June 09, 2014

In 2010, after an initial round of coordinated stimulus from both wealthy and developing countries, deficit hawks around the world regrouped. Pointing to growing deficits and debt, they demanded that countries reverse course and begin moving toward balanced budgets. The deficit hawks argued that deficit reduction could be accomplished without impairing growth because of the effect it would have in boosting confidence among businesses and consumers.

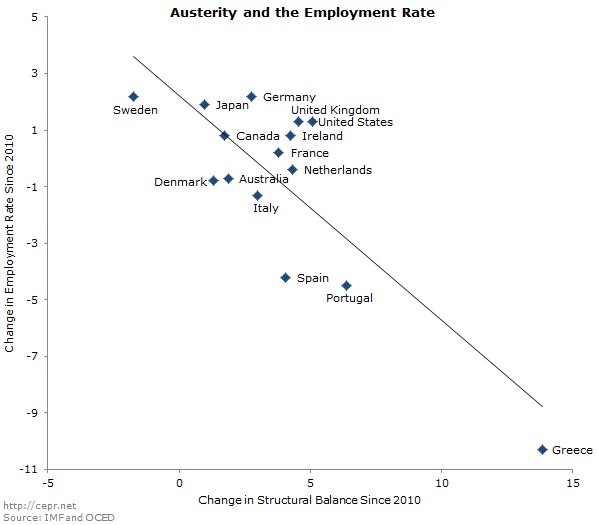

Many economists argued against this drive towards austerity at the time. They noted and rigorously explained the fallacious logic in the idea that deficit reduction could be expansionary. They also pointed out how fiscal policy had already saved the economy from a second depression and that more stimulus would likely be necessary. However, now we have more than three years of data, so we no longer have to speculate. A simple picture can be worth a thousand words (or in this case, billions).

The figure plots the change in the structural balance since 2010 against the change in the employment rate (the percentage of the workforce that is employed) over the same time period. The structural balance is an accounting tool that is designed to measure changes in fiscal policy. For this reason, it tries to pull out the effect of cyclical fluctuations. This means that if the structural deficit gets smaller it is because the government has changed its policy to move toward smaller deficits with budget cuts and/or tax increases. The more negative the change in the structural deficit, the larger the mix of spending cuts and tax increases. Plotting the change in the structural balance against the change in the employment rate gives us a picture of how countries that abandoned fiscal policy strategies quickly have fared since 2010.

In order to understand this picture, it is important to contextualize the position of each country with an understanding of their economic situation in 2010 and the various predictions economists and policy makers offered after the Great Recession. First, many countries were running relatively large structural balance deficits and had high unemployment in 2010. Therefore, if the pain caucus predictions were correct, we would expect to see a strong positive correlation between changes in the structural balance and employment rate. In this worldview, as countries like Greece and Spain cut their budgets in order to qualify for international support, increased confidence in financial markets would return them to full employment quickly.

Clearly, the data show the opposite trend. This image very crisply suggests what Keynesians have been arguing in more nuanced ways for four years, namely that many countries cut fiscal spending too soon, prolonging the negative impacts of the Great Recession for workers. In this respect it is perhaps worth highlighting the example of Japan. No country has a debt level anywhere near Japan’s which is now approaching 250 percent of GDP. Nonetheless the country’s new Prime Minister, Shinzo Abe, pushed through a vigorous stimulus program that began to take effect early in 2013. The economy responded as would be predicted by textbook Keynesian economics, growth accelerated, the inflation rate increased modestly, and the employment to population ratio rose by 1.7 percentage points, the equivalent of 4 million new jobs in the United States.

It is tragic to realize that too many economists and policy makers have not learned what Keynes explained in The General Theory of Employment, Interest and Money in 1936. There is no good reason that so many countries employment rates have barely budged or decreased since 2010. It seems Robert Lucas was wrong when he said, “I guess we are all Keynesians in the foxhole.”