The nonsense is flowing thick and heavy now that Congress has just voted to hand the bulk of a $1.5 trillion tax cut to the richest people in the country. Vox is out front getting its two cents in, telling us the big problem is the government debt built up by the baby boomers and the Social Security and Medicare that they plan to collect.The context is an interview with Bruce Gibney who is hawking a new book blaming the baby boomers for everything evil.

The confusion is thick and heavy here. For example, Gibney whines about the debt-to-GDP ratio. Fans of economics might refer him to burden of servicing the debt, which is less than 1.0 percent of GDP after subtracting the money rebated by the Federal Reserve Board to the Treasury. By comparison, it was more than 3.0 percent of GDP in the 1990s. It is also worth noting that this burden did not prevent the 1990s from being a very prosperous decade by almost any measure.

Then we get the usual complaint about Social Security and Medicare. Yeah, isn’t it outrageous how boomers think that they should be able to have an income and health care after a lifetime working? For what it is worth, boomers get a much worse return on their Social Security than the generations that preceded them, both because they paid a much higher tax rate during their working life and also because of the increase in the normal retirement age from 65 to 67.

Medicare is expensive, but that is because we pay twice as much for our doctors, drugs, and medical equipment as people in other countries. This is a big deal, but not one that has boomers as the villains.

Incredibly, in calculating debt Gibney somehow has not noticed the cost of patent and copyright monopolies that the government grants as a way of paying for innovation. In the case of prescription drugs alone, this costs around $370 billion a year, roughly equal to 40 percent of Social Security spending. (This issue is discussed in Chapter 5 of my [free] book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer.)

If we want to talk about harm to future generations we should also talk about the completely unnecessary austerity pushed by the deficit hawks in the years following the 2008 crash. This has cost us more than $1 trillion a year in lost output ($3,000 per person, per year).

We live in a society where the rich are running wild trying to take everything they can from the rest of us and put in their own pockets. So naturally, that increases the demand for people like Gibney who try to get people to beat up their parents and grandparents and ignore this massive heist by the rich.

The nonsense is flowing thick and heavy now that Congress has just voted to hand the bulk of a $1.5 trillion tax cut to the richest people in the country. Vox is out front getting its two cents in, telling us the big problem is the government debt built up by the baby boomers and the Social Security and Medicare that they plan to collect.The context is an interview with Bruce Gibney who is hawking a new book blaming the baby boomers for everything evil.

The confusion is thick and heavy here. For example, Gibney whines about the debt-to-GDP ratio. Fans of economics might refer him to burden of servicing the debt, which is less than 1.0 percent of GDP after subtracting the money rebated by the Federal Reserve Board to the Treasury. By comparison, it was more than 3.0 percent of GDP in the 1990s. It is also worth noting that this burden did not prevent the 1990s from being a very prosperous decade by almost any measure.

Then we get the usual complaint about Social Security and Medicare. Yeah, isn’t it outrageous how boomers think that they should be able to have an income and health care after a lifetime working? For what it is worth, boomers get a much worse return on their Social Security than the generations that preceded them, both because they paid a much higher tax rate during their working life and also because of the increase in the normal retirement age from 65 to 67.

Medicare is expensive, but that is because we pay twice as much for our doctors, drugs, and medical equipment as people in other countries. This is a big deal, but not one that has boomers as the villains.

Incredibly, in calculating debt Gibney somehow has not noticed the cost of patent and copyright monopolies that the government grants as a way of paying for innovation. In the case of prescription drugs alone, this costs around $370 billion a year, roughly equal to 40 percent of Social Security spending. (This issue is discussed in Chapter 5 of my [free] book Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer.)

If we want to talk about harm to future generations we should also talk about the completely unnecessary austerity pushed by the deficit hawks in the years following the 2008 crash. This has cost us more than $1 trillion a year in lost output ($3,000 per person, per year).

We live in a society where the rich are running wild trying to take everything they can from the rest of us and put in their own pockets. So naturally, that increases the demand for people like Gibney who try to get people to beat up their parents and grandparents and ignore this massive heist by the rich.

Read More Leer más Join the discussion Participa en la discusión

In a rare, serious column discussing various proposals to improve labor market outcomes, David Brooks makes the common “problem with men” mistake. The piece refers to men dropping out of the labor force at alarming rates and then endorses programs to induce men to get over cultural stereotypes and apply for jobs in fast-growing occupations dominated by women, like nursing and teaching.

Actually, the labor market experience of less-educated men has not been very different from the experience of less educated women, as was shown in a recent paper by Brian Dew. The employment rate for men between the ages of 25 and 34 with a high school degree or less is down by 8.2 percentage points from its peak in 1999. For women, it is down by 6.9 percentage points.

For less-educated workers between the ages of 35 and 44 the employment rate is down by 4.1 percentage points from a 1999 peak for men and 9.7 percentage points for women. For older prime-age workers (45 and 54) the employment rate is down 3.3 percentage points from a 2000 peak for men and by 6.7 percentage points for women.

The fact that there have been sharp declines in employment rates for both less-educated men and women indicates the problem is more likely a problem of weak demand than some gender-specific problem with men. Nonetheless, policies to overcome gender stereotypes are a good thing, as are policies to end sexual harassment and other factors that keep women out of many higher paying jobs.

In a rare, serious column discussing various proposals to improve labor market outcomes, David Brooks makes the common “problem with men” mistake. The piece refers to men dropping out of the labor force at alarming rates and then endorses programs to induce men to get over cultural stereotypes and apply for jobs in fast-growing occupations dominated by women, like nursing and teaching.

Actually, the labor market experience of less-educated men has not been very different from the experience of less educated women, as was shown in a recent paper by Brian Dew. The employment rate for men between the ages of 25 and 34 with a high school degree or less is down by 8.2 percentage points from its peak in 1999. For women, it is down by 6.9 percentage points.

For less-educated workers between the ages of 35 and 44 the employment rate is down by 4.1 percentage points from a 1999 peak for men and 9.7 percentage points for women. For older prime-age workers (45 and 54) the employment rate is down 3.3 percentage points from a 2000 peak for men and by 6.7 percentage points for women.

The fact that there have been sharp declines in employment rates for both less-educated men and women indicates the problem is more likely a problem of weak demand than some gender-specific problem with men. Nonetheless, policies to overcome gender stereotypes are a good thing, as are policies to end sexual harassment and other factors that keep women out of many higher paying jobs.

Read More Leer más Join the discussion Participa en la discusión

An article in the NYT on China’s plans to create a market for trading permits to emit greenhouse gases told readers that China has the world’s second-largest economy after the United States. According to the International Monetary Fund’s estimates, China’s economy is currently more than 20 percent larger than the U.S. economy, using a purchasing power parity measure. This measure, which applies a common set of prices to the goods and services produced in both countries, is clearly the correct measure of output to use in an analysis of greenhouse gas emissions.

The piece also wrongly asserts that:

“Chinese emissions per person are still somewhat less than the average per capita figure in the United States, although the gap has been narrowing.”

While it is true that the gap in per person emissions has been narrowing, the U.S. still emits more than twice as much per person as China.

An article in the NYT on China’s plans to create a market for trading permits to emit greenhouse gases told readers that China has the world’s second-largest economy after the United States. According to the International Monetary Fund’s estimates, China’s economy is currently more than 20 percent larger than the U.S. economy, using a purchasing power parity measure. This measure, which applies a common set of prices to the goods and services produced in both countries, is clearly the correct measure of output to use in an analysis of greenhouse gas emissions.

The piece also wrongly asserts that:

“Chinese emissions per person are still somewhat less than the average per capita figure in the United States, although the gap has been narrowing.”

While it is true that the gap in per person emissions has been narrowing, the U.S. still emits more than twice as much per person as China.

Read More Leer más Join the discussion Participa en la discusión

There is a lot of craziness in the era of Trump. According to the Washington Post, a tax bill that gives the overwhelming majority of its benefits to the richest people in the country had “working-class roots.” This is pretty loony stuff.

There is a lot of craziness in the era of Trump. According to the Washington Post, a tax bill that gives the overwhelming majority of its benefits to the richest people in the country had “working-class roots.” This is pretty loony stuff.

Read More Leer más Join the discussion Participa en la discusión

An NYT article on the winners and losers from the bill listed among the losers people who buy individual insurance, since it will leave insurers “stuck with more people who are older and ailing.” The issue here is ailing, not older. The exchanges can already charge different prices based on their age. While the law limits the band between age groups, so it’s not exactly equal to the difference in costs, this is a relatively small matter. The health of the people within an age group makes far more difference.

It is also important to note that many of the people who are predicted to go uninsured because of the repeal of the mandate are people who would have otherwise gotten Medicaid. These are people who would effectively get free insurance if they applied on the exchanges but won’t make the effort without the mandate.

An NYT article on the winners and losers from the bill listed among the losers people who buy individual insurance, since it will leave insurers “stuck with more people who are older and ailing.” The issue here is ailing, not older. The exchanges can already charge different prices based on their age. While the law limits the band between age groups, so it’s not exactly equal to the difference in costs, this is a relatively small matter. The health of the people within an age group makes far more difference.

It is also important to note that many of the people who are predicted to go uninsured because of the repeal of the mandate are people who would have otherwise gotten Medicaid. These are people who would effectively get free insurance if they applied on the exchanges but won’t make the effort without the mandate.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

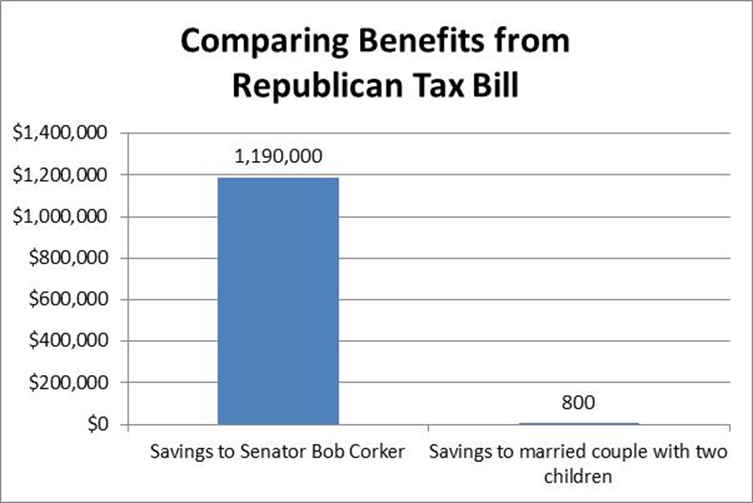

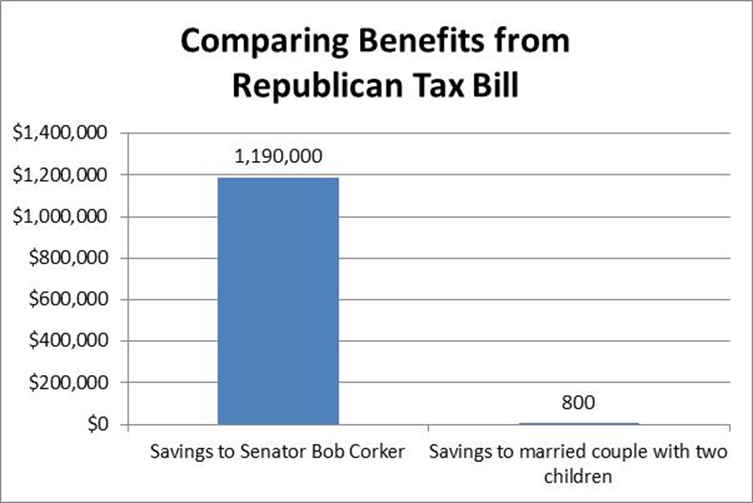

David Sirota, Josh Keefe, and Alex Kotch, writing at International Business Times, reported that a provision inserted into the Republican tax bill will provide large benefits to former holdout Senator Bob Corker, as well as President Trump. The provision would allow income from real estate investment trusts to be taxed at a 20 percent rate, as opposed to the 37 percent tax rate paid by high income individuals.

According to Corker’s disclosure forms, he makes between $1.2 million and $7.0 million annually in this sort of income. (We don’t know how much Donald Trump earns in this type of income since he broke his campaign promise about releasing his tax returns after his audit was completed.) If we plug in the top end $7 million figure, Corker could be saving as much as $1,190,000 from this late addition to the tax bill.

By comparison, much has been made of Senator Marco Rubio’s effort to change the refundability rules on the child tax credit, thereby giving more money to moderate-income families. According to calculations by the Center on Budget and Policy Priorities, with this change, a married couple with two children, earning $30,000 a year, will get back an additional $800 a year.

Source: International Business Times and Center on Budget and Policy Priorities.

David Sirota, Josh Keefe, and Alex Kotch, writing at International Business Times, reported that a provision inserted into the Republican tax bill will provide large benefits to former holdout Senator Bob Corker, as well as President Trump. The provision would allow income from real estate investment trusts to be taxed at a 20 percent rate, as opposed to the 37 percent tax rate paid by high income individuals.

According to Corker’s disclosure forms, he makes between $1.2 million and $7.0 million annually in this sort of income. (We don’t know how much Donald Trump earns in this type of income since he broke his campaign promise about releasing his tax returns after his audit was completed.) If we plug in the top end $7 million figure, Corker could be saving as much as $1,190,000 from this late addition to the tax bill.

By comparison, much has been made of Senator Marco Rubio’s effort to change the refundability rules on the child tax credit, thereby giving more money to moderate-income families. According to calculations by the Center on Budget and Policy Priorities, with this change, a married couple with two children, earning $30,000 a year, will get back an additional $800 a year.

Source: International Business Times and Center on Budget and Policy Priorities.

Read More Leer más Join the discussion Participa en la discusión

It is common to look at the ratio of new hires to job openings to get a sense of the tightness of the labor market. The idea is that if there is a high ratio of hires to openings, employers are not having trouble finding workers, whereas a low ratio means that jobs are going unfilled. This means either that employers are unable to find qualified workers, or that they are not willing to offer the market wage for some reason.

The Post had an article about the Trump administration’s plans to reduce the pay and benefits for federal government employees. It notes the arguments of Trump administration economists that federal employees are overpaid. It is worth noting that the ratio of hiring to openings in the federal government is far lower than in the pre-recession period.

The table below shows this ratio for several major sectors in the first six months of 2007 compared with the most recent six months.

| Ratio of Hires to Job Openings | |||||

| Jan-June ’07 | May-Oct ’17 | ||||

| Total Private | 1.16 | 0.93 | |||

| Retail | 1.78 | 1.08 | |||

| Accomodation and Food Service | 1.59 | 1.13 | |||

| Private minus retail &food service | 1.02 | 0.87 | |||

| Health Care & Social Assistance | 0.67 | 0.54 | |||

| Federal Government | 1.61 | 0.42 | |||

| S&L Education | 1.13 | 0.92 | |||

| S&L Other | 0.57 | 0.55 | |||

Source: Bureau of Labor Statistics.

As can be seen the ratio of hiring to openings is just over one quarter of its pre-recession level. This suggests that the federal government is already having a difficult time getting qualified workers given current pay and benefit packages. If it reduces pay and benefits further, then the federal government will presumably have an even more difficult time attracting qualified workers.

It is common to look at the ratio of new hires to job openings to get a sense of the tightness of the labor market. The idea is that if there is a high ratio of hires to openings, employers are not having trouble finding workers, whereas a low ratio means that jobs are going unfilled. This means either that employers are unable to find qualified workers, or that they are not willing to offer the market wage for some reason.

The Post had an article about the Trump administration’s plans to reduce the pay and benefits for federal government employees. It notes the arguments of Trump administration economists that federal employees are overpaid. It is worth noting that the ratio of hiring to openings in the federal government is far lower than in the pre-recession period.

The table below shows this ratio for several major sectors in the first six months of 2007 compared with the most recent six months.

| Ratio of Hires to Job Openings | |||||

| Jan-June ’07 | May-Oct ’17 | ||||

| Total Private | 1.16 | 0.93 | |||

| Retail | 1.78 | 1.08 | |||

| Accomodation and Food Service | 1.59 | 1.13 | |||

| Private minus retail &food service | 1.02 | 0.87 | |||

| Health Care & Social Assistance | 0.67 | 0.54 | |||

| Federal Government | 1.61 | 0.42 | |||

| S&L Education | 1.13 | 0.92 | |||

| S&L Other | 0.57 | 0.55 | |||

Source: Bureau of Labor Statistics.

As can be seen the ratio of hiring to openings is just over one quarter of its pre-recession level. This suggests that the federal government is already having a difficult time getting qualified workers given current pay and benefit packages. If it reduces pay and benefits further, then the federal government will presumably have an even more difficult time attracting qualified workers.

Read More Leer más Join the discussion Participa en la discusión

Everyone remembers Marco Rubio walking the union picket lines, demanding stronger enforcement of workplace safety rules, and strong fiscal stimulus to counter unemployment. Oh, wait, Senator Rubio has been on the other side of all these issues. He has opposed strengthening workers’ rights to organize, stronger enforcement of workplace safety rules, as well as stimulus measures to counter unemployment.

That’s okay, in New York Times-land he still gets to be a “longtime champion of the working class.” The context is Senator Rubio’s fight for making more of the child tax credit refundable. His threat to hold out on this issue earned a slightly more generous provision that will net a single mother earning $20,000 about $300 a year.

This would be equivalent to an increase in the minimum wage of 15 cents an hour for a full-time year-round worker. It is equal to roughly 0.15 percent of the gains for the richest 0.1 percent of taxpayers. It’s great that we have The New York Times to tell us that Rubio is a champion of the working class, most of us would probably never realize it based on his actions.

Everyone remembers Marco Rubio walking the union picket lines, demanding stronger enforcement of workplace safety rules, and strong fiscal stimulus to counter unemployment. Oh, wait, Senator Rubio has been on the other side of all these issues. He has opposed strengthening workers’ rights to organize, stronger enforcement of workplace safety rules, as well as stimulus measures to counter unemployment.

That’s okay, in New York Times-land he still gets to be a “longtime champion of the working class.” The context is Senator Rubio’s fight for making more of the child tax credit refundable. His threat to hold out on this issue earned a slightly more generous provision that will net a single mother earning $20,000 about $300 a year.

This would be equivalent to an increase in the minimum wage of 15 cents an hour for a full-time year-round worker. It is equal to roughly 0.15 percent of the gains for the richest 0.1 percent of taxpayers. It’s great that we have The New York Times to tell us that Rubio is a champion of the working class, most of us would probably never realize it based on his actions.

Read More Leer más Join the discussion Participa en la discusión

The NYT seems confused on how the new lower limit on mortgage interest deduction in the Republican tax bill would work. It told readers:

“The bill does retain significant subsidies, allowing home buyers to deduct interest on mortgages as high as $750,000.”

In fact, the bill allows homeowners to deduct interest on $750,000 of principal, regardless of the size of the mortgage. While the phrasing in the NYT piece might have led someone to believe that they could not deduct any interest on an $800,000 mortgage, in fact, they would be able to deduct almost all of their interest.

If a homeowner was paying 4.0 percent interest on an $800,000 mortgage, they would be able to deduct the interest on $750,000, or $30,000, from their taxable income. They would only lose out on the opportunity to deduct the $2,000 in interest on the $50,000 in principal above $750,000. Furthermore, after four or five years, when they had paid some of the principal, this homeowner would again be able to deduct the full amount of interest paid on their mortgage.

This distinction is important since the reduction in the cap on mortgage principal eligible for the interest deduction (from $1,000,000 to $750,000) is likely to have a very limited impact on the housing market. The doubling of the standard deduction and the cap on deductions for state and local income and property taxes are likely to be far more important.

Note: Typo corrected, thanks Raleedy.

The NYT seems confused on how the new lower limit on mortgage interest deduction in the Republican tax bill would work. It told readers:

“The bill does retain significant subsidies, allowing home buyers to deduct interest on mortgages as high as $750,000.”

In fact, the bill allows homeowners to deduct interest on $750,000 of principal, regardless of the size of the mortgage. While the phrasing in the NYT piece might have led someone to believe that they could not deduct any interest on an $800,000 mortgage, in fact, they would be able to deduct almost all of their interest.

If a homeowner was paying 4.0 percent interest on an $800,000 mortgage, they would be able to deduct the interest on $750,000, or $30,000, from their taxable income. They would only lose out on the opportunity to deduct the $2,000 in interest on the $50,000 in principal above $750,000. Furthermore, after four or five years, when they had paid some of the principal, this homeowner would again be able to deduct the full amount of interest paid on their mortgage.

This distinction is important since the reduction in the cap on mortgage principal eligible for the interest deduction (from $1,000,000 to $750,000) is likely to have a very limited impact on the housing market. The doubling of the standard deduction and the cap on deductions for state and local income and property taxes are likely to be far more important.

Note: Typo corrected, thanks Raleedy.

Read More Leer más Join the discussion Participa en la discusión