September 28, 2016

As you may have heard, spending on Social Security Disability Insurance has been rising over the past 25 years. Many major news outlets have portrayed this increase as a looming disaster with headlines such as the following:

“It’s Time to Reform Our Bankrupt Disability Insurance,” National Review, September 2015

“Social Security Disability Insurance Program Is Financially Unsustainable,” Mercatus Center, September 2015

“With Social Security Disability Fund Going Broke by 2016, Congress Set for Partisan, Election-Year Showdown,” Fox News, August 2015

“Another Looming Crisis: Social Security Disability Insurance,” The Hill, July 2015

“Social Security Disability Insurance Is Failing,” Senate Republic Policy Committee, March 2015

“Averting the Disability-Insurance Meltdown,” Wall Street Journal, February 2015

“7 Facts About America’s Disability Check Explosion,” Breitbart, January 2015

“SSA: Disability Recipients Soar, Funding Nearly Depleted Under Obama,” Newsmax, December 2013

“Social Security Disability Claims Out-Of-Control,” NewsBlaze, October 2013

“The Rising Cost of Social Security Disability Insurance,” Cato Institute, August 2013

“Social Security Disability Insurance Costs Are Exploding,” Washington Examiner, August 2013

“Social Security Disability Fund to Go Broke in 2016,” Washington Examiner, July 2013

“Disability Explosion Puts Social Security in Danger,” Investor’s Business Daily, June 2013

“Disability Insurance, Out of Control,” Chicago Tribune, April 2013

“Disability Insurance: America’s $124 Billion Secret Welfare Program,” The Atlantic, March 2013

“Unfit for Work: The Startling Rise of Disability in America,” Planet Money (National Public Radio), March 2013

“Social Security Disability Program Reveals Budget Quagmire,” Washington Post, February 2012

“Social Security Disability Benefits Unsustainable,” Cato Institute, November 2010

“America’s Hidden Welfare Program: Social Security’s Disability Insurance Is Expensive, Destructive, and Out of Control,” Slate, September 2010

Given this sort of reporting, a normal reader might think that assistance to disabled workers has been “spiraling out of control.” But that just isn’t true.

Social Security Disability Insurance (SSDI) is one of two major programs providing assistance to disabled workers.[1] The second program, “Workers’ Compensation” (WC), is broadly similar to SSDI but differs in three important ways [2]:

-

WC only applies to injuries incurred at work. SSDI covers disabilities and injuries that preclude work regardless of whether or not they occurred at work;

-

WC is regulated at the state level, while SSDI is administered at the federal level;

-

Although all the pertinent rules and regulations relating to WC benefits are determined by state governments [3], WC is generally run by private insurance companies. By contrast, SSDI is run directly through the government.

The last distinction is important when weighing the burden that SSDI and WC impose on society. From the point of view of a typical worker, it doesn’t matter if they have to pay an extra $5 in WC insurance premiums or an extra $5 in taxes to fund SSDI; either way, they are down $5. This means that if one program increases in cost but the other decreases by a greater amount, the worker is left paying less overall. [4]

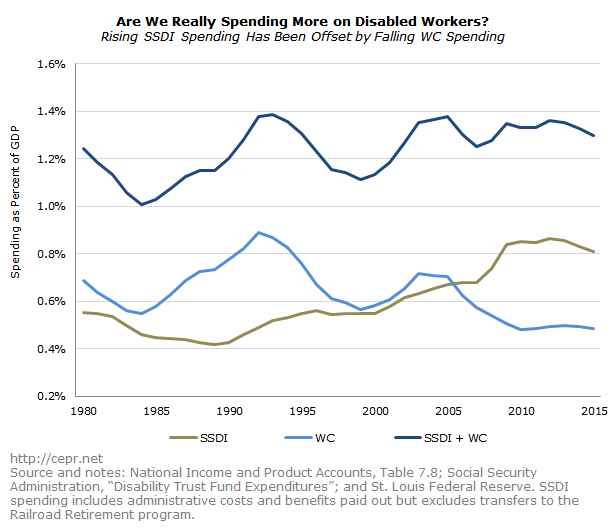

Therefore it is important to note that while SSDI costs have indeed gone up, the increase has been almost fully offset by a decline in WC spending. This can be seen in the figure below, which shows SSDI spending, WC spending, and “SSDI plus WC spending” as a percentage of GDP from 1980 to 2015.

Thirty years ago, WC was actually a more substantial program than SSDI. WC was larger as a percentage of GDP every year between 1980 and 2005, though the reverse has been true for the past decade. In 1980–81, when SSDI spending was 0.55 percent of GDP, WC spending was 0.66 percent; total spending on the two programs was 1.21 percent of GDP. SSDI bottomed out at 0.42 percent of GDP between 1988 and 1990, at which point WC spending was 0.74 percent — still over 0.3 percentage points higher. In 1993, when total spending on the two programs peaked at 1.39 percent of GDP, WC was responsible for nearly two-thirds of the combined total (0.87 versus 0.52 percent of GDP, respectively).

Since then, SSDI has covered an ever-growing share of the two programs’ combined costs — and this has created the perception that spending on disability benefits is “out of control.” But the reality is that total spending on the two programs has barely budged over the past thirty-five years. In the graph above, “SSDI plus WC spending” fluctuates as a percentage of GDP but always stays within the relatively narrow range of 1.0 to 1.4 percent. Relative to 1980–81, SSDI spending is up 0.26 percent of GDP, but total spending on WC and SSDI is up by just 0.08 percentage points. In other words, that “out of control” increase in disability payments amounts to an extra 8 cents out of every $100 of GDP. Insofar as spending on disabled workers has increased at all, it has been to an incredibly minor degree.

[1] SSDI is not to be confused with Supplemental Security Income (SSI), which is a separate program providing cash assistance to disabled Americans; while there are many differences between the two programs, the most important is that SSDI is only available to workers.

[2] For greater detail on the similarities and differences between SSDI and WC, see p. 5 and 21 of this 2015 CEPR report.

[3] This includes the level of benefits, the types of injuries for which workers can receive benefits, the duration of benefits, the reimbursement rates for various medical treatments, etc.

[4] However, it can matter to the company. WC premiums are “experience-rated,” meaning that companies and industries with higher WC take-up rates pay higher premiums than companies and industries with fewer injured workers. If injured workers who should be collecting WC instead receive SSDI, then firms have less incentive to make their workplaces safe. The costs associated with these injuries are born by the workforce as a whole rather than the companies causing them.