February 03, 2017

February 3, 2017 (Jobs Byte)

By Dean Baker

Wage growth appears to be slowing in the most recent data.

The unemployment rate inched up in January to 4.8 percent, as the economy reportedly added 227,000 jobs. The modest change in the unemployment rate was also associated with a rise in the employment-to-population ratio (EPOP) to 59.9 percent. This is equal to the previous high for the recovery in March of last year. The jobs growth figure was somewhat higher than had generally been expected, but is somewhat offset by the fact that the prior months’ numbers were revised down by 39,000.

While the rise in the EPOP is good news, it is still well below pre-recession levels. The drop remains even when looking at prime-age workers (ages 25-54), with the EPOP for prime-age men 2.7 percentage points below pre-recession peaks and the EPOP for women is down 1.5 percentage points. The overall EPOP for African Americans hit a new high for the recovery, at 57.5 percent. While these data are erratic, the January figure is more than a full percentage point above the year-round average for 2016.

Other data in the household survey were mixed, notably there was a substantial decline in the share of unemployment due to voluntary quits. The January percentage was 11.4 percent, 1.1 percentage point below its November peak. This measure of workers’ confidence in their labor market prospects is almost a full percentage point below the pre-recession peak of 12.3 percent, and almost four percentage points below the 15.2 percent peak in April of 2000.

The payroll job increases were driven by a jump of 45,900 in retail and 36,000 in construction. There was also an unusually large increase of 19,800 jobs in finance and insurance, following a rise of 20,200 in December. This compares to an average gain of just 8,600 jobs a month in the period from November of 2015 to November of 2016.

Professional and technical services added 22,700 jobs in January, roughly in line with its growth over the last year. Health care added just 18,300 jobs in January, well below its average of 31,200 over the last year. Restaurants added 29,900 jobs for the month, somewhat above the monthly average gain of 23,800 jobs over the last year.

Manufacturing added 5,000 jobs for the month. Employment in the sector is down by 46,000 from its year-ago level and by 220,000 from when President Obama took office eight years ago. (It had fallen by 4,543,000 during President Bush’s two terms in office.) Last month, there were 49,900 people employed in coal mining, compared to 86,400 in January of 2009.

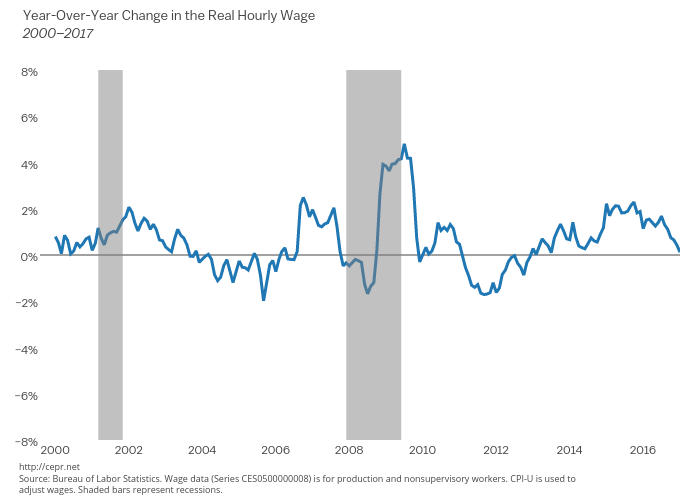

Wage growth appears to have moderated slightly in the most recent data. The average hourly wage in January was 2.5 percent above its year-ago level. Comparing the average for the last three months with the prior three months, wages grew at just a 2.2 percent annual rate. It is worth remembering that there is some shift from non-wage benefits such as health care to wages, so that wage growth exceeds to some extent the rate of growth of compensation. The Employment Cost Index rose by just 2.2 percent over the last year.

Real wage growth for production and non-supervisory workers has been positive for the last three years of the Obama administration. The sharp decline in energy prices in 2014 and 2015 produced healthy gains for those years of more than 2.0 percent. The pace of real wage growth has slowed as energy prices stabilized in the last year, but real wages are still going up even if not very fast.

The January job gains were likely in part attributable to weather, as there were few serious snowstorms in the northeast and Midwest in the period preceding the reference week, which is unusual for January. This could suggest somewhat weaker growth going forward. It is also worth noting the continued weakness in hours. Although the number of jobs has increased by 1.6 percent over the last year, the aggregate weekly hours index has risen by just 1.1 percent.

On the whole the report shows a labor force that is growing at a respectable, but not overly rapid rate. There is no evidence of overheating in the form of accelerating wage growth or longer workweeks. However by any measure the last jobs report of the Obama years is hugely better than the first one.