We are grateful to Jean Ross and the Bernard and Anne Spitzer Charitable Trust for generous funding of this study.

The Coronavirus Aid, Relief and Economic Security Act (the CARES Act) was an important and quick response to the economic and public health crisis wrought by the COVID-19 pandemic. Passed in March 2020, the initial Act provided $100 billion in relief to health care providers, with further allocations of funds later in 2020 and 2021. The initial formulas for distributing the funds led to widespread inequities in which providers received the funding. Wealthier hospitals with higher levels of Medicare reimbursements, higher private pay patients, or higher prior net revenues received emergency funding from the Provider Relief Fund (PRF) far more than did hospitals with greater need—i.e., those relying on Medicaid or serving rural or lower income communities. Pushback from public health experts and others led to reforms in how PRF funds were distributed. The next two funding phases made funds available to hospitals that were most impacted by COVID-19, including smaller and financially strapped community hospitals as well as large academic medical centers with high COVID-19 caseloads. Some hospitals, mainly rural hospitals and those serving poor communities, were missed in the first three phases of CARES ACT distributions. This inequity was remedied in the fourth and final distribution of PRF funds augmented by funds allocated to these hospitals in the Biden American Rescue Plan (ARP).

In this paper, we examine the rules for the allocation of Provider Relief Funds, the ways in which the rules and allocations changed over the 2020–2021 period, and the resulting outcomes. We draw lessons for the future design of policies to support providers.

By March 2020 evidence of the human tragedy and economic devastation of the COVID-19 pandemic was undeniable. Deaths were on the rise and the COVID-19 pandemic ravaged the US economy. Hospitals and health providers were especially hard hit as voluntary surgeries, and the revenue they generated, dropped precipitously while health and safety costs for treating an increasing number of COVID-19 patients rose dramatically. In response to this financial emergency, President Trump signed the CARES Act into law on March 27. The Act contained provisions for $100 billion in grants to health care providers. In late April, additional funds were provided bringing the total to $178 billion.1 President Biden’s ARP, signed into law on March 11, 2021, included an additional $8.5 billion earmarked for rural hospitals, bringing the total amount of health care relief funding to $186.5 billion (Liss 2021a). Collectively these funds are known as the Provider Relief Fund (PRF) and are administered by the US Department of Health and Human Services (HHS). Grants from the PRF are distributed by HHS’ Health Resources & Services Administration (HRSA).2

Congressional language in the CARES Act makes clear that the purpose of the grants was to enable providers to prevent, prepare for, and respond to the coronavirus; funds were to reimburse providers for health care expenses and lost revenue related to the coronavirus; providers were to have flexibility in how they used these funds; and funds were limited to providers caring for patients with, or suspected of having, COVID-19. But the legislation did not specify the rules to be used in allocating the funds. It gave the Trump administration’s Department of HHS and Treasury Secretary Steven Mnuchin great discretion in the adoption of formulas for the distribution of CARES Act funds. For the first round of funding, they made the decision to send out automatic payments. These were based on (1) the proportion of fee-for-service Medicare (but not Medicaid) payments that a provider received in 2019, and (2) a provider’s recent gross receipts net of the initial disbursement. Those with higher Medicare reimbursements and higher gross receipts received higher levels of CARES Act funds.

This resulted in an inequitable distribution of funds to hospitals, with disproportionately less going to rural hospitals, critical access hospitals, and those serving poor communities. Many of these hospitals also faced disproportionately higher rates of COVID-19-related hospital admissions due to the poverty and vulnerability of the populations in their catchment areas.3 Most of these types of hospitals were also financially fragile prior to the coronavirus pandemic and had fewer resources than other hospitals to respond to the onslaught of COVID-19 hospitalizations.

The medical and health policy communities responded quickly to these inequities. Subsequent rounds of funding were based on the number of COVID-19 patients treated, referred to as the “High Impact Allocation” of CARES Act funds. To receive these funds, hospitals had to demonstrate that COVID-19 was having a high impact on their finances and ability to treat patients. Unlike the earlier rounds of funding, disbursement was not automatic. But like the earlier rounds of funding, allocations did not take into consideration a hospital’s endowment and other assets.

Beginning in April 2020, HRSA allocated $30 billion to hospitals (and other providers) based on their share of total Medicare fee-for-service reimbursements in 2019 (Ellison 2020a). Another $20 billion was allocated to hospitals based on the hospital’s net patient revenue (Liss 2020a). Because these payments were automatic, hospitals and other health providers were not required to apply for the funds or to attest to losses of revenue or increases in expenses as a result of the pandemic. CARES Act grants did not take into account the financial resources of hospitals receiving these funds and whether they had sufficient cash reserves to weather the pandemic on their own or with limited federal assistance. Nor did it take into consideration the level of uncompensated care that hospitals provided. Money simply appeared in bank accounts of hospitals that served these Medicare beneficiaries or that had high patient revenue. On its website, HRSA refers to this as “Phase One General Distribution Payments” and reports that a total of $46 billion was ultimately distributed to 320,000 providers who bill for Medicare fee-for-service (Health Resources & Services Administration 2021a).

In addition to the CARES Act, the Centers for Medicare and Medicaid Services (CMS) created another avenue for financial assistance to cash-strapped hospitals. It offered accelerated and advance payments (AAP) to hospitals and other providers who care for Medicare patients. The CMS AAP program provided advance payments for services expected to be provided to Medicare patients over a period of 120 days from receipt of CMS funds. If charges for the care of Medicare patients did not exhaust the advance payment, the balance was treated as a loan that hospitals and other recipients would have to repay. That is, the payments were essentially loans, based on the number of Medicare patients the hospital or health provider expected to treat over a period of six months beginning in April 2020. Signing up for the loans closed on April 26. In all, CMS distributed $100 billion in loans, with a repayment start date of six months after receipt of the funds. However, hospitals lobbied successfully to delay repayment. Like the grants authorized by the CARES Act, these loans went mainly to the same hospital systems that treat large numbers of Medicare recipients and received CARES Act grants from HHS (Center for Medicare and Medicaid Services 2020; Bannow 2021).

Research in the spring of 2020 already documented that CARES Act funds were disproportionately going to wealthier hospitals, i.e., those with more private insurance revenue, larger operating margins, and less uncompensated care (Schwartz and Damico 2020). Typically, these hospitals have a higher level of private pay patients relative to Medicare patients, and they typically command reimbursement rates from private insurers that average two times the Medicare rates per patient. Schwarz and Damico documented that the CARES Act allocations exacerbated inequality that already existed among hospitals. They found that hospitals in the top decile of private insurance revenue received $44,321 in federal relief funds per hospital bed compared to only $20,710 per bed for hospitals in the lowest decile of private insurance revenue.

Similarly, Drucker, Silver-Greenberg, and Kiff (2020) documented the extent to which the initial distribution of CARES Act funds went to some of the wealthiest hospitals in the US. In the first two months following passage of the Act, HRSA distributed $72 billion to large hospital systems. In just two months more than $5 billion went to 20 large hospital chains that had well over $100 billion in cash on hand, much of it the result of investments in financial assets.

A 2021 report by Medical Advising Congress on Medicaid and CHIP Policy (MACPAC) also found Medicaid and CHIP providers received little funding through the 2020 general distributions. In 2020, about $50.2 billion in relief payments were made through the general distribution based on providers’ patient care revenue, but only $2.6 billion of these payments went to Medicaid and CHIP-enrolled providers not enrolled in Medicare. Moreover, less than 15 percent of the $18 billion initially allocated for the Phase 2 distribution was spent on Medicaid and CHIP providers (MACPAC 2021, 3).

Nonprofit Hospitals. Wealthy nonprofit hospitals—among them large academic medical centers (AMCs)also benefited more from CARES Act funding than did their less well-resourced counterparts. Large nonprofit systems often have total earnings far in excess of their net operating revenue from patient care because they own for-profit subsidiaries and receive nonoperating income from investments in financial assets. These investments range from shares of publicly traded companies to joint ventures with Silicon Valley venture capital funds (Liss 2020c). These activities became legal under a 1998 change in the Internal Revenue Service (IRS) rules governing nonprofit hospitals. This change allowed nonprofits to set up large, tax-exempt for-profit subsidiaries for the first time. As a result, some nonprofit hospitals are able to offset health care operating losses with nonoperating revenue gains, thereby relieving financial pressures. But only some hospitals have had the resources to pursue these financial strategies. Large health care systems, particularly AMCs whose research capabilities facilitated the establishment of these subsidiaries, have had the resources to aggressively pursue these activities. Smaller systems with fewer resources have largely been excluded from these pursuits. This has led to heightened variation among nonprofit hospitals in their level of financial stability. The formulas for distributing CARES Act funds exacerbated the pre-pandemic level of economic inequality among the nation’s hospitals.

The financial investments of nonprofit hospitals are the source of the large piles of cash that many of these hospitals were sitting on when the pandemic began. Nonetheless, in April and May 2020, these hospital systems accepted large CARES Act grants that did not need to be repaid. For example, the Catholic health system Ascension (the second largest nonprofit hospital system by revenue), received $496.8 million in grants even though it had 231 days of cash on hand. Cleveland Clinic, with 337 days of cash on hand, received $161.1 million in grants. Another of the largest Catholic health systems, CommonSpirit, had 142 days of cash on hand and received $427.8 million in grants. Other wealthy hospitals with 200 or more days of cash on hand—Advent Health, Mayo Clinic, Banner Health, and others—accepted hundreds of thousands of dollars in grants. By contrast, Kaiser Permanente, the largest nonprofit by revenue, with 200 days of cash on hand, declined to receive a grant of more than $500 million. The hospital system accepted just $5.5 million in grants for its Maui Health system (Liss 2020c).

For-Profit and Private Equity-Owned Hospitals. For-profit hospital systems also benefited from federal CARES Act largesse, despite the fact that most had balance sheets in the black and were financially healthy. For-profits generally keep far less cash on hand than do nonprofit hospitals because they are better able to raise funds in financial markets. For-profit hospitals also tend to have higher margins because they have a higher proportion of revenues coming from privately insured patients, and as noted above, typically have, and are usually able to negotiate, higher payments from insurance companies compared to what they receive from Medicare. Schwarz and Damico (2020) documented that the formulas used by HHS to give out grants have favored hospital systems with higher margins.

By the end of May 2020, for example, the four largest for-profit hospital systems had received $2.2 billion in grants that would not need to be repaid (Liss 2020b). Some of these hospitals had large cash reserves. Healthcare Corporation of America (HCA), the largest for-profit hospital system, had total net income of $3.5 billion in 2019 and $732 million in cash or cash equivalents on hand as of March 31, 2020. It received very large grants from CARES Act funds by the end of May (Liss 2020b). Federal officials later found accountability errors in virtually every HCA grant or award, primarily related to employment, contracting, and consumer protection, but also tax and CEO pay issues. HCA later returned most if not all of the funding.4 Most other hospital systems, however, did not. Tenet, with $613 million in cash and cash equivalents on hand as of March 31, 2020, received $517 million in grants.5

Community Health Systems (CHS) received a CARES grant of $420 million, which was more than the health system earned in 2019 when it registered a net loss of $675 million. Universal Health Services (UHS),6 with $55 million in cash on hand on March 31, received a grant of $239 million (Liss 2020b). In addition to CARES Act funding, some for-profit health systems scored a windfall by taking advantage of the tax break for real estate owners, that somehow made its way into the CARES Act. Struggling CHS got a tax refund of $184 million in the first quarter of 2020 (Herman 2020).

Hospitals owned by private equity (PE) firms at the start of the pandemic also got CARES Act bailout funds. We consulted the Good Jobs First COVID stimulus watch tracker at the end of June to determine how the three largest hospital chains owned by PE fared. Steward Health, owned until recently by PE firm Cerberus Capital, received an initial $166.6 million, but later much more, as indicated below. Prospect Medical Holdings, owned until recently by PE firm Leonard Green, initially received $41.7 million, and later much more. LifePoint, owned by Apollo, received $155.5 million in grants.

In all, HRSA reports this general distribution to hospitals and providers resulted in a total of $46 billion distributed to 320,000 providers who bill for Medicare fee-for-service (Health Resources & Services Administration 2021a).

In May, HHS responded to the criticism that its formula for disbursing grant money left out critical access and rural hospitals struggling to care for COVID-19 patients by announcing a second program to distribute $18 billion in High Impact grants to providers who, during the 2018–19 period, participated in state Medicaid programs or CHIP, as well as Medicare providers whose initial awards were very small. These providers were eligible to apply for grants. Unlike the initial distribution of grant funding, these payments were not automatic. They did not just appear in health providers’ bank accounts. Critical access, rural, and children’s hospitals had to apply for these grants.

The terms and conditions stipulated that the funds were to be used “to prevent, prepare for, and respond to coronavirus, and for related expenses or lost revenues attributable to coronavirus” (Health Resources & Services Administration 2021b). Smaller and poorer hospitals were often uncertain of their eligibility or whether, if they used the funds to pay off debts and stave off closure during the pandemic, the government would want to claw these funds back. Did paying a very large, overdue electric bill to keep the lights on and avoid shuttering the facility meet the guidelines? The FAQ explanations of the guidelines from HHS were confusing and, in some instances, contradictory. The CEO of a hospital in rural Western Oklahoma used only $50,000 of the $3 million HHS sent to her hospital because she was afraid that if she spent the money to keep the hospital up and running, she would have to return the funds (Bailey 2021). MACPAC (2021) also found that small providers with few administrative staff found the application process burdensome; and Medicaid and CHIP providers who were not included in the HHS list of potentially eligible providers had to follow an elaborate process to prove they were eligible.

In the end, HHS received many fewer applications for these funds than anticipated. HRSA reports on is website that just $6 billion was distributed to 60,832 health providers (Health Resources & Service Administration 2021a).

HHS also announced that it would make targeted distributions of funds available. The agency announced plans to distribute $22 billion to hospitals with high COVID-19 admissions in its Phase 2 High Impact distribution from the PRF. It targeted $12 billion to 395 hospitals that provided inpatient care for 100 or more COVID-19 patients through April 10, 2020. These hospitals accounted for 71 percent of patients treated at 6,000 US hospitals. Of the $22 billon in Phase 2 High Impact funds, $2 billion of these funds were targeted to hospitals and health providers based on so-called disproportionate share payments, i.e., extra payments by Medicare to hospitals that treat a disproportionate share of low-income patients, and to those treating uncompensated care (charity care) patients. An additional $10 billion was targeted to hospitals, clinics, and health centers in rural areas. These funds, like the earlier distribution that went mainly to wealthy hospitals, were distributed based on the relevant HHS rules. Hospitals experiencing a high impact of COVID-19 care simply submitted the number of COVID-19 patients treated by April 10 to HHS, which then calculated the payment due to the hospital and sent the funds. For payments to safety net hospitals and children’s hospitals, HHS used data available from Medicaid and Medicare. These providers were eligible to apply for additional payments if warranted by their operating expenses. Indian Health Service facilities were eligible for grants from a $400 million allocation, distributed on the basis of operating expenses (U.S. Department of Health and Human Services 2020a; Ellison 2020b; Health Resources & Services Administration 2021c). These funds began flowing in June, 2020.

Finally, on July 10, nearly four months after the earliest grants were made, HHS acknowledged that safety net and rural providers may have been missed in the earlier distributions of funds. The agency recognized “the urgent need these vital funds play supporting safety net providers and those serving large rural populations facing financial devastation catalyzed by the pandemic,” and released an additional $4 billion. Approximately $3 billion was for hospitals whose profit margins were thin, which made it impossible for them to meet the surge of patients suffering from COVID-19 and withstand the fall in revenue from the decline in surgeries for non-life-threatening conditions. In addition to low profit margins, hospitals eligible to receive these funds served poor urban and rural communities. Another $1 billion was for specialty rural hospitals and hospitals in small non-rural metropolitan areas such as suburban hospitals that serve rural populations and have smaller profit margins (less than 3 percent) and limited resources. The $4 billion was intended to help 215 hospitals (U.S. Department of Health and Human Services 2020b).

Providing information on how this money was distributed, HRSA reported that $20.75 billion was distributed in two rounds to over 1500 hospitals experiencing a high impact from COVID-19. Payments amounting to $10 billion were made to 8,351 facilities in rural areas in the first round. An additional 507 rural facilities received a total of $1 billion in the second round. A total of $520 million was distributed to 438 tribal hospitals, clinics, and urban health centers that housed Indian Health Service providers. A total of $10.11 billion went to 764 safety net hospitals in the first round of distributions, and another $3 billion was distributed to 227 facilities in the second round. Seventy-two free-standing children’s hospitals received $1 billion. Skilled nursing facilities and other nursing homes also received targeted funds from HRSA (Health Resources & Services Administration 2021c).

In all, about $46 billion was distributed to 11,883 facilities. Many of these facilities sorely needed the funds to be financially stable or even to survive, including rural hospitals, safety net hospitals, and children’s hospitals treating young patients covered by CHIP. High Impact funds did help many hospitals impacted by COVID-19 that received little or no funding in the Phase 1 distribution. But the effects appear to have been very uneven. One study found that hospitals Hospital Service Areas (HSA) serving populations that were 34 percent or more Black received higher payments than other hospitals, although the payments were not consistent with the much higher rates of morbidity and mortality from the disease. Hospitals in areas that had larger Hispanic populations received far less in High Impact funds than other hospitals (Buxbaum and Rak 2021).

But the distribution of High Impact funds to hospitals that desperately needed the funding is not the entire story. These funds went to all hospitals treating large numbers of COVID-19 patients regardless of the hospital’s ability to care for these patients without such funding, and that turned out to include academic-affiliated hospitals that also cared for large numbers of patients with COVID-19. Many of these hospitals had substantial assets and large endowments. For example, Cleveland Clinic, which as noted above, had received $161.1 million in Phase 1 of CARES Act funding, received $9.2 million in High Impact funds.7 Cleveland Clinic was not alone. Many wealthy academically affiliated hospitals that treated COVID-19 patients received High Impact CARES Act funds, with hospitals with larger assets or larger endowments receiving larger disbursements of these funds (Cantor et al. 2021).

As the pandemic raged on, HHS announced a third general distribution (Phase 3) of CARES Act PRFs on October 1. Providers who had already received the maximum in PRFs equal to 2 percent of 2018 patient revenue were now eligible to apply for further relief. To qualify, health providers needed to demonstrate a change in operating revenue or an increase in operating expenses caused by the coronavirus. HHS accepted applications up to November 6. In particular, the funds were intended for behavioral health providers as well as new health providers not previously eligible because they began practicing in the January 1, through March 31, 2020 period treating patients covered by Medicare, Medicaid, or CHIP (including dentists, assisted living facilities, and behavioral health providers).

On December 16, 2020, HHS announced that it had completed its review of applications. About 70,000 applicants were believed to have met the criteria to receive a grant from this general distribution, meaning they were eligible for grants covering 88 percent of their requested funds. In total, HHS allocated $24.5 billion for this purpose. Another 35,000 applicants were rejected, either because they had no losses attributable to COVID-19, or because they had already received relief payments equal to 88 percent of the losses they reported. Recipients had to attest to the terms and conditions for receiving the funds before the money was released. The funds were expected to be released by the end of January 2021 (AAFP 2021; AHLA 2021). Health Resources & Services Administration (Health Resources & Services Administration 2021a) reported that a total of 97,433 health providers received funds in this third general distribution.

In September 2021, the Biden administration’s Department of HHS announced the Phase 4 distribution of more than $17 billion in CARES Act funds. The funds were intended to aid a wide range of providers who suffered financially from the COVID-19 pandemic between July 1, 2020 and March 31, 2021. However, the focus in this distribution was on equity. HRSA was instructed to reimburse smaller providers at a higher percentage than large providers and to provide “bonus” payments to providers based on the services they render to Medicaid, CHIP, and Medicare patients.

Simultaneously, the Biden administration announced a targeted distribution of $8.5 billion for rural providers as part of Biden’s ARP. A total of $25.5 billion was targeted to service providers that serve Medicaid, CHIP, and Medicare beneficiaries living in particular rural areas. In all, HRSA announced plans to distribute funds in a manner that recognized that earlier distributions failed to consider the higher costs of treating poorer patients (Liss 2021a; Health Resources & Services Administration 2021d).

In December 2021, HHS released $9 billion through HRSA in the PRF Phase 4 General Distribution. In addition, the government released nearly $2 billion at the end of January 2022. More than 74,000 providers across the US received nearly $11 billion in PRF funds. The $2 billion exhausted these funds. In addition, HRSA distributed about $7.5 billion to more than 43,000 providers in rural areas allocated for this purpose in the ARP. The $18.5 billion has been a lifeline for smaller or financially distressed providers whose needs were not sufficiently addressed in earlier fund distributions. By January 2022, 82 percent of applications for these funds had been processed (U.S. Department of Health and Human Services 2022). The funds, as noted above, reimbursed provider expenses through March 31, 2021. This is before delta and micron variants struck and again put providers and their finances under duress.

The $11 billion distributed to providers by the Biden administration in the Phase 4 distribution fell short of the $17 billion announced in September 2021 by nearly $7 billion as the Biden administration diverted CARES Act funds intended to aid health providers to pay for vaccines. The Biden administration wasn’t alone. The Trump administration had also diverted CARES Act funds to vaccines. Trump diverted $10 billion to pharmaceutical companies to pay for the development of the vaccines. Biden diverted close to $7 billion to pay the pharmaceutical companies for doses of the vaccine so they could be distributed for free to the public in the US. In all, $16.7 billion, or almost 10 percent of CARES Act funds intended to help providers through the pandemic, has gone to pharmaceutical companies (Cohrs 2021, 2022).

The implementation of the CARES Act had differential impacts on hospitals and other health providers in this health emergency. Too many grants and loans went to wealthy hospitals with sufficient resources to get through an extended emergency. Many returned to profitability before the end of 2020, and nearly all of them—whether nonprofit, for-profit, or private equity-owned—were profitable by the first quarter of 2021. By contrast, federal funds for safety net and rural hospitals, hospitals serving Medicaid and CHIP patients, and those severely impacted by COVID-19 patients arrived later, had confusing eligibility requirements, and were not generous enough to reimburse these providers for the higher costs of treating poorer patients. Median operating margins of nonprofit hospitals were squeezed by the pandemic and fell to 0.5 percent in fiscal year 2020. But median days of cash on hand grew substantially as a result of CARES Act bailouts, from 44 days in fiscal year 2019 to 247 days in fiscal year 2020 (Kacik 2021).

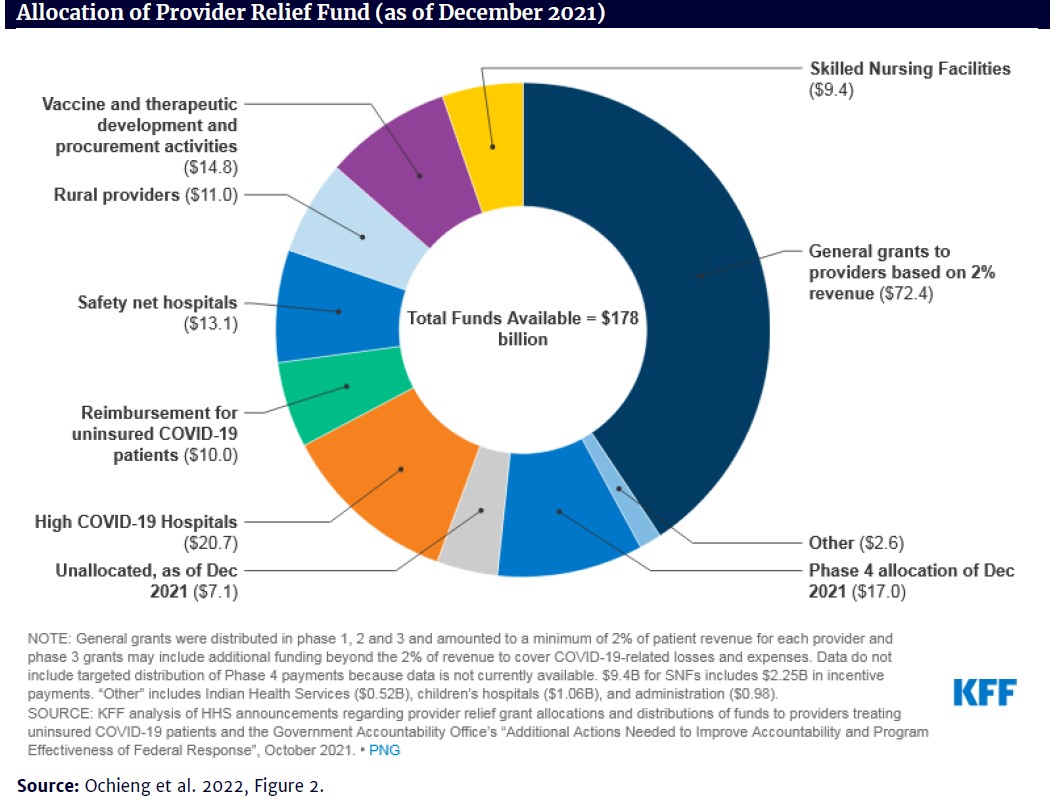

The figure, below, shows the distribution of PRFs as of December 2021. Of the total available funds of $178 billion, safety net and rural hospitals received $24 billion (13.5 percent), whereas providers receiving grants based on the 2 percent of revenue initial formula received $72.4 billion (40.7 percent) (Ochieng et al. 2022).

On the plus side, despite the bungled distribution of federal grants, most safety net and rural hospitals received enough funds to stay afloat. Health care bankruptcies hit their lowest level since 2010 in the second quarter of 2021 and were down for the entire 12 months ending June 30, 2021. This is an unprecedented decline for an industry that is typically among the most distressed. The largest providers rarely face bankruptcy, so the decline was among smaller hospitals and other providers. Of the bankruptcies that did occur, 40 percent were in the Southeast, where many states have failed to expand Medicaid (Bannow 2021; Ochieng et al. 2022). Critical access hospitals and other rural hospitals appear to have received more PRFs as a share of their operating expenses than other types of hospitals, at least in 2020 (MACPAC 2021), but it is not apparent whether the additional federal funding will be adequate to stave off future closures.

On the negative side, the federal government placed no restrictions on the use of grants from the CARES Act’s PRFs that were distributed automatically to hospitals based on their share of Medicare patients treated and on their net operating revenue. Even the distribution of High Impact funds from the PRF, which did bail out many smaller providers struggling under the financial stress of caring for large numbers of COVID-19 patients, went disproportionately to wealthy academic medical centers that also treated these patients. Hospitals that had assets and large endowments tended to get higher High Impact distributions despite having the financial resources to make it through the pandemic without drawing on the PRF for support (Cantor et al. 2021).

An important outstanding question is whether some hospital systems or their owners have taken advantage of the added government funding from the CARES Act to pursue their own interests. Much more research is needed to establish whether and how hospitals may have used federal grants and loans to free up their own funds for other financial or profit-making activities, as opposed to supplementing their operating revenues to cover pandemic-related expenses or losses. Money is fungible, so it may not be literally true that dollars from CARES Act grants and loans have been used for other financial activities, but some patterns and case examples are suggestive.

Of particular concern are hospital mergers and acquisitions (M&As), which have continued at a steady pace during the pandemic, despite the fact that hospital operating margins fell and remained considerably below pre-pandemic levels during 2020 and 2021.8 M&As are costly ventures, yet health care M&A activity slowed only slightly in 2020 (Kaufman Hall 2021c). More importantly, the percentage of “mega mergers” increased (those in which the smaller partner had more than $1 billion in annual revenues) in 2020, and even more so in 2021 (Kaufman Hall 2022). Nonprofit systems were involved in 87 percent of the mergers in 2021, up from 81 percent in 2020 (Kelly 2022).

This question is particularly timely and important because hospitals have increasingly used mergers and acquisitions as a financial strategy, but M&As are not only costly ventures, they more often than not fail to achieve their cost and quality goals. So, the question arises, should hospitals be pursuing M&As when they are so financially strapped that they are eligible for and receive federal funds to offset their financial losses due to the pandemic? While hospitals typically claim that M&As improve financial stability, research shows that hospital consolidation has led to greater monopoly power in local markets, leading to higher prices for patients (Cooper, Craig, Gaynor, and Van Reenen 2018; Gaynor 2018). Citizen groups and government regulators are increasingly worried about these effects, and several recent anti-trust lawsuits have been filed against hospitals, including in North Carolina (Larcey 2021) and Connecticut (Paavola 2022); and mergers have been halted in New Jersey (Ellison 2021b) and the Rhode Island by the Federal Trade Commission and State Attorneys General (Gagosz 2022).

Examples of recent megamergers include nonprofit as well as for-profit and private equity affiliated systems that received millions in CARES Act funds in the 2020–21 period. In May 2021, for example, Piedmont Healthcare in Georgia accelerated its acquisition activity with the purchase of three hospitals from HCA that ring Atlanta, adding them to the 11 hospitals currently in the Piedmont system. The combined hospitals will serve nearly three-quarters of Georgia’s population (Liss 2021e). Piedmont Healthcare received $310.1 million in CARES Act grants and $292.6 million in loans in the 2020–21 period, none of which has been repaid to the government.9

In June 2021, two of Michigan’s largest providers, Spectrum Health and Beaumont Health, announced a $12.9 billion merger that will create a health system spanning 22 hospitals and 305 outpatient facilities. It also includes Spectrum’s health insurance plan (Priority Health), which enrolls 1.2 million customers. Both systems had strong net operating revenues in 2020 (Landi 2021). Together the two systems received $750.9 million in CARES Act awards and $651.4 in loans in the 2020–21 period. Beaumont was cited for accountability issues in relation to employment, government contracting, and environmental safety, but has made no refunds to the government.

In September 2021, nonprofit Intermountain Healthcare announced its merger with SCL Health, a Catholic health system based in Broomfield, Colorado, to form an $11 billion health system. The deal means Intermountain, with hospitals in Utah, Idaho, and Nevada, will now have a major presence in Colorado, Kansas, and Montana as well. The combined system will operate 33 hospitals and employ 58,000 people in six states (Liss 2021c and 2021d). Together the two systems received $394.3 million in CARES Act awards and $482.2 in loans in the 2020–21 period. Both systems are flagged for government contracting accountability issues in the COVID Stimulus Watch Tracker, but have not repaid any funds.

Of even greater concern are the formerly private equity-owned health systems that have received millions in federal CARES Act subsidies while at the same time undertaking risky debt-driven M&As and extracting wealth from those systems via the sale of their assets and the payment of dividends to themselves (Batt and Appelbaum 2021). In August 2021, for example, Steward Health Care (recently sold by PE firm Cerberus Capital), purchased five hospitals and associated physician practices in South Florida from Tenet Healthcare for $1.1 billion. The acquisition doubled the size of Steward’s presence in Florida, according to industry consulting firm, Kaufman Hall (Kelly 2022). Steward received $524.1 million in CARES Act grants and $426.7 million in loans in the 2020–21 period. Steward’s awards have been flagged by government officials as having contracting accountability issues, but it has not refunded any money. Prior to the pandemic, Cerberus had already destabilized the Steward system by selling off most of its real estate properties for $1.25 billion, leaving the hospitals saddled with long-term inflated leases on property they once owned. Cerberus used the proceeds to pay itself and investors almost $500 million in dividends and used the rest for an M&A buying spree. Its Massachusetts hospitals were cited in 2018 as having the lowest financial stability of any in the state (LaFrance, Batt, and Appelbaum 2021).

Similarly, Prospect Medical Holdings, owned until recently by PE firm Leonard Green, created a 20 hospital, for-profit chain through M&As financed by debt—debt that was loaded on to financially fragile safety net hospitals that had never before had that level of debt. Leonard Green sold off much of the hospitals’ real estate and extracted at least $658 million in fees and dividends while the hospital chain received $375 million in COVID-19 rescue funds in 2020 alone. In 2021, Prospect Medical Holdings threatened to close some of its hospitals when asked to return the dividends, and in October 2021, a US Senate Committee heard shocking testimony from nurses regarding the poor patient care and safety at its hospitals.10

Apollo-owned LifePoint Healthcare’s acquisition of Kindred Healthcare is another case in point. After amassing a total of $1.6 billion in CARES Act bailout grants and loan, LifePoint announced in June 2021 that it would acquire Kindred Healthcare, a provider of home and hospice care, owned by PE firms TPG Capital and Welsh, Carson, Anderson, & Stowe. The combined company will have 77,000 employees in 34 states and will be the largest PE-owned health care company in the US (O’Grady 2021; Paavola 2021; Willmer 2020). Kindred received $21 million in grants and $146.9 million in loans in that period, all of which have been flagged for employment and contracting accountability issues. It refunded the government $135.5 million in February 2021.

More generally, recent research has highlighted the role that private equity firms have played in accelerating M&As in health care and undermining competition, raising major antitrust concerns (Scheffler, Alexander, and Godwin 2021).

Other PE-owned health companies have taken advantage of the pandemic to pay a hefty dividend to their PE owners. In March 2021, Blackstone extracted $200 million from Apria Healthcare in the form of a dividend recapitalization (Goldstein 2021). In a dividend recapitalization, a PE firm requires a portfolio company to take on additional debt to pay a dividend to the PE firm and its investors. In this particularly egregious case, Blackstone required Apria to take out $410 million in new debt in order to pay Blackstone and its investors $460 million in dividends. This occurred at the same time that Apria, which rents out ventilators and other equipment critical to coronavirus hospital patients, paid $40.5 million to settle a lawsuit with federal prosecutors regarding millions of dollars in false medical claims for ventilator rentals (Torbati 2021).

Similarly, DuPage Medical Group, a multi-specialty physician practice of 775 doctors owned by PE firm Ares Management, collected $80 million in CARES Act funds in 2020, a $39.9 million grant from HHS, and a 39.5 loan from CMS. In February 2021, a wholly owned subsidiary of DuPage borrowed funds to pay a $209 million dividend to Ares (Willmer 2021).

It’s not clear just how widespread these practices are. The lack of audited financial statements for hospitals and other health providers makes it difficult to gauge both how unfair the initial distribution of grants and loans was or how widespread the self-serving use of these funds has been. We do not know how often funds intended to bail out an overwhelmed health systems are used instead to the financial benefit of the hospital system or its owners, rather than for patient care (Liss 2021b). Here we raise the question whether health systems that have enough resources to engage in costly M&A activity or pay dividends to their shareholders should be receiving taxpayer subsidies.

The passage of the CARES Act was an important and appropriate congressional response to the COVID-19 crisis as it hit the financial stability of the health care industry. Yet the implementation of the law failed to fulfill the legislative intent to provide financial stability to those health care providers most negatively affected by the pandemic. Instead, the Trump administration’s initial distribution formula disproportionately allocated funds to those least in need rather than those most in need. By using a provider’s share of fee-for-service Medicare payments and, especially, its net patient revenue, the Trump administration’s formula in the initial distribution of funds privileged hospitals that serve well insured patients or that charge high fees over hospitals that serve lower income communities or rely disproportionately on Medicaid funding. Moreover, because the financial resources of hospitals vary dramatically across the country—depending on the relative mix of private versus government reimbursements, their reimbursement rates, their market power, their ownership structures, and a host of other factors—a one size fits all formula for fund distribution is fundamentally flawed.

That approach to fund allocation is the main source of inequities among hospitals in the overall distribution of funds from the PRF established by the CARES Act.

The Trump administration’s subsequent distribution of High Impact funds based on the number of COVID-19 cases treated by hospitals went a long way toward meeting the needs of hospitals overwhelmed by the pandemic. One study found that these payments were successful in reaching communities with higher shares of Black residents but failed to meet the need in communities that were home to large numbers of Hispanic residents (Buxbaum and Rak 2021). The distribution of High Impact funds, like the earlier distribution based on hospitals’ net revenue, failed to take differences in hospitals’ assets and endowments into account in allocating funds. Here again, wealthier hospitals treating COVID-19 patients received higher payments (Cantor et al. 2021). Rural hospitals and safety net hospitals, with much greater dependence on Medicaid funding, remained underfunded until the arrival of the Biden administration, which favored these and other providers largely left out of earlier rounds of funding in its Phase 4 distribution of PRF funds. It also included a special distribution to rural hospitals in the ARP passed shortly after Biden’s election.

The CARES Act legislation and the administration of the PRF hold important lessons for future bailouts of the health care system due to pandemics, natural disasters, or unhealthy living areas that result from climate change.

AAFP. 2021. “Information You Need on the Provider Relief Fund.” American Association of Family Practitioners, June 15. https://www.aafp.org/family-physician/patient-care/current-hot-topics/recent-outbreaks/covid-19/covid-19-financial-relief/cares-act-provider-relief-fund.html

AHLA. 2021. “A Summary of CARES Act Provider Relief Efforts.” American Health Law Association, February 18. https://www.americanhealthlaw.org/content-library/publications/bulletins/91e7baca-1bd7-4dad-b9b8-ad9f9592292f/a-summary-of-cares-act-provider-relief-effortsArtiga, S., B. Corallo, and O. Pham. 2020. Racial disparities in COVID-19: Key findings from available data and analysis. August 17. Washington, DC. Kaiser Family Foundation. https://www.kff.org/disparities-policy/issue-brief/racial-disparities-covid-19-key-findings-available-data-analysis/

Bailey, B. 2021. “How the CARES Act Forgot America’s Most Vulnerable Hospitals.” ProPublica and The Frontier, January 28. https://www.propublica.org/article/oklahoma-hospitals-cares

Bannow, T. 2021. “Healthcare Bankruptcy Filings Hit ‘Unprecedented’ Low. ” Modern Healthcare, September 1. https://www.modernhealthcare.com/providers/healthcare-bankruptcy-filings-hit-unprecedented-low?utm_source=modern-healthcare-am-thursday&utm_medium=email&utm_B=20210901&utm_content=article1-headline

Batt, R. and E. Appelbaum. 2021. “Private Equity in Healthcare: Profits before Patients and Workers.” Perspectives on Work. Champaign, ILL: Labor and Employment Relations Association. https://cepr.net/private-equity-in-healthcare-profits-before-patients-and-workers/

Buxbaum, J.D., and Rak, S. 2021. “Equity and the Uneven Distribution of Federal COVID-19 Relief Funds to US Hospitals.” Health Affairs, September.

https://www.healthaffairs.org/doi/abs/10.1377/hlthaff.2020.02018

Cantor, J., N. Qureshi, B. Briscombe, J. Chapman, and C.M. Whaley. 2021. “Association Between COVID-19 Relief Funds and Hospital Characteristics in the US. Jama Health Forum, October 22. https://jamanetwork.com/journals/jama-health-forum/fullarticle/2785399

Center for Medicare and Medicaid Services (CMS). 2020. “Medicare Accelerated and Advance Payments . State by State and by Provider Type,” CMS, May 2 https://www.cms.gov/files/document/covid-accelerated-and-advance-payments-state.pdf

Cohrs, R. 2021. “The Trump Administration Quietly Spent Billions in Hospital Funds on Operation Warp Speed.” Stat News, March 2. https://www.statnews.com/2021/03/02/trump-administration-quietly-spent-billions-in-hospital-funds-on-operation-warp-speed/

__________. 2022. “The Biden Administration Used Billions in Hospital COVID-19Funds to Pay Drugmakers.” Stat News, January 26. https://www.statnews.com/2022/01/26/the-biden-administration-used-billions-in-hospital-covid-19-funds-to-pay-drugmakers/

Cooper, Z., S. V. Craig, M. Gaynor, and J. Van Reenen. 2018. The price ain’t right? Hospital prices and health spending on the privately insured. The Quarterly Journal of Economics 134(1): 51-107.

Drucker, J., J. Silver-Greenberg, and S. Kiff. 2020. “Wealthiest Hospitals Got Billions in Bailout for Struggling Health Providers.” New York Times, May 25/updated July1. https://www.nytimes.com/2020/05/25/business/coronavirus-hospitals-bailout.html?action=click&module=RelatedLinks&pgtype=Article

Ellison, A. 2020a. “HHS Unveils Plan to Deliver $40B in COVID-19 Aid to Hospitals.” Becker’s Hospital Review, April 23. https://www.beckershospitalreview.com/finance/hhs-unveils-plan-to-deliver-40b-in-covid-19-aid-to-hospitals.html

__________.2020b. “HHS Begins Distribution of Payments to Hospitals with High COVID-19 Admissions, Rural Providers:” Becker’s Hospital Review, May 4. https://www.beckershospitalreview.com/finance/hhs-doling-out-22b-to-covid-19-hotspots-rural-hospitals.html

_________. 2021. “HCA Annual Profit Climbs to $3.8 Billion.” Becker’s Hospital Review, February 1. https://www.beckershospitalreview.com/finance/hca-annual-profit-climbs-to-3-8b.html?origin=CFOE&utm_source=CFOE&utm_medium=email&utm_content=newsletter&oly_enc_id=9552E0906923F7T

_________. 2021b “New Jersey hospitals take rare step in merger fight with FTC.” Becker’s Hospital Review, August 21. https://www.beckershospitalreview.com/hospital-transactions-and-valuation/new-jersey-hospitals-take-rare-step-in-merger-fight-with-ftc.html?origin=CFOE&utm_source=CFOE&utm_medium=email&utm_content=newsletter&oly_enc_id=9552E0906923F7T

Gagosz, A. 2022. “R.I. Attorney General denies Lifespan-Care New England health care merger. The Boston Globe. February 17. https://www.bostonglobe.com/2022/02/17/metro/ri-attorney-general-denies-lifespan-care-new-england-health-care-merger/?s_campaign=breakingnews:newsletter

Gaynor, M. 2018. Examining the impact of health care consolidation. Statement before the Committee on Energy and Commerce Oversight and Investigations Subcommittee U.S. House of Representatives, Washington, D.C. 2018. https://docs.house.gov/meetings/IF/IF02/20180214/106855/HHRG-115-IF02-Wstate-GaynorM-20180214.pdf

Goldstein, M. 2021. “Private Equity Firms Are Piling on Debt to Pay Dividends.” New York Times, February 19. https://www.nytimes.com/2021/02/19/business/private-equity-dividend-loans.html

Health Resources & Services Administration (HRSA) Website. 2021a. https://www.hrsa.gov/provider-relief/past-payments/general-distribution (visited on September 23, 2021).

__________. 2021b. https://www.hrsa.gov/provider-relief/past-payments/terms-conditions (visited on September 23, 2021).

__________. 2021c. https://www.hrsa.gov/provider-relief/past-payments/targeted-distribution (visited on September 23, 2021).

__________. 2021d. https://www.hrsa.gov/provider-relief/future-payments (visited on September 23, 2021).

Herman, B. 2020. “Corporations Reap Windfalls from Coronavirus Tax Breaks.” Axios, June 18. https://www.axios.com/coronavirus-tax-breaks-corporations-nol-interest-deduction-d0cfd642-d324-412c-985a-aabd7080ef37.html?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosvitals&stream=top

Kacik, A. 2021. “COVID-19 Sinks Not-for-profit Hospital’s Operating Margins.” Modern Healthcare, March 25. https://www.modernhealthcare.com/finance/covid-19-sinks-not-profit-hospitals-operating-margins?utm_source=modern-healthcare-covid-19-coverage&utm_medium=email&utm_campaign=20210325&utm_content=article1-readmore

Kaufman Hall. 2021a. “National Hospital Flash Report.” January. https://www.kaufmanhall.com/sites/default/files/2021-01/nationalhospitalflashreport_jan.-2021_final.pdf

__________. 2021b. “National Hospital Flash Report.” December. https://www.kaufmanhall.com/sites/default/files/2021-12/Dec2021-National-Hospital-Flash-Report.pdf

__________. 2021c. “2020 M&A in Review: COVID-19 as Catalyst for Transformation.” https://www.kaufmanhall.com/sites/default/files/documents/2021-01/2020-Mergers-Acquisitions-Review_KaufmanHall.pdf#page=1&zoom=auto,-171,612

__________. 2022. “2021 M&A in Review: A New Phase in Healthcare Partnerships.” January 10. https://www.kaufmanhall.com/insights/research-report/2021-ma-review-new-phase-healthcare-partnerships

Kelly, S. 2022. “Hospitals turned to M&A to shore up core operations last year.” Healthcare Dive, January 11. https://www.healthcaredive.com/news/hospitalma-to-shore-up-core-operations-2021/616967/

La France, Aimee, Rosemary Batt, and Eileen Appelbaum. 2021. “Hospital Ownership and Financial Stability: A Matched Case Comparison of a Non-Profit Health System and a Private Equity Owned Health System.” In Jennifer Hefner and Ingrid Nembhard, eds., The Contributions of Health Care Management to Grand Health Care Challenges. In Volume 20, Advances in Health Care Management. Bingley, UK: Emerald Publishing.

Landi, H. 2021. “The top 10 healthcare M&A deals of 2021. December 14. Fierce Healthcare. https://www.fiercehealthcare.com/special-report/top-10-healthcare-m-a-deals-2021

Larcey, D. 2021. “HCA/Mission hit with anti-trust lawsuit, accused of exorbitant prices, declining quality.” Asheville Citizen Times, August 10. https://www.citizen-times.com/story/news/2021/08/10/hca-mission-anti-trust-class-action-lawsuit-claims-higher-prices-lower-quality/5544976001/

Liss, S. 2020a. “For-Profit, Higher-Margin Hospitals at Advantage When It Comes to CARES Funding.” Healthcare Dive, May 14. https://www.healthcaredive.com/news/for-profit-higher-margin-hospitals-at-advantage-when-it-comes-to-cares-fun/577941/

__________. 2020b. “Here’s How Much For-Profit Hospitals Have Received in Bailout Funding so Far.” Healthcare Dive, May 26. https://www.healthcaredive.com/news/heres-how-much-for-profit-hospitals-have-received-in-covid-19-bailout-fund/578378/ 2020b

__________. 2020c. “Non-profit Health Systems – Despite Huge Cash Reserves – Got Billions in CARES Funding.” Healthcare Dive, June 21. https://www.healthcaredive.com/news/non-profit-health-systems-despite-huge-cash-reserves-get-billions-in-car/580078/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202020-06-23%20Healthcare%20Dive%20%5Bissue:28080%5D&utm_term=Healthcare%20Dive

__________. 2021a. “HHS to Release $25.5B in COVID-19 Relief Funding for Providers.” Healthcare Dive, September 13. https://www.healthcaredive.com/news/hhs-to-release-255b-in-covid-19-relief-funding-for-providers/606456/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202021-09-13%20Healthcare%20Dive%20%5Bissue:36662%5D&utm_term=Healthcare%20Dive

__________. 2021b. “Health Systems Need to Provide Policymakers with Audited Financial Statements: Report.” Healthcare Dive, August23. https://www.healthcaredive.com/news/health-systems-need-to-provide-policymakers-with-audited-financial-statemen/605333/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202021-08-24%20Healthcare%20Dive%20%5Bissue:36277%5D&utm_term=Healthcare%20Dive

__________. 2021c. “Hospital MA to Proceed at a ‘Robust Pace.’ Moody’s Says.” Healthcare Dive, April 22. https://www.healthcaredive.com/news/hospital-ma-to-proceed-at-a-robust-pace-moodys-says/598868/

__________. 2021d. “Intermountain Inks Merger Deal with SCL Health to Create$11 billion System.” Healthcare Dive, September 16. https www.healthcaredive.com/news/intermountain-inks-merger-deal-with-scl-health-to-create-11b-system/606715/

__________. 2021e. “Piedmont Healthcare Accelerates Hospital Buys throughout Georgia.” Healthcare Dive, May 13. https://www.healthcaredive.com/news/piedmont-healthcare-accelerates-hospital-buys-throughout-georgia/600123/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202021-05-13%20Healthcare%20Dive%20%5Bissue:34222%5D&utm_term=Healthcare%20Dive

MACPAC. 2021. “COVID Relief Funding for Medicaid Providers.” Issue Brief. February. https://www.macpac.gov/wp-content/uploads/2021/02/COVID-Relief-Funding-for-Medicaid-Providers.pdf

Mensik, H. 2021. “UHS Posts Q1 Profit, Will Hand Back Some CARES Funds.” Healthcare Dive, April 27. https://www.healthcaredive.com/news/uhs-posts-q1-profit-will-hand-back-some-cares-funds/599071/?utm_source=Sailthru&utm_medium=email&utm_campaign=Issue:%202021-04-27%20Healthcare%20Dive%20%5Bissue:33869%5D&utm_term=Healthcare%20Dive

O’Grady, E. 2021a “Private Equity Firms Reap Payouts after Hospital Chain Received $1.6 billion in CARES Act Support.” Private Equity Stakeholder Project, September 28. https://pestakeholder.org/private-equity-firms-reap-payouts-after-hospital-chain-received-1-6-billion-in-cares-act-support/

__________. 2021b. “Private Equity Has Already Reaped Hundreds of Millions of Dollars of Debt-Financed Dividends from Health Care Companies in 2021.” Private Equity Stakeholder Project, March 24. https://pestakeholder.org/private-equity-has-already-reaped-hundreds-of-millions-of-dollars-of-debt-funded-dividends-from-health-care-companies-in-2021/

Ochieng, N., J. Fuglesten Biniek, M. Musumeci, and T. Neuman. 2022. “Funding for Health Care Providers During the Pandemic: An Update.” Kaiser Family Foundation. Jan 27. https://www.kff.org/coronavirus-covid-19/issue-brief/funding-for-health-care-providers-during-the-pandemic-an-update/

Paavola, A. 2021. “Hospital MA activity shifts to regional partnerships: Kaufman Hall.” Becker Hospital Review, July 8. https://www.beckershospitalreview.com/hospital-transactions-and-valuation/hospital-m-a-activity-shifts-to-regional-partnerships-kaufman-hall.html?origin=CFOE&utm_source=CFOE&utm_medium=email&utm_content=newsletter&oly_enc_id=9552E0906923F7T

__________. 2022. “Connecticut residents file antitrust lawsuit against Hartford HealthCare.” Becker Hospital Review. Feb 15. https://www.beckershospitalreview.com/legal-regulatory-issues/connecticut-residents-file-antitrust-lawsuit-against-hartford-healthcare.html?origin=RCME&utm_source=RCME&utm_medium=email&utm_content=newsletter&oly_enc_id=9552E0906923F7T

Scheffler, R. M., L.M. Alexander, J.R. Godwin. 2021. “Soaring Private Equity in the Healthcare Sector: Consolidation Accelerated, Competition Undermined, and Patients at Risk.” May 17. https://publichealth.berkeley.edu/news-media/research-highlights/study-finds-private-equity-investment-undermines-a-stable-competitive-healthcare-industry/

Schwartz, K. and A. Damico. 2020. “Distribution of CARES Act Funding Among Hospitals.” May 13. Kaiser Family Foundation. https://www.kff.org/health-costs/issue-brief/distribution-of-cares-act-funding-among-hospitals/

Torbati, Y. 2021. “How private equity extracted hundreds of millions of dollars from a firm accused of Medicare fraud.” March 1. The Washington Post. https://www.washingtonpost.com/business/2021/03/01/blackstone-healthcare-private-equity-dividend-apria/

U.S. Department of Health and Human Services. 2020a. “Distribution of Payments to Hospitals with High COVID-19 Admissions, Rural Providers.” News Release, HHS.gov, May 1. https://public3.pagefreezer.com/bhttps://www.hhs.gov/about/news/2020/05/01/hhs-begins-distribution-of-payments-to-hospitals-with-high-covid-19-admissions-rural-providers.html

__________. 2020b. “HHS Announces Over $4 Billion in Additional Relief Payments to Healthcare Providers Impacted by the Coronavirus Pandemic.” News Release, HHS.gov, July 10. https://public3.pagefreezer.com/browse/HHS%20%E2%80%93%C2%A0About%20News/20-01-2021T12:29/https://www.hhs.gov/about/news/2020/07/10/hhs-announces-over-4-billion-in-additional-relief-payments-to-providers-impacted-by-coronavirus-pandemic.html

__________.2020c. “HHS Increases and Begins Distributing over $24 billion in Phase 3 COVID-19 Provider Relief funding.” News Release, HHS.gov, December 16, https://www.hhs.gov/about/news/2020/12/16/hhs-increases-begins-distributing-over-24-billion-in-phase-3-covid-19-provider-relief-funding.html

__________.2022. “HHS Distributing $2 billion More in Provider Relief Fund Payments to Health Care Providers Impacted by the COVID-19 Pandemic.” News Release, HHS.gov, January 25. https://www.hhs.gov/about/news/2022/01/25/hhs-distributing-2-billion-more-provider-relief-fund-payments-health-care-providers-impacted-covid-19-pandemic.html

Willmer, S. 2020. “Apollo’s Hospital Chain Tapped $1.5 Billion in U.S. Taxpayer Aid.” Bloomberg News, September 14. https://news.bloomberglaw.com/in-house-counsel/apollos-hospital-chain-tapped-1-5-billion-in-u-s-taxpayer-aid?context=article-related

__________.2021. “Privat Equity Piles on Debt to Pull Cash from Health Firms.” Bloomberg News, March 24. https://www.bloomberg.com/news/articles/2021-03-24/private-equity-piles-on-debt-to-pull-cash-from-health-care-firms