Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

Mortgage applications have been falling all through the fall, they are now down 22 percent from year-ago levels, with purchase applications down 3 percent. This matters because if people aren’t taking out mortgages they are not buying homes. Residential construction has been a drag on GDP in the last three quarters. Also, when people buy a new home they typically buy appliances and other items associated with moving. This means less consumption spending as well.

The decline in refinancing will also affect consumption. Typically people refinance a mortgage to get a lower interest rate, which frees up money for other spending. With interest rates up by a percentage point from pre-tax cut levels, few people can save money by refinancing.

This should be worth a bit of news coverage, but both the NYT and WaPo didn’t mention the new or recent data on mortgage applications. To be clear, this is not recession stuff, but with the stimulus from the tax cut fading, and our trading partners showing unexpected weakness, we are likely to see substantially weaker growth in the near future. That should warrant a bit of attention.

Mortgage applications have been falling all through the fall, they are now down 22 percent from year-ago levels, with purchase applications down 3 percent. This matters because if people aren’t taking out mortgages they are not buying homes. Residential construction has been a drag on GDP in the last three quarters. Also, when people buy a new home they typically buy appliances and other items associated with moving. This means less consumption spending as well.

The decline in refinancing will also affect consumption. Typically people refinance a mortgage to get a lower interest rate, which frees up money for other spending. With interest rates up by a percentage point from pre-tax cut levels, few people can save money by refinancing.

This should be worth a bit of news coverage, but both the NYT and WaPo didn’t mention the new or recent data on mortgage applications. To be clear, this is not recession stuff, but with the stimulus from the tax cut fading, and our trading partners showing unexpected weakness, we are likely to see substantially weaker growth in the near future. That should warrant a bit of attention.

Read More Leer más Join the discussion Participa en la discusión

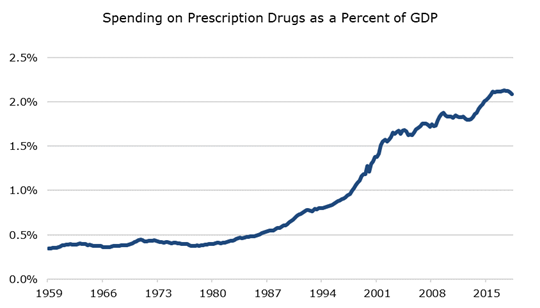

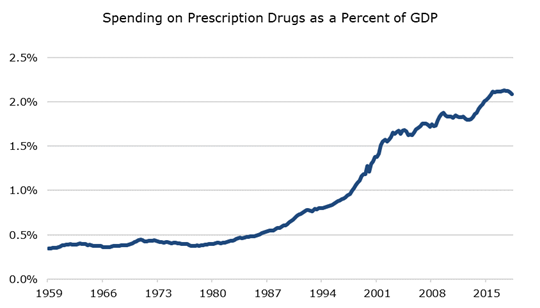

Austin Frakt had an interesting Upshot piece in the NYT saying that drug spending in the US began to sharply diverge from other countries in the 1990s. This actually is not very clear, since the comparison group dating back to the 1980s is small. I am actually more struck by the explosion in spending in the 1980s, with it nearly doubling as a share of GDP over the course of the decade. Note that drug spending had not been increasing at all as a share of GDP over the prior two decades.

The obvious villain here is the passage of the Bayh-Dole Act in 1980, which allowed private corporations to get patent rights to government-funded research. This undoubtedly led to more investment in research and development, but it also led to a huge increase in spending the difference between the current 2.2 percent of GDP that we spend on drugs and the 0.4 percent we spent in 1980 is equal to $360 billion a year, roughly five times annual spending on food stamps.

Austin Frakt had an interesting Upshot piece in the NYT saying that drug spending in the US began to sharply diverge from other countries in the 1990s. This actually is not very clear, since the comparison group dating back to the 1980s is small. I am actually more struck by the explosion in spending in the 1980s, with it nearly doubling as a share of GDP over the course of the decade. Note that drug spending had not been increasing at all as a share of GDP over the prior two decades.

The obvious villain here is the passage of the Bayh-Dole Act in 1980, which allowed private corporations to get patent rights to government-funded research. This undoubtedly led to more investment in research and development, but it also led to a huge increase in spending the difference between the current 2.2 percent of GDP that we spend on drugs and the 0.4 percent we spent in 1980 is equal to $360 billion a year, roughly five times annual spending on food stamps.

Read More Leer más Join the discussion Participa en la discusión

The New York Times ran a very confusing piece on the difficulties that many people in China are facing in getting access to drugs. The piece does not clearly distinguish between the problem of drugs not being legally available because they have not been licensed by China’s drug safety agency and drugs being expensive in China due to patent monopolies.

These are very different issues. The first can be readily solved by making the licensing agency more efficient and possibly also relying on approvals by other agencies. (The piece indicates this has recently become the practice.)

The issue of drugs being expensive due to patent monopolies is more complicated. China has to make a decision as to whether it wants to rely on patent monopolies as a mechanism to finance research or whether it instead depends more on a pre-funding mechanism that would allow new drugs to be sold in a free market at generic prices.

This is a huge issue and China’s policy in this area will have enormous implications for the rest of the world. If it decides to make new drugs widely available at their free market price, it will be difficult for the US and European companies to charge prices that are often more than 100 times as much, both in their own markets and in the developing world.

The New York Times ran a very confusing piece on the difficulties that many people in China are facing in getting access to drugs. The piece does not clearly distinguish between the problem of drugs not being legally available because they have not been licensed by China’s drug safety agency and drugs being expensive in China due to patent monopolies.

These are very different issues. The first can be readily solved by making the licensing agency more efficient and possibly also relying on approvals by other agencies. (The piece indicates this has recently become the practice.)

The issue of drugs being expensive due to patent monopolies is more complicated. China has to make a decision as to whether it wants to rely on patent monopolies as a mechanism to finance research or whether it instead depends more on a pre-funding mechanism that would allow new drugs to be sold in a free market at generic prices.

This is a huge issue and China’s policy in this area will have enormous implications for the rest of the world. If it decides to make new drugs widely available at their free market price, it will be difficult for the US and European companies to charge prices that are often more than 100 times as much, both in their own markets and in the developing world.

Read More Leer más Join the discussion Participa en la discusión

This is a fact that would have been worth mentioning in an NYT piece on how health care may be affected by last Tuesday’s elections. Near the end, the article referred to the Trump administration’s promotion of short-term insurance policies but only said that they, “do not have to cover pre-existing conditions or provide all the benefits required by the health law.”

The important feature of these short-term plans from the standpoint of the Affordable Care Act (ACA) is that they are designed to be appealing to relatively healthy people. By excluding people who are likely to suffer from costly health conditions, they can offer insurance at a lower price. This has the effect of pulling healthier people out of the ACA insurance pools.

This means that the people remaining in the ACA pools will be less healthy on average and therefore have higher costs. That will drive up the price of insurance in the ACA pools, likely pushing more relatively healthy people to buy short-term insurance plans. The end result in this story is that the ACA pools end up being extremely expensive, which makes the prohibition on discrimination over pre-existing conditions pointless.

This is the importance of short-term insurance policies. It should have been mentioned in the piece.

This is a fact that would have been worth mentioning in an NYT piece on how health care may be affected by last Tuesday’s elections. Near the end, the article referred to the Trump administration’s promotion of short-term insurance policies but only said that they, “do not have to cover pre-existing conditions or provide all the benefits required by the health law.”

The important feature of these short-term plans from the standpoint of the Affordable Care Act (ACA) is that they are designed to be appealing to relatively healthy people. By excluding people who are likely to suffer from costly health conditions, they can offer insurance at a lower price. This has the effect of pulling healthier people out of the ACA insurance pools.

This means that the people remaining in the ACA pools will be less healthy on average and therefore have higher costs. That will drive up the price of insurance in the ACA pools, likely pushing more relatively healthy people to buy short-term insurance plans. The end result in this story is that the ACA pools end up being extremely expensive, which makes the prohibition on discrimination over pre-existing conditions pointless.

This is the importance of short-term insurance policies. It should have been mentioned in the piece.

Read More Leer más Join the discussion Participa en la discusión

Read More Leer más Join the discussion Participa en la discusión

That seems like an obvious question that went unanswered in this NYT piece. It did talk about how this would increase Amazon’s bargaining power if it could play off two cities (and Seattle) against each other, but it did not raise the question of the initial commitments. In many of these bidding wars, the winner ends up losing by giving away more in concessions than it could ever hope to get back from the investment generated. It will be surprising if this is not the case here.

That seems like an obvious question that went unanswered in this NYT piece. It did talk about how this would increase Amazon’s bargaining power if it could play off two cities (and Seattle) against each other, but it did not raise the question of the initial commitments. In many of these bidding wars, the winner ends up losing by giving away more in concessions than it could ever hope to get back from the investment generated. It will be surprising if this is not the case here.

Read More Leer más Join the discussion Participa en la discusión

The Washington Post used its lead editorial to demand that the Trump administration do more to protect US intellectual property from China. The highlight of the piece is the accusation that a Chinese state-owned company hired a number of employees from Micron, who brought over files containing Micron’s latest DRAM technology.

Assuming this is true, this sort of theft is indeed a problem. The company has now been indicted and it will be interesting to see the response of the Chinese government. However, it is important to note that this sort of taking of technology is not restricted to Chinese companies.

Some people may have heard of a company called “Uber.” It hired one of the top people from Waymo, the self-driving car unit of Alphabet. The new hire brought along stolen files containing much of Waymo’s latest technology.

While the Post’s response to this problem is a call for greater protectionism to put tighter locks on technology, the free market solution would be to work to have more technology in the public domain. This can be done through greater public support for research and shorter patents (see chapter 5 of Rigged [it’s free]). If there is less money to be made by stealing other companies’ technology, then it is less likely to be done.

While the protectionists at the Post may not understand this point, we all benefit if technology is freely available and can be transferred around the globe at the lowest possible costs. If Chinese producers are then able to produce goods and services at lower costs, then US consumers will benefit, even if the Post’s friends may see lower profits.

The Washington Post used its lead editorial to demand that the Trump administration do more to protect US intellectual property from China. The highlight of the piece is the accusation that a Chinese state-owned company hired a number of employees from Micron, who brought over files containing Micron’s latest DRAM technology.

Assuming this is true, this sort of theft is indeed a problem. The company has now been indicted and it will be interesting to see the response of the Chinese government. However, it is important to note that this sort of taking of technology is not restricted to Chinese companies.

Some people may have heard of a company called “Uber.” It hired one of the top people from Waymo, the self-driving car unit of Alphabet. The new hire brought along stolen files containing much of Waymo’s latest technology.

While the Post’s response to this problem is a call for greater protectionism to put tighter locks on technology, the free market solution would be to work to have more technology in the public domain. This can be done through greater public support for research and shorter patents (see chapter 5 of Rigged [it’s free]). If there is less money to be made by stealing other companies’ technology, then it is less likely to be done.

While the protectionists at the Post may not understand this point, we all benefit if technology is freely available and can be transferred around the globe at the lowest possible costs. If Chinese producers are then able to produce goods and services at lower costs, then US consumers will benefit, even if the Post’s friends may see lower profits.

Read More Leer más Join the discussion Participa en la discusión