October 04, 2016

During tonight’s vice-presidential debate, Republican candidate Mike Pence will likely discuss his track record as governor of Indiana. However, Pence will likely leave out a few important facts about that record — including unsuccessful healthcare, tax, and labor market policies. Let’s look at each of these in turn.

Health Insurance Coverage

Pence has generally been hesitant to expand health insurance coverage to low- and middle-income Hoosiers. Indiana is one of over 20 states that refused to set up a state-level private health insurance exchange for people not covered by an employer-provided plan; this means that Indiana’s residents must rely on the federal exchange, Healthcare.gov. Even more importantly, Pence delayed Indiana’s Medicaid expansion for over a year. Whereas 25 states expanded access to Medicaid on January 1, 2014, Indiana waited until February 2015 to make the program more widely available. And even when the expansion finally occurred, Pence ensured that the new enrollees would have to pay small fees for their coverage.

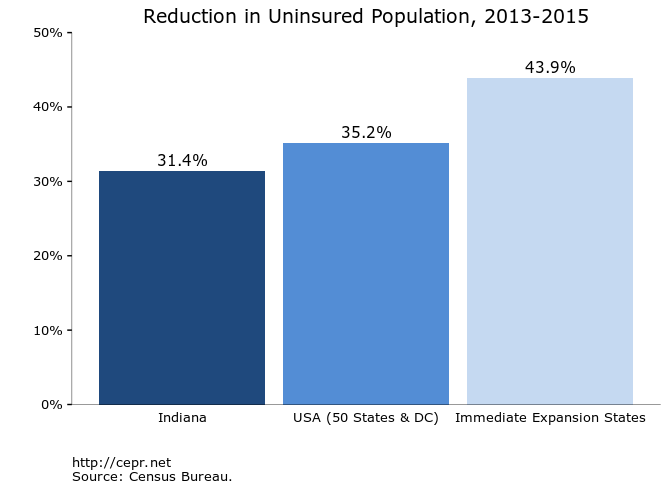

The figure below shows the reduction in the uninsured population in Indiana versus in the nation as a whole. A third bar shows the reduction among states that expanded access to Medicaid in January 2014. It seems that Pence’s policies have made it more difficult for many poor Hoosiers to access health insurance.

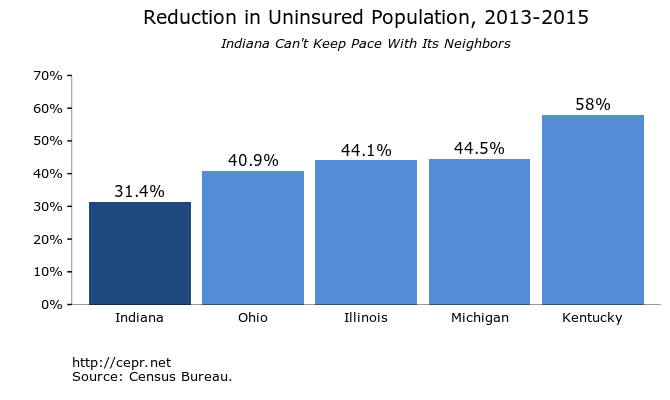

Moreover, Indiana has lagged even further behind its neighbors. The four states bordering Indiana — two of which had Republican governors at the time — chose to expand access to Medicaid in 2014. Not surprisingly, they all saw more impressive reductions in their uninsured populations than the Hoosier state between 2013 and 2015. This is depicted in the figure below.

Taxes

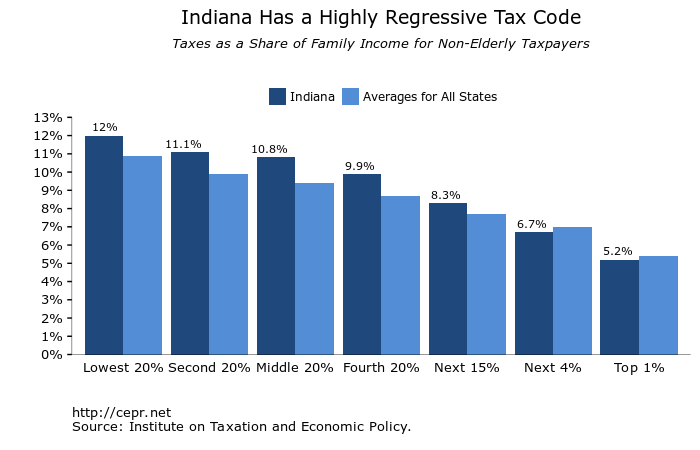

Indiana has a remarkably regressive tax code. Hoosier families in the top one percent of the state income distribution pay just 5.2 percent of their incomes in state and local taxes; for families in the bottom fifth of the distribution, it’s 12.0 percent, the seventh-highest rate in the country.

In fairness to Pence, regressive tax codes are the norm at the state and local level. However, Indiana’s tax code is unusually regressive, as shown below. Only Hoosiers in the top five percent of the income distribution pay lower taxes than they would in other states.

The Indiana tax code was regressive even before Pence became governor. However, Pence’s reforms have only made the tax code more regressive. Since getting into office, Pence has eliminated inheritance and estate taxes, reduced taxes on corporate profits by about one-third, and cut the individual income tax from 3.4 to 3.23 percent. (The two latter reforms only go into effect in 2017.) All three of those taxes disproportionately hit the wealthy. By contrast, Pence has done nothing to reduce Indiana’s sales tax, which is highly regressive: as of 2015, families in the bottom fifth of the income distribution paid over seven percent of their incomes in sales taxes, compared to just one percent for the richest families. Moreover, Indiana certainly has room to reduce its sales tax: according to the Census Bureau, the state government of Indiana collects over $2 in sales taxes for every $1 in individual income taxes. And for every $1 collected from the corporate income tax, the government collects over $12 in sales taxes. If Pence claims tonight that he is a “tax cut governor,” it should be noted that he has only cut taxes for the rich, not for the poor.

There is one last point worth adding. Although Pence’s tax reforms redistributed income towards the rich, inequality nonetheless could have come down if pre-tax income had become more equal. Instead, Pence has supported former governor Mitch Daniels’ “right-to-work” policy and has refused to raise the minimum wage. During his time as a United States Congressman, he even sponsored legislation aimed at preventing the Federal Reserve from reducing unemployment. Pence’s record on tax policy is therefore emblematic of his broader record of supporting employers at the expense of workers.

Jobs and Growth

Have these regressive policies created a booming economy in Indiana? Have “job creators” flocked to the state, bringing wealth and ample job opportunities with them? Not exactly.

In fact, since Pence assumed office in January 2013, job growth in Indiana has been below the national average. Figure 4 shows that between January 2013 and August 2016, total job growth was 5.4 percent in Indiana compared to 6.9 percent for the nation as a whole.

Still, haven’t Pence’s reforms at least led to a booming private sector? Again, not exactly. Since January 2013, the number of private-sector jobs has increased less than 6.3 percent in Indiana, well short of the 7.9 percent average for the country as a whole.

Finally, income growth under Pence has been boringly normal. Between 2012 and 2015, real gross domestic product grew 6.2 percent for the state of Indiana, not significantly different from the 6.8 percent growth experienced by the U.S. as a whole.

Conclusion

During Mike Pence’s time as governor of Indiana, the state has cut taxes for the wealthy but not for the poor or the middle class. Gains in health insurance coverage have been much less significant in Indiana than in other states thanks to Pence’s decision to the delay Indiana’s Medicaid expansion until 2015. And even when Medicaid was expanded, poor Hoosiers were asked to pay fees that they wouldn’t have paid in other states. If these policies were meant to create jobs by cutting back on the size of government, clearly they haven’t worked: job growth has been significantly slower in the state led by Governor Mike Pence than in the country led by President Barack Obama. A conservative achievement this is not.