Those of us pushing the Federal Reserve Board to hold off on raising interest rates have pointed out that the members of the Fed’s Open Market Committee, like other economists, have repeatedly over-estimated the non-accelerating inflation rate of unemployment (NAIRU), the unemployment rate at which inflation would start spiraling upward. In 2014, they had put it at 5.4 percent. Today the unemployment rate stands at 4.1 percent, with no evidence of acceleration in the inflation rate.

If the Fed’s inflation hawks had their way, there would have been sharper increases in interest rates over the last four years. These would have slowed growth and prevented millions of workers from getting jobs and tens of millions from getting pay hikes. For this reason, we have argued for caution in raising rates until there is clear evidence that inflation is becoming a problem.

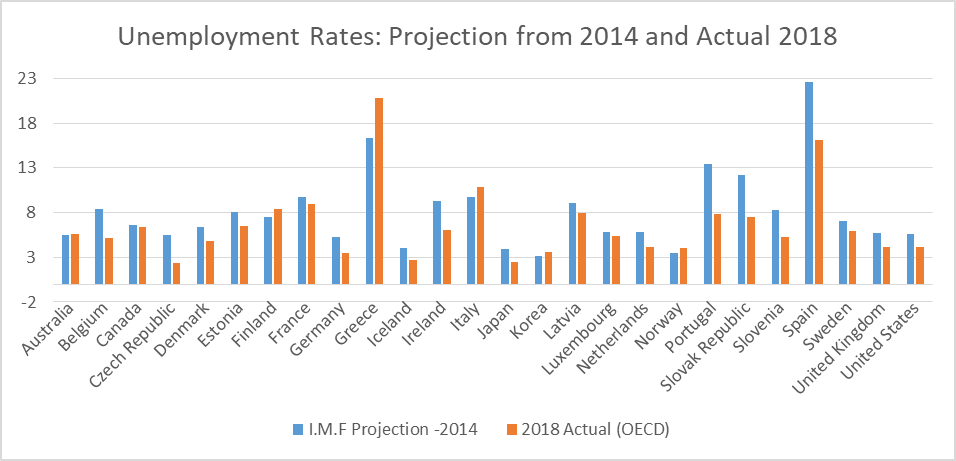

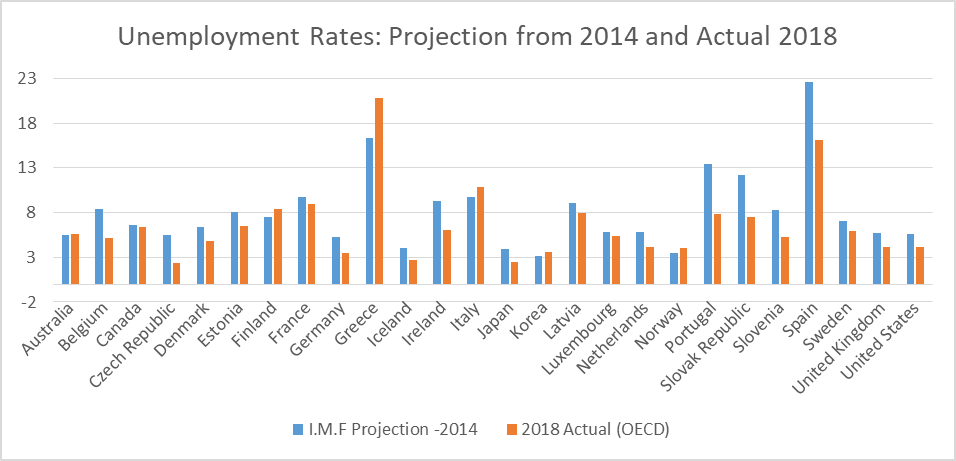

It turns out that the United States is not the only place where economists have trouble projecting floors to the unemployment rate. The figure below shows the IMF’s projection of unemployment rates from April of 2014 for the calendar year 2018. It also shows the most recent measure from the OECD.

In the vast majority of cases, the most recent month’s unemployment measure is well below the 2014 projection. For example, Belgium would have an unemployment rate of 8.3 percent in 2018. The most recent month’s data put the unemployment rate at 5.2 percent. For Germany, the projection was 5.2 percent unemployment; the most recent number was 3.5 percent. For the UK it projected 5.7 percent; the most recent number is 4.2 percent.

In some cases, the gaps are dramatic. The IMF projected an unemployment rate for of 5.5 percent for the Czech Republic; the actual rate is 2.4 percent. For the Slovak Republic, the projection was 12.2 percent; the actual figure is 7.5 percent. In the case of Spain, the projection was 22.6 percent; the most recent figure is 16.1 percent. On the whole, the average projected rate was 8.0 percent, the average current rate is 6.6 percent.

There are six countries in which the actual rate is worse than the projected rate. The actual rate in Finland is 0.9 percentage points higher than the 2014 projection. The rate in Italy is 1.2 percentage points higher. But, Greece is the big winner in this category. Its 20.8 percent unemployment rate is 4.5 percentage points higher than the 16.5 percent rate projected four years ago.

The moral of this story is that economists have a very bad track record in projecting unemployment rates. If a central bank wants to raise interest rates to head off inflation, it would be well-advised to look at what is happening to prices rather than relying on projections of NAIRUs. (The 2014 projections can be seen as NAIRU projections since the IMF assumed that the cyclical component of unemployment would be largely gone by that point.)

Those of us pushing the Federal Reserve Board to hold off on raising interest rates have pointed out that the members of the Fed’s Open Market Committee, like other economists, have repeatedly over-estimated the non-accelerating inflation rate of unemployment (NAIRU), the unemployment rate at which inflation would start spiraling upward. In 2014, they had put it at 5.4 percent. Today the unemployment rate stands at 4.1 percent, with no evidence of acceleration in the inflation rate.

If the Fed’s inflation hawks had their way, there would have been sharper increases in interest rates over the last four years. These would have slowed growth and prevented millions of workers from getting jobs and tens of millions from getting pay hikes. For this reason, we have argued for caution in raising rates until there is clear evidence that inflation is becoming a problem.

It turns out that the United States is not the only place where economists have trouble projecting floors to the unemployment rate. The figure below shows the IMF’s projection of unemployment rates from April of 2014 for the calendar year 2018. It also shows the most recent measure from the OECD.

In the vast majority of cases, the most recent month’s unemployment measure is well below the 2014 projection. For example, Belgium would have an unemployment rate of 8.3 percent in 2018. The most recent month’s data put the unemployment rate at 5.2 percent. For Germany, the projection was 5.2 percent unemployment; the most recent number was 3.5 percent. For the UK it projected 5.7 percent; the most recent number is 4.2 percent.

In some cases, the gaps are dramatic. The IMF projected an unemployment rate for of 5.5 percent for the Czech Republic; the actual rate is 2.4 percent. For the Slovak Republic, the projection was 12.2 percent; the actual figure is 7.5 percent. In the case of Spain, the projection was 22.6 percent; the most recent figure is 16.1 percent. On the whole, the average projected rate was 8.0 percent, the average current rate is 6.6 percent.

There are six countries in which the actual rate is worse than the projected rate. The actual rate in Finland is 0.9 percentage points higher than the 2014 projection. The rate in Italy is 1.2 percentage points higher. But, Greece is the big winner in this category. Its 20.8 percent unemployment rate is 4.5 percentage points higher than the 16.5 percent rate projected four years ago.

The moral of this story is that economists have a very bad track record in projecting unemployment rates. If a central bank wants to raise interest rates to head off inflation, it would be well-advised to look at what is happening to prices rather than relying on projections of NAIRUs. (The 2014 projections can be seen as NAIRU projections since the IMF assumed that the cyclical component of unemployment would be largely gone by that point.)

Read More Leer más Join the discussion Participa en la discusión

The NYT ran a piece about a revised trade pact between the European Union and Mexico with the headline, “In a message to Trump, Europe and Mexico announce trade pact.” The piece tells readers:

“…it sends a message to Mr. Trump that some of America’s closest trading partners are moving ahead with deals of their own — potentially leaving American exporters on the losing end in foreign markets.”

This is not how this treaty would be viewed in standard economics. While some US exporters may lose markets in Mexico’s relatively small market, as a result of better treatment for EU exporters, other exporters would gain markets due to expanded growth in both regions. In addition, the US should benefit insofar as increased trade between the EU and Mexico could lead to lower prices for items that we import from these countries.

This is how the same logic by which the United States gained from the formation of the European Common Market and later the EU. By making the region stronger economically, it became a more valuable trading partner. It is striking that the NYT apparently is so unfamiliar with basic economics.

It is also worth pointing out that the paper wrongly referred to the pact as a “free trade” agreement. Politicians like to call their deals “free trade” agreements because intellectual-types then think they have to support them. In reality, this pact includes the imposition of a number of regulatory measures that have nothing directly to do with free trade and enhanced patent, copyright, and related protections, which are explicitly protectionist.

The paper should not see it as its responsibility to help politicians promote their agenda by adopting their language. It would be more accurate and save space simply to refer to the pact as a “trade agreement.”

The NYT ran a piece about a revised trade pact between the European Union and Mexico with the headline, “In a message to Trump, Europe and Mexico announce trade pact.” The piece tells readers:

“…it sends a message to Mr. Trump that some of America’s closest trading partners are moving ahead with deals of their own — potentially leaving American exporters on the losing end in foreign markets.”

This is not how this treaty would be viewed in standard economics. While some US exporters may lose markets in Mexico’s relatively small market, as a result of better treatment for EU exporters, other exporters would gain markets due to expanded growth in both regions. In addition, the US should benefit insofar as increased trade between the EU and Mexico could lead to lower prices for items that we import from these countries.

This is how the same logic by which the United States gained from the formation of the European Common Market and later the EU. By making the region stronger economically, it became a more valuable trading partner. It is striking that the NYT apparently is so unfamiliar with basic economics.

It is also worth pointing out that the paper wrongly referred to the pact as a “free trade” agreement. Politicians like to call their deals “free trade” agreements because intellectual-types then think they have to support them. In reality, this pact includes the imposition of a number of regulatory measures that have nothing directly to do with free trade and enhanced patent, copyright, and related protections, which are explicitly protectionist.

The paper should not see it as its responsibility to help politicians promote their agenda by adopting their language. It would be more accurate and save space simply to refer to the pact as a “trade agreement.”

Read More Leer más Join the discussion Participa en la discusión

The papers are full of pieces deploring the debt the US government is accumulating under the Trump administration. However, we can know that these people are not serious because they never take into account the implicit debt created by the granting of patent and copyright monopolies.

The story here is a simple one. The government grants these monopolies as a way of paying for research and creative work. What is at issue here is a simple logical point that cannot be disputed by honest people.

Suppose the government were to spend another $400 billion this year on biomedical and other research and creative work. This means that the deficit and debt would be $400 billion larger because it paid out more money to corporations and individuals for this work. That’s very straightforward and all our deficit hawk friends are running around yelling and screaming over this additional debt burden.

Now suppose it grants patents and copyrights this year that will add an average of $50 billion a year over the next decade to the price of prescription drugs, software, and other protected items. Ignoring interest and discounting, how is that different from adding $500 billion to the debt?

In the case of the debt, we are obligating the government to make payments to the bondholders. In the case of patents and copyrights, we are requiring taxpayers to pay more money to drug companies and software makers. That is in effect a privately collected tax.

Perhaps people feel better about being taxed by Pfizer and Microsoft than by the government, but if we care about the impact on living standards as conventionally calculated, the two are the same. (To head off one excuse, no, the patent/copyright rents are not optional in any way, as taxes, in general, are not optional. After all, the government could have excise taxes on drugs and software. No one would say that changes the debt story at all.)

Anyhow, any deficit/debt monger who doesn’t talk about the cost of patent and copyright monopolies is just being a political hack. They are not making serious economic arguments.

The papers are full of pieces deploring the debt the US government is accumulating under the Trump administration. However, we can know that these people are not serious because they never take into account the implicit debt created by the granting of patent and copyright monopolies.

The story here is a simple one. The government grants these monopolies as a way of paying for research and creative work. What is at issue here is a simple logical point that cannot be disputed by honest people.

Suppose the government were to spend another $400 billion this year on biomedical and other research and creative work. This means that the deficit and debt would be $400 billion larger because it paid out more money to corporations and individuals for this work. That’s very straightforward and all our deficit hawk friends are running around yelling and screaming over this additional debt burden.

Now suppose it grants patents and copyrights this year that will add an average of $50 billion a year over the next decade to the price of prescription drugs, software, and other protected items. Ignoring interest and discounting, how is that different from adding $500 billion to the debt?

In the case of the debt, we are obligating the government to make payments to the bondholders. In the case of patents and copyrights, we are requiring taxpayers to pay more money to drug companies and software makers. That is in effect a privately collected tax.

Perhaps people feel better about being taxed by Pfizer and Microsoft than by the government, but if we care about the impact on living standards as conventionally calculated, the two are the same. (To head off one excuse, no, the patent/copyright rents are not optional in any way, as taxes, in general, are not optional. After all, the government could have excise taxes on drugs and software. No one would say that changes the debt story at all.)

Anyhow, any deficit/debt monger who doesn’t talk about the cost of patent and copyright monopolies is just being a political hack. They are not making serious economic arguments.

Read More Leer más Join the discussion Participa en la discusión

The NYT had yet another piece about the potential political fallout if China retaliates for Trump’s tariffs by imposing tariffs of its own on US agricultural exports. It noted that farmers in some states could turn against the Republicans, highlighting the Senate race in North Dakota in today’s paper.

It is striking that it seems no one is mentioning the benefit to US consumers from lower food prices that would be implied by lower farm prices. While the actual savings may not be very large, the higher prices that consumers would likely see as a result of Trump’s tariffs on steel and aluminum also are not very large. Nonetheless, there have been many news articles on the costs of these tariffs, it is peculiar that the NYT and other papers have no interest in discussing the flip side of the coin when it might show a positive side to the tariffs.

As I have noted elsewhere, the actual impact on farm prices is likely exaggerated. If China reduces its purchases of a particular crop from the US, then it presumably increases purchases from another country. If this third country shifts its exports from somewhere else to China, then there is a market opening up to our farmers in somewhere else. The net effect is still likely to be negative for US farmers (the trade story in a world without tariffs is almost certainly more efficient than the world with tariffs), but it is just not true that if China doesn’t buy the stuff, they have to throw it in the garbage.

None of this to say that I think Trump’s tariffs are a good idea (I don’t), it just would be best if we could try to keep the discussion of them serious.

The NYT had yet another piece about the potential political fallout if China retaliates for Trump’s tariffs by imposing tariffs of its own on US agricultural exports. It noted that farmers in some states could turn against the Republicans, highlighting the Senate race in North Dakota in today’s paper.

It is striking that it seems no one is mentioning the benefit to US consumers from lower food prices that would be implied by lower farm prices. While the actual savings may not be very large, the higher prices that consumers would likely see as a result of Trump’s tariffs on steel and aluminum also are not very large. Nonetheless, there have been many news articles on the costs of these tariffs, it is peculiar that the NYT and other papers have no interest in discussing the flip side of the coin when it might show a positive side to the tariffs.

As I have noted elsewhere, the actual impact on farm prices is likely exaggerated. If China reduces its purchases of a particular crop from the US, then it presumably increases purchases from another country. If this third country shifts its exports from somewhere else to China, then there is a market opening up to our farmers in somewhere else. The net effect is still likely to be negative for US farmers (the trade story in a world without tariffs is almost certainly more efficient than the world with tariffs), but it is just not true that if China doesn’t buy the stuff, they have to throw it in the garbage.

None of this to say that I think Trump’s tariffs are a good idea (I don’t), it just would be best if we could try to keep the discussion of them serious.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post decided to give us “Finance 202” to tell us that tax cuts at this point in the business cycle are a bad idea. The gist of the argument is that the economy is approaching full employment, so there is little room left for further stimulus. The piece also tells us that because of increase indebtedness, the government will be less will positioned to provide stimulus to the economy in the next recession.

There are several points worth noting on this one. First, the Washington Post has no clue whether we are close to full employment right now. We know this because no one has a clue. The experts at places like the Congressional Budget Office (CBO) have been repeatedly proven wrong. Just four years ago, CBO put the non-accelerating rate of inflation rate of unemployment (NAIRU), the effective measure of full employment in conventional terms, at 5.4 percent.

The unemployment rate is now 4.1 percent with no evidence of rising inflation. As a result of the unemployment rate falling below CBO’s estimate of the NAIRU, millions of more workers have jobs, with the main beneficiaries being blacks, Hispanics, and less-educated workers. The tighter labor market has also allowed tens of millions of workers to get pay increases.

Given this history (we can tell the same story about the late 1990s boom and the mis-measurement of the NAIRU), how does the Post know that the unemployment rate cannot get down to 3.5 percent or even 3.0 percent? If this is possible, and we pursue policies that prevent the unemployment rate from falling (e.g. higher interest rates from the Fed or fiscal tightening by Congress) we will needlessly be keeping millions of the most disadvantaged from getting jobs and pay increases. Instead of the government fighting poverty and inequality, it will be causing it.

It is also important to note that we have already paid an enormous price for having deficits that are too small. We have needlessly kept the unemployment rate higher than necessary, with a cost to our children of a permanently smaller economy, to the tune of $1 trillion to $2 trillion annually. For some reason, the deficit hawks are never forced to acknowledge the enormous damage they have inflicted on the country.

The argument that the government won’t be able to have stimulus in the next recession because of the debt, ignores what is taking place in the world. Japan has a debt-to-GDP ratio of more than 200 percent, over twice the US ratio. Until recently, investors were paying the Japanese government to lend it money, as its long-term interest rate was negative in nominal terms. Japan’s inflation rate has consistently been near zero, although it recently has been inching up to its 2.0 percent target. In other words, there is little economic reason to believe that the US will not be able to finance stimulus in the next recession.

The Post piece does point to the political obstacles to stimulus, noting that only two Republicans voted for the 2009 stimulus. But the Republican opposition had little to do with debt levels. The big problem was there was a Democrat in the White House, as many Republicans, including Senate Minority Leader Mitch McConnell said explicitly.

This is not an argument for giving more tax cuts to rich people. However, the objection is that the money could be better used, not that the deficit is too large. Although there is one possible benefit to giving still more money to the rich after the massive upward redistribution of the last four decades; maybe they will explode.

The Washington Post decided to give us “Finance 202” to tell us that tax cuts at this point in the business cycle are a bad idea. The gist of the argument is that the economy is approaching full employment, so there is little room left for further stimulus. The piece also tells us that because of increase indebtedness, the government will be less will positioned to provide stimulus to the economy in the next recession.

There are several points worth noting on this one. First, the Washington Post has no clue whether we are close to full employment right now. We know this because no one has a clue. The experts at places like the Congressional Budget Office (CBO) have been repeatedly proven wrong. Just four years ago, CBO put the non-accelerating rate of inflation rate of unemployment (NAIRU), the effective measure of full employment in conventional terms, at 5.4 percent.

The unemployment rate is now 4.1 percent with no evidence of rising inflation. As a result of the unemployment rate falling below CBO’s estimate of the NAIRU, millions of more workers have jobs, with the main beneficiaries being blacks, Hispanics, and less-educated workers. The tighter labor market has also allowed tens of millions of workers to get pay increases.

Given this history (we can tell the same story about the late 1990s boom and the mis-measurement of the NAIRU), how does the Post know that the unemployment rate cannot get down to 3.5 percent or even 3.0 percent? If this is possible, and we pursue policies that prevent the unemployment rate from falling (e.g. higher interest rates from the Fed or fiscal tightening by Congress) we will needlessly be keeping millions of the most disadvantaged from getting jobs and pay increases. Instead of the government fighting poverty and inequality, it will be causing it.

It is also important to note that we have already paid an enormous price for having deficits that are too small. We have needlessly kept the unemployment rate higher than necessary, with a cost to our children of a permanently smaller economy, to the tune of $1 trillion to $2 trillion annually. For some reason, the deficit hawks are never forced to acknowledge the enormous damage they have inflicted on the country.

The argument that the government won’t be able to have stimulus in the next recession because of the debt, ignores what is taking place in the world. Japan has a debt-to-GDP ratio of more than 200 percent, over twice the US ratio. Until recently, investors were paying the Japanese government to lend it money, as its long-term interest rate was negative in nominal terms. Japan’s inflation rate has consistently been near zero, although it recently has been inching up to its 2.0 percent target. In other words, there is little economic reason to believe that the US will not be able to finance stimulus in the next recession.

The Post piece does point to the political obstacles to stimulus, noting that only two Republicans voted for the 2009 stimulus. But the Republican opposition had little to do with debt levels. The big problem was there was a Democrat in the White House, as many Republicans, including Senate Minority Leader Mitch McConnell said explicitly.

This is not an argument for giving more tax cuts to rich people. However, the objection is that the money could be better used, not that the deficit is too large. Although there is one possible benefit to giving still more money to the rich after the massive upward redistribution of the last four decades; maybe they will explode.

Read More Leer más Join the discussion Participa en la discusión

The Associated Press had a fact check on Donald Trump’s promise of a simplified tax form. The piece noted that the IRS has had a simplified “1040EZ” form for decades and it is not clear that the form will be any shorter or simpler with the new tax law. It did correctly point out that many fewer people will itemize their deductions, which will make filing simpler for them.

It would have been worth pointing out that the Trump administration could have made the filing process much simpler but chose not to. It could have had the IRS fill out people’s tax forms for them. For the vast majority of people who take the standard deduction, the IRS already has the information necessary to determine their tax liability.

This means the IRS could fill out their forms and then send them to taxpayers for their review. If the person feels the IRS made a mistake, they correct the form with the necessary documentation. Otherwise, they accept the refund calculated by the IRS or pay the additional tax being assessed. This has been the practice in several European countries for decades.

The likely reason that Trump and the Republicans in Congress chose not to go this route is that it would wipe out H&R Block and other tax services and software companies who get tens of billions of dollars in revenue each year from people for doing their taxes. This seems the only plausible explanation since Trump and his team couldn’t be that much more incompetent than the folks running tax agencies in other countries.

The Associated Press had a fact check on Donald Trump’s promise of a simplified tax form. The piece noted that the IRS has had a simplified “1040EZ” form for decades and it is not clear that the form will be any shorter or simpler with the new tax law. It did correctly point out that many fewer people will itemize their deductions, which will make filing simpler for them.

It would have been worth pointing out that the Trump administration could have made the filing process much simpler but chose not to. It could have had the IRS fill out people’s tax forms for them. For the vast majority of people who take the standard deduction, the IRS already has the information necessary to determine their tax liability.

This means the IRS could fill out their forms and then send them to taxpayers for their review. If the person feels the IRS made a mistake, they correct the form with the necessary documentation. Otherwise, they accept the refund calculated by the IRS or pay the additional tax being assessed. This has been the practice in several European countries for decades.

The likely reason that Trump and the Republicans in Congress chose not to go this route is that it would wipe out H&R Block and other tax services and software companies who get tens of billions of dollars in revenue each year from people for doing their taxes. This seems the only plausible explanation since Trump and his team couldn’t be that much more incompetent than the folks running tax agencies in other countries.

Read More Leer más Join the discussion Participa en la discusión

Donald Trump was apparently angry about the value of the Russian ruble and the Chinese yuan against the dollar. He complained in a tweet that both are playing the “Currency Devaluation game” in a tweet yesterday.

Neil Irwin rightly points out that the complaint against Russia is bizarre, both because we don’t have much trade with Russia, but also because the most obvious reason its currency is falling is sanctions pushed by the United States and other western countries. The story with China is a bit more complicated.

China’s currency has actually been rising against the dollar over the last year, with the yuan going from 14.5 cents to 15.9 cents. So the claim that China is devaluing its currency is pretty obviously wrong.

There is, however, an issue of whether China is still deliberately depressing its currency against the dollar. As Irwin notes, China is no longer buying large amounts of dollars and other reserves, as it did in the last decade. This buying raised the value of the dollar and kept down the value of the yuan.

However, China still holds a massive stock of foreign reserves, with its central bank holding more than $3 trillion in reserves and its sovereign wealth fund holding another $1.5 trillion in foreign assets. These huge stocks of assets have the effect of holding down the value of the yuan in the same way that the Fed’s holdings of assets keep down interest rates.

The vast majority of economists accept that the Fed’s holdings of more than $4 trillion in assets have lowered long-term rates. It is inconsistent to argue that the Fed’s holdings of assets keep interest rates down, but China’s holdings of excessive amounts of foreign exchange don’t have a comparable effect on the value of the yuan.

In short, Trump is clearly wrong in claiming that China is currently devaluing its currency. However, he does have a case that China is still keeping down the value of its currency. Interestingly, he never made this complaint in the context of his threatened tariffs. This is the sort of well-specified policy goal that might warrant the threat of tariffs.

Donald Trump was apparently angry about the value of the Russian ruble and the Chinese yuan against the dollar. He complained in a tweet that both are playing the “Currency Devaluation game” in a tweet yesterday.

Neil Irwin rightly points out that the complaint against Russia is bizarre, both because we don’t have much trade with Russia, but also because the most obvious reason its currency is falling is sanctions pushed by the United States and other western countries. The story with China is a bit more complicated.

China’s currency has actually been rising against the dollar over the last year, with the yuan going from 14.5 cents to 15.9 cents. So the claim that China is devaluing its currency is pretty obviously wrong.

There is, however, an issue of whether China is still deliberately depressing its currency against the dollar. As Irwin notes, China is no longer buying large amounts of dollars and other reserves, as it did in the last decade. This buying raised the value of the dollar and kept down the value of the yuan.

However, China still holds a massive stock of foreign reserves, with its central bank holding more than $3 trillion in reserves and its sovereign wealth fund holding another $1.5 trillion in foreign assets. These huge stocks of assets have the effect of holding down the value of the yuan in the same way that the Fed’s holdings of assets keep down interest rates.

The vast majority of economists accept that the Fed’s holdings of more than $4 trillion in assets have lowered long-term rates. It is inconsistent to argue that the Fed’s holdings of assets keep interest rates down, but China’s holdings of excessive amounts of foreign exchange don’t have a comparable effect on the value of the yuan.

In short, Trump is clearly wrong in claiming that China is currently devaluing its currency. However, he does have a case that China is still keeping down the value of its currency. Interestingly, he never made this complaint in the context of his threatened tariffs. This is the sort of well-specified policy goal that might warrant the threat of tariffs.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Dalton Cooney argues in a Washington Post column that capping the deduction for state and local income taxes (SALT) is a good thing in a Washington Post column today. He makes the valid point that if wealthy suburbs want to tax themselves to have better schools than lower income inner city areas, there is no reason the federal government should subsidize this decision with a deduction on federal income taxes.

However, this misses the fact that the tax that is most likely to be affected by the loss of deductibility is the state income tax. In more liberal states like New York and California, this tax runs to more than 8 percent for high-end earners. (California has a top bracket of 13.3 percent.) These taxes are not paying for better schools for the children of the wealthy, but for redistributive policies that benefit lower-income people.

With the near-term prospect for federal measures in areas like extending health care coverage, quality child care, or free college very poor, if such measures are to advance anywhere it will be at the state level. By capping the deduction for SALT, the new tax bill will make it more difficult politically to pay for such initiatives. For this reason, the workarounds recently passed by New York, including replacing a portion of the income tax with a full deductible employer-side payroll tax, are a good thing.

Dalton Cooney argues in a Washington Post column that capping the deduction for state and local income taxes (SALT) is a good thing in a Washington Post column today. He makes the valid point that if wealthy suburbs want to tax themselves to have better schools than lower income inner city areas, there is no reason the federal government should subsidize this decision with a deduction on federal income taxes.

However, this misses the fact that the tax that is most likely to be affected by the loss of deductibility is the state income tax. In more liberal states like New York and California, this tax runs to more than 8 percent for high-end earners. (California has a top bracket of 13.3 percent.) These taxes are not paying for better schools for the children of the wealthy, but for redistributive policies that benefit lower-income people.

With the near-term prospect for federal measures in areas like extending health care coverage, quality child care, or free college very poor, if such measures are to advance anywhere it will be at the state level. By capping the deduction for SALT, the new tax bill will make it more difficult politically to pay for such initiatives. For this reason, the workarounds recently passed by New York, including replacing a portion of the income tax with a full deductible employer-side payroll tax, are a good thing.

Read More Leer más Join the discussion Participa en la discusión