February 07, 2011

$44 trillion is a really big number. None of us, not even Bill Gates, will see anything close to that amount of money in our lifetime. It can sound very scary, which is exactly why the business-oriented group Third Way used it in reference to the projected shortfall in Social Security funding over the next 75 years. This was supposed to scare people into supporting cuts to Social Security to overcome this huge shortfall.

A more honest approach would try to put this number in a context that makes it understandable to people. This can be done by providing a basis of comparison for this $44 trillion number.

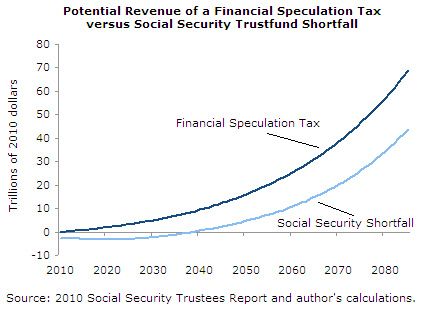

The graph below projects the revenue from a financial speculation tax over the next 75 years, using the same methodology as Third Way’s Social Security graph. This tax would apply to trades of stocks, options, futures, credit default swaps, and other financial assets. The tax would be set a low rate so that it would just reset trading costs back to the level of the 1980s or early 90s. Such a tax would have almost no impact on ordinary investors, even if it would be a big hit to Wall Street speculators. The United Kingdom has had this sort of tax for decades (although just on stock trades) and still has the largest financial market in Europe.

If the projected shortfall in Social Security is a big scary number, we can easily raise an even bigger scarier number just by taxing the sort of Wall Street high-rollers who brought on the economic crisis.

Or, to put it slightly differently, we can compare the Third Way’s $44 trillion to projected future income over Social Security’s 75-year planning period. It is equal to 0.6 percent of future income over this period. Third Way could have found this number in a few seconds by looking at the Social Security Trustees Report. Most people can understand what 0.6 percent is, but it isn’t quite as scary as $44 trillion.