October 27, 2016

The Social Security scare story is a long established Washington ritual. Bloomberg news decided to bring it out again in time for Halloween. The basic story is that the Social Security trust fund is projected to face a shortfall in less than two decades. This means that unless Congress appropriates additional revenue, the program is projected to only be able to pay a bit more than 80 percent of scheduled benefits.

This much is not really in dispute. The question is how much should we be worried about this projected shortfall and what should we do about it. Bloomberg’s answer to the first question is that we should be very worried. It goes through the list of potential fixes and implies that all would be difficult or impossible.

I will just take one potential fix, which is raising the payroll tax by 2.58 percentage points to cover the projected shortfall. Bloomberg tells us:

“…it’s doubtful that the American public would accept such jarring changes.”

That’s an interesting political assessment. It would be worth knowing the basis for this assertion. We had comparably jarring changes in the form of Social Security tax increases in the decades of 40s, 50s, 60s, 70s, and 80s. There was no massive tax revolt against any of these tax increases; what has convinced Bloomberg that we can never again have a comparable increase in the payroll tax?

A piece of evidence suggesting that tax increases necessary to support Social Security might be politically viable is the fact that few people even noticed the 2.0 percentage point increase in the payroll tax at the start of 2013 when the payroll tax holiday ended. This was at a time when the labor market was still very weak from the recession and wages had been stagnant for more than a decade. (A survey conducted for the National Academy for Social Insurance also found that people were willing to pay higher taxes to support the scheduled level of Social Security benefits.)

Given this history and evidence, Bloomberg’s claim that the public won’t tolerate the sort of tax increases necessary to fully fund Social Security looks like an unsupported assertion.

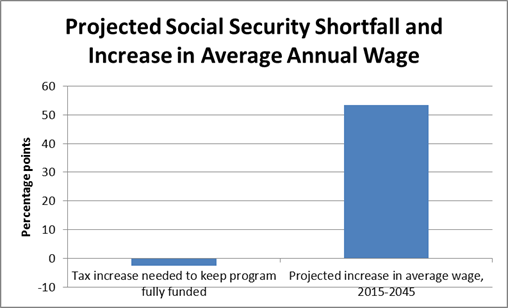

The other point on this topic is that economists usually believe that workers care first and foremost about their after-tax wage, not the tax rate. The Social Security trustees project that real before-tax wages will rise on average by more than 50 percent over the next three decades. By comparison, the tax increase needed to fully fund Social Security seems relatively small, as shown below.

Source: Social Security trustees report, 2015 and author’s calculations.

Most workers have not seen their wages increase as much as the average wage over the last four decades since a disproportionate share went to those at top. These are people like CEOs, Wall Street traders, and doctors and other highly paid professionals. Workers stand to lose much more in terms of after-tax income if this upward redistribution continues over the next three decades than they would from the “jarring” Social Security tax increase that Bloomberg feels the need to warn us about.

So, of course people could get really worried about Social Security, as Bloomberg wants, or they can focus on the upward redistribution which will have far more impact on their well-being and that of their children. (Yes, this is the topic of my new book, Rigged: How Globalization and the Rules of the Modern Economy Were Structured to Make the Rich Richer, which can be downloaded for free.)

Comments