November 27, 2018

It is accepted that the Organization of the Petroleum Exporting Countries (OPEC) is a cartel that restrains oil production and keeps prices higher than they would otherwise be. Indeed, this is the premise behind the “OPEC Accountability Act of 2018” in the US Senate. This bill would address high and rising oil prices by trying to break OPEC. US pressure on OPEC — particularly on friendly governments such as Saudi Arabia that are seen as leaders in the organization — to “open the spigots” is not new. Nor is the control of oil exports by producing countries for political purposes. However, the environmental impact of high oil prices is only lightly considered.

There is little debate that motor vehicle industry changes to increase fuel efficiency were a historic and significant environmental advance. When OPEC action has led to increased prices, the quantity of oil in demand has fallen. This was starkly demonstrated when the Organization of Arab Petroleum Exporting Countries (OAPEC) — founded in 1968 — flexed its price-making muscles in the 1970s. Production cuts and an embargo against sale of oil to several countries raised the spot price of West Texas Intermediate (WTI) crude from $3.56 per barrel in mid-1973 to $4.31 later in the year to $10.11 in January. By the time President Jimmy Carter famously suggested we all turn down our thermostats, the price of WTI crude had reached $14.85 per barrel. The price finally peaked in mid-1980 at $39.50 — a 1000 percent increase in seven years. The price of gasoline more than tripled. In response, we got the Department of Energy, the Chevy Citation, and more fuel-efficient Japanese and German automobile imports.

More recently, the total vehicle miles traveled in the US fell in 2007 amid high oil prices and the Great Recession, and did not increase again until gas prices fell over the second half of 2014 ? from $3.69 per gallon to $2.12.

So, producers and consumers reduce the quantity of oil they demand as prices rise. But the relationship between OPEC price hikes and environmental benefit is not a straight line. Not all the oil supply comes from OPEC, and the high price of oil gives additional incentive to all suppliers to expand their output. Assuming OPEC members raise prices by restricting their own output, we expect some fraction of the reduction in supply to be offset by expansion on the part of other, non-OPEC, producers. The extent of “crowding in” of oil supply due to OPEC production cuts depends on the relative elasticities of the supply of other producers and of demand. If demand is highly inelastic, then prices rise sharply in response to the OPEC cuts; if supply is highly elastic, then the marginal producers increase their output sharply, given the price increase. Of course, the added supply from other producers softens the price blow from OPEC — the cartel must cut prices even further in order to achieve a price target. In the end, for every barrel of oil in OPEC cuts,

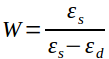

barrels of oil are supplied elsewhere — where ?s > 0 is the price elasticity of supply and ?d < 0 is the price elasticity of demand. Thus, only 1 – W barrels of oil in total are taken off the market for every barrel of oil withheld by OPEC.

The direct effect of OPEC cuts, then, is to reduce the quantity of oil exchanged in the market. It does not simply follow that this translates into a smaller ecological footprint; the dynamic gets more complicated when we examine the oil sources affected. By withholding supply, OPEC has generally retained access to inexpensive, long-proven reserves. By contrast, more marginal suppliers tend to tap increasingly dirtier sources as prices rise. Consider tar sands oil, for example. According to a summary by John H. Cushman Jr. at InsideClimate News, “Competing estimates based on the same [US Energy Department’s National Energy Technology Laboratory] model found tar sands oil 13 percent dirtier than Mexican, 18 percent dirtier than Venezuelan and 19 percent dirtier than Saudi crude.” Further, a life-cycle model by the federal Argonne National Laboratory showed tar sands oil to be 21 percent dirtier than the oil at US refineries.

OPEC’s access to relatively clean oil means that when it restricts its output, it crowds in dirtier oil from other suppliers taking advantage of the higher price. In terms of the carbon footprint of a barrel of OPEC oil, the increase in the total carbon footprint when OPEC reduces its own supply by one barrel is

where F is the relative carbon footprint of one barrel of non-OPEC oil. If WF < 1, OPEC cuts reduce the overall carbon footprint; otherwise, OPEC cuts increase the carbon footprint.

For example, if F=1.2, then a barrel added from suppliers of dirtier oil adds 20 percent more emissions than an OPEC barrel for which it might substitute. If W=0.5, then these producers supply only half as many barrels as OPEC removes from the market, so for every barrel cut by OPEC, the carbon footprint of non-OPEC oil added to the market is W=0.6. Nevertheless, a barrel of oil removed by OPEC itself reduces the footprint by 1.0, so the net effect on the carbon footprint of oil overall is WF-1, or -0.4. In other words, in this example, the net effect of OPEC reducing oil production by one barrel is only partially offset, reducing carbon emissions by 40 percent of those embodied by the barrel of OPEC oil withheld the market.

Of course, if W is larger, then the offset is greater and the net reduction in footprint shrinks. However, as shown below, most of the estimates of W are in the range of 0.27 to 0.54, which would mean that OPEC’s cut of one barrel of oil would result in a reduction of carbon emissions of 36 to 68 percent from those that would occur in the absence of the OPEC cut. (See appendix.)

Thus, the impact of eliminating OPEC, and thereby increasing the quantity of oil produced, would be to substantially increase carbon emissions, at least in the short run.

In the medium run, higher oil prices increase investment in dirty sources of oil. However, they also provide incentive for increased investment in renewables and energy efficiency.

More environmentally sound than relying on OPEC-driven price increases would be to impose a carbon tax. This would decrease demand for oil while removing the incentive for investment in dirty oil and providing revenues that may be redistributed to consumers or used for public investment in greenhouse gas reduction.

Appendix

Table 1: Selected Footprint Responses to OPEC Output Cut Based on Caldara, Cavallo, and Iacoviello (with F=1.2)

| ?s | ?d | W | WF | WF-1 | ||

|---|---|---|---|---|---|---|

|

Table A.3 |

Medians |

0.13 |

-0.13 |

0.50 |

0.60 |

-0.40 |

|

Means |

0.10 |

-0.22 |

0.31 |

0.38 |

-0.63 |

|

|

Downward-sloping supply |

-0.16 |

-0.07 |

1.78 |

2.13 |

1.13 |

|

|

High |

0.26 |

-0.08 |

0.76 |

0.92 |

-0.08 |

|

|

Table A.4 |

Medians |

0.07 |

-0.24 |

0.23 |

0.27 |

-0.73 |

|

Means |

0.07 |

-0.19 |

0.27 |

0.32 |

-0.68 |

|

|

Figure A.2(a) |

Target |

0.02 |

-0.13 |

0.13 |

0.16 |

-0.84 |

|

Selected |

0.07 |

-0.17 |

0.29 |

0.35 |

-0.65 |

|

|

Figure A.2(b) |

Target |

0.15 |

-0.13 |

0.54 |

0.64 |

-0.36 |

|

Selected |

0.12 |

-0.10 |

0.45 |

0.55 |

-0.45 |

In a survey of the literature by the Federal Reserve, most of the estimates show W in the range of 0.27–0.54, resulting in a fall in footprint of 0.36–0.68 OPEC-barrels-per-barrel of oil held back by OPEC. The only study that would suggest that OPEC production cuts would harm the environment was Krichene (2002). Krichene estimated that supply was not only downward-sloping — meaning that producers cut supply in response to a rise in price — but more elastic than demand.

With such highly elastic downward-sloping supply, OPEC cuts in output would crowd in a disproportionate supply of non-OPEC oil, thereby lowering prices. Thus, to maintain high prices, OPEC must — counterintuitively — expand its production and therefore crowd out even more non-OPEC oil. On net, then, higher prices due to OPEC movements associate with both less oil and a cleaner mix, resulting in a much smaller footprint.

To be conservative, we ignore the possibility of such a double-dividend to the environment from high oil prices by removing Krichene’s estimate from our analysis.