When you’re rich and powerful in the United States you get to lie freely to advance your position in public debate, including the opinion page of The New York Times. This is why the paper ran an anti-free trade diatribe against China, insisting that the country respect patent and copyright protections claimed by U.S. companies.

The column, by two former U.S. intelligence officials, asserted:

“Chinese companies, with the encouragement of official Chinese policy and often the active participation of government personnel, have been pillaging the intellectual property of American companies. All together, intellectual-property theft costs America up to $600 billion a year, the greatest transfer of wealth in history. China accounts for most of that loss.”

Hmmm, $600 billion a year? That’s more than 3 percent of U.S. GDP, it’s more than 25 percent of all U.S. exports, it’s roughly 30 times what we spend each year on TANF. Does that make sense?

The column doesn’t give the source for this number, but when the industry groups have come up with these sorts of figures in the past, it is usually by assigning the retail value of their product in the United States to every unauthorized copy everywhere in the world. Let’s say that there are 100 million unauthorized versions of Microsoft Windows in China. (I have no idea if this is a reasonable number.) If the retail price of Windows is $50 a copy, then the industry group writes down $5 billion as the theft, even if most of these people would switch to a decent operating system even if they were just charged a couple of dollars for Windows.

We get the same story for prescription drugs. A generic version of a drug like the Hepatitis C drug Sovaldi may sell for a few hundred dollars in the developing world. Gilead Sciences has a retail price of $84,000. If there are a million treatments in India and elsewhere, this comes to $84 billion in “theft.” We, of course, have to skip the fact that Gilead Sciences doesn’t have clear patent rights to this drug in much of the world. If they say so, it is good enough for the debate and The New York Times.

Anyhow, it is striking that this sort of nonsense is supposed to be treated respectfully by serious people. We expect President Trump and other political figures to go to bat with China and other countries to enforce the claims of Microsoft, Pfizer, and other companies whining about their intellectual “property,” but when it comes to adjusting currency values to address the trade deficit — well, then we are all really wimpy and can’t do anything. After all, that is just about the income of manufacturing workers (you know uneducated people), not the money of people who really matter.

So, there you have it. The folks who matter have a right to expect the president to massively interfere in the internal affairs of China and other countries to make them richer. But, ordinary workers? Well, let’s twiddle our thumbs and pretend to give a damn.

When you’re rich and powerful in the United States you get to lie freely to advance your position in public debate, including the opinion page of The New York Times. This is why the paper ran an anti-free trade diatribe against China, insisting that the country respect patent and copyright protections claimed by U.S. companies.

The column, by two former U.S. intelligence officials, asserted:

“Chinese companies, with the encouragement of official Chinese policy and often the active participation of government personnel, have been pillaging the intellectual property of American companies. All together, intellectual-property theft costs America up to $600 billion a year, the greatest transfer of wealth in history. China accounts for most of that loss.”

Hmmm, $600 billion a year? That’s more than 3 percent of U.S. GDP, it’s more than 25 percent of all U.S. exports, it’s roughly 30 times what we spend each year on TANF. Does that make sense?

The column doesn’t give the source for this number, but when the industry groups have come up with these sorts of figures in the past, it is usually by assigning the retail value of their product in the United States to every unauthorized copy everywhere in the world. Let’s say that there are 100 million unauthorized versions of Microsoft Windows in China. (I have no idea if this is a reasonable number.) If the retail price of Windows is $50 a copy, then the industry group writes down $5 billion as the theft, even if most of these people would switch to a decent operating system even if they were just charged a couple of dollars for Windows.

We get the same story for prescription drugs. A generic version of a drug like the Hepatitis C drug Sovaldi may sell for a few hundred dollars in the developing world. Gilead Sciences has a retail price of $84,000. If there are a million treatments in India and elsewhere, this comes to $84 billion in “theft.” We, of course, have to skip the fact that Gilead Sciences doesn’t have clear patent rights to this drug in much of the world. If they say so, it is good enough for the debate and The New York Times.

Anyhow, it is striking that this sort of nonsense is supposed to be treated respectfully by serious people. We expect President Trump and other political figures to go to bat with China and other countries to enforce the claims of Microsoft, Pfizer, and other companies whining about their intellectual “property,” but when it comes to adjusting currency values to address the trade deficit — well, then we are all really wimpy and can’t do anything. After all, that is just about the income of manufacturing workers (you know uneducated people), not the money of people who really matter.

So, there you have it. The folks who matter have a right to expect the president to massively interfere in the internal affairs of China and other countries to make them richer. But, ordinary workers? Well, let’s twiddle our thumbs and pretend to give a damn.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

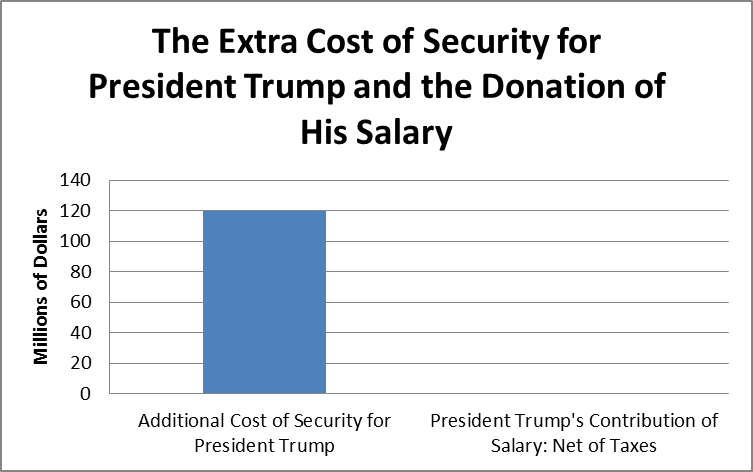

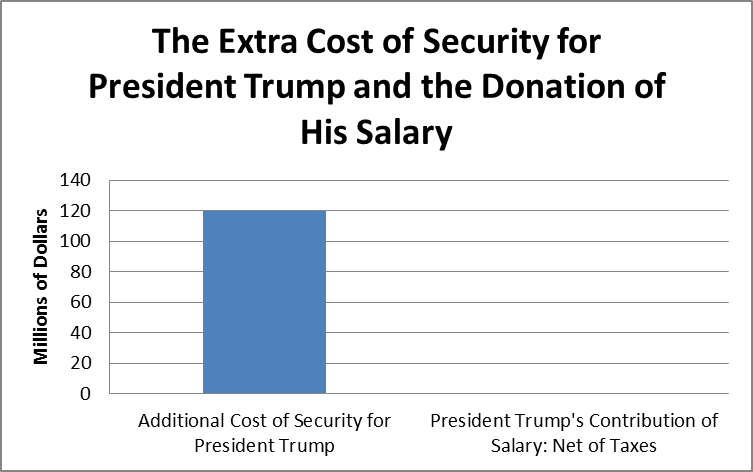

President Trump has made a point of very publicly donating his $400,000 annual salary as president to various civic minded efforts. He recently announced the donation of $100,000 to a camp run by the Department of Education to encourage women to enter science, technology, education, and math. He donated his first quarter’s pay of $100,000 the National Park Service to help pay for the cost of the restoration of the Civil War battlefield at Antietam.

While these contributions will likely support socially useful activities, people should not be misled into thinking the national budget has benefited by having a billionaire business person in the White House. According to the New York Times, Congress had to appropriate an additional $120 million to cover the additional security costs required by Trump as a result of the unusual security demands that he and his family have placed on the Secret Service and government agencies.

To be clear, these are not the normal costs of protecting the president. This $120 million is additional spending that was needed as a result of factors unique to Trump. This includes the Secret Service protection for his adult children (adult children of prior presidents have not been protected), his decision to have his wife and one of his sons stay in New York for the first six months of his presidency, and his habit of visiting Trump properties rather than vacationing at Camp David, like prior presidents. Camp David is already well-secured, and therefore does not require much additional spending when the president visits. This is not the case with Mar-a-Lago and various other Trump properties.

The chart below gives the relative costs of the additional security spending required by the Trump family and the value of his donated salary, net of taxes. (It assumes that he would pay 40 percent of his $400,000 annual salary in taxes.)

Source: New York Times and CNN.

As can be seen, the additional cost of security for President Trump and his family is more than 400 times the net value of the contribution of his presidential paycheck. The public would be considerably better off with a president who pocketed his paycheck and made less extravagant security demands on the Secret Service and other governmental agencies.

President Trump has made a point of very publicly donating his $400,000 annual salary as president to various civic minded efforts. He recently announced the donation of $100,000 to a camp run by the Department of Education to encourage women to enter science, technology, education, and math. He donated his first quarter’s pay of $100,000 the National Park Service to help pay for the cost of the restoration of the Civil War battlefield at Antietam.

While these contributions will likely support socially useful activities, people should not be misled into thinking the national budget has benefited by having a billionaire business person in the White House. According to the New York Times, Congress had to appropriate an additional $120 million to cover the additional security costs required by Trump as a result of the unusual security demands that he and his family have placed on the Secret Service and government agencies.

To be clear, these are not the normal costs of protecting the president. This $120 million is additional spending that was needed as a result of factors unique to Trump. This includes the Secret Service protection for his adult children (adult children of prior presidents have not been protected), his decision to have his wife and one of his sons stay in New York for the first six months of his presidency, and his habit of visiting Trump properties rather than vacationing at Camp David, like prior presidents. Camp David is already well-secured, and therefore does not require much additional spending when the president visits. This is not the case with Mar-a-Lago and various other Trump properties.

The chart below gives the relative costs of the additional security spending required by the Trump family and the value of his donated salary, net of taxes. (It assumes that he would pay 40 percent of his $400,000 annual salary in taxes.)

Source: New York Times and CNN.

As can be seen, the additional cost of security for President Trump and his family is more than 400 times the net value of the contribution of his presidential paycheck. The public would be considerably better off with a president who pocketed his paycheck and made less extravagant security demands on the Secret Service and other governmental agencies.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post had a column by Ohio attorney general Mike DeWine explaining why he was suing five opioid manufacturers. Dewine explains:

“We believe evidence will show that they flooded the market with prescription opioids, such as OxyContin and Percocet, and grossly misleading information about the risks and benefits of these drugs. And as a result, we believe countless Ohioans and other Americans have become hooked on opioid pain medications, all too often leading to the use of cheaper alternatives such as heroin and synthetic opioids. Almost 80 percent of heroin users start with prescription opioids.”

The incentive to distribute “grossly misleading” information about their products comes from the government-granted patent monopolies which allow companies to charge prices that can be several thousand percent above the free market price. This is straight textbook economics. Corporations are motivated by profit. If they can sell a pill for five dollars that costs them a few cents to manufacture, they have an enormous incentive to market it as widely as possible.

This is a problem with prescription drugs more generally. Manufacturers often exaggerate the effectiveness and safety of their drugs. While it is illegal to knowingly misrepresent the quality of a drug, it is extremely difficult to prove this in court, which means a company has a big incentive to do so. The cost to the public from such misrepresentations is enormous, and unfortunately, it gets very little attention from the media even in the context of the opioid crisis where it is quite obvious.

In the case of opioids, it is true that some of the villains are generic manufacturers. When a drug comes off patent, it is subject to competition. However, even the generics benefit from the high prices that result from patent and related protection. The first generic in a market gets six months of exclusivity, which means that no other generic is allowed to enter the market. Over time more generics will typically enter bringing the price closer to the free market price, but there will be a substantial period in which prices remain inflated, compared to a scenario in which all drugs could be produced as generics on the day they were approved by the Food and Drug Administration.

Addendum

Since some folks don’t think the pharmaceutical industry has been deliberately pushing opioids, here a good WaPo piece on the topic.

The Washington Post had a column by Ohio attorney general Mike DeWine explaining why he was suing five opioid manufacturers. Dewine explains:

“We believe evidence will show that they flooded the market with prescription opioids, such as OxyContin and Percocet, and grossly misleading information about the risks and benefits of these drugs. And as a result, we believe countless Ohioans and other Americans have become hooked on opioid pain medications, all too often leading to the use of cheaper alternatives such as heroin and synthetic opioids. Almost 80 percent of heroin users start with prescription opioids.”

The incentive to distribute “grossly misleading” information about their products comes from the government-granted patent monopolies which allow companies to charge prices that can be several thousand percent above the free market price. This is straight textbook economics. Corporations are motivated by profit. If they can sell a pill for five dollars that costs them a few cents to manufacture, they have an enormous incentive to market it as widely as possible.

This is a problem with prescription drugs more generally. Manufacturers often exaggerate the effectiveness and safety of their drugs. While it is illegal to knowingly misrepresent the quality of a drug, it is extremely difficult to prove this in court, which means a company has a big incentive to do so. The cost to the public from such misrepresentations is enormous, and unfortunately, it gets very little attention from the media even in the context of the opioid crisis where it is quite obvious.

In the case of opioids, it is true that some of the villains are generic manufacturers. When a drug comes off patent, it is subject to competition. However, even the generics benefit from the high prices that result from patent and related protection. The first generic in a market gets six months of exclusivity, which means that no other generic is allowed to enter the market. Over time more generics will typically enter bringing the price closer to the free market price, but there will be a substantial period in which prices remain inflated, compared to a scenario in which all drugs could be produced as generics on the day they were approved by the Food and Drug Administration.

Addendum

Since some folks don’t think the pharmaceutical industry has been deliberately pushing opioids, here a good WaPo piece on the topic.

Read More Leer más Join the discussion Participa en la discusión

I had a blog post a couple of days back in which I argued that rising stock prices reflected expectations of higher future corporate earnings, at least insofar as they were not just driven by irrational exuberance. Since no one seems to be expecting higher growth, the expectation of higher corporate profits presumably means that investors are expecting a redistribution of income away from workers and consumers to corporate profits. This is actually a plausible scenario given Donald Trump’s proposed tax cuts and his plans for changing regulations in ways that will benefit corporations.

This is good news for the 10 percent or so of the population that holds substantial amounts of stock. It is pretty bad news for everyone else. In other words, you probably wouldn’t want to be boasting about a run-up in stock prices unless you think it’s good news to redistribute money from everyone else to the richest 10 percent and especially the richest one percent.

Narayana Kocherlakota, the former president of the Minneapolis Federal Reserve district bank, and a very good economist, disagreed with my assessment. He cited work by John Cochrane arguing that stock market movements could be explained primarily by changes in risk premia. When I questioned whether risk premia had fallen since Trump was elected Kocherlakota tweeted back an index showing the spread between high yield (i.e. risky) corporate bonds and Treasury bonds. This index had indeed fallen since Donald Trump’s election.

Breitbart decided to write up this exchange and expound on how Donald Trump was indeed making America great again and therefore reducing the risk that investors perceived in the economy. The only problem is that they left out my response tweet to Kocherlakota. In this tweet, I pointed out that the spread had just fallen back to its 2014 level.

This matters because if we think this index is a good measure of perceived risk, and if we think risk premia explain movements in the stock market, then we would expect the stock market in 2014 to have been close to its current level and we would have expected sharp declines in 2015 and 2016 as risk premia were rising. Of course, the market was considerably lower in 2014 than it is today. It rose throughout the next two years even as risk premia by this measure were increasing.

That would indicate that a fall in risk premia is not a good explanation of the run-up in stock prices in the last six months. The shift of income from workers and consumers to corporate profits is still the leading candidate.

I had a blog post a couple of days back in which I argued that rising stock prices reflected expectations of higher future corporate earnings, at least insofar as they were not just driven by irrational exuberance. Since no one seems to be expecting higher growth, the expectation of higher corporate profits presumably means that investors are expecting a redistribution of income away from workers and consumers to corporate profits. This is actually a plausible scenario given Donald Trump’s proposed tax cuts and his plans for changing regulations in ways that will benefit corporations.

This is good news for the 10 percent or so of the population that holds substantial amounts of stock. It is pretty bad news for everyone else. In other words, you probably wouldn’t want to be boasting about a run-up in stock prices unless you think it’s good news to redistribute money from everyone else to the richest 10 percent and especially the richest one percent.

Narayana Kocherlakota, the former president of the Minneapolis Federal Reserve district bank, and a very good economist, disagreed with my assessment. He cited work by John Cochrane arguing that stock market movements could be explained primarily by changes in risk premia. When I questioned whether risk premia had fallen since Trump was elected Kocherlakota tweeted back an index showing the spread between high yield (i.e. risky) corporate bonds and Treasury bonds. This index had indeed fallen since Donald Trump’s election.

Breitbart decided to write up this exchange and expound on how Donald Trump was indeed making America great again and therefore reducing the risk that investors perceived in the economy. The only problem is that they left out my response tweet to Kocherlakota. In this tweet, I pointed out that the spread had just fallen back to its 2014 level.

This matters because if we think this index is a good measure of perceived risk, and if we think risk premia explain movements in the stock market, then we would expect the stock market in 2014 to have been close to its current level and we would have expected sharp declines in 2015 and 2016 as risk premia were rising. Of course, the market was considerably lower in 2014 than it is today. It rose throughout the next two years even as risk premia by this measure were increasing.

That would indicate that a fall in risk premia is not a good explanation of the run-up in stock prices in the last six months. The shift of income from workers and consumers to corporate profits is still the leading candidate.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Since several people have asked, I thought I would do some recycling. My plan (which I know I have stolen from someone) is to require companies to turn over an amount of stock, in the form of non-voting shares, roughly equal to the targeted tax rate. This means if we’re shooting for a 28 percent tax rate, then the shares going to the government are equal to 28 percent of the total. If the target is 20 percent, then the government’s shares are equal to 20 percent of the total.

From that point forward the government’s shares are treated the same as the other shares of the company. If the company pays a $2 per share dividend, the government gets $2 for each of its shares. If the company buys back 10 percent of its shares at $100 a share, it buys back 10 percent of the government’s shares at $100 per share. A company taking over the company at a $120 per share price has to also pay the government $120 per share. The basic story is that there is no way to cheat the government out of its tax revenue unless the corporation’s management is also cheating its shareholders.

To be as clear as possible, this is not a government takeover of corporate America. As it stands now, the government makes a claim on corporate profits in the form of income taxes. This just changes the form of this claim on profits.

Some folks may want the government to run the whole economy. I don’t. I value having firms compete in the market. This tax proposal doesn’t change that story. In fact, it has the nice feature that companies will no longer make decisions with an eye toward reducing their tax liability, since the only way they can do that is by screwing shareholders. Instead, companies will make decisions that maximize their expected profits.

I should also point out that this can be done on a voluntary basis. Wherever the tax rate is set, companies can be given the option of issuing stock in the same amount (e.g. a 25 percent tax rate means 25 percent of shares). This would have the advantage from the company’s perspective of ending the need to file tax returns. They just pay the government what they are paying shareholders.

From the government’s standpoint it reduces the enforcement costs. The companies that go this route will require minimal enforcement resources. Meanwhile, the companies that don’t opt to go this route will be telling the I.R.S. that they think they can reduce their tax liability substantially below the official rate. The I.R.S. can then focus its resources on policing these companies. That might not be as good as requiring all companies to go the stock route, but it would be a big step forward in my view.

Here are a couple of columns making the argument. Sorry, I’ve never written a longer piece making the case.

Since several people have asked, I thought I would do some recycling. My plan (which I know I have stolen from someone) is to require companies to turn over an amount of stock, in the form of non-voting shares, roughly equal to the targeted tax rate. This means if we’re shooting for a 28 percent tax rate, then the shares going to the government are equal to 28 percent of the total. If the target is 20 percent, then the government’s shares are equal to 20 percent of the total.

From that point forward the government’s shares are treated the same as the other shares of the company. If the company pays a $2 per share dividend, the government gets $2 for each of its shares. If the company buys back 10 percent of its shares at $100 a share, it buys back 10 percent of the government’s shares at $100 per share. A company taking over the company at a $120 per share price has to also pay the government $120 per share. The basic story is that there is no way to cheat the government out of its tax revenue unless the corporation’s management is also cheating its shareholders.

To be as clear as possible, this is not a government takeover of corporate America. As it stands now, the government makes a claim on corporate profits in the form of income taxes. This just changes the form of this claim on profits.

Some folks may want the government to run the whole economy. I don’t. I value having firms compete in the market. This tax proposal doesn’t change that story. In fact, it has the nice feature that companies will no longer make decisions with an eye toward reducing their tax liability, since the only way they can do that is by screwing shareholders. Instead, companies will make decisions that maximize their expected profits.

I should also point out that this can be done on a voluntary basis. Wherever the tax rate is set, companies can be given the option of issuing stock in the same amount (e.g. a 25 percent tax rate means 25 percent of shares). This would have the advantage from the company’s perspective of ending the need to file tax returns. They just pay the government what they are paying shareholders.

From the government’s standpoint it reduces the enforcement costs. The companies that go this route will require minimal enforcement resources. Meanwhile, the companies that don’t opt to go this route will be telling the I.R.S. that they think they can reduce their tax liability substantially below the official rate. The I.R.S. can then focus its resources on policing these companies. That might not be as good as requiring all companies to go the stock route, but it would be a big step forward in my view.

Here are a couple of columns making the argument. Sorry, I’ve never written a longer piece making the case.

Read More Leer más Join the discussion Participa en la discusión

Donald Trump has been anxious to take credit for the sharp run-up in stock prices since his election. While it is not clear that anything really lies behind this run-up (remember Wall Street investors are the same folks who thought AOL.com was worth $250 billion back in 2001 and that subprime mortgage backed securities were perfectly safe assets), in principle, stock prices are supposed to represent the present value of future corporate profits. If we assume that the rise in stock prices actually reflect something in the world, and not just Wall Street fantasies, then Trump has given these companies a reason to expect larger future profits.

Profits can rise for two reasons. Either they can be the same share of a larger economic pie or they can be a larger share of the same economic pie. There is no reason to believe that anyone is now expecting faster economic growth than before the election. In fact, the I.M.F. recently cut its growth projection for the U.S. If nothing Trump has done or given any indication of doing is likely to boost the U.S. growth rate then the higher expected profits must mean that investors anticipate that corporations will have a larger share of the economic pie.

There are several paths through which Trump’s policies could have this effect. Most obviously, he has called for sharp reductions in the corporate tax rate. If his tax cuts go through, then after-tax corporate profits will be higher even if there is no change in before-tax profits.

A second route for higher corporate profits is by facilitating rip-offs of consumers. The Consumer Financial Protection Bureau (CFPB) was set up in large part to prevent predatory practices by the financial industry. For example, it has sought to make it more difficult for financial firms to slip conditions into contracts that no one would ever agree to if they understood them.

If the CFPB is prevented from protecting consumers then we can assume that financial firms will put more effort into ripping off their customers. This will actually reduce growth since the resources spent writing deceptive contracts could have otherwise been devoted to productive uses.

Another route in which corporate profits can be increased is by letting them destroy the environment at zero cost. For example, the Trump administration reversed an Obama administration executive order that required mining companies to restore hilltops after they did surface mining. By allowing these companies to mine areas without repairing the damage the Trump administration is saving them money. The people in the communities will suffer the consequences in the form of polluted streams and ruined forests, but this is still good news for corporate profits.

Lastly, Trump’s regulatory changes might shift money from wages to profits. The most obvious example here is the plan to reverse the Obama administration’s rule raising the cap under which salaried workers are automatically entitled to overtime pay. By allowing employers to require salaried workers to put in more than 40 hours a week, often without any additional pay, the Trump administration will be putting downward pressure on wages and boosting corporate profits.

For these reasons, investors might have some real cause for expecting higher corporate profits as a result of the Trump presidency. However, none of these reasons are good news for the 90 percent of the country that does not have substantial stock holdings.

Donald Trump has been anxious to take credit for the sharp run-up in stock prices since his election. While it is not clear that anything really lies behind this run-up (remember Wall Street investors are the same folks who thought AOL.com was worth $250 billion back in 2001 and that subprime mortgage backed securities were perfectly safe assets), in principle, stock prices are supposed to represent the present value of future corporate profits. If we assume that the rise in stock prices actually reflect something in the world, and not just Wall Street fantasies, then Trump has given these companies a reason to expect larger future profits.

Profits can rise for two reasons. Either they can be the same share of a larger economic pie or they can be a larger share of the same economic pie. There is no reason to believe that anyone is now expecting faster economic growth than before the election. In fact, the I.M.F. recently cut its growth projection for the U.S. If nothing Trump has done or given any indication of doing is likely to boost the U.S. growth rate then the higher expected profits must mean that investors anticipate that corporations will have a larger share of the economic pie.

There are several paths through which Trump’s policies could have this effect. Most obviously, he has called for sharp reductions in the corporate tax rate. If his tax cuts go through, then after-tax corporate profits will be higher even if there is no change in before-tax profits.

A second route for higher corporate profits is by facilitating rip-offs of consumers. The Consumer Financial Protection Bureau (CFPB) was set up in large part to prevent predatory practices by the financial industry. For example, it has sought to make it more difficult for financial firms to slip conditions into contracts that no one would ever agree to if they understood them.

If the CFPB is prevented from protecting consumers then we can assume that financial firms will put more effort into ripping off their customers. This will actually reduce growth since the resources spent writing deceptive contracts could have otherwise been devoted to productive uses.

Another route in which corporate profits can be increased is by letting them destroy the environment at zero cost. For example, the Trump administration reversed an Obama administration executive order that required mining companies to restore hilltops after they did surface mining. By allowing these companies to mine areas without repairing the damage the Trump administration is saving them money. The people in the communities will suffer the consequences in the form of polluted streams and ruined forests, but this is still good news for corporate profits.

Lastly, Trump’s regulatory changes might shift money from wages to profits. The most obvious example here is the plan to reverse the Obama administration’s rule raising the cap under which salaried workers are automatically entitled to overtime pay. By allowing employers to require salaried workers to put in more than 40 hours a week, often without any additional pay, the Trump administration will be putting downward pressure on wages and boosting corporate profits.

For these reasons, investors might have some real cause for expecting higher corporate profits as a result of the Trump presidency. However, none of these reasons are good news for the 90 percent of the country that does not have substantial stock holdings.

Read More Leer más Join the discussion Participa en la discusión