July 05, 2016

Since the Fed first announced its 2 percent inflation target on January 25, 2012, inflation has consistently run too low. In fact, the Fed has undershot its target in 48 of the 51 months since its announcement.

The most recent data from the Consumer Price Index (CPI) show that inflation over the past year has been just 1.0 percent. Part of this weakness is due to the volatile energy (down 10.1 percent from one year ago) and food (up 0.7 percent) aspects of the index. The Fed typically pulls out these components and looks at the “core” CPI. This measure shows a somewhat higher rate of inflation with a modest increase over the last year.

However, this increase is driven entirely by the shelter component (up 3.4 percent). When shelter is excluded from the core measure, inflation is well below the Fed’s target and has actually been falling in recent months.

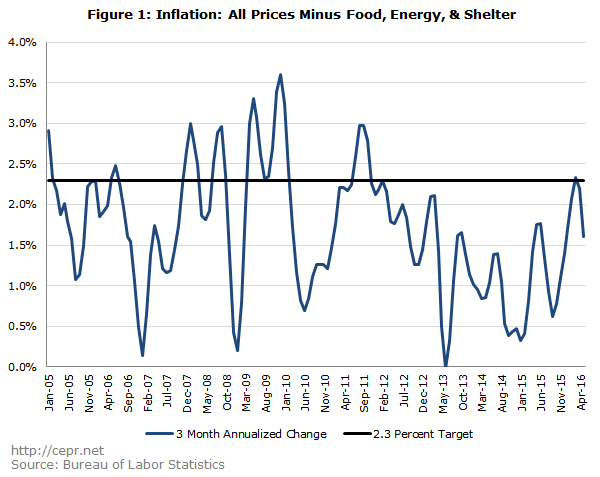

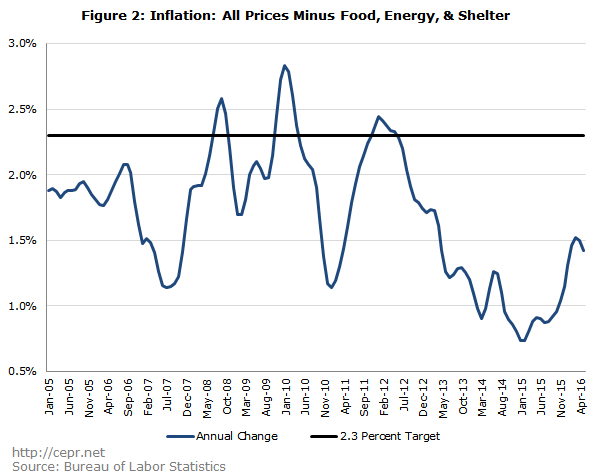

The figures below show annualized rates of inflation for all goods and services minus food, energy, and shelter. Figure 1 employs typical CEPR methodology by comparing the past three months to the previous three months using seasonally adjusted data. Figure 2 compares the past three months to the same three months from the previous year using non-adjusted data. In both figures, the actual inflation data are compared to the 2.3 percent inflation rate which the Fed implicitly targets for this particular measure. One obvious takeaway from the graphs is that inflation has consistently undershot the Fed’s target over the past four years. Another takeaway is that there is no upward trend in this “core inflation minus shelter” index, and it may even be headed downward.