Many pundit types were thrown for a loop by the Labor Department’s release of its Contingent Worker Survey yesterday. The survey, the first one since 2005, showed no increase in the percentage of workers employed as independent contractors, such as those who work for Uber and Lyft.

While that didn’t surprise those of us who follow the data closely, the release did seem to catch some of the proselytizers of the gig economy by surprise. It turns out that replacing taxi drivers (many of whom are contract workers) by contract workers for Uber and Lyft, has not transformed the labor market.

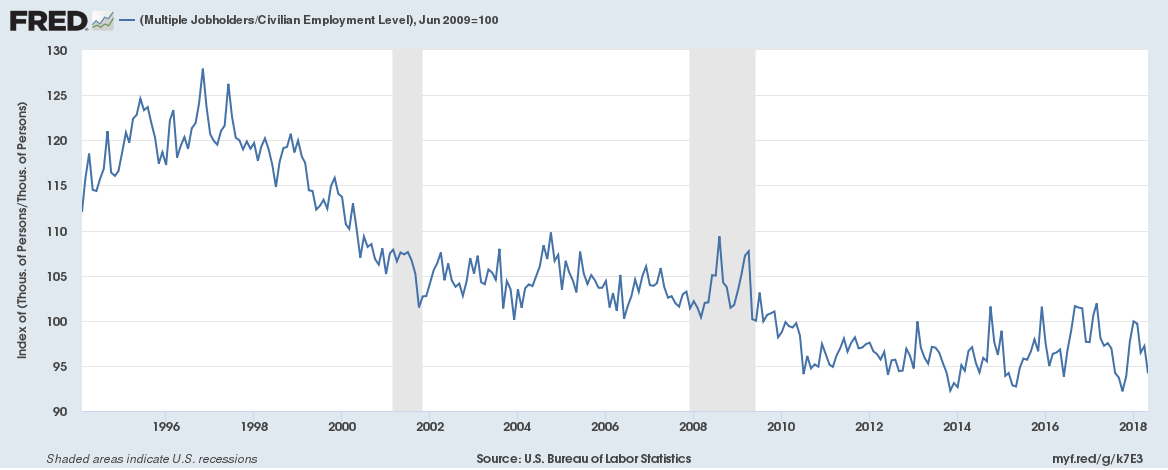

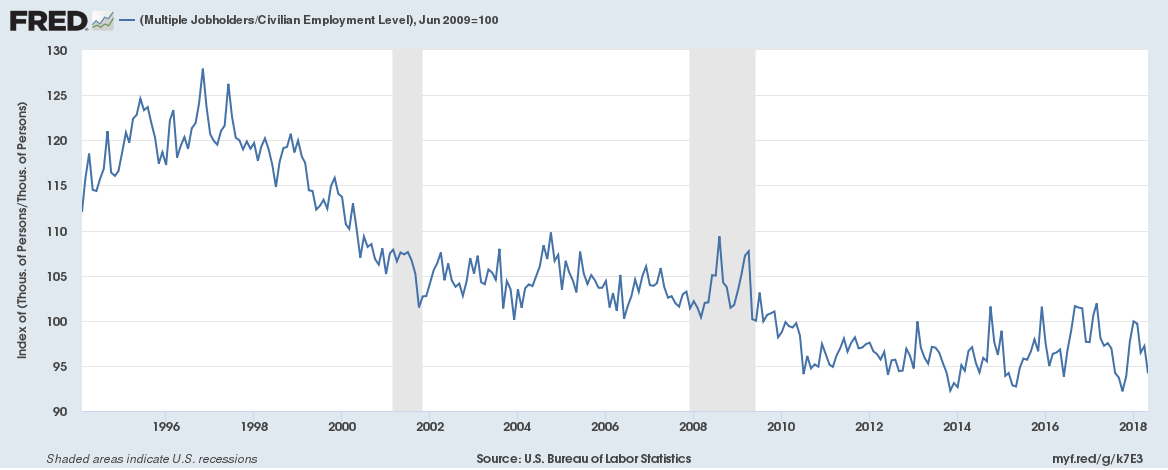

As has been pointed by out by Larry Mishel and others, most of the people doing gig economy work do it as a sidebar, in addition to their main jobs. But it is worth noting that even here the data points to a decline in the percentage of workers employed in multiple jobs over the last quarter century.

So even insofar as workers are turning to Uber or TaskRabbit to supplement their income, it seems to a large extent it is substituting for other side work they used to do. It seems the gig economy means much more to pundits than to workers.

Many pundit types were thrown for a loop by the Labor Department’s release of its Contingent Worker Survey yesterday. The survey, the first one since 2005, showed no increase in the percentage of workers employed as independent contractors, such as those who work for Uber and Lyft.

While that didn’t surprise those of us who follow the data closely, the release did seem to catch some of the proselytizers of the gig economy by surprise. It turns out that replacing taxi drivers (many of whom are contract workers) by contract workers for Uber and Lyft, has not transformed the labor market.

As has been pointed by out by Larry Mishel and others, most of the people doing gig economy work do it as a sidebar, in addition to their main jobs. But it is worth noting that even here the data points to a decline in the percentage of workers employed in multiple jobs over the last quarter century.

So even insofar as workers are turning to Uber or TaskRabbit to supplement their income, it seems to a large extent it is substituting for other side work they used to do. It seems the gig economy means much more to pundits than to workers.

Read More Leer más Join the discussion Participa en la discusión

It’s great that the Washington Post has so many reporters with mind reading abilities. As a result, we know that Trump is “convinced that his attendance at the G–7 summit is essential.”

Good to know that Trump is convinced of this fact. Otherwise, we might just think it would be too politically embarrassing for him not to show up just after a statement from G–7 (minus the US) finance ministers condemned his trade policy.

If news outlets like the Post didn’t have reporters with mind reading abilities, the rest of us would just know what politicians say and do. We wouldn’t be able to learn what they actually think.

It’s great that the Washington Post has so many reporters with mind reading abilities. As a result, we know that Trump is “convinced that his attendance at the G–7 summit is essential.”

Good to know that Trump is convinced of this fact. Otherwise, we might just think it would be too politically embarrassing for him not to show up just after a statement from G–7 (minus the US) finance ministers condemned his trade policy.

If news outlets like the Post didn’t have reporters with mind reading abilities, the rest of us would just know what politicians say and do. We wouldn’t be able to learn what they actually think.

Read More Leer más Join the discussion Participa en la discusión

That would have been an appropriate headline for an NYT article in which Alex Azar, the head of the Department of Health and Human Sevices, claimed that the Trump Administration’s policies are not responsible for double-digit price increases for insurance policies in the exchange. If Azar really believes what he claims, he doesn’t understand the basics of insurance.

The Trump Administration has adopted policies that allow more healthy people to opt out of the exchanges’ insurance pool. It created an expanded set of short-term bare-bones policies that would be attractive to people in good health as an alternative to the policies available in the exchanges. Congress also passed legislation that ends enforcement of the individual mandate, which means that healthy have more incentive not to sign up for insurance at all.

Since per person health care costs are rising at less than a 5.0 percent annual rate, the only explanation for the double-digit premium rate increases in the exchanges is a change in the mix of people getting insurance, with the pools becoming less healthy. (The Affordable Care Act was explicitly designed to create a single insurance pool so that the premiums paid by relatively healthy people subsidize the less healthy.) If we accept Mr. Azar’s assertions at face value, that the Trump Administration’s policies are not responsible for the rapid rise in premiums, it indicates he does not understand how insurance markets work.

That would have been an appropriate headline for an NYT article in which Alex Azar, the head of the Department of Health and Human Sevices, claimed that the Trump Administration’s policies are not responsible for double-digit price increases for insurance policies in the exchange. If Azar really believes what he claims, he doesn’t understand the basics of insurance.

The Trump Administration has adopted policies that allow more healthy people to opt out of the exchanges’ insurance pool. It created an expanded set of short-term bare-bones policies that would be attractive to people in good health as an alternative to the policies available in the exchanges. Congress also passed legislation that ends enforcement of the individual mandate, which means that healthy have more incentive not to sign up for insurance at all.

Since per person health care costs are rising at less than a 5.0 percent annual rate, the only explanation for the double-digit premium rate increases in the exchanges is a change in the mix of people getting insurance, with the pools becoming less healthy. (The Affordable Care Act was explicitly designed to create a single insurance pool so that the premiums paid by relatively healthy people subsidize the less healthy.) If we accept Mr. Azar’s assertions at face value, that the Trump Administration’s policies are not responsible for the rapid rise in premiums, it indicates he does not understand how insurance markets work.

Read More Leer más Join the discussion Participa en la discusión

It is a standard and really awful journalistic practice to make assertions about what politicians really believe or what is important to them. Reporters do not know what are in the heads of politicians. This is why they should just stick to reporting what they say and what they do.

Going in the opposite direction, they often neglect to report very relevant things that they say and do. Coverage of the Republicans’ policies on retirement income very much falls in this category. Politico has a piece today that reports on the failure of the Obama administration’s myRA accounts. These were designed as small dollar savings accounts (capped at $15,000) that would be investing exclusively in government bonds. Few people signed up for the program and the Trump administration canceled it.

The piece then turns to a discussion of state-run 401(k) type accounts which are being created by Oregon, Illinois, California, and a number of other states controlled by Democrats. The article then points out Republican opposition to these plans, ostensibly because they lack necessary consumer protections.

“These plans have triggered significant pushback from Republicans and the financial industry, however, which argue that the state plans lack important consumer protections and could funnel workers into costly products that don’t fit their savings needs. The biggest argument has centered on a 1974 law, the Employment Retirement Income Security Act (ERISA), which was created after a series of scandals around private-sector pensions in the 1950s and ’60s. ERISA imposed a fiduciary duty on employers that manage their workers’ retirement plans, requiring them to act in the best interest of their employees, and also set standards around financial disclosures. These rules are designed to protect workers, but they also discourage small businesses from offering 401(k)s and other, similar savings plans.”

This is where it would have been appropriate for the article to note that Republicans in Congress and the Trump administration, with few exceptions, have been doing everything they can to gut the Consumer Financial Protection Bureau. They also have sought to block the Fiduciary Rule put in place by the Obama administration, which would require that investment advisers act in the interest of their clients.

While we may not be able to know the state of mind of the Republicans who are working to undermine state-run retirement plans, it is worth pointing out that in other contexts they have been doing everything possible to undermine consumer protections. That makes the notion that they are actually concerned about the safety of workers’ retirement accounts rather dubious.

It seems much more likely that they are doing the bidding of the financial industry in trying to prevent competition that will take away business and drive down fees. But we would not want reporters to attribute motives.

It is a standard and really awful journalistic practice to make assertions about what politicians really believe or what is important to them. Reporters do not know what are in the heads of politicians. This is why they should just stick to reporting what they say and what they do.

Going in the opposite direction, they often neglect to report very relevant things that they say and do. Coverage of the Republicans’ policies on retirement income very much falls in this category. Politico has a piece today that reports on the failure of the Obama administration’s myRA accounts. These were designed as small dollar savings accounts (capped at $15,000) that would be investing exclusively in government bonds. Few people signed up for the program and the Trump administration canceled it.

The piece then turns to a discussion of state-run 401(k) type accounts which are being created by Oregon, Illinois, California, and a number of other states controlled by Democrats. The article then points out Republican opposition to these plans, ostensibly because they lack necessary consumer protections.

“These plans have triggered significant pushback from Republicans and the financial industry, however, which argue that the state plans lack important consumer protections and could funnel workers into costly products that don’t fit their savings needs. The biggest argument has centered on a 1974 law, the Employment Retirement Income Security Act (ERISA), which was created after a series of scandals around private-sector pensions in the 1950s and ’60s. ERISA imposed a fiduciary duty on employers that manage their workers’ retirement plans, requiring them to act in the best interest of their employees, and also set standards around financial disclosures. These rules are designed to protect workers, but they also discourage small businesses from offering 401(k)s and other, similar savings plans.”

This is where it would have been appropriate for the article to note that Republicans in Congress and the Trump administration, with few exceptions, have been doing everything they can to gut the Consumer Financial Protection Bureau. They also have sought to block the Fiduciary Rule put in place by the Obama administration, which would require that investment advisers act in the interest of their clients.

While we may not be able to know the state of mind of the Republicans who are working to undermine state-run retirement plans, it is worth pointing out that in other contexts they have been doing everything possible to undermine consumer protections. That makes the notion that they are actually concerned about the safety of workers’ retirement accounts rather dubious.

It seems much more likely that they are doing the bidding of the financial industry in trying to prevent competition that will take away business and drive down fees. But we would not want reporters to attribute motives.

Read More Leer más Join the discussion Participa en la discusión

In her Washington Post column Megan McArdle tells readers that we are making great progress in developing cures for cancer, but then she warns these cures can be very expensive:

“But immune-based therapies are unlikely to ever be available for a few cents a dose, especially not the personalized ones. Of the immunotherapies we already have, Opdivo and Yervoy combination drug therapy can cost a quarter of a million dollars; CAR T-cell almost double that.”

The part missing from this story is that the reason these cures would be expensive is because of the government-granted patent monopolies that make them expensive. Without these monopolies, these therapies almost certainly would be cheap.

We do have to pay for the research, but at the point people are receiving these therapies the research has already been done. We are trying to recover these costs from people facing a potentially fatal disease. This situation is made even more perverse from an economic perspective since most often there are third-party payers, either insurers or the government. So we will expect these people and/or their families to be spending time lobbying insurers or the government to pay for incredibly expensive treatments, which may or may not be helpful.

What a brilliant system!

The alternative is to pay for the research upfront. The government currently spends more than $30 billion a year on biomedical research through the National Institutes of Health. We could triple this amount to replace the research that is now patent-supported. It can still be done through the private sector, even by the same companies. They would just be working under long-term contracts — think of defense contractors. (See Rigged [it’s free], Chapter 5, where this is discussed in more detail.)

In addition to having the benefit of all new therapies available at their free market price, which would almost always be cheap, this system would have the advantage that all the research results would be immediately available to other researchers (a requirement of funding) so that research could progress more quickly. In addition, this system would remove the incentive that patent monopolies give companies to lie about the safety and effectiveness of their drugs.

In her Washington Post column Megan McArdle tells readers that we are making great progress in developing cures for cancer, but then she warns these cures can be very expensive:

“But immune-based therapies are unlikely to ever be available for a few cents a dose, especially not the personalized ones. Of the immunotherapies we already have, Opdivo and Yervoy combination drug therapy can cost a quarter of a million dollars; CAR T-cell almost double that.”

The part missing from this story is that the reason these cures would be expensive is because of the government-granted patent monopolies that make them expensive. Without these monopolies, these therapies almost certainly would be cheap.

We do have to pay for the research, but at the point people are receiving these therapies the research has already been done. We are trying to recover these costs from people facing a potentially fatal disease. This situation is made even more perverse from an economic perspective since most often there are third-party payers, either insurers or the government. So we will expect these people and/or their families to be spending time lobbying insurers or the government to pay for incredibly expensive treatments, which may or may not be helpful.

What a brilliant system!

The alternative is to pay for the research upfront. The government currently spends more than $30 billion a year on biomedical research through the National Institutes of Health. We could triple this amount to replace the research that is now patent-supported. It can still be done through the private sector, even by the same companies. They would just be working under long-term contracts — think of defense contractors. (See Rigged [it’s free], Chapter 5, where this is discussed in more detail.)

In addition to having the benefit of all new therapies available at their free market price, which would almost always be cheap, this system would have the advantage that all the research results would be immediately available to other researchers (a requirement of funding) so that research could progress more quickly. In addition, this system would remove the incentive that patent monopolies give companies to lie about the safety and effectiveness of their drugs.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

The NYT had a piece documenting the drop in inflation-adjusted spending per student nationally and in many of the states that have been seeing strikes and protests by teachers. The analysis is very useful, but a figure at the top of the piece may have given readers a misleading impression.

The figure shows nationwide inflation-adjusted spending per pupil since 1970. It shows a steady rise until the Great Recession, then a fall with the downturn and a partial recovery in the last few years. It notes that we are not yet back to the pre-recession level of spending.

This may lead people to believe that a proper baseline is a constant real level of spending. This is not the case.

Suppose that we have one teacher for every twenty students. If we keep this ratio, and the teacher’s inflation-adjusted pay rises in step with overall productivity growth, then spending per student would rise in step with overall productivity growth. In that case, we would expect to see inflation-adjusted spending per student rise in step with the economy’s productivity growth, not just inflation.

The full story on spending is somewhat more complicated. Growing productivity can lead to savings in some areas of education, but insofar as a major expense is for teachers, and we don’t have rising student to teacher ratios, the baseline should be that inflation-adjusted per pupil spending rises roughly in step with productivity growth, not that it stays flat.

The NYT had a piece documenting the drop in inflation-adjusted spending per student nationally and in many of the states that have been seeing strikes and protests by teachers. The analysis is very useful, but a figure at the top of the piece may have given readers a misleading impression.

The figure shows nationwide inflation-adjusted spending per pupil since 1970. It shows a steady rise until the Great Recession, then a fall with the downturn and a partial recovery in the last few years. It notes that we are not yet back to the pre-recession level of spending.

This may lead people to believe that a proper baseline is a constant real level of spending. This is not the case.

Suppose that we have one teacher for every twenty students. If we keep this ratio, and the teacher’s inflation-adjusted pay rises in step with overall productivity growth, then spending per student would rise in step with overall productivity growth. In that case, we would expect to see inflation-adjusted spending per student rise in step with the economy’s productivity growth, not just inflation.

The full story on spending is somewhat more complicated. Growing productivity can lead to savings in some areas of education, but insofar as a major expense is for teachers, and we don’t have rising student to teacher ratios, the baseline should be that inflation-adjusted per pupil spending rises roughly in step with productivity growth, not that it stays flat.

Read More Leer más Join the discussion Participa en la discusión

With the release of the Social Security and Medicare Trustees Report AP tweeted out:

“BREAKING: Government: Medicare will become insolvent in 2026, three years earlier than expected, Social Security to follow in 2034.”

What AP meant to say was that the programs would first face a shortfall. The programs would still be able to afford the vast majority of scheduled benefits. In the case of Medicare, the projections show that if nothing were done the program, it would be paying out more than 90 percent of scheduled benefits.

In the case of Social Security, the program would be paying out more than 75 percent of scheduled benefits in the years after 2034, assuming no changes are ever made. In the case of Social Security, since the average inflation-adjusted benefit is projected to be roughly 20 percent higher in 2034 than it is today, the payable benefit would still be roughly the same as what retirees get today.

Of course, it would unacceptable for the program not to pay promised benefits, but it is wrong to imply that people face a prospect of not collecting Social Security 16 years down the road. There is no scenario under current law where that is possible.

With the release of the Social Security and Medicare Trustees Report AP tweeted out:

“BREAKING: Government: Medicare will become insolvent in 2026, three years earlier than expected, Social Security to follow in 2034.”

What AP meant to say was that the programs would first face a shortfall. The programs would still be able to afford the vast majority of scheduled benefits. In the case of Medicare, the projections show that if nothing were done the program, it would be paying out more than 90 percent of scheduled benefits.

In the case of Social Security, the program would be paying out more than 75 percent of scheduled benefits in the years after 2034, assuming no changes are ever made. In the case of Social Security, since the average inflation-adjusted benefit is projected to be roughly 20 percent higher in 2034 than it is today, the payable benefit would still be roughly the same as what retirees get today.

Of course, it would unacceptable for the program not to pay promised benefits, but it is wrong to imply that people face a prospect of not collecting Social Security 16 years down the road. There is no scenario under current law where that is possible.

Read More Leer más Join the discussion Participa en la discusión

I was going to ignore Robert Samuelson’s column this week, but then I realized he said the economy was “roaring,” not “snoring.” GDP growth for the second quarter was 2.2 percent. That’s okay, but given our long-term average is close to 3.0 percent, that hardly fits the definition of “roaring.”

We did create a lot of jobs last month, as we have for the last several years, but strong job growth in the face of mediocre GDP growth means that productivity growth is weak. That’s not exactly a positive for the economy.

I was going to ignore Robert Samuelson’s column this week, but then I realized he said the economy was “roaring,” not “snoring.” GDP growth for the second quarter was 2.2 percent. That’s okay, but given our long-term average is close to 3.0 percent, that hardly fits the definition of “roaring.”

We did create a lot of jobs last month, as we have for the last several years, but strong job growth in the face of mediocre GDP growth means that productivity growth is weak. That’s not exactly a positive for the economy.

Read More Leer más Join the discussion Participa en la discusión

Charles Calomiris argued in an NYT column this morning that the Volcker rule needs to be fixed. The argument centers on the idea that it has raised the cost of trading and thereby discouraged arbitrage trades.

He cites the specific example of a breakdown in the relationship between currency spot and future prices and interest rate differentials. This means, in principle, that there are sure profit-making opportunities in the market that are going untaken.

While we are supposed to see this as a really bad thing, the question is why? The logic, of course, is that if an arbitrage possibility exists, then prices in the market are not exactly right. But what does it mean if the dollar is in some sense too high or too low by a tenth or two-tenths of a percent for a few hours or even a few days?

Do we think there will be mistaken trades of real goods and services (e.g. cars or wheat) because of the imperfections in the market? Even if there were, what’s the big deal if someone happened to pay 0.2 percent too much for a car or the seller got a price that was 0.2 percent less than they had expected?

There has been a tendency among economists to glorify liquidity like it is some sort of holy grail. Certainly, it is valuable for people to know they can sell a stock or bond when they want to. But if they have to wait a few minutes to complete the sale and they may be off by a fraction of a percent in terms of the price they get (in either direction), is this a real concern?

Charles Calomiris argued in an NYT column this morning that the Volcker rule needs to be fixed. The argument centers on the idea that it has raised the cost of trading and thereby discouraged arbitrage trades.

He cites the specific example of a breakdown in the relationship between currency spot and future prices and interest rate differentials. This means, in principle, that there are sure profit-making opportunities in the market that are going untaken.

While we are supposed to see this as a really bad thing, the question is why? The logic, of course, is that if an arbitrage possibility exists, then prices in the market are not exactly right. But what does it mean if the dollar is in some sense too high or too low by a tenth or two-tenths of a percent for a few hours or even a few days?

Do we think there will be mistaken trades of real goods and services (e.g. cars or wheat) because of the imperfections in the market? Even if there were, what’s the big deal if someone happened to pay 0.2 percent too much for a car or the seller got a price that was 0.2 percent less than they had expected?

There has been a tendency among economists to glorify liquidity like it is some sort of holy grail. Certainly, it is valuable for people to know they can sell a stock or bond when they want to. But if they have to wait a few minutes to complete the sale and they may be off by a fraction of a percent in terms of the price they get (in either direction), is this a real concern?

Read More Leer más Join the discussion Participa en la discusión