sectors, then the cost of services will always rise relative to the cost of manufactured goods. Will tells us that this is the story of rapidly rising health care costs.

There are a couple of big problems with this story. First, it is not always the case that productivity in services rises less rapidly than productivity in manufacturing. ATMs have hugely increased the ability of banks to serve customers without tellers. Film developing became hugely more productive with digital cameras.

It is quite likely in the decades ahead that we will see innovations in technology that will lead to large increases in productivity in health care. For example, improvements in diagnostic technology will likely allow a skilled technician to diagnose illnesses with better accuracy than the best doctor. Similarly, robots will almost certainly be able to perform delicate surgeries with more precision than the best surgeon. In these and other areas of health care there is enormous potential for productivity gains, assuming that doctors and others who stand to lose don’t use their political power to block the technology.

This brings up the second point. While health care costs have risen everywhere, no other country pays anything close to what we do in the United States, even though they have comparable outcomes. The figure below shows per capita health care spending in the United States and five other wealthy countries since 1971. (The numbers shown are from the OECD and expressed in purchasing power parity. I converted them to 2016 dollars using the PCE deflator.)

As can be seen, health care costs have been rising everywhere, but nowhere have they risen anywhere near as rapidly as in the United States. At the start of this period in 1971 the United States didn’t even lead the pack in per capita spending, coming in slightly below Denmark. In 2015, health care costs in the U.S. were more than twice as high as in Denmark and France and almost 2.4 times as high as in the United Kingdom. Even if we compare costs with Germany, the second most expensive country in this group, the savings would still be almost $4,200 a year per person, or more than $1.3 trillion for the country as a whole.

The reason our health care costs have risen so much more rapidly than anywhere else is not Baumol’s disease. Health care is a service everywhere, not just in the United States. The difference stems from the fact that doctors, insurers, drug companies, and medical equipment makers are far more capable of controlling the political process in the United States than in these other countries. They use their political power to restrict competition and get government subsidies. As a result, these actors are able to secure massive rents that come out of the pockets of the rest of us.

It is understandable that columnists and newspapers that would like to protect these rents would try to tell the public that high-cost health care is just a fact of nature, but it is not true.

Read More Leer más Join the discussion Participa en la discusión

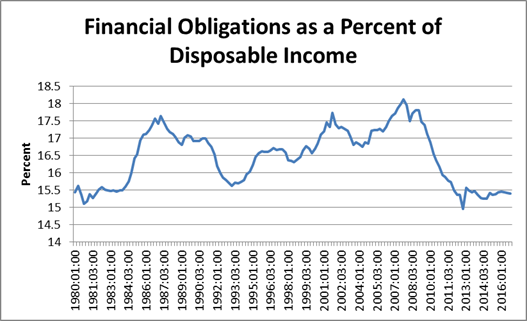

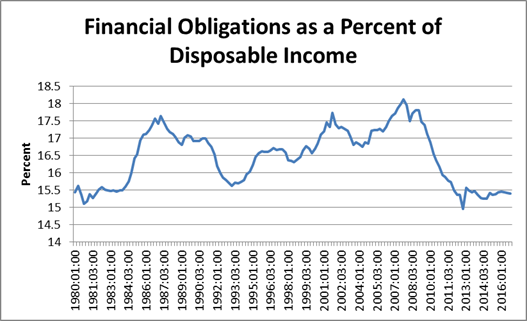

There were a number of articles about the scary news that debt levels are again above their housing bubble peaks. If you need something to be scared about (really?) I suppose you can worry about this, but if you want to seriously consider the economic impact of this data point, there ain’t much there.

There are two big differences between now and our previous peak ten years ago. One is that the economy and income is considerably higher today. The other major difference is that interest rates are considerably lower on average than they were ten years ago.

We actually have a very good summary statistic from the Federal Reserve Board that tells us the burden of the debt level. It is called the “financial obligations ratio.” It measures the ratio of debt service payments, plus rent, to disposable income. (Rent is included since rent and mortgage payments can be seen as substitutes.)

Here’s the story since they started the series in 1980.

Source: Federal Reserve Board.

Source: Federal Reserve Board.

As can be seen, at 15.4 percent, this ratio is near its low point for the last four decades. It is far below the peaks hit during the housing bubble years. In other words, there is little reason to worry about debt burdens suddenly creating a massive drag on the economy and leading to the sort of financial crisis we saw when the housing bubble collapsed.

This doesn’t mean that many people are not struggling to cope with student loans and other debts. Household income has barely recovered from pre-crisis levels and many families are still worse off than they were a decade ago. That’s a really bad story, but it doesn’t mean a financial crisis is imminent.

Can the picture change if interest rates rise? Sure, but not very quickly. (Most of this debt is fixed rate mortgage debt.) Furthermore, how much do we expect rates to rise and how quickly?

The long and short is that many people (not me) were caught sleeping by the run-up of debt in the housing bubble years. They aren’t making up for it by worrying about debt now, they are just being wrong again.

There were a number of articles about the scary news that debt levels are again above their housing bubble peaks. If you need something to be scared about (really?) I suppose you can worry about this, but if you want to seriously consider the economic impact of this data point, there ain’t much there.

There are two big differences between now and our previous peak ten years ago. One is that the economy and income is considerably higher today. The other major difference is that interest rates are considerably lower on average than they were ten years ago.

We actually have a very good summary statistic from the Federal Reserve Board that tells us the burden of the debt level. It is called the “financial obligations ratio.” It measures the ratio of debt service payments, plus rent, to disposable income. (Rent is included since rent and mortgage payments can be seen as substitutes.)

Here’s the story since they started the series in 1980.

Source: Federal Reserve Board.

Source: Federal Reserve Board.

As can be seen, at 15.4 percent, this ratio is near its low point for the last four decades. It is far below the peaks hit during the housing bubble years. In other words, there is little reason to worry about debt burdens suddenly creating a massive drag on the economy and leading to the sort of financial crisis we saw when the housing bubble collapsed.

This doesn’t mean that many people are not struggling to cope with student loans and other debts. Household income has barely recovered from pre-crisis levels and many families are still worse off than they were a decade ago. That’s a really bad story, but it doesn’t mean a financial crisis is imminent.

Can the picture change if interest rates rise? Sure, but not very quickly. (Most of this debt is fixed rate mortgage debt.) Furthermore, how much do we expect rates to rise and how quickly?

The long and short is that many people (not me) were caught sleeping by the run-up of debt in the housing bubble years. They aren’t making up for it by worrying about debt now, they are just being wrong again.

Read More Leer más Join the discussion Participa en la discusión

Morning Edition had an interview (sorry, not posted yet) with Republican Senator Ben Sasse talk about the need for honest leadership. He was critical of Donald Trump’s claims that he would help manufacturing workers. While the criticism is justified, Sasse condemned the idea of turning to protectionism.

Of course, the United States would not have to turn to protectionism: it has been practicing selective protectionism for decades. We have maintained the barriers that largely protect our doctors, dentists, and other highly paid professionals from foreign competition. This allows doctors and dentists to earn twice as much as their counterparts in Canada and Western Europe.

We also have been pushing longer and stronger patent and copyright protection in both trade deals and domestic law. This is the reason that we pay $440 billion (2.3 percent of GDP) a year for prescription drugs rather than their free market price, which would likely be in the range of $40 billion to $80 billion.

The protection for highly paid professionals and patent and copyrights are a major part of the upward redistribution of the last four decades. Unfortunately, Senator Sasse was not prepared to talk about this protectionism honestly even if he could condemn Donald Trump’s flirtation with protectionism for manufacturing workers as being dishonest.

Morning Edition had an interview (sorry, not posted yet) with Republican Senator Ben Sasse talk about the need for honest leadership. He was critical of Donald Trump’s claims that he would help manufacturing workers. While the criticism is justified, Sasse condemned the idea of turning to protectionism.

Of course, the United States would not have to turn to protectionism: it has been practicing selective protectionism for decades. We have maintained the barriers that largely protect our doctors, dentists, and other highly paid professionals from foreign competition. This allows doctors and dentists to earn twice as much as their counterparts in Canada and Western Europe.

We also have been pushing longer and stronger patent and copyright protection in both trade deals and domestic law. This is the reason that we pay $440 billion (2.3 percent of GDP) a year for prescription drugs rather than their free market price, which would likely be in the range of $40 billion to $80 billion.

The protection for highly paid professionals and patent and copyrights are a major part of the upward redistribution of the last four decades. Unfortunately, Senator Sasse was not prepared to talk about this protectionism honestly even if he could condemn Donald Trump’s flirtation with protectionism for manufacturing workers as being dishonest.

Read More Leer más Join the discussion Participa en la discusión

Who said it’s not a good labor market when you can get paid hundreds of millions of dollars for losing your investors money (compared with a stock index). The big question is why do the people who sign these contracts (managers of pension funds and university endowments) still have jobs?

Who said it’s not a good labor market when you can get paid hundreds of millions of dollars for losing your investors money (compared with a stock index). The big question is why do the people who sign these contracts (managers of pension funds and university endowments) still have jobs?

Read More Leer más Join the discussion Participa en la discusión

We have all heard the argument from conservatives about the benefits of relying on the private sector rather than the government. Private companies are fast moving and can respond more quickly to changing conditions and technology. By contrast, the government is slow and bureaucratic. And, there is more than a bit of truth to this story.

So what happens when we have the slow-moving bureaucratic government making payments to fast moving dynamic insurers in a program like Medicare. Well, all good believers in the superiority of the private sector will expect the insurers to rob the government blind. And this seems to be the case.

The NYT reported the allegations of a whistle-blower at United Health, the country’s largest insurer. According to the whistle-blower, Benjamin Poehling a former finance director at United Health, the company had a policy of altering patient’s medical conditions to put them in groups for which Medicare provides higher compensation.

The issue here involves Medicare Advantage program, which now includes roughly one-third of the people receiving Medicare benefits. People enrolled in Medicare Advantage get their health care covered by a private insurer. The insurer gets compensated by Medicare, with the fee adjusted depending on the patient’s health condition. The insurers get more money for enrolling a less healthy person than enrolling a more healthy person.

According to Mr. Poehling, United Health would find ways to have patients be labeled with conditions that came with higher reimbursements. He claims that other insurers engaged in the same practice. According to the piece, this could have meant billions of dollars in overpayments over the last 15 years. While this is not a large amount relative to Medicare’s total budget (the program will spend over $600 billion this year), it is a large amount for one company to steal.

This sort of gaming of a government program is exactly the sort of behavior that would be expected in this situation. Since insurers stand to gain large amounts of money by making their insurees appear sicker than they actually are, we should expect that they would engage in this sort of gaming.

While there is no easy way to prevent this sort of practice (the insurer will always know more about the health of the patient than the government), the best route is to have an effective deterrence. Since most cases of this sort of fraud are likely to go undetected, it is important that when individuals are caught, they face serious penalties.

If the higher-ups at United Health could look forward to spending most of the rest of their lives in jail, then it may discourage this sort of fraud in the future. Alternatively, we could look to go back to a single-payer system similar to the traditional Medicare program. Since neither of these outcomes seem likely at the moment, look forward to a lot more taxpayer dollars going into the pockets of corrupt insurance company executives.

Note: Typos corrected from earlier version, thanks to Robert Salzberg.

We have all heard the argument from conservatives about the benefits of relying on the private sector rather than the government. Private companies are fast moving and can respond more quickly to changing conditions and technology. By contrast, the government is slow and bureaucratic. And, there is more than a bit of truth to this story.

So what happens when we have the slow-moving bureaucratic government making payments to fast moving dynamic insurers in a program like Medicare. Well, all good believers in the superiority of the private sector will expect the insurers to rob the government blind. And this seems to be the case.

The NYT reported the allegations of a whistle-blower at United Health, the country’s largest insurer. According to the whistle-blower, Benjamin Poehling a former finance director at United Health, the company had a policy of altering patient’s medical conditions to put them in groups for which Medicare provides higher compensation.

The issue here involves Medicare Advantage program, which now includes roughly one-third of the people receiving Medicare benefits. People enrolled in Medicare Advantage get their health care covered by a private insurer. The insurer gets compensated by Medicare, with the fee adjusted depending on the patient’s health condition. The insurers get more money for enrolling a less healthy person than enrolling a more healthy person.

According to Mr. Poehling, United Health would find ways to have patients be labeled with conditions that came with higher reimbursements. He claims that other insurers engaged in the same practice. According to the piece, this could have meant billions of dollars in overpayments over the last 15 years. While this is not a large amount relative to Medicare’s total budget (the program will spend over $600 billion this year), it is a large amount for one company to steal.

This sort of gaming of a government program is exactly the sort of behavior that would be expected in this situation. Since insurers stand to gain large amounts of money by making their insurees appear sicker than they actually are, we should expect that they would engage in this sort of gaming.

While there is no easy way to prevent this sort of practice (the insurer will always know more about the health of the patient than the government), the best route is to have an effective deterrence. Since most cases of this sort of fraud are likely to go undetected, it is important that when individuals are caught, they face serious penalties.

If the higher-ups at United Health could look forward to spending most of the rest of their lives in jail, then it may discourage this sort of fraud in the future. Alternatively, we could look to go back to a single-payer system similar to the traditional Medicare program. Since neither of these outcomes seem likely at the moment, look forward to a lot more taxpayer dollars going into the pockets of corrupt insurance company executives.

Note: Typos corrected from earlier version, thanks to Robert Salzberg.

Read More Leer más Join the discussion Participa en la discusión

Gretchen Morgenson had a good piece this weekend on fees paid by public pension funds. These fees are large and have grown rapidly in recent decades. The fees go to some of the richest people in the country, such as private equity and hedge fund managers (think of Peter Peterson or Mitt Romney).

The fees often do not correspond to any benefits to the pension funds in the form of higher returns. In other words, these fees are the equivalent of a massive welfare program under which the taxpayers are putting money in the pockets of some of the richest people in the country — for doing nothing.

A simple way to combat this taxpayer handout to the very wealthy is strong transparency requirements. If pension funds were required to public post the full terms of all contracts with pension fund advisers, private equity companies, and others involved in managing their money, along with the returns on the assets, it would likely cut down on the heist.

It’s simple, but probably too big of a lift in the corrupt political environment of the U.S. today.

Gretchen Morgenson had a good piece this weekend on fees paid by public pension funds. These fees are large and have grown rapidly in recent decades. The fees go to some of the richest people in the country, such as private equity and hedge fund managers (think of Peter Peterson or Mitt Romney).

The fees often do not correspond to any benefits to the pension funds in the form of higher returns. In other words, these fees are the equivalent of a massive welfare program under which the taxpayers are putting money in the pockets of some of the richest people in the country — for doing nothing.

A simple way to combat this taxpayer handout to the very wealthy is strong transparency requirements. If pension funds were required to public post the full terms of all contracts with pension fund advisers, private equity companies, and others involved in managing their money, along with the returns on the assets, it would likely cut down on the heist.

It’s simple, but probably too big of a lift in the corrupt political environment of the U.S. today.

Read More Leer más Join the discussion Participa en la discusión

Bloomberg reports that Esther George, perhaps the Fed’s biggest inflation hawk, has a new argument for raising interest rates: she claims that inflation is a big tax on the poor. This is peculiar for two reasons.

First, the people who are denied work as a result of higher interest rates will be disproportionately those at the bottom of the ladder: African Americans, Hispanics, and workers with less education. Furthermore, higher unemployment rates mean that the workers who have jobs will have less bargaining power and be less able to push up their wages. It’s hard to see how people who lose jobs and get lower pay increases will benefit from a slightly lower inflation rate.

The other reason why the argument doesn’t quite work is that even the modest inflation we have seen in recent years is driven almost entirely by rising rents.

Source: Bureau of Labor Statistics.

Higher interest rates could actually make rental inflation worse. An immediate effect of higher interest rates is lower construction. This will reduce the supply of housing in cities with rapidly rising rents, making the shortage of housing units worse. This will compound the negative effect of reduced labor market opportunities.

That hardly seems like a winning policy option for the poor.

Bloomberg reports that Esther George, perhaps the Fed’s biggest inflation hawk, has a new argument for raising interest rates: she claims that inflation is a big tax on the poor. This is peculiar for two reasons.

First, the people who are denied work as a result of higher interest rates will be disproportionately those at the bottom of the ladder: African Americans, Hispanics, and workers with less education. Furthermore, higher unemployment rates mean that the workers who have jobs will have less bargaining power and be less able to push up their wages. It’s hard to see how people who lose jobs and get lower pay increases will benefit from a slightly lower inflation rate.

The other reason why the argument doesn’t quite work is that even the modest inflation we have seen in recent years is driven almost entirely by rising rents.

Source: Bureau of Labor Statistics.

Higher interest rates could actually make rental inflation worse. An immediate effect of higher interest rates is lower construction. This will reduce the supply of housing in cities with rapidly rising rents, making the shortage of housing units worse. This will compound the negative effect of reduced labor market opportunities.

That hardly seems like a winning policy option for the poor.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post ran a column by

“Canadian authorities do not inspect every shipment of products headed for the U.S. marketplace to ensure that packages don’t contain adulterated, counterfeit or illegal drugs. Canada does not have the resources to undertake such comprehensive searches, and the Canadian and U.S. governments are not currently set up to facilitate such a program. Canada’s health-inspection regime is designed to ensure the safety of medications for Canadians, not for other countries.”

While this is undoubtedly true, there is a little secret that fans of economics and logic have long known. With additional money, Canada could expand the size of its regulatory agency so it would have the resources to undertake such comprehensive searches.

And, where might Canada get the additional money? It can tax the drugs being sold to people in the United States. With the price of drugs in the United States often two or three times the price of drugs in Canada, there is plenty of room to impose a tax to cover the additional inspection costs and still leave massive savings for people in the United States.

The entire Food and Drug Administration budget for medical product safety last year was $2.7 billion. We will spend over $440 billion on prescription drugs in 2017. A small tax on whatever passes through Canada should easily cover the cost of inspections and, in fact, could cover the cost for Canada as well. This is a classic win-win through trade under which everyone can benefit.

Of course, Ms. Aglukkaq is correct that this is not a good solution to the problem of making drugs affordable in the U.S. We should be looking for alternatives to supporting research through government granted patent monopolies, as Senator Sanders has been doing. Along with Sherrod Brown and 15 other Democratic senators, Sanders has proposed money for a prize fund which would buy up the patents for approved drugs and put them in the public domain so that they could be sold at their free market price.

The bill also proposes that the government pay for the clinical testing of new drugs. The test results would be in the public domain, which would enormously benefit researchers and doctors when deciding which drugs to prescribe. And, the approved drug would also be available at free market prices.

The big problem is that, while drugs are cheap, patent monopolies make them expensive. Unfortunately, the Washington Post doesn’t like people pointing things like this out on its opinion page. (It is probably worth mentioning that the Post gets large amounts of advertising revenue from drug companies.)

The Washington Post ran a column by

“Canadian authorities do not inspect every shipment of products headed for the U.S. marketplace to ensure that packages don’t contain adulterated, counterfeit or illegal drugs. Canada does not have the resources to undertake such comprehensive searches, and the Canadian and U.S. governments are not currently set up to facilitate such a program. Canada’s health-inspection regime is designed to ensure the safety of medications for Canadians, not for other countries.”

While this is undoubtedly true, there is a little secret that fans of economics and logic have long known. With additional money, Canada could expand the size of its regulatory agency so it would have the resources to undertake such comprehensive searches.

And, where might Canada get the additional money? It can tax the drugs being sold to people in the United States. With the price of drugs in the United States often two or three times the price of drugs in Canada, there is plenty of room to impose a tax to cover the additional inspection costs and still leave massive savings for people in the United States.

The entire Food and Drug Administration budget for medical product safety last year was $2.7 billion. We will spend over $440 billion on prescription drugs in 2017. A small tax on whatever passes through Canada should easily cover the cost of inspections and, in fact, could cover the cost for Canada as well. This is a classic win-win through trade under which everyone can benefit.

Of course, Ms. Aglukkaq is correct that this is not a good solution to the problem of making drugs affordable in the U.S. We should be looking for alternatives to supporting research through government granted patent monopolies, as Senator Sanders has been doing. Along with Sherrod Brown and 15 other Democratic senators, Sanders has proposed money for a prize fund which would buy up the patents for approved drugs and put them in the public domain so that they could be sold at their free market price.

The bill also proposes that the government pay for the clinical testing of new drugs. The test results would be in the public domain, which would enormously benefit researchers and doctors when deciding which drugs to prescribe. And, the approved drug would also be available at free market prices.

The big problem is that, while drugs are cheap, patent monopolies make them expensive. Unfortunately, the Washington Post doesn’t like people pointing things like this out on its opinion page. (It is probably worth mentioning that the Post gets large amounts of advertising revenue from drug companies.)

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión