January 07, 2013

January 7, 2013 (Housing Market Monitor)

By Dean Baker

Phoenix looks to have gone from boom to bust back to boom again.

The December reports on the housing market were again overwhelmingly positive, indicating that the recovery will continue into 2013. The Case-Shiller 20-City Index rose by 0.7 percent in October, its ninth consecutive increase, pushing the year-over-year rise to 4.3 percent. Prices rose in 17 of the 20 cities, with only Chicago, Boston, and New York showing price declines.

Most of the biggest increases were in the West. Las Vegas led the way with a 2.4 percent rise in prices, followed by San Diego with a 1.7 percent increase, Phoenix with a 1.3 percent rise, Los Angeles 1.2 percent, and San Francisco 1.1 percent. Atlanta also continued to see rapid rises in house prices, with a 1.4 percent increase in October, bringing the annual rate of increase over the last three months to 21.1 percent.

In all of these cities, the biggest price rises were in the bottom tier of the housing market. In Las Vegas, prices in the bottom tier rose 3.8 percent in October, bringing the annual rate over the last three months to 35.8 percent. By comparison, prices for homes in the top tier rose 1.1 percent in October and have risen at just a 5.7 percent annual rate in the last three months. (The fastest increase in Las Vegas has actually been in the middle tier over this period.)

In Atlanta, there is a similar story with bottom-tier prices rising 3.1 percent in October and at a 46.8 percent annual rate in the last quarter. Prices for homes in the top tier rose at a 1.2 percent rate in October and have risen at 12.0 percent annual rate over the last quarter. In Phoenix the price of homes in the bottom tier rose 3.5 percent in October and has risen at a 39.5 percent annual rate over the last quarter. Over the last year, prices for homes in the bottom tier have risen by 42.9 percent.

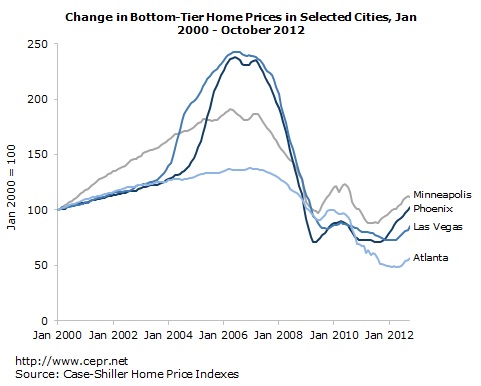

The price increases in the bottom tier of these and other western metropolitan markets are truly extraordinary. On the one hand, it is not altogether surprising that prices in this segment of the market would rise the most rapidly since it had been badly beaten up in the crash, especially after the ending of the first-time buyers tax credit.

On the other hand, clearly there is a substantial component of speculation driving these increases. Investors are buying many of these properties with the hope of being able to sell them at a substantial profit in the near future. There is a risk that prices are again running ahead of demand, which certainly seems to be the case in Phoenix, where the vacancy rate has been rising. If this is the case then prices may again turn downward in the near future.

That seems to be the story in Minneapolis where prices for homes in the bottom tier rose by 28.4 between May of 2011 and September of 2012, then fell by 0.6 percent in October. It may be premature to assume that boom is over, but it certainly raises the possibility of another downturn. Needless to say, the people trying to buy or sell homes that they live in have likely been somewhat unnerved by the sequence of extraordinary price fluctuations in this segment of the market.

Other data on the housing market were also overwhelmingly positive. Existing home sales rose by 5.9 percent in November and now stand 14.5 percent above year-ago levels. Inventories of unsold homes were just 4.8 months of sales, the lowest level since before the crash. New home sales rose 4.4 percent in November and were 15.3 percent above year-ago levels. Housing starts rose to an 899,000 annual rate, 26.8 percent above their year-ago level.

All of this news indicates that the housing market will continue to be a source of strength for the economy in 2013. However, two important warning signs remain. First, there continues to be an unusually large overhang of vacant units. Second, some of the price gains in recent months in bubble markets saw a narrow boost from speculation. But this should not prevent the overall market from contributing to growth.